Budget planner

Helping you manage your money

Budget planner

Helping you manage your money

In challenging times, spending knowledge is power.

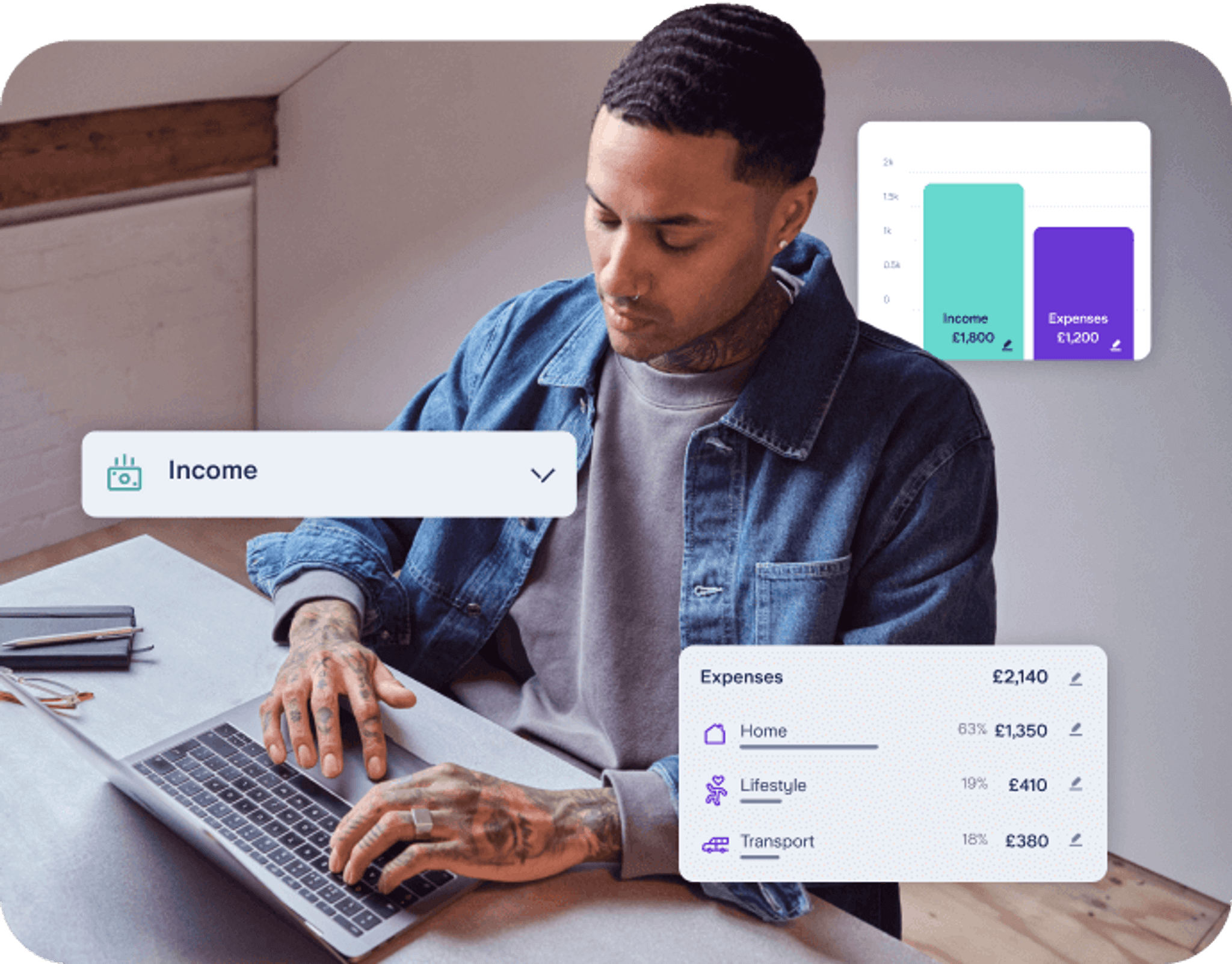

Starling’s free budget planner brings your finances into focus, so you know where to cut back – or carry on. Understand where your money goes, so you can set realistic budgets to stay in control, and get closer to your saving goals.

The Budget Planner takes about 5-10 minutes to complete.

What do I need to fill out the Budget Planner?

Exact figures are best. However, if you just want to get a general idea of your spending, you can enter your best estimates. Remember: it’s better to estimate higher rather than lower.

Here are some things you might need:

- Payslips

- Other income statements

- Bank statements

- Debit and credit card statements

- Transaction history

- Receipts – if you often pay in cash

How does the Budget Planner work?

Fill out all the categories that apply to you and we’ll calculate your spending against your income. Don’t include details that might identify you. Once finished, you’ll see a breakdown of your outgoings by category. Our budget planner helps you figure out exactly where your money is going – household expenses, bills, travel, etc.

If you’re within budget, we’ll suggest setting money aside to help you hit your saving goals.

If you’re overspending, we’ll direct you to organisations that provide free and impartial support with debt and money management.

Is your situation likely to change? No problem – come back with your new figures and we’ll recalculate.

The budget planner is intended as general information and isn’t advice. You should take independent advice if you have any questions about your specific circumstances.