Starling for desktop

Online banking on the big screen

Online banking on the big screen

We’ve taken our award-winning mobile app and built it into a browser.

Manage your money from

your tablet, desktop or laptop

Expect some of the same great features – only bigger.

Whether you’ve got a personal, joint or business account, you can get online with Starling today.

Log in to online bankingSo what exactly do you get with Starling’s online banking?

Convenience

Maybe the payment information you need is in an email or you simply want to see everything on a bigger screen. Whatever makes online banking good for you, go online with Starling.

Security

We’re a bank, so we’re pretty big on security. We were rated in the joint top spot in the latest Which? online banking security test. Built-in security features like data encryption and multi-layer authentication help keep your money safe.

Features

Real-time data

See your actual balance and an up-to-date list of transactions.

Spending Insights

We’ll show you where you’re spending – whether that’s on things like entertainment, holidays, transport and more. Want to see the transactions you made between two specific dates? Just use the filters.

Marketplace

Starling’s Marketplace offers a range of smart integrations with all your favourite products, from pensions and investment products for personal customers to digital receipts and accountancy software for businesses. Connect them in-app, and manage them in-app or online to enjoy extra functionality from your Starling account.

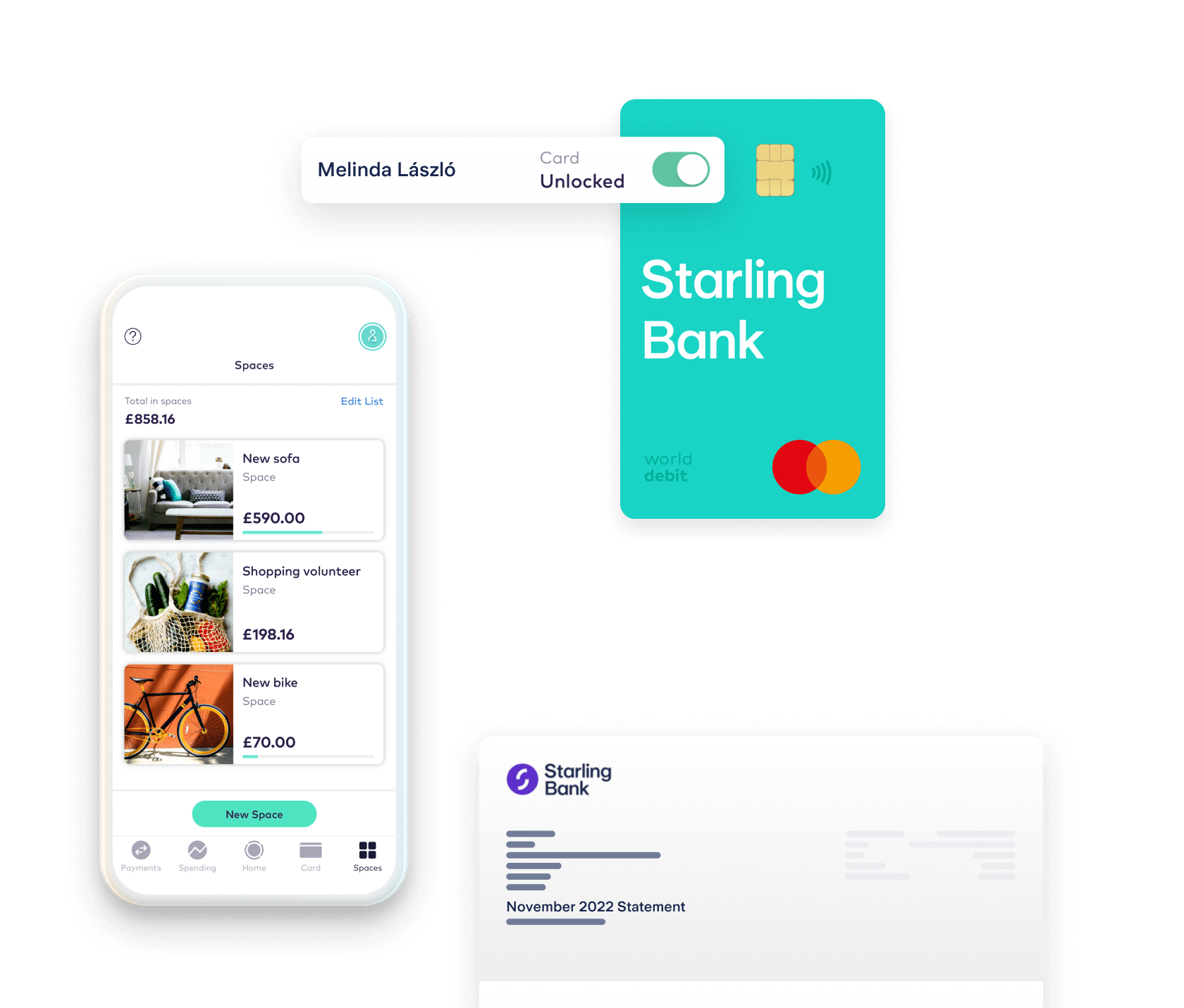

Spaces

A Space for you to set money aside. Maybe that’s a holiday (for personal accounts), a wedding (for joint accounts) or a new laptop (for business accounts). You can organise and visualise the money you’ve set aside – all in one place.

See statements

View and export statements, and save them straight to your desktop.

Card controls

Lost your debit card? You can freeze your card online.

Manage payments

View, setup and edit standing orders and Direct Debits and any other regular payments you might have.

Connect accounts

If you have a business account with Starling, you can link other business accounts using Online Banking. See a snapshot of your balances and get a fuller picture of your business finances.

Benefits of going online

Online banking comes in handy in all kinds of scenarios – whether you run your own business or just prefer using your laptop over your mobile. Here are just some of the main benefits.

Quick snapshot

The bigger the screen, the more transactions you can see at once.

Stay put

If you’re working in a browser already, it can be easier to have your banking there.

Be organised

Export statements straight to your computer desktop.

Visit our FAQs to find out more.

Go online with Starling today

Existing customer?

Just follow these 3 simple steps:

Go to the login page.

Enter your account number and mobile number.

Tap the notification on your mobile, confirm your login attempt and you’ll then be prompted to scan the QR code on your device via the Starling app.

And voilà! Up pops the homepage, with all your transactions.

Log in to online banking