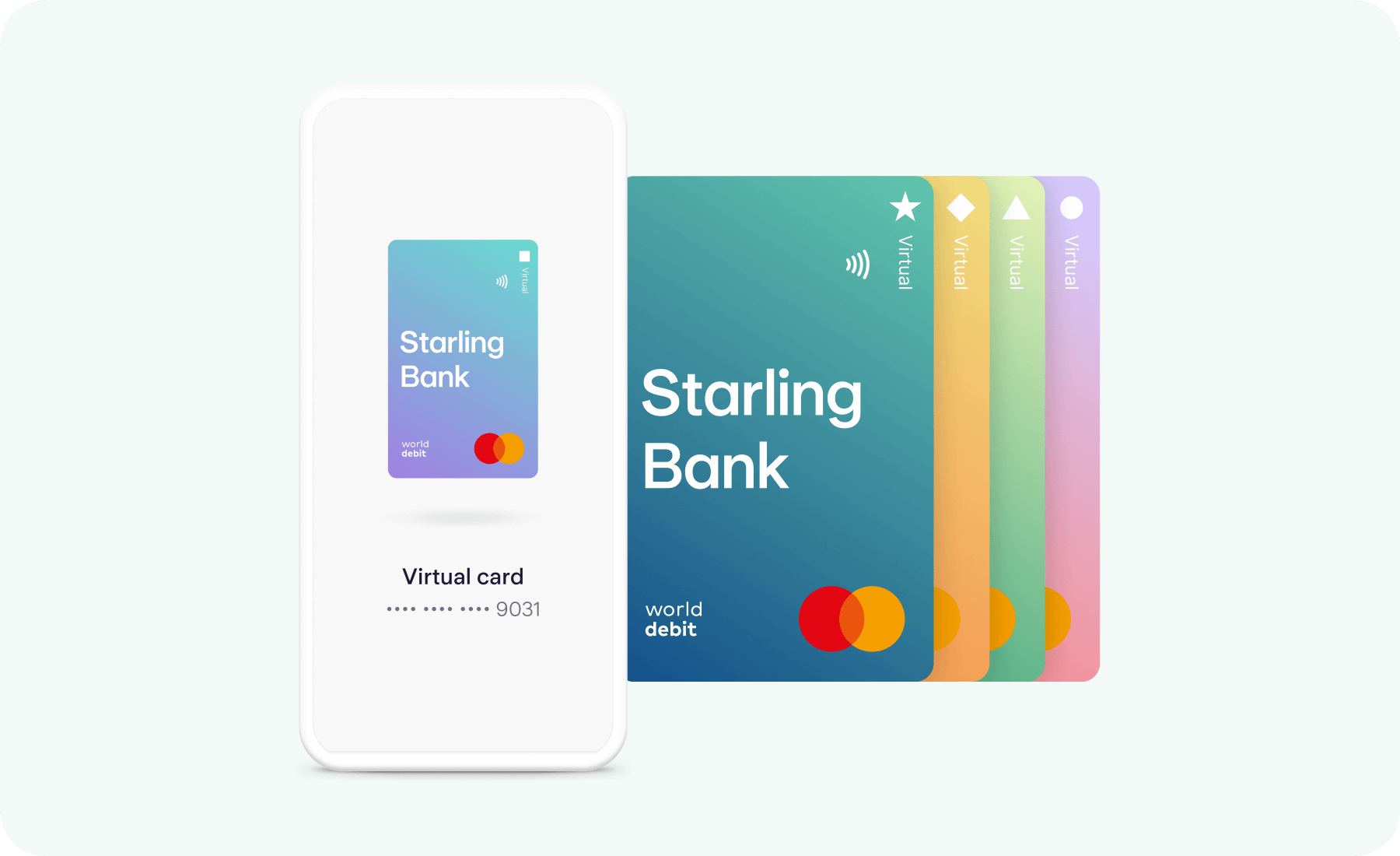

Virtual cards let you spend directly from a Space

Virtual cards let you spend directly from a Space

Create virtual debit cards linked to budgets you’ve created, and only ever spend as much as you plan to.

What is a virtual card?

Virtual cards work just like normal debit cards, but they’re linked to Spaces. You can create them for free as part of our personal and joint current accounts.

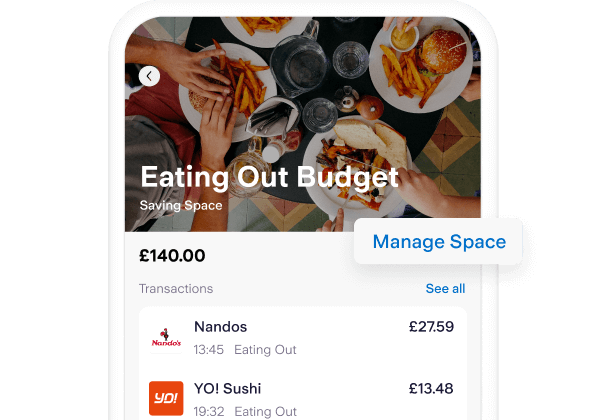

When you spend, we’ll take the money from your chosen Space instead of your main balance. Paying for fuel? Do it from your ‘Car Costs’ Space. On holiday with your partner? You can both spend directly from your carefully budgeted – and shared – ‘Weekend Break’ Space.

Create a virtual card, and we’ll give you a unique card number, CVV number and expiry date linked only to the Space.

What are the benefits of virtual cards?

Unbreakable budgets

Need to stick to a budget? Let’s say you’re making home improvements. Set money aside in a ‘DIY’ Space, and use your virtual card every time you buy materials.

One look at your Space shows what you’ve spent, and what’s left. When the money in your Space is used up, your virtual card will decline (until you top the Space up) instead of dipping into your main balance.

It’s ideal for holidays, retail therapy, a night out or, well, anything you can think of really.

Try our budget planner to better manage your money.

Extra security

Buying from a website you’ve not used before, or making a payment over the phone? Use a virtual card - the details are only linked to the money in your Space, and not your main balance. Just in case.

You can also delete or lock your virtual card once it’s been used - even more reassurance your money is safe. Remember, your money is guaranteed up to £85,000 by the FSCS, and that includes money in a Space.

Better subscriptions management

Use Bills Manager to pay Direct Debits and standing orders from a Space. Add a virtual card to your Bills Space to pay subscriptions - such as Netflix and Amazon Prime - from your Bills Space too.

All you’ll need to do is update your card details with the merchant.

Paying subscriptions from a Space helps you spot price fluctuations more easily too - since the payments aren’t buried in your main transactions feed.

Can I use a virtual card in shops?

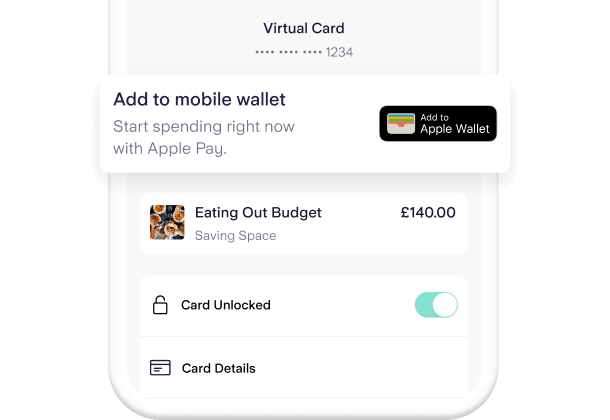

You can use your card details online and over the phone, or add the card to your mobile wallet to shop in-person. When you spend, we’ll deduct the money from your Space, and not your main balance.

It’s just like a normal debit card, but we won’t send you a physical card in the post.

Check out our blog post on virtual cards.

How to set up a virtual card

Step 1

On your personal or joint account, create a Space or choose an existing one. Tap ‘Manage Space’.

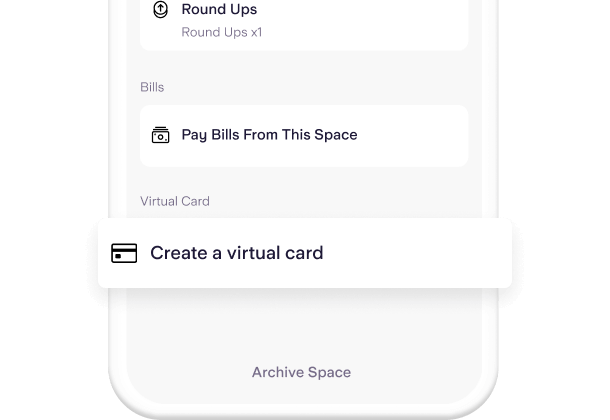

Step 2

Now tap ‘Create a virtual card’ at the bottom of the menu.

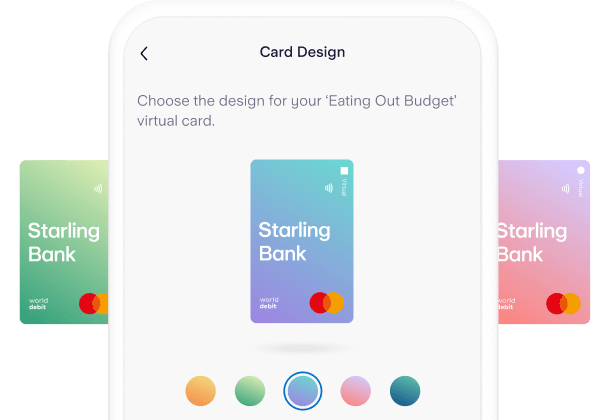

Step 3

Choose from five different colours - each colour has its own shape to help you identify it too.

Step 4

You can add to your mobile wallet by tapping ‘Add to mobile wallet’.

Virtual cards FAQs

How many virtual cards can I have?

You can have up to five active virtual cards at any one time, and create up to five new virtual cards every week.

For example, you could have five active virtual cards on your personal account, and another five on your joint account. Both joint account holders can have up to five active virtual cards at once – that’s ten for the joint account in total.Does it cost money to have a virtual card?

It’s totally free to create and have virtual cards with our personal and joint current accounts. Virtual cards aren’t currently available for business accounts.

I have a joint account. Can we both have a virtual card for the same Space?

Yes, you can both spend from the same Space. You’ll both need to individually follow the steps to create a virtual card for the Space. The virtual cards will have different details to each other – just like your main joint debit cards.

How do I delete a virtual card?

Go to Spaces, then choose the Space connected to the virtual card you wish to cancel. Tap ‘Manage Space’ and then ‘Delete virtual card’.

You can also cancel virtual cards in the Card tab in the app. Just tap ‘All Cards’ in the top right corner and select the card you wish to cancel.How do I dispute a virtual card transaction?

The fastest way to resolve a suspicious transaction is to contact the merchant directly. We also suggest you contact the payment handler (such as PayPal), if appropriate.

If you still need support, please head to Online Banking. Find the transaction in the Space, then select ‘Need help with this transaction?’, where you can raise a dispute.Can a virtual card make my account overdrawn?

Spaces do not have an overdraft. A virtual card can only spend money you’ve set aside in the Space. In the vast majority of cases, if there isn’t enough money in the Space to cover your virtual card transaction, it will be declined and we’ll send you a notification. There is no charge for declined transactions.

What are the spending limits for a virtual card?

Each virtual card has an individual daily spending limit of £500, regardless of the currency you’re using. You can make up to 50 transactions per day.

You can spend up to £500 per transaction on your mobile wallet.

Virtual cards cannot be used to spend at money transfer services, crypto exchanges or betting companies.

Looking for help?

Visit our help centre for a full range of frequently asked questions on virtual cards. It’s often the quickest way to get the answers you need – from within the app or online.

Visit our help centre