Our help centre is designed to be your first port of call whenever you have questions about our products and services. It’s often the quickest way to get the answers you need – from within the app or online.

Here to help

If money worries are getting in the way, you’re navigating a big life change or you’re in a good place to start saving, we’re here to help at every stage.

How we can support you

Worried about money?

If you’re struggling with money and might need more support than usual, talk to us. Our Customer Service team is here to provide dedicated support to help you deal with the unexpected.

Better ways to budget

Read advice from the experts on budgeting, saving and organising your money. Whatever your circumstances, taking charge will help you feel in control.

Time to tackle your debt?

If you have debt concerns, get in touch. Especially if there’s been a change in your circumstances that could impact your repayments.

Big life changes

If you need to change your details due to an exciting life event (such as moving overseas) or inform us of an account holder’s bereavement, our Customer Service team can help.

Fraud and scams

We’re committed to helping our customers keep their money safe. Scammers are always trying something new, so we keep you updated on what to look out for.

- Card payment scams: How to help stay safe

- Call 159 if you suspect a scam

- Scams targeting younger people

- Cost of living scams to watch out for

- Phishing scams: How to protect yourself

- Protecting you from fraud and scams

- Fake text messages and calls: How to stay safe

- Planning a holiday? Watch out for these scams

Help for business owners

Whether it’s loans, missed repayments or dealing with debt, we can help you and your business get back on track.

How can Starling support?

We go above and beyond when it comes to customer service, especially if you're going through a difficult time. Our Specialist Support team is on hand to help.

Budget Planner

Helping you manage your money.

In challenging times, spending knowledge is power.

The Starling budget planner brings your finances into focus, so you know where to cut back – or carry on. Understand where your money goes, so you can set realistic budgets to stay in control, and get closer to your saving goals.

Head to our help centre for:

Personal banking

Joint banking

Tools for transparency

With a rising cost of living, it’s never been more important to see your money clearly. We’re making sure you can, with:

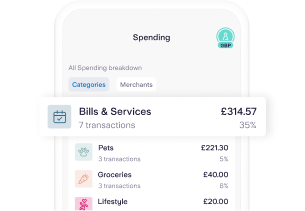

Spending Insights

Get up close and personal with your spending habits – now customisable by date range with 58 categories. Keep tabs on rising costs and see exactly where your money is going.

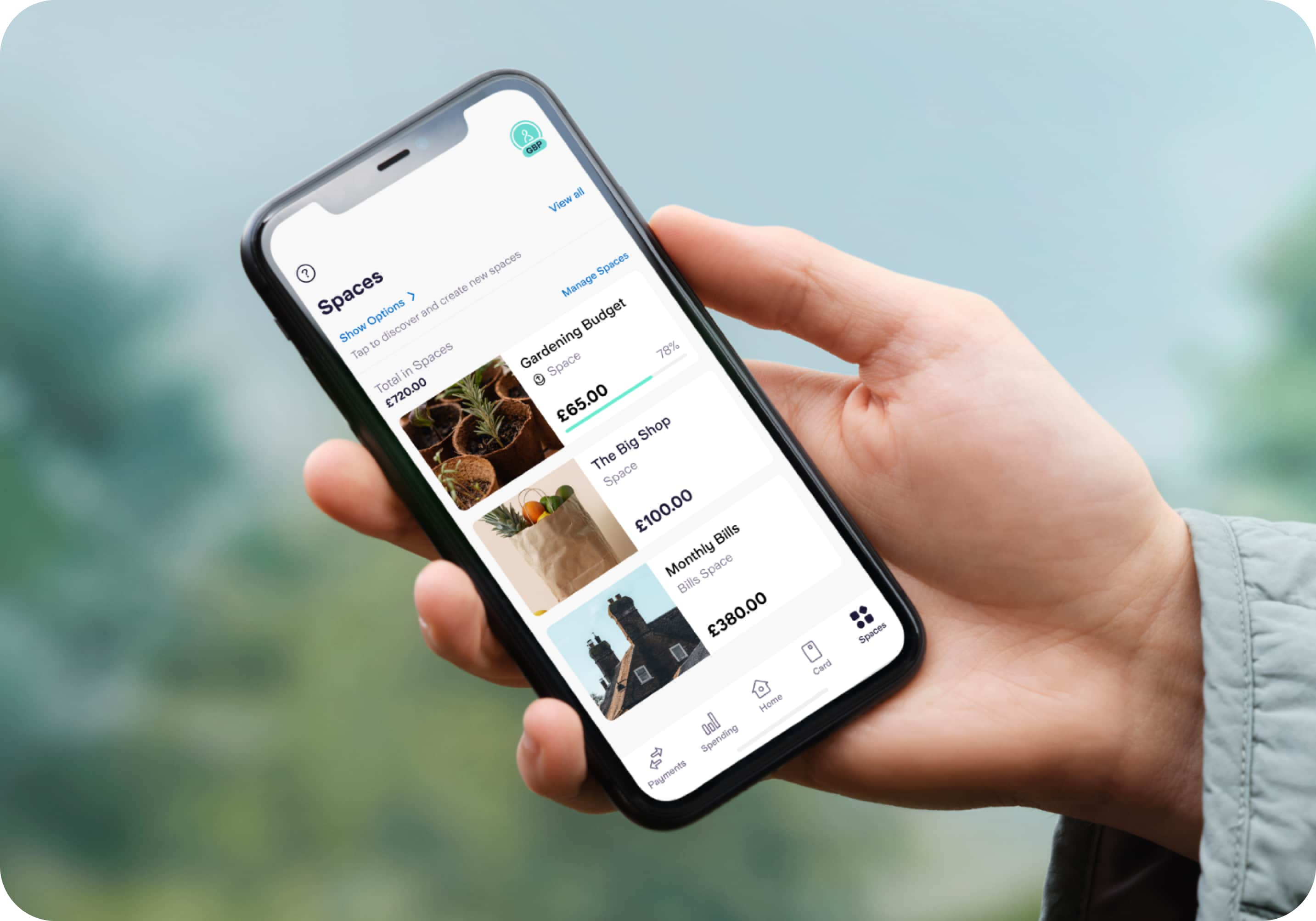

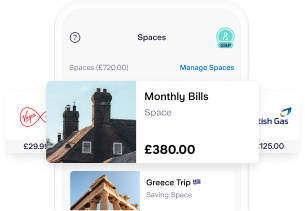

Bills Manager

Set up a Space for all your essential spending to ring-fence your bills. Is it time to scrap those won’t-be-missed subscriptions? Tally them up in Bills Manager – then decide.

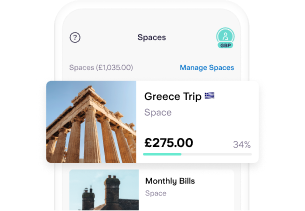

Spaces

Try the digital ‘envelope method’ by dividing up essential spending into Spaces – that could be petrol or household bills. Consider these virtual money pots a safer, smarter alternative to cash stuffing.

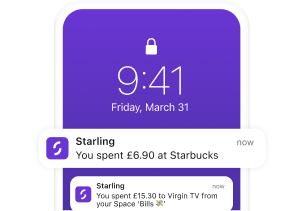

Instant spending notifications

See exactly what you’re spending and what’s left. We notify you instantly everytime you pay for something, giving you a real-time balance – and peace of mind.

Need something else?

Contact Starling

If you’re a Starling customer, the fastest way to contact us is via the app. Or if you prefer, call us on 020 7930 4450 or pop over an email to help@starlingbank.com. Either way, we’re here 24/7.

If you’re reaching out via the app: Log in to your app, tap the menu icon in the top right corner, tap ‘Help’ and then ‘Talk to Starling’. You’ll then be able to send us a message or start a live chat session.

Can’t access the app? Find out what to do if you’ve lost your phone or have been locked out of it.

If you're reporting fraud, please contact us in app or over the phone so we can look into this as soon as possible.

Access for everyone

Let us know if you’d like to receive information in another format, such as large print, braille or audio.