Organise your money with Spaces

Organise your money with Spaces

A Space is a pot of money within your app, kept separate from your balance. It’s great for getting expenses neatly sorted and under your control.

What’s so great about Spaces?

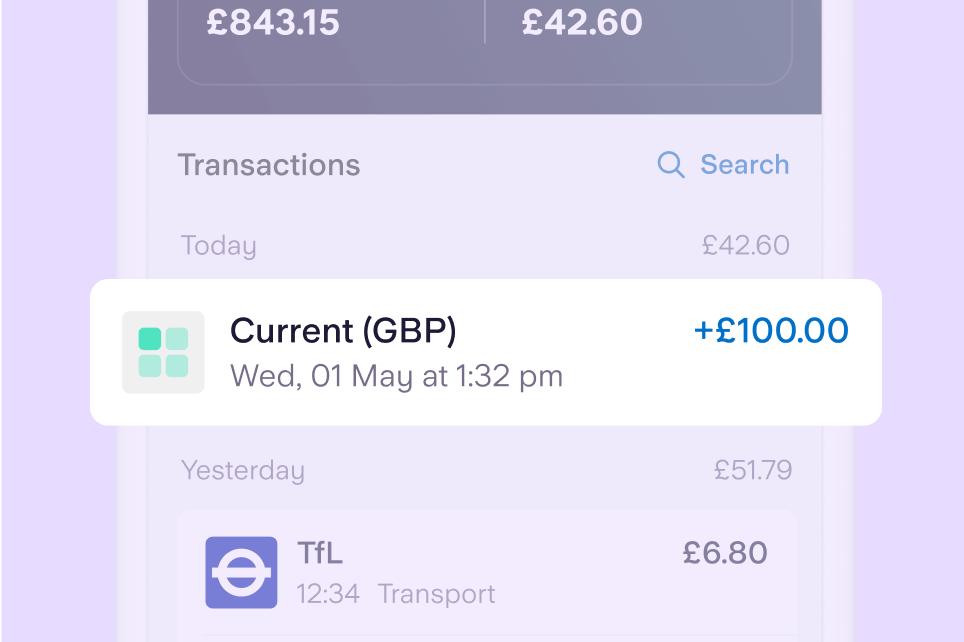

Manage money easily

Add or withdraw money in Spaces with a few taps. Or, use Split Payment to separate money across different Spaces and accounts in one go.

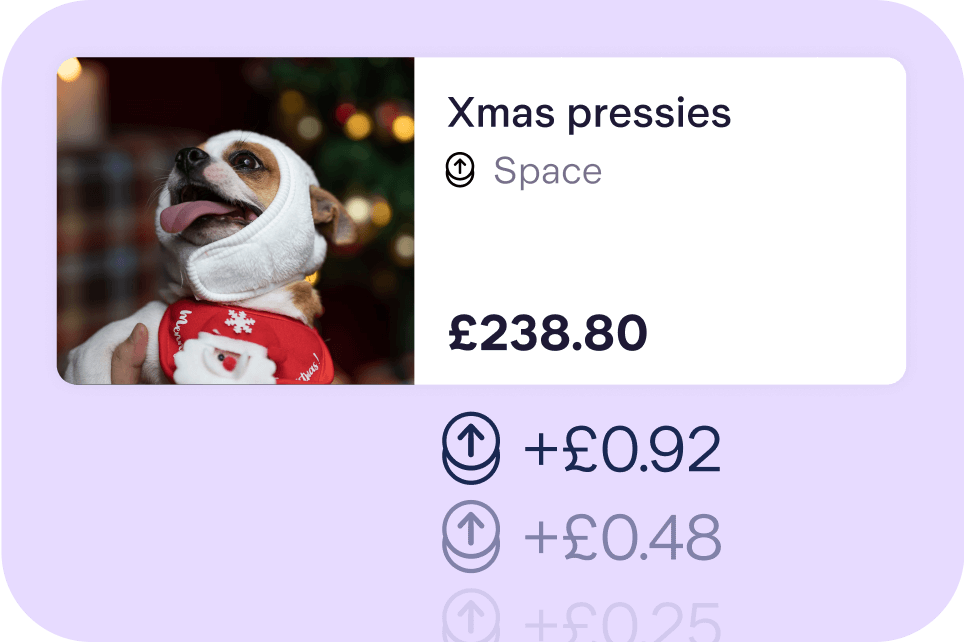

Make every penny count

Round Up whatever you spend to the nearest pound and send the spare change to your chosen Space.

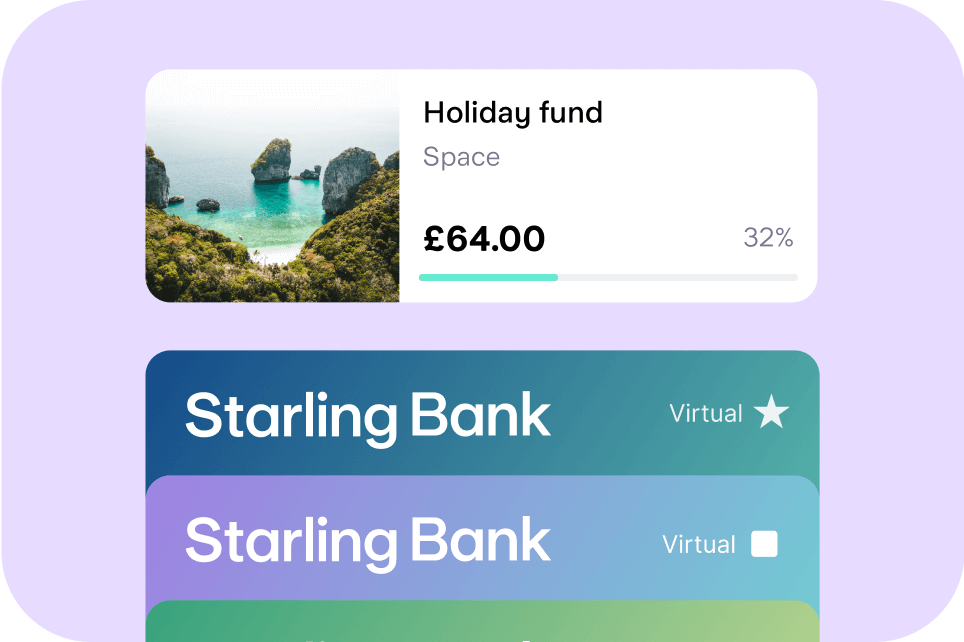

Spend with virtual cards

Have a virtual debit card for every Space so you only spend the money that’s in the Space it’s linked to.

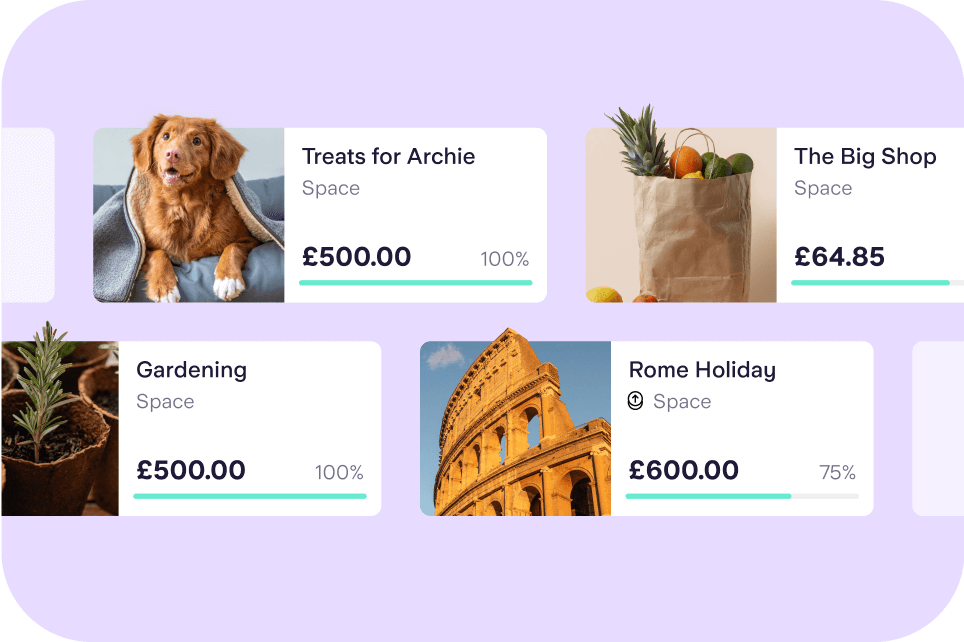

Make it your own

Personalise, view and organise your Spaces all in one place and order them however you like.

How does it work?

Step 1

Tap ‘Spaces’.Step 2

Hit ‘Space’, then give it a name.Step 3

Set a target amount, and add or withdraw money whenever you like.

Introducing the Easy Saver

Our easy-access savings account, paying 3.75% AER, 3.68% gross variable* interest. Easy to add money, with no minimum deposit. Easy to withdraw to your current account, with no need to give notice, no penalties and no maximum number of withdrawals.

*18+, UK residents. Interest paid monthly. Starling personal current account required. Subject to eligibility. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.