The award-winning business bank account

The award-winning business bank account

Business banking – but not as you know it. Apply for a digital business account with zero monthly fees and join a growing community of UK businesses who have changed the way they bank.

Apply now

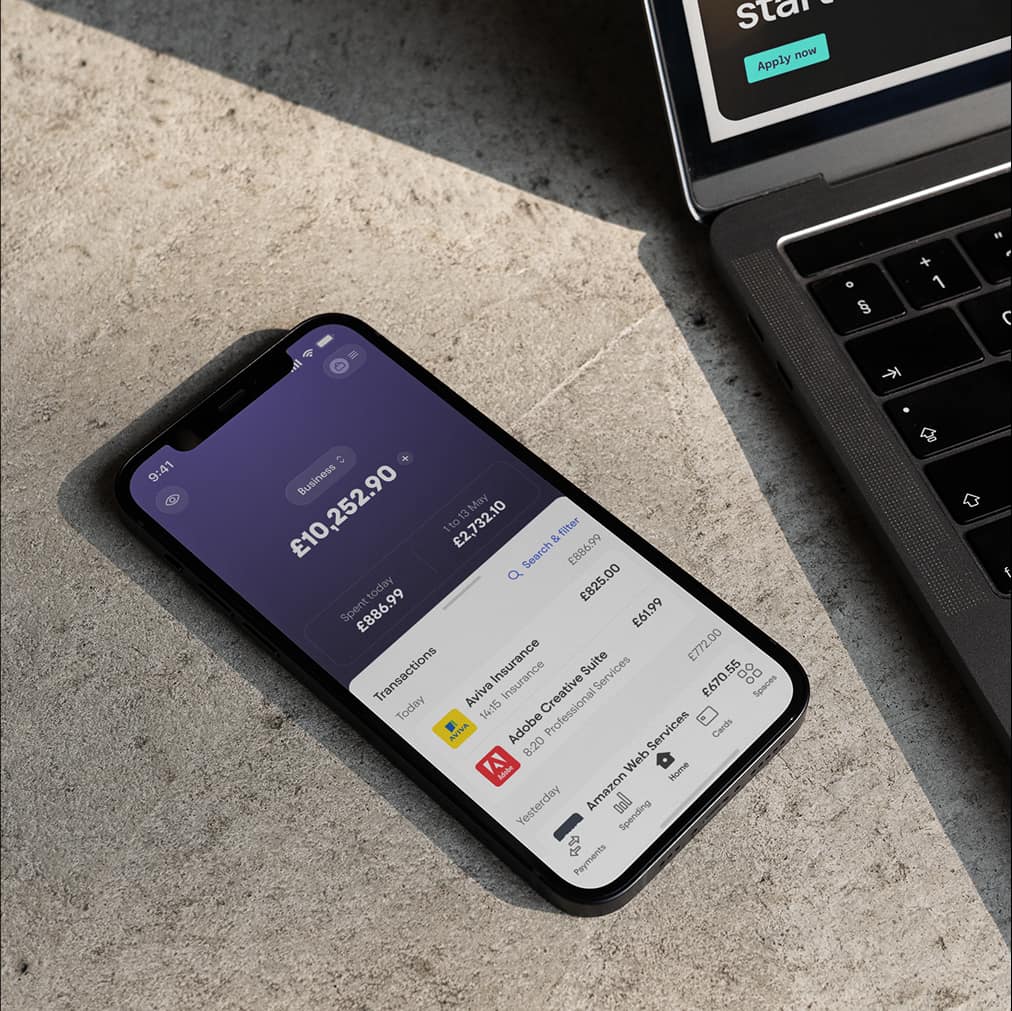

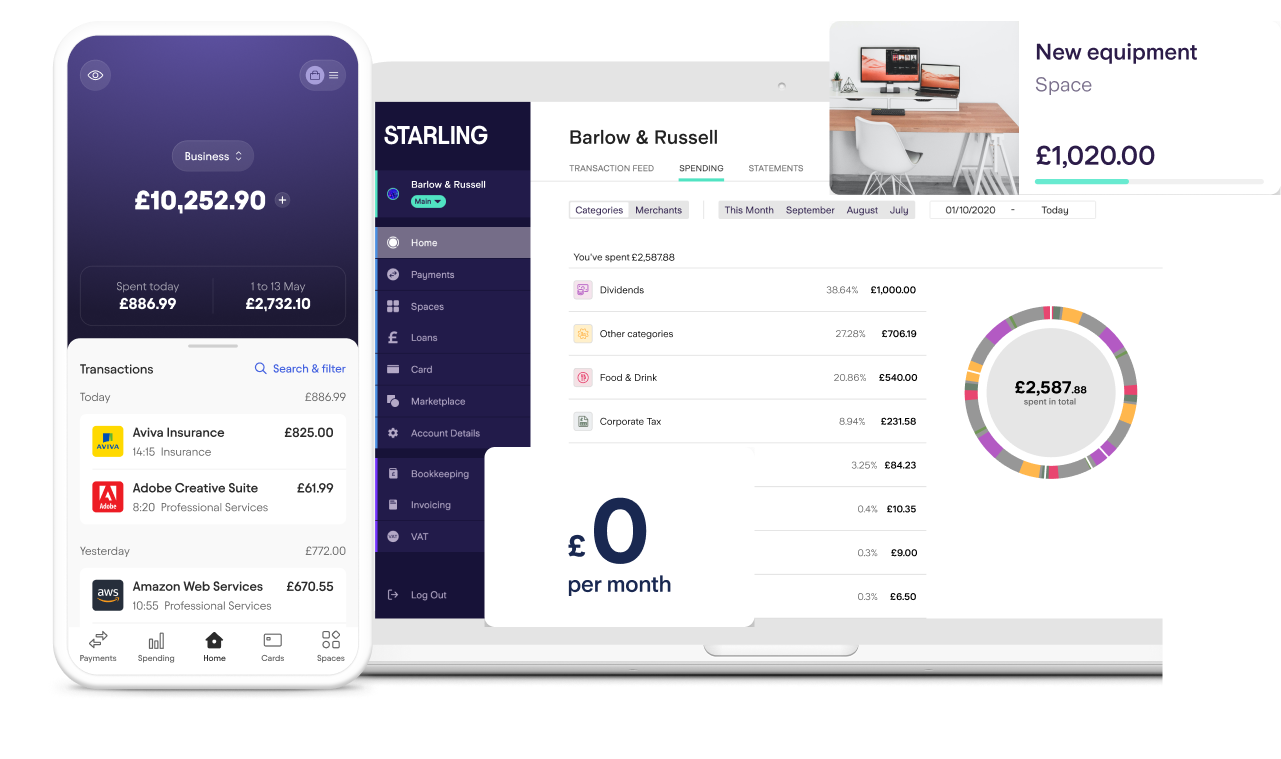

Less admin. More control.

There’s a faster, easier way to stay on top of your business’s finances. Apply for a digital business account easily within the app to get your Mastercard debit card, plus:

£0 a month

No monthly fees or UK payment charges. Other banks charge fees for what limited companies get for free with Starling business. Give our comparison table a quick scan to see for yourself.Free 24/7 UK support

Fast response times and help from real humans via app, phone or email.A fully regulated UK bank account

Your money’s covered up to £120,000 by the Financial Services Compensation Scheme.Switch with ease

If you want us to, we’ll move all your banking over for you through the Current Account Switch Service (all it takes is a few taps in-app).

Want to check if you’re eligible?

Take a look at our eligibility page to find out if your business is eligible for a business account.

Check if you're eligibleGood for business

Great for sole traders, limited companies and limited liability partnerships (LLPs), including startups.

Free access for multiple directors/PSCs. Easily add directors to your account. But please note, we can’t provide access for third parties (like accountants) or other team members (e.g. finance teams or assistants).

Integrate accounting software like Xero, QuickBooks, and FreeAgent from the Starling Marketplace.

Integrate other business services like Zettle and SumUp.

Connect other business accounts you hold with other banks.

Mobile and online banking.

Feature-packed, with no monthly fees

Automated business spending categorisation

Receipt capture

Separate Spaces for separate costs

Pay Direct Debits and standing orders from separate Spaces

Managed scheduled payments

Instant payment notifications when you pay or get paid, and get a reminder the day before payments are due

Card security controls, like card locking and personalised card settings

Free ATM withdrawals. Up to 6 a day, with a daily limit of £300, regardless of withdrawn currency

Free UK bank transfers

International payments to bank accounts in 34 countries worldwide, with no hidden fees

No fees abroad for card payments or ATM withdrawals

Apple, Google, Samsung and Garmin Pay

Deposit cash at the Post Office for a 0.7% fee (£3 minimum fee)

Customise it

with add-ons

Design the account that’s right for you, by signing up the services your business actually needs. Add on as many as you like, through the app.

Euro business

account

We’re not accepting applications for euro accounts at the moment, but they’ll be available to apply for again soon.

£2/month

Exchange and hold euros

Local account details to make and receive local payments with ease

Spend on your card like a local using your regular business card

US dollar business account

We’re not accepting applications for US dollar accounts at the moment, but they’ll be available to apply for again soon.

£5/month

Hold, send and receive dollars

Get local account details, for easier, cost-free payments

Use your regular business card; no need to faff around with two

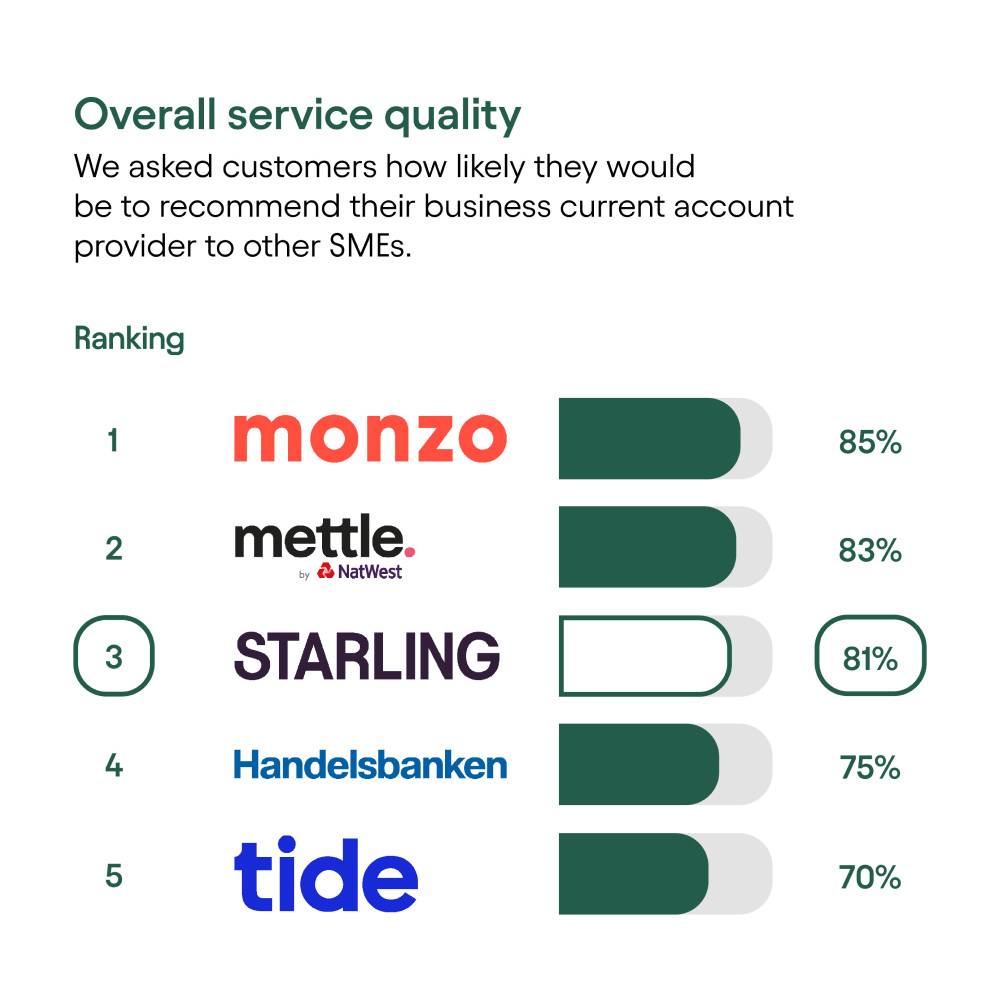

Independent service quality survey results

Business current accounts

Published February 2026.

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 17 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs). The results represent the view of customers who took part in the survey.

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here.

Spending, simplified

Instant payment notifications. Get notified the second you pay or get paid, and get a reminder the day before payments are due.

Spending analytics. Break down your monthly spending and automatically sort it by category.

Digital receipts. Keep your files in order by adding digital receipts to payments.

Separate Spaces for separate costs. Set things like tax and overheads to one side.

Bills Manager. Get a clearer view of your money by paying Direct Debits and standing orders from a separate Space.

Many a happy customer

Don’t just take our word for it. We’ve been reviewed thousands of times on Trustpilot, and our customers think we’re “easily the best business bank account they’ve had”, “a refreshing experience”, and that we “make business banking easy”.

Supporting your business

We’ve teamed up with bestselling author Della Hudson to provide you with free and helpful guides on how to successfully manage your business.

You can also find out how to contact us for support on our service information page.

Eligibility requirements

A limited company or LLP registered at Companies House. General partnerships or charities which are not registered as a limited company are not yet supported.

Limited companies and LLPs need all persons of significant control (PSCs) to be a UK resident and natural persons (i.e. no corporate shareholders).

All directors with access to the account must be UK residents.

The business must not be a holding company, dissolved, in liquidation or engage in any activities set out in our terms and conditions.

Evidence of your trading activities so we understand that your business does what you say it does. We can’t accept Companies House documents for this.

Meet our standard anti-money laundering (AML)/ Know Your Customer (KYC), fraud and credit checks and processes.

Refer to our terms and conditions to check sectors not supported. We also do not offer client money accounts.

What you need to open a business bank account

A smartphone (and signal).

Valid photo ID such as a passport or UK driving licence.

If you have documents which confirm the nature of your business at hand this will be easier. Example documents could be a trade registration or bank statement which shows your business activity.

About 10 minutes of your time to complete the application. Then it’s over to our team to approve your details and open your account.