Sole trader banking

Set up a sole trader bank account

Set up a sole trader bank account

An award-winning account with no monthly fees.

Apply now

Business banking, your way

Plate spinning, juggling, putting out fires; it’s fair to say that life as a sole trader can be a bit of a balancing act.

So whether you’re self-employed or happily side-hustling, we’ve built an award-winning sole trader account to save you time and money while you run the show – and (here’s the best part) there’s no monthly fee.

Why it’s good for business

No monthly fees

A straightforward account opening process which takes minutes. No fussy forms, no waiting around, no need to visit a branch (not that we have any). Get straight to business today with a simple in-app application and no monthly fees.

24/7 UK support

Chat to our all-human, all-UK-based team via the app or on the phone. If you’re working, so are we.

No hidden fees

No monthly account fees, no UK transfer fees, no bank ATM fees, and no fees abroad. Where we do have charges and fees, they are transparent and easy to understand. Find out more about charges and fees.

Want to check if you’re eligible?

Take a look at our eligibility page to find out if your business is eligible for a business account.

Check if you’re eligibleAward-winning banking

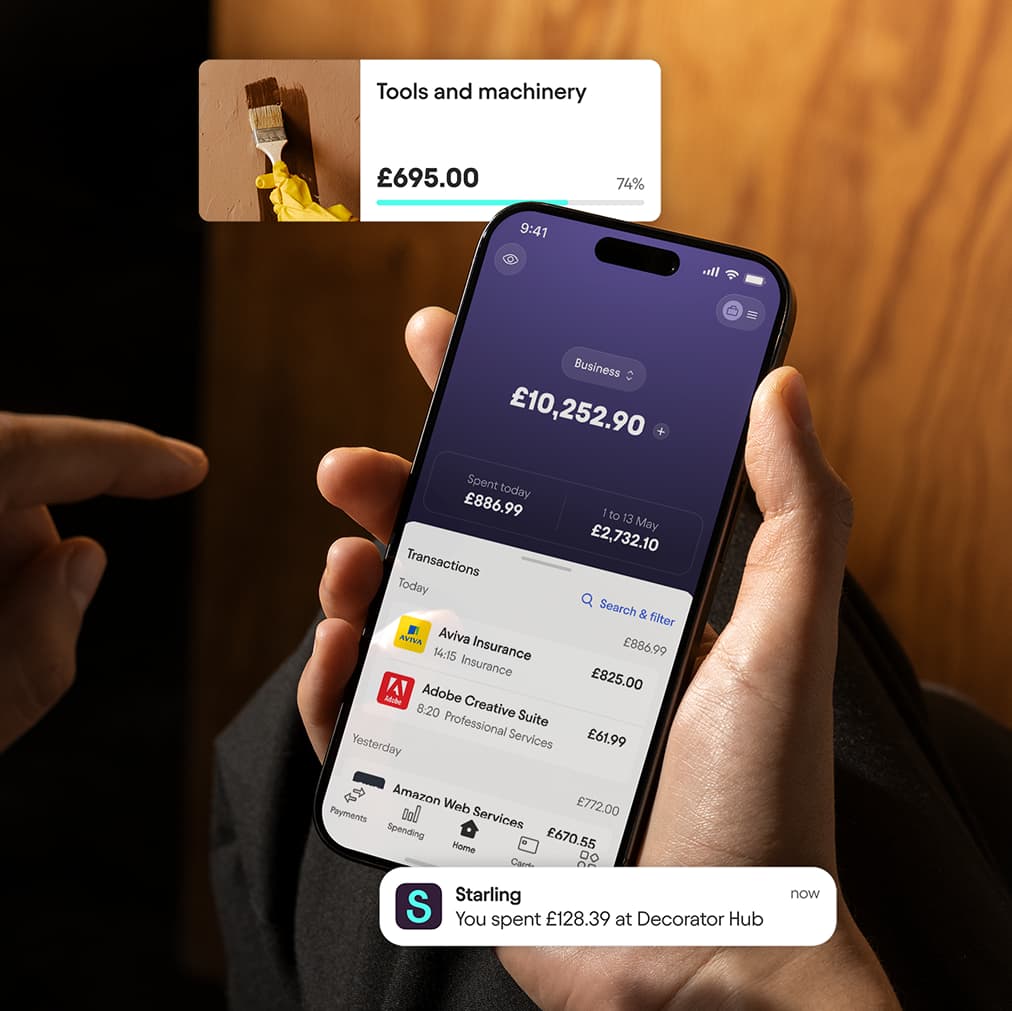

Instant payment alerts. Client payment? Networking lunch? Get real-time alerts as soon as money enters or leaves your account.

Capture receipts. Buried in receipts? There’s an easier way. Stay organised by capturing them in-app as you go.

Automate your expenses. We’ll automatically put your expenses into business categories to simplify your self-assessment tax return.

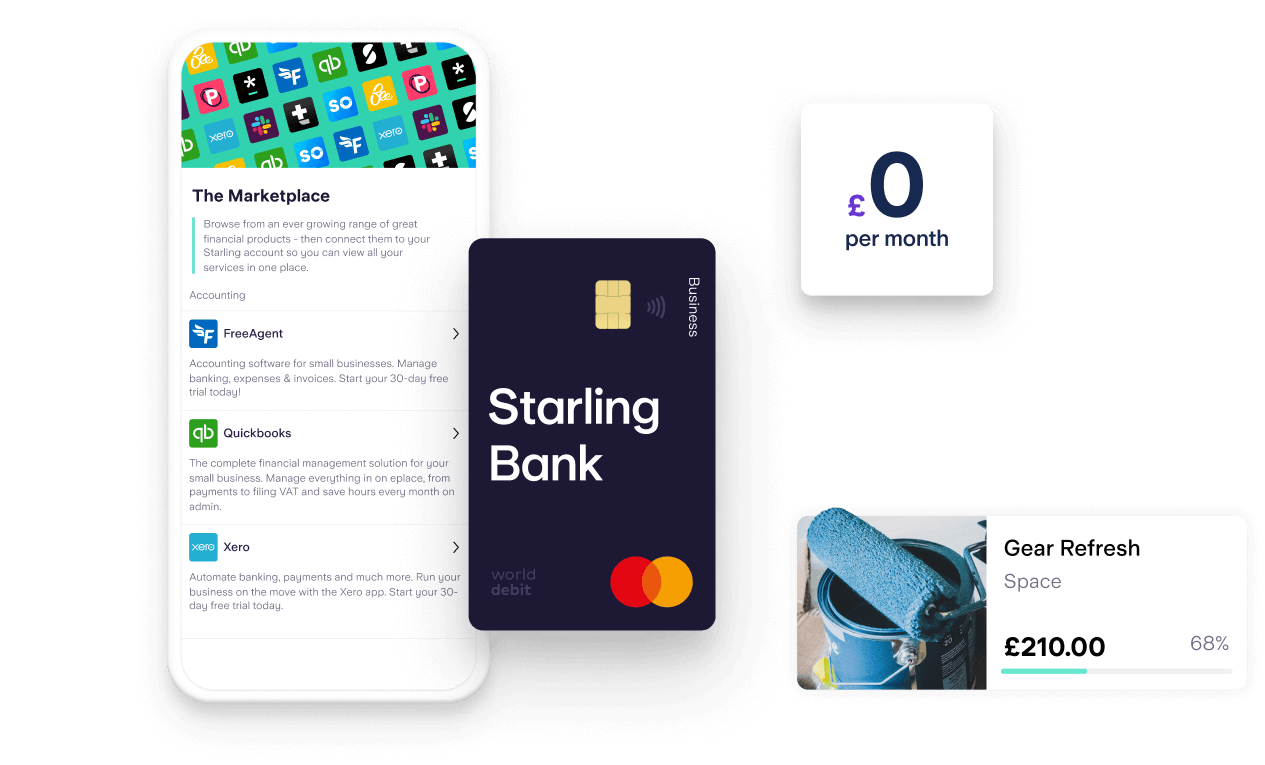

Connect to business tools. Link your account to other services, such as accounting software or insurance, through our Marketplace. Use Xero, QuickBooks or FreeAgent? No problem, connect for free.

Space to separate overheads. Business trips. Tax. A new laptop. Whatever’s coming up, keep it to one side in Spaces.

Bills Manager. Get a clearer view of your money by paying Direct Debits and standing orders straight from a Space.

Cash and cheque deposits. Deposit cash at the Post Office for a 0.7% fee (£3 minimum fee), and deposit cheques of £1,000 or less via the Starling app. When we said you wouldn’t miss branches, we meant it.

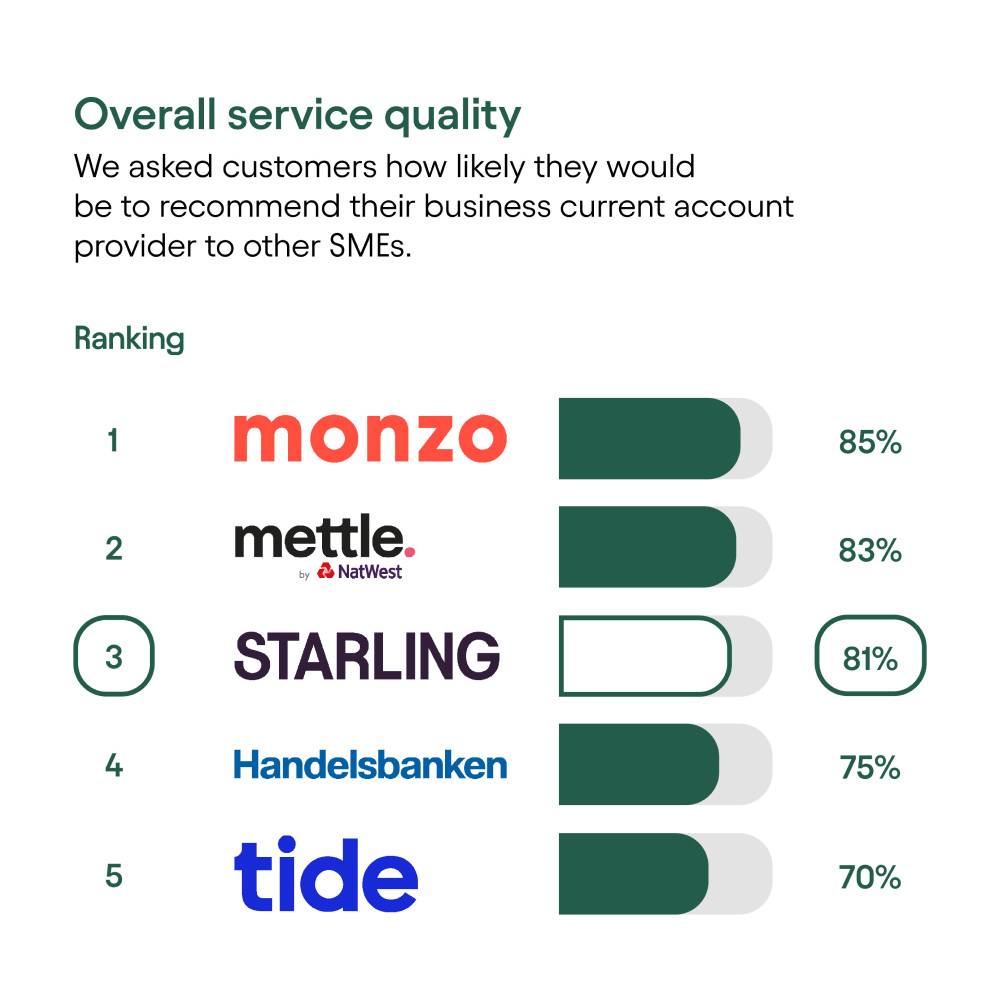

Independent service quality survey results

Business current accounts

Published February 2026.

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 17 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs). The results represent the view of customers who took part in the survey.

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here.

To open an account as a sole trader, customers must meet certain eligibility checks, which include looking at credit data.

When applying for the account we will need evidence of trading activity, and the sole trader can’t engage in any of the prohibited activities set out in the sole trader current account terms.

What our customers say

Need help opening your sole trader account?

Our help centre is designed to be your first port of call whenever you have questions about our products and services. It’s often the quickest way to get the answers you need – from within the app or online.

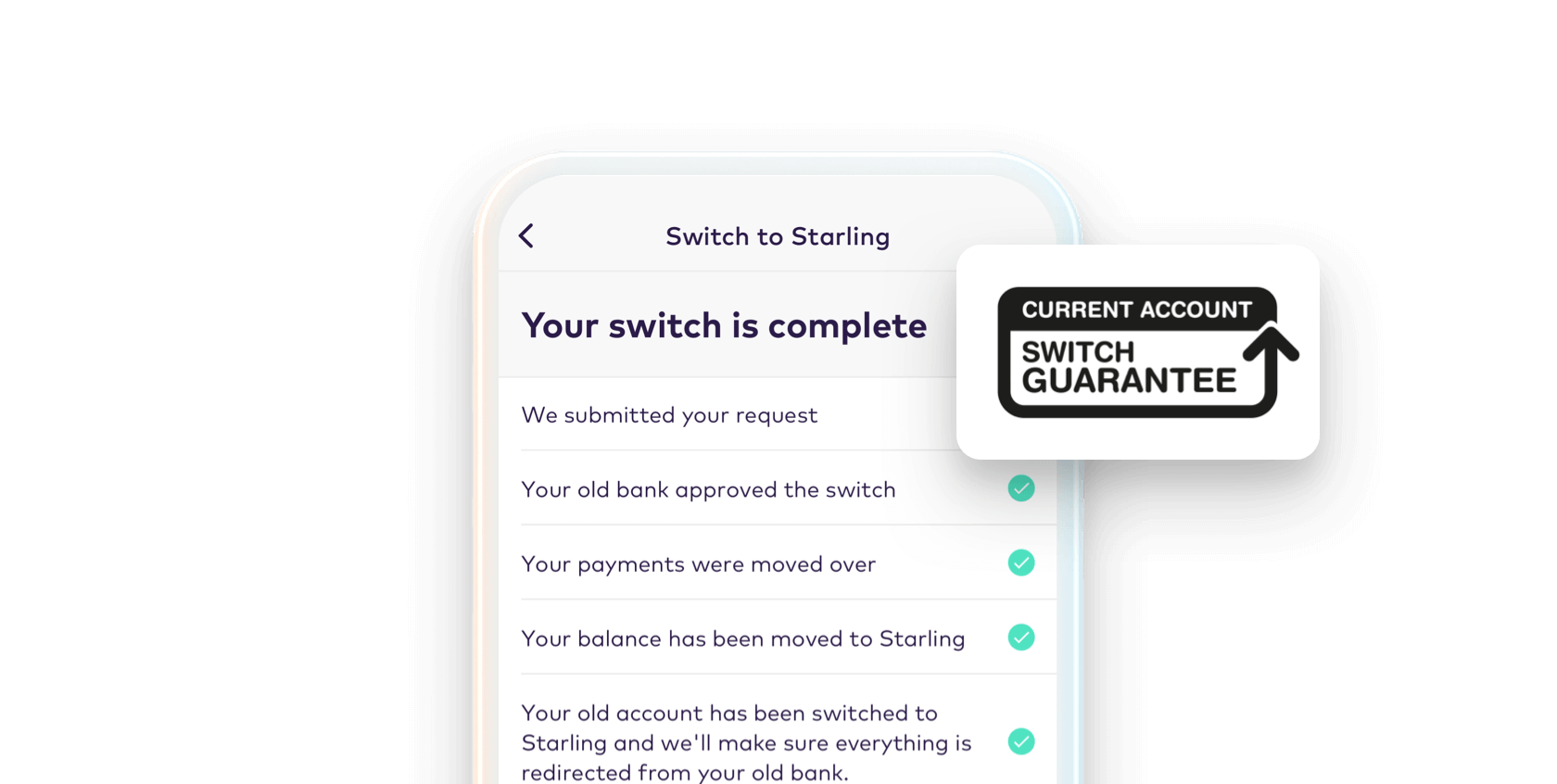

Visit our help centreReady to switch to Starling?

We take the hassle out of switching banks. With just a few taps in the app, you can let us know you’re ready to make the move, and we’ll take it from there. Our switching service is simple, completed in seven working days and covered by the Current Account Switch Guarantee.

Apply for a Starling sole trader account and enjoy app-based banking at its best.

Start your applicationSole trader accounts are subject to eligibility checks, which include looking at credit data and understanding the nature of your business.