Good with money starts here.

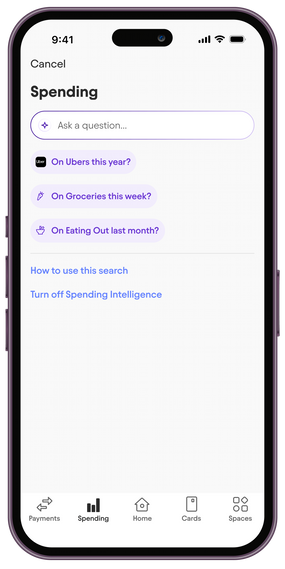

Organise your money, build great habits and stay in control of your spending.

Learn moreGame-changing banking.

Life-changing habits.

There’s an account

with your name on it.

Joint

Bills, budgets or just splitting brunch: it’s better together.

Do life together

Personal

Spend, organise and save with the habit-building bank account.

Tell me more

Business

No monthly fees and free 24/7 UK support.

Let's talk business

Kite

The free debit card for kids, managed from your account.

Teach life skills

Budgets and bucket lists.

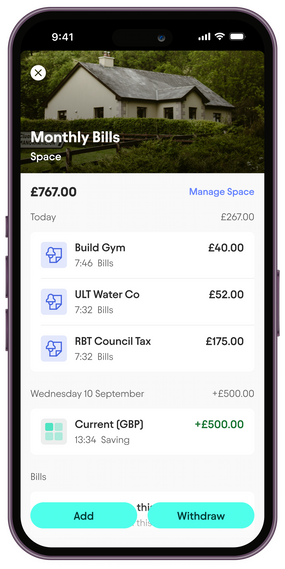

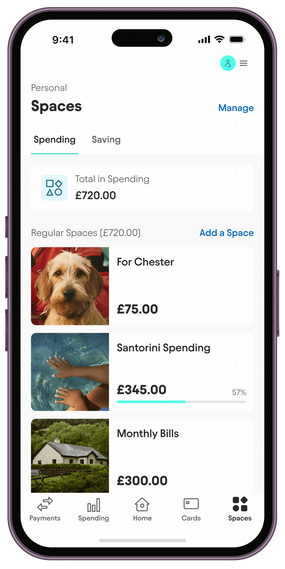

Set aside money with Spaces within the app, separated from your balance. Good for tracking goals, and great for keeping your expenses neatly sorted.

Watch your money grow

Our savings accounts.

Fixed Saver

The top earner. 3.30% AER/gross interest.

Find out moreEasy Saver

Withdraw anytime. 2.50% AER/ 2.46% gross (variable) interest.

Find out moreFlexible Cash ISA

NEW

Tax-free savings. 2.50%/ 2.46% tax free (variable) interest.

Find out more18+, UK residents. Interest paid monthly for the Easy Saver and Flexible Cash ISA. Interest paid at the end of the term for the Fixed Saver. Starling personal current account required. Subject to eligibility. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. Tax free is the tax free rate of interest payable where interest is exempt from income tax.

Industry-leading security, including face and fingerprint recognition, and groundbreaking new tools powered by AI.

Your money is protected.

Eligible deposits are protected up to £120,000 by the Financial Services Compensation Scheme (FSCS).

24/7 UK support from humans.

Whatever the time, whatever the day. Start a live chat in seconds or give us a call – we’re ready to help.

Scam Intelligence.

Not sure if something’s a scam? Upload a screenshot and our AI will flag concerns, such as generic photos or low prices.

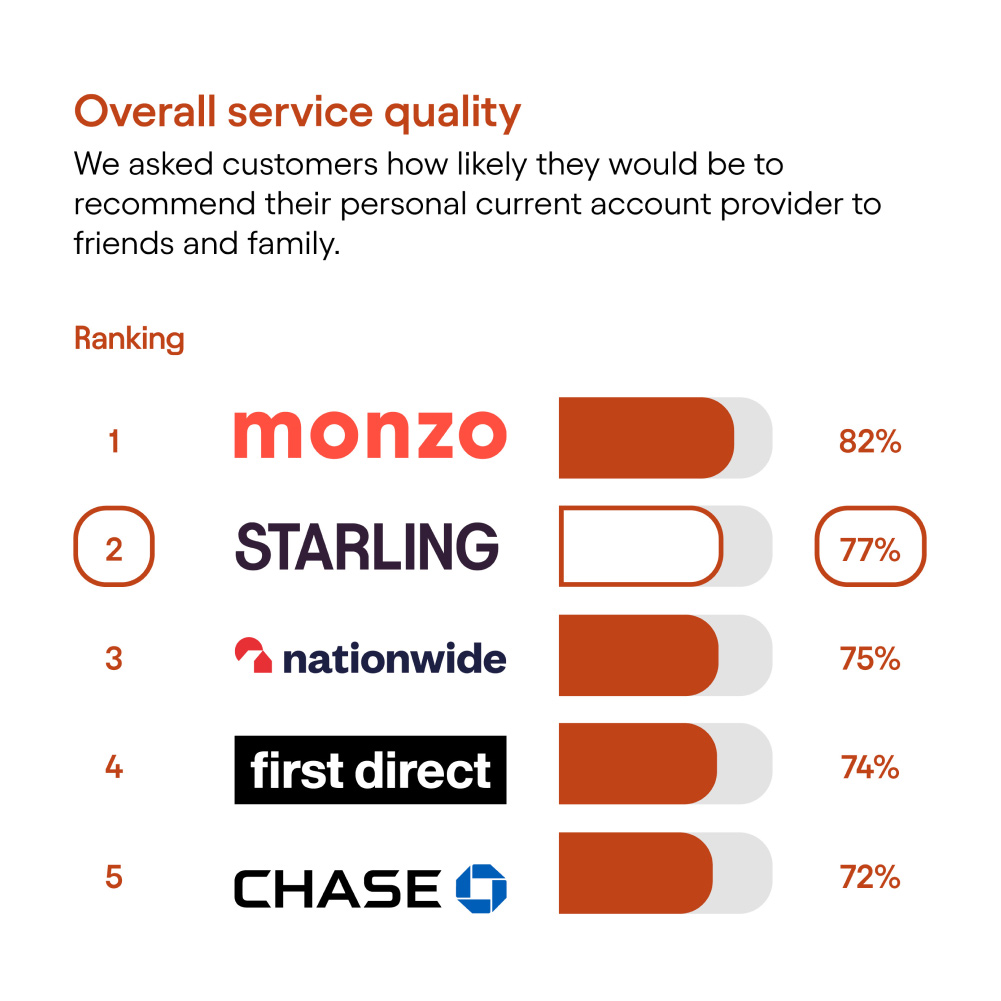

Independent service quality survey results

Personal current accounts, Great Britain

Published February 2026.

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

The requirement to publish the Financial Conduct Authority Service Quality Information for personal current accounts can be found here.

2024 Authorised Push Payment (APP) scam performance data

Authorised push payment (APP) scams happen when someone is tricked into transferring money to a fraudster’s bank account. Information about Starling’s performance prior to the introduction of the reimbursement requirement in October 2024 can be found in PSR’s latest APP Scams Performance Report published in February 2026.

Join the millions of people getting good with money.

Award-winning accounts. No monthly fees. Industry-leading security features.

Apply now