Help with the cost of living

Help with the cost of living

How we’re supporting you.

The cost of living crisis is having an impact on all of us. We’ve been listening to our customers to better understand what we can do – and what we can build – to help. Things are constantly changing, so we’ll continue to look at new ways to support you. Here’s where to start...

Introducing: The Budget Planner

Understanding your spending can help you feel in control when things feel uncertain.

So we’ve launched a free, easy-to-use Budget Planner on our website. Within 5-10 minutes, you’ll get a detailed breakdown of your spending habits, expert tips to help you save and a list of useful resources.

Start here

Tools for transparency

With a rising cost of living, it’s never been more important to see your money clearly. We’re making sure you can, with:

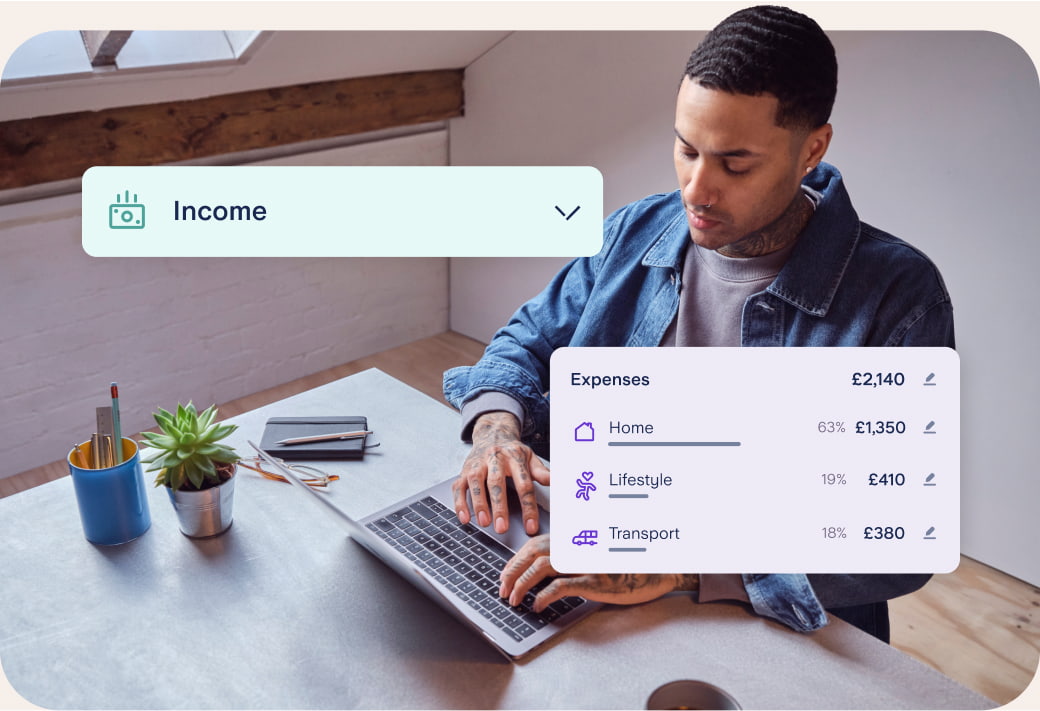

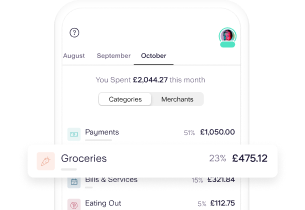

Spending Insights

Get up close and personal with your spending habits – now customisable by date range with 58 categories. Keep tabs on rising costs and see exactly where your money is going.

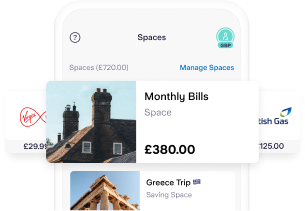

Bills Manager

Set up a Space for all your essential spending to ring-fence your bills. Is it time to scrap those won’t-be-missed subscriptions? Tally them up in Bills Manager – then decide.

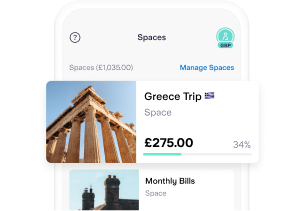

Spaces

Try the digital ‘envelope method’ by dividing up essential spending into Spaces – that could be petrol or household bills. Consider these virtual money pots a safer, smarter alternative to cash stuffing.

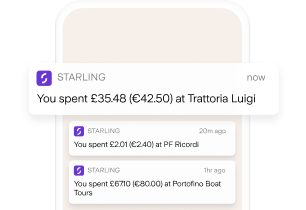

Instant Spending Notifications

See exactly what you’re spending and what’s left. We notify you instantly every time you pay for something, giving you a real-time balance – and peace of mind.

Helping you budget better

Money management made easy. Discover need-to-know app features that could help you get a handle on your finances.

Helping you take control. Worried about rising living costs? We’ve gathered tips from the experts. Heard of the ‘pause before you buy’ approach? How about the ‘Breathing Space’ scheme? Visit our blog for more ideas on how to take control of your finances.

Need to talk? We’re all ears – 24/7. Our Customer Service team is here to help you deal with the unexpected and talk through options together.

Support with money worries

Speak to us

If you’re feeling worried about money, you can talk to our specialist teams on 020 3841 4955 or email us at moneyworries@starlingbank.com

Speak to usYou can also get free, independent advice from these organisations:

Money Helper: Free and impartial money advice from the government, offering support over the phone and online.

StepChange: A charity providing expert advice, support and solutions to help manage debt.

Debt Advice Foundation: A national debt advice and education charity offering free and confidential support.

Money Advice Trust: A national charity helping people tackle their debts and manage their money with confidence.

Citizens Advice: Free, confidential advice to help with debt and money worries, benefits, work and legal problems.

Tip: Try the Benefits Calculator

In a cost of living squeeze, extra income could make a big difference. Charity Turn2us offers a free benefits calculator, which tells you what you could be entitled to. This could include Universal Credit, state pensions, carer’s allowance or cost of living support.

Turn2us is a national charity that provides practical help to people who are experiencing financial difficulties.

Helping businesses stay on top

Cost of living support and resources

Resources for independent help. There are lots of organisations out there that offer free and impartial debt advice specifically for business owners.

Worried about the future of your business? The first step is talking things through. If you have a Starling loan or overdraft, call us on 0204 506 8350 or email us at businesslendingsupport@starlingbank.com

What happens if I miss a repayment? If you miss (or expect to miss) a repayment, get in touch with us and we can come up with a plan together.

Business Bounce Back Loans Scheme (BBLS)

Pay As You Grow. For anyone who’s struggling (or will struggle) to meet their monthly repayments on a Bounce Back Loan, there are ways we can help.

Protecting you from fraud and scams

During the financial crisis, scammers are coming up with new ways of committing fraud, including email, text and social media scams. Recent examples include a message alerting social media users to a discounted energy bill or a council tax rebate.

Your Starling account is protected by powerful, industry-leading security features. But if you notice something suspicious, or think you may have been the victim of fraud, get in touch with our customer service team as soon as you can.

What does fraud look like in a cost of living crisis? Read up on the scams to watch out for. You can also find more on how to stay safe with the national, Take Five campaign.