We offer overdraft interest rates of 15%, 25% and 35% EAR (variable).

Representative example

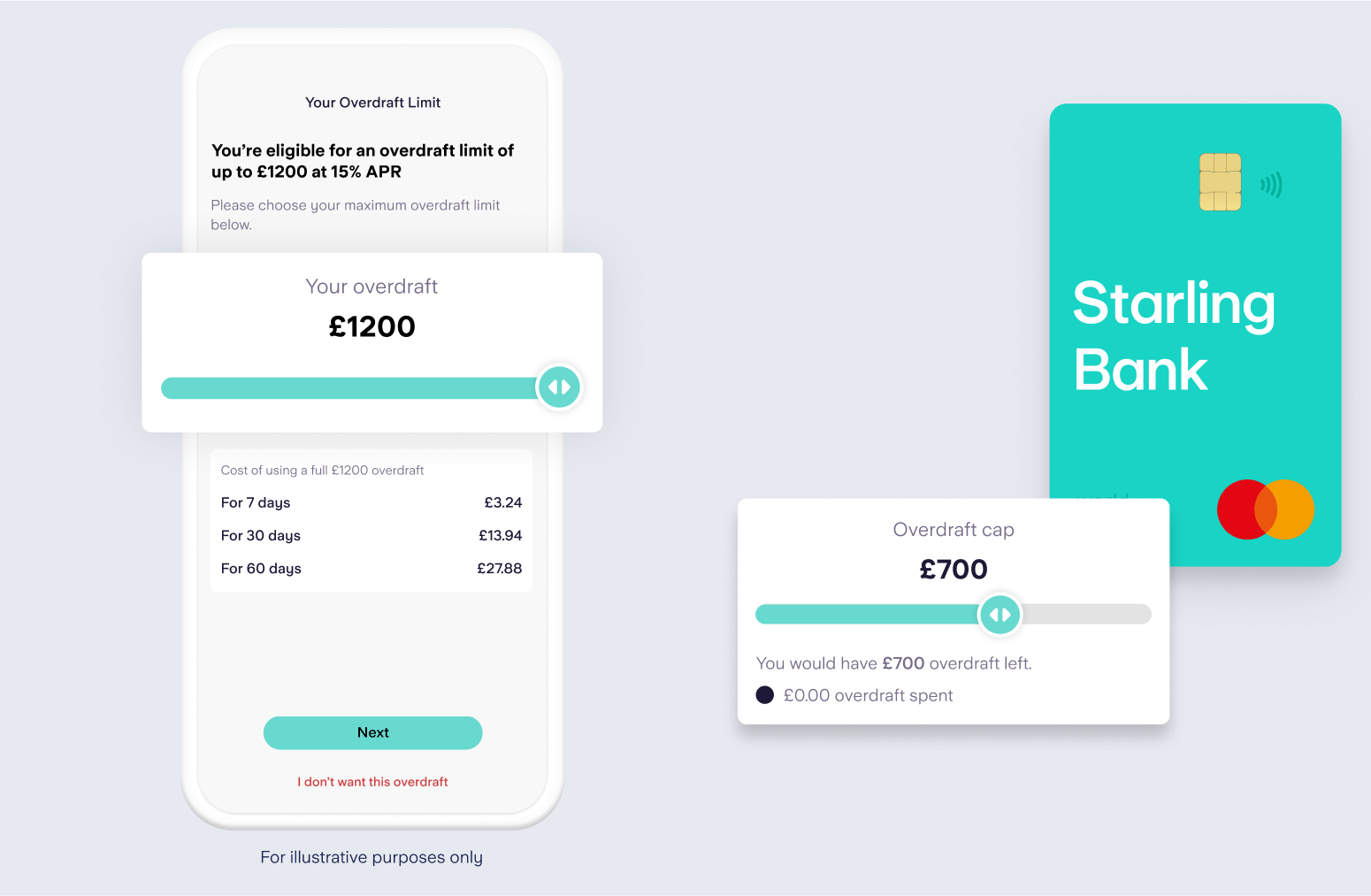

The representative APR (variable) is 15%. If you used an arranged overdraft of £1,200 for 30 days, at 15% EAR/APR (variable), it would cost you £13.94 in interest.

How does our overdraft compare?

The representative APR shows the cost of borrowing over a year, so you can use it to compare the cost of our overdraft against other overdrafts and ways of borrowing.

If you already have a personal account with us, you can check if you’re eligible for an overdraft in the app.

How does an overdraft work?

We all need a little extra support from time to time. At Starling, we know that an overdraft can act like a short-term safety net when you’re feeling the burn financially.

But we want to make banking better – which means offering a better kind of overdraft. One that’s easy to manage and fair on fees. Manage your money and keep tabs on your overdraft, all from our award-winning app.