Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

Budgeting can help you plan your spending, feel more in control of your money and identify where savings might be possible. To help you learn how to budget and get on track with your financial goals for 2024, Starling product manager May Narbonne talks through the budgeting tools in the Starling app.

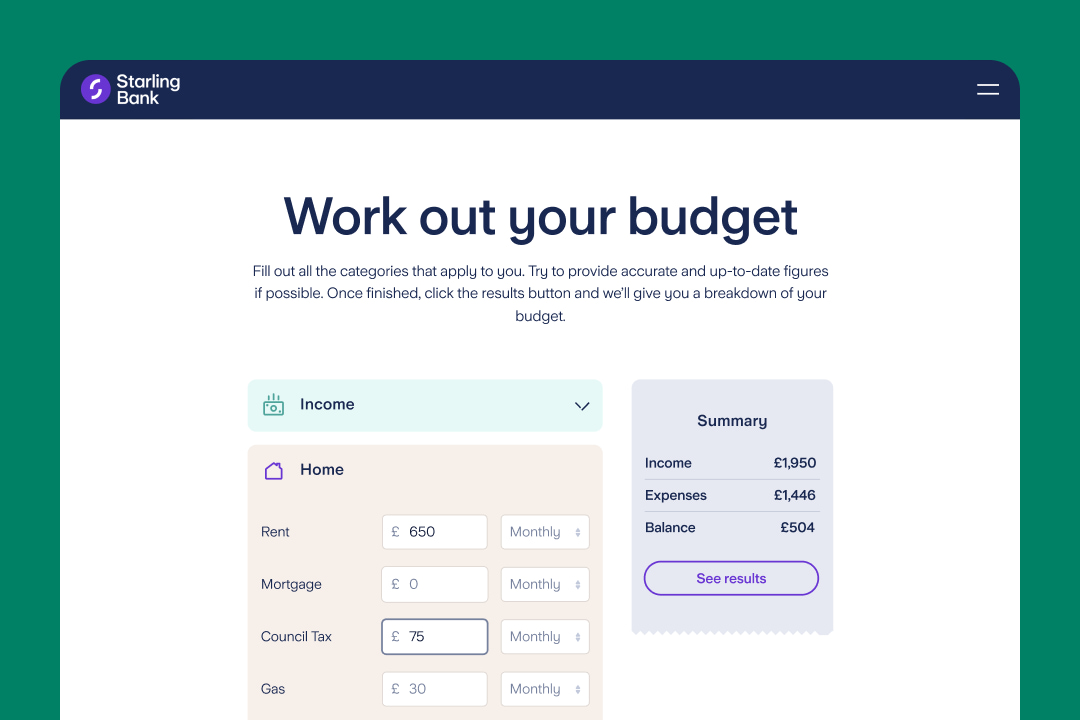

When creating a personal budget, step one is taking a magnifying glass to your finances. That's where our Budget Planner comes in. This free online tool is available through our website and can be used by anyone, not just Starling customers. It has been designed to help you understand where your money is going each month and should only take 5-10 minutes to complete.

Starling customers can check how much they spend on various spending categories, including rent, bills, childcare, groceries, shopping and entertainment, by going to the Spending Insights section of the Starling app. Whenever you spend from your Starling account, we automatically categorise the transaction for you.

If needed, you can amend the category to make it even more accurate. For example, if you buy flowers for someone, this transaction may show up under 'Groceries' or 'Shopping', depending on where you purchase them. With a few taps, you could change the category to 'Gift'.

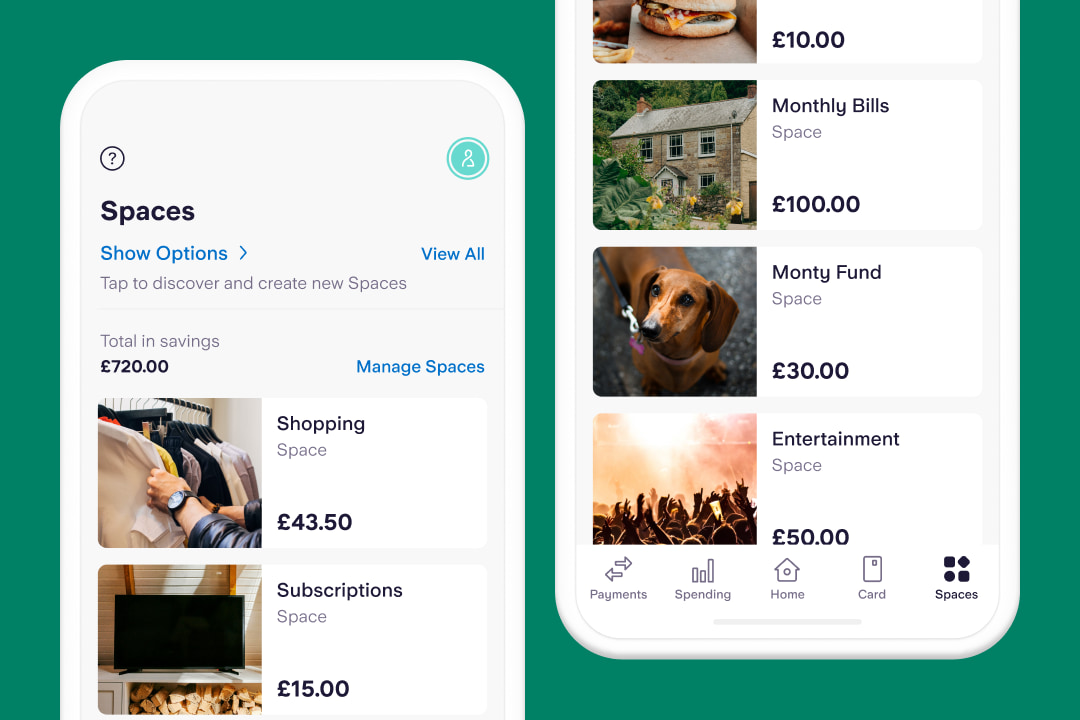

The Spaces feature enables you to keep money separate from your main balance. You can set up multiple Spaces, which makes the feature ideal for budgeting using the digital envelope method.

To try this method, look back at your results for the Budget Planner and decide on an amount that you plan or expect to spend on rent or mortgage, bills, nights out, pets - whatever spending categories make sense for you. Then create separate Spaces for each of your chosen categories.

You can name each Space, add a photograph and transfer money into your Space as you go, or set up automatic transfers for just after pay day. Each Space becomes an 'envelope' with allocated funds for a particular purpose, which can help you stick to a budget.

Of course, you can also use Spaces to set money aside for future goals, such as a summer holiday.

If you're using Spaces to separate money for different purposes, one budgeting tip is to use Bills Manager to pay Direct Debits and standing orders straight from a Space. For example, if you have a 'Home' Space, you could pay your rent or mortgage directly from this Space, as well as council tax and household bills. Or if you have a 'Dogs' Space, you could use Bills Manager to pay your pet insurance.

You could also set up a virtual card to pay for dog food, veterinary bills, or toys and treats from your local pet shop, straight from your 'Dogs' Space.

A virtual card is similar to a normal debit card - it has a card number, expiry date and CVV - but only exists on your phone. When you set one up, you won't receive a physical debit card in the post, but you will be able to use it to make online payments, or payments with a digital wallet, for example using Apple Pay or Google Pay. You can create up to five virtual cards, each one connected to a different Space.

If you've built up savings you don't immediately need, you could look into setting up a Starling Fixed Saver (subject to eligibility). The minimum sum to put into a Fixed Saver is £2,000 and you can earn 4.05% AER/Gross interest rate for a fixed 12 month period (see our Summary Box). You can set up multiple Fixed Savers at the same time. Interest is calculated daily and paid at the end of the 12 months.*

It's important to make sure you have easily accessible savings for emergencies before putting money aside in a Fixed Saver, as the money you put into a Fixed Saver will not be accessible for 12 months.

Whether you're a budgeting newbie or very experienced, get started with our Budget Planner and dive into the Starling app to discover our simple money management tools for budgeting.

* Rates correct as of 1st November 2024. 18+, UK Residents. Minimum deposit of £2,000. Starling personal current account required. AER stands for Annual Equivalent Rate and shows what the interest rate would be if interest were paid and compounded once each year. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

12th December 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024