Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

A mobile wallet makes for an easy and convenient way to pay for something without using cash or a physical card. The cards in your mobile wallet are stored on your smartphone, tablet or smartwatch, so you can easily pay for things when you’re out and about. You can also use your mobile wallet to pay for something on certain websites.

Starling customers can add various Starling debit cards to their mobile wallet and, depending on their device, use Apple Pay, Google Pay, Samsung Pay or Garmin Pay to make payments.

A digital wallet is a system for storing virtual versions of debit, credit or loyalty cards and sometimes things like boarding passes or train tickets. Digital wallets, such as Google Wallet or Apple Wallet, can be stored on mobile devices or on a laptop or desktop. A mobile wallet is a digital wallet stored on a mobile device, such as a smartphone, tablet or smartwatch.

Mobile wallets work by storing your debit card information on your mobile device. Once set up, you can use your mobile wallet to make a quick, easy payment anywhere you see the contactless sign (or Apple Pay or Google Pay signs). Apple Pay and Google Pay can also be used for many websites when online shopping.

Depending on your device, you may need to unlock the wallet with biometric security, such as Face ID or fingerprint ID, or through a passcode or PIN, to make a payment.

No matter which device you’re paying with, you’ll be saved the faff of finding your physical wallet or purse when you grab a coffee or pop out to the shops. As long as you have your phone or smart watch, you’re good to go.

Using a mobile wallet to pay for your bus or tram ticket can be especially useful. You can also use it for most UK metros, including the London Underground.

If you have an Apple device, you can enable Express Mode to speed things up at payment points across many public transport networks (including Transport for London) - there’s no need to use Face ID or Touch ID. All you need to do is hold your iPhone or Apple Watch to the card reader at the barrier or paypoint. If you have an Android phone with Google Pay, you may also be able to use your phone without unlocking each time.

You can add a Starling personal, joint or business card to your Apple Wallet or Google Wallet straight from the Starling app, even before your physical debit card arrives. Simply go to the ‘Cards’ section of the app and click ‘Add to Apple Wallet’ or ‘Add to Google Wallet’. If you want to make your Starling card your default payment option, you can just drag it to the top of your mobile wallet and voilà – you’re set.

If you want to use Samsung Pay or make payments with your Garmin Watch, download the Samsung or Garmin app and follow the on-screen instructions.

If you bank with Starling, you can also set up free virtual cards to help organise your budget and add these to your digital wallet.

Virtual cards only exist in the Starling app and your mobile wallet, not as physical cards. You can create up to five virtual cards for a personal Starling account and another five for a Starling joint account. These can then be used to make payments directly from Spaces, the section of the app where you can set money aside from your main balance for a holiday, DIY project – anything you like.

Making payments from Spaces using a free virtual card can be especially helpful if you use Spaces to budget – you could have Spaces for your grocery shop or nights out, with allocated funds separate from your main balance. With virtual cards, there’s no need to move money back from Spaces into your main balance to spend it – simply open your mobile wallet, select your virtual card and tap.

The main advantage of a mobile wallet is that it allows you to make payments without a physical debit card, something that’s very useful if you don’t have your wallet to hand.

Another advantage is that mobile wallets often have a much higher payment cap for payments, compared to the £100 cap when making a contactless payment with a physical card. For details on the cap for your mobile wallet payments, go to ‘Card & payment limits’ in the ‘Cards’ section of the app.

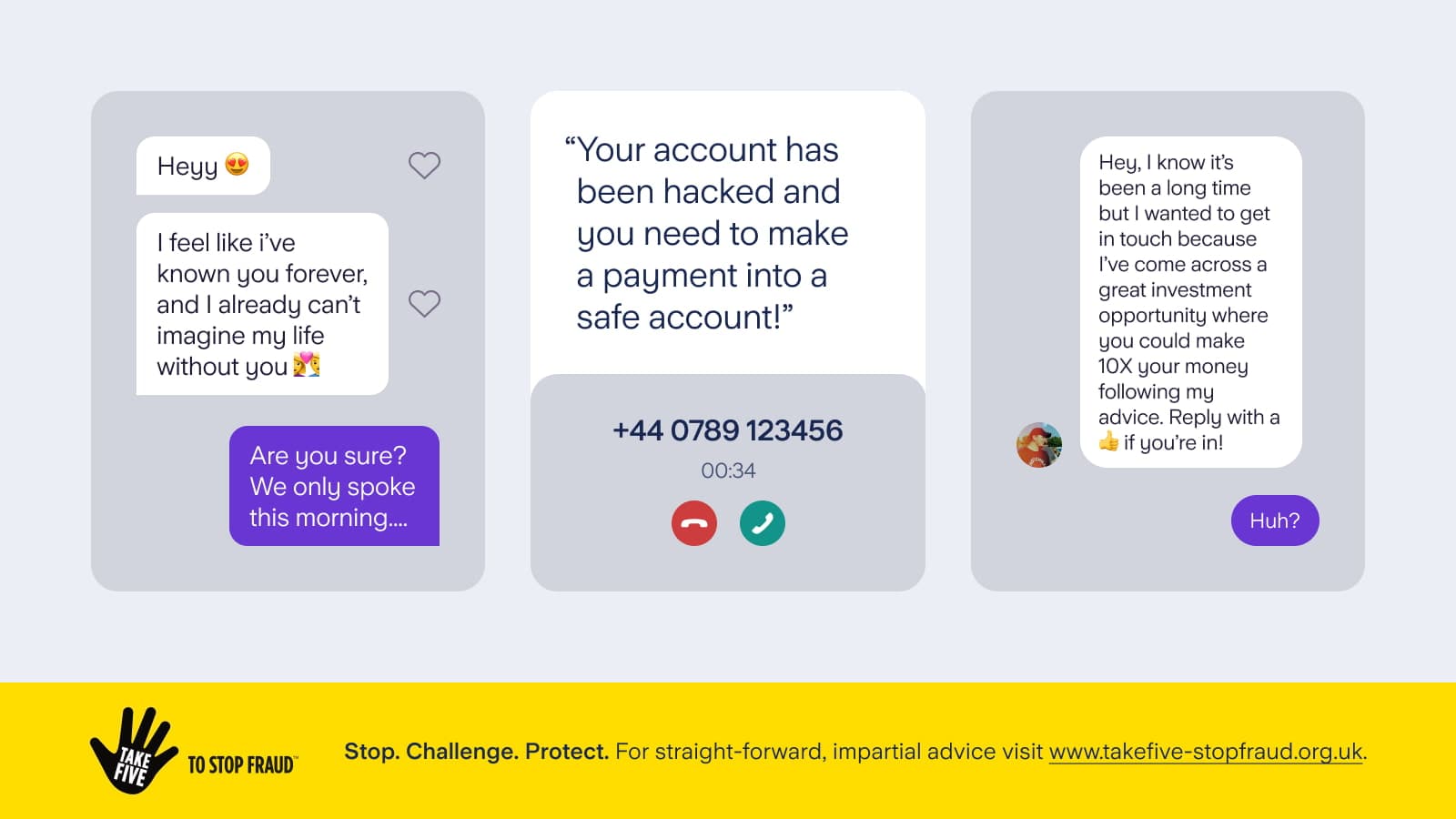

To keep yourself safe, you need to secure your mobile device with Face ID, fingerprint ID, passcodes or PINs. The exact method depends on the device you’re using and the settings you’ve chosen. To minimise the risk of mobile wallet scams, always use different passcodes, PINs or passwords for different devices and apps. It’s especially important to use a unique password and PIN for your banking app.

If your smartphone is lost or stolen, you can lock or cancel your physical Starling card by calling our Customer Service using the number on the back of your debit card. This will also lock or cancel the Starling card in your mobile wallet. Our team is on hand 24/7 to support you.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

12th December 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024