We’re not accepting applications for euro accounts at the moment, they’ll be available to apply for again soon.

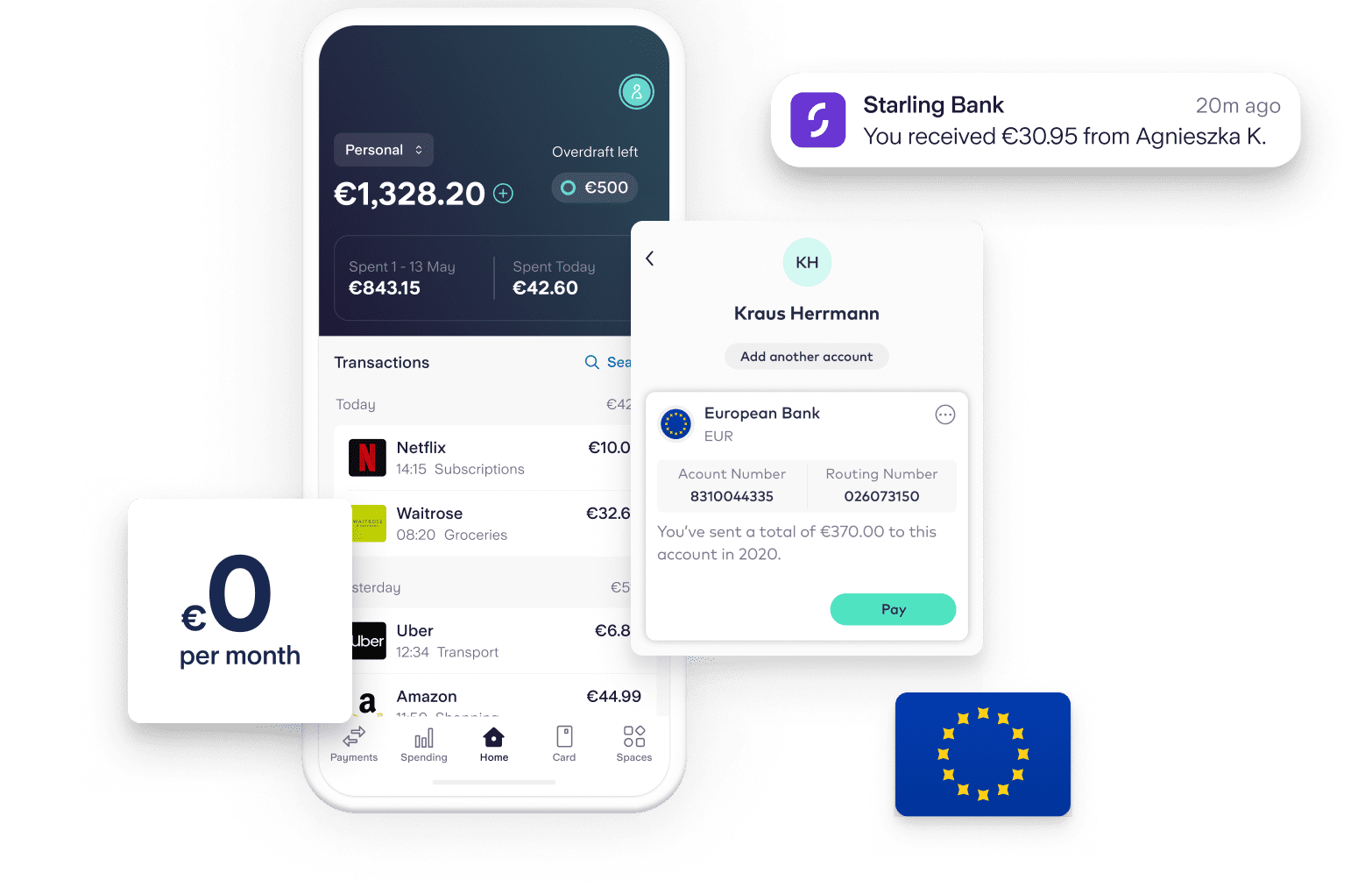

No account fees

It’s free to hold, send and receive euros with Starling, and there are no monthly fees.

Hold, send and receive euros for free.

We’re not accepting applications for euro accounts at the moment, they’ll be available to apply for again soon.

Have friends or family in Europe that you send or receive money from? Good news – you can hold, send and receive euros for free with a Starling euro account. Get the app and a bunch of award-winning features to boot.

Want to convert your euros into pounds or vice versa? Make it happen with a tap. You’ll get the current exchange rate with a 0.4% conversion fee added on top to cover our costs. No hidden commission, no sneaky extra charges.

We only process SEPA payments on working days. If you schedule a payment for a weekend or Bank Holiday, then it will be processed the following working day. Payments generally take 1-3 working days to arrive.

It’s free to hold, send and receive euros with Starling, and there are no monthly fees.

Transfer between your Starling GBP and euro accounts 24/7 – even at the weekend. Exchange rates vary during working days, but are fixed at weekends. We’ll always show you the available rate, so you can choose to wait until Monday morning.

Use a single debit card to manage your EUR and GBP accounts. If you want your EUR card transactions to come from your EUR account, go to the ‘Card and Currency Controls’ section in the app and turn it on with a tap.

Our euro account is a full current account with its own unique IBAN – and you can rest easy knowing that your total Starling deposits are covered to £85,000 or equivalent by the Financial Services Compensation Scheme.

We don’t pay interest on the balance in your euro account.

You can find the terms and conditions for your euro account on the Legal documents page.

Maybe you’re from Bristol but own a flat in Barcelona. You might have moved here from Madrid but send money back to mum. Whatever your situation looks like, the Starling euro account is great for...

If you’re planning on going on holiday, you can still spend with your card and withdraw cash with your Starling current account anywhere, for free, without opening a euro account. Find out more about travelling with Starling.

We charge a 0.4% conversion fee when you exchange currency between your Starling GBP and euro accounts

Please note: our euro account can only send SEPA payments

Secondary accounts are subject to eligibility criteria, which means that the option to apply for these accounts in the app will only be visible for customers that match our criteria.

We think we have the best personal euro current account, but don’t just take our word for it. We’ve been reviewed thousands of times on Trustpilot. Our customers think we’re “the best bank bar none”, “a true breath of fresh air”, and “freaking love” us.