Budgeting

“Bills, Bills, Bills” – Sorted in three simple steps

By Esmeralda Dyer Bray

Saving

Your boiler breaks. An unexpected bill appears on your doorstep. Poppy gets her paws on your secret chocolate stash. If disaster strikes, you can soften the blow by being well-prepared financially. You can’t control what comes your way, but you can future-proof your bank balance ready for those ‘ouch!’ moments – with an emergency fund.

An emergency fund is exactly what it sounds like – it’s a set amount of money stashed away for unexpected events or surprise expenses. Most importantly, it gives you options in times of stress or crisis, like if you’ve lost your job, been suddenly admitted to hospital or something major happens. But it’s not just money to help you keep the boiler on, it can also give you a lot of freedom and added security, should you need to leave a difficult relationship or navigate a big life change of any kind.

Your emergency fund needs to be easily accessible. And no, we’re not talking about cash under your mattress or money in a tin. We’re talking about money in a bank account, ideally one that’s separate from your main account so you know not to touch it.

With an Easy Saver, (subject to eligibility), you can add money from your Starling personal account and withdraw money again as many times as you like and earn 3.75% AER (3.68% gross variable interest* on up to £1,000,000). You need to be a UK resident over the age of 18 to apply for an Easy Saver and have a Starling personal account. Interest is paid monthly.

The general rule of thumb is to save at least three months’ worth of essential living expenses. So if you ever lost your job and needed time to find another one, you can afford to cover your rent or mortgage, bills and food for three months. If that equates to £1,000 a month, then you should aim to build up at least £3,000.

Sometimes the hardest part is figuring out how much you can afford to set aside – too much and you feel like you’re stripping away too much of the fun stuff. But too little feels like you’re having to save for eternity with no end in sight. Enter: our Budget Planner, which can help you create a realistic budget that’s in line with your income and monthly expenses. It’s available on our website and can be used by anyone – not just Starling customers.

On top of all your monthly bills and saving goals, saving up three months worth of living expenses can feel like a lot. But you can build this up gradually by saving in a way that works for you – by practising good money habits. You can do this over time without having to make drastic changes to your lifestyle. Or even, without realising you’re saving. That’s why we’ve built certain tools into our app.

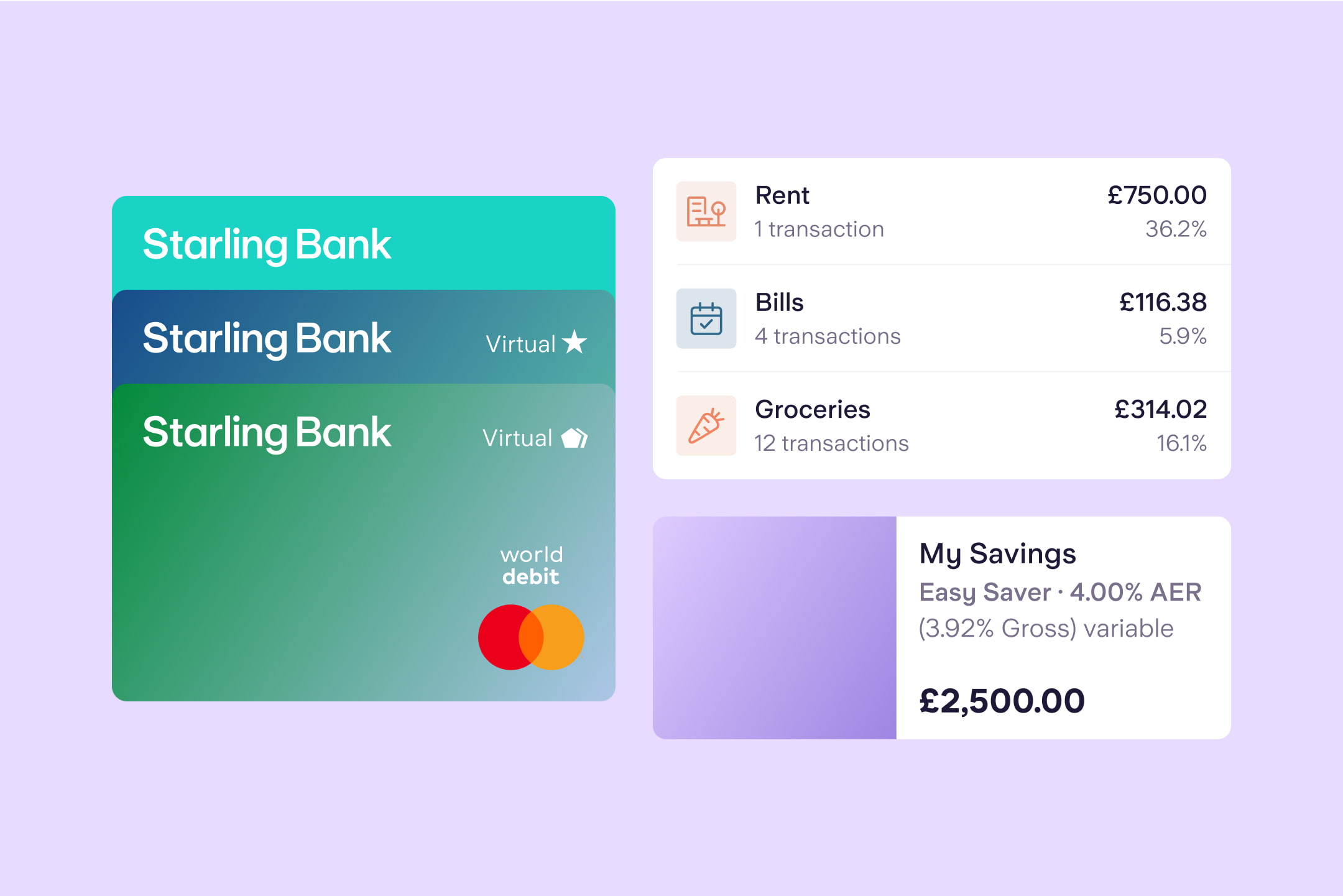

Spending Insights can show you where your money’s going every month and identify areas where you can save – you may find that you have too many unused subscriptions or could cut down on takeaways. If you’re looking for ways to organise your money or manage bills better, our Spaces feature allows you to set aside money for different things. You can also set up Bills Manager to pay bills from your chosen Space or because every penny counts, you can choose to Round Up whatever you spend to the nearest pound.

If you’ve dipped into your emergency fund, make sure that you prioritise building it back up when you’re ready. We know it feels hard. But just remember how glad you were to have it when you needed it. Future you will thank you.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, you should speak to an independent financial advisor.

*Rate correct as of 16th May 2025. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

Dip in and out of your savings, all whilst earning interest.

Explore our Easy Saver

Budgeting

By Esmeralda Dyer Bray

Expert interviews

By Vicky Reynal

Budgeting

By Charlotte Lorimer

Saving

By Matt Poskitt