Budgeting

“Bills, Bills, Bills” – Sorted in three simple steps

By Esmeralda Dyer Bray

To make the most of your holiday money, it’s a good idea to create a holiday budget. With a plan in place, you’ll hopefully spend less time stressing about money, and more time having a proper break - whether that’s a walking holiday in the Lake District or a fortnight on the beaches of Croatia.

First, set a limit for how much you’re happy to spend in total. Think about what you’d like to do when you’re there: Lunches and dinners to try the local cuisine? A spot of ocean kayaking or hiking in the hills? It all adds up.

If you use the Starling app, you can keep your holiday money separate from your main balance by creating a ‘Holiday’ Space. That way, you won’t accidentally dip into the money you’ve set aside for your trip.

You can top up your ‘Holiday’ Space at any time and even set a target for your goal amount.

You can also add a photo of your destination for added motivation. Anything goes - a campervan for a trip to the Isle of Skye, the Duomo for a weekend in Florence, it’s up to you.

Divide your holiday money into spending categories, for example accommodation, shopping and taxis.

Holiday budget: Six days in Mallorca

| Accommodation | £420 |

| Flights | £180 |

| Restaurants | £300 |

| Boat trip | £50 |

| Taxi | £50 |

| Shopping | £50 |

| Total | £1,050 |

|---|

If you don’t already have travel insurance, you may want to budget for that. It’s also a good idea to have a buffer of money for emergencies and the unplanned.

To avoid dipping into your holiday money for things you’ve forgotten to pack - a phone charger, an adaptor, sunglasses - write a list of what you’ll need before you start packing.

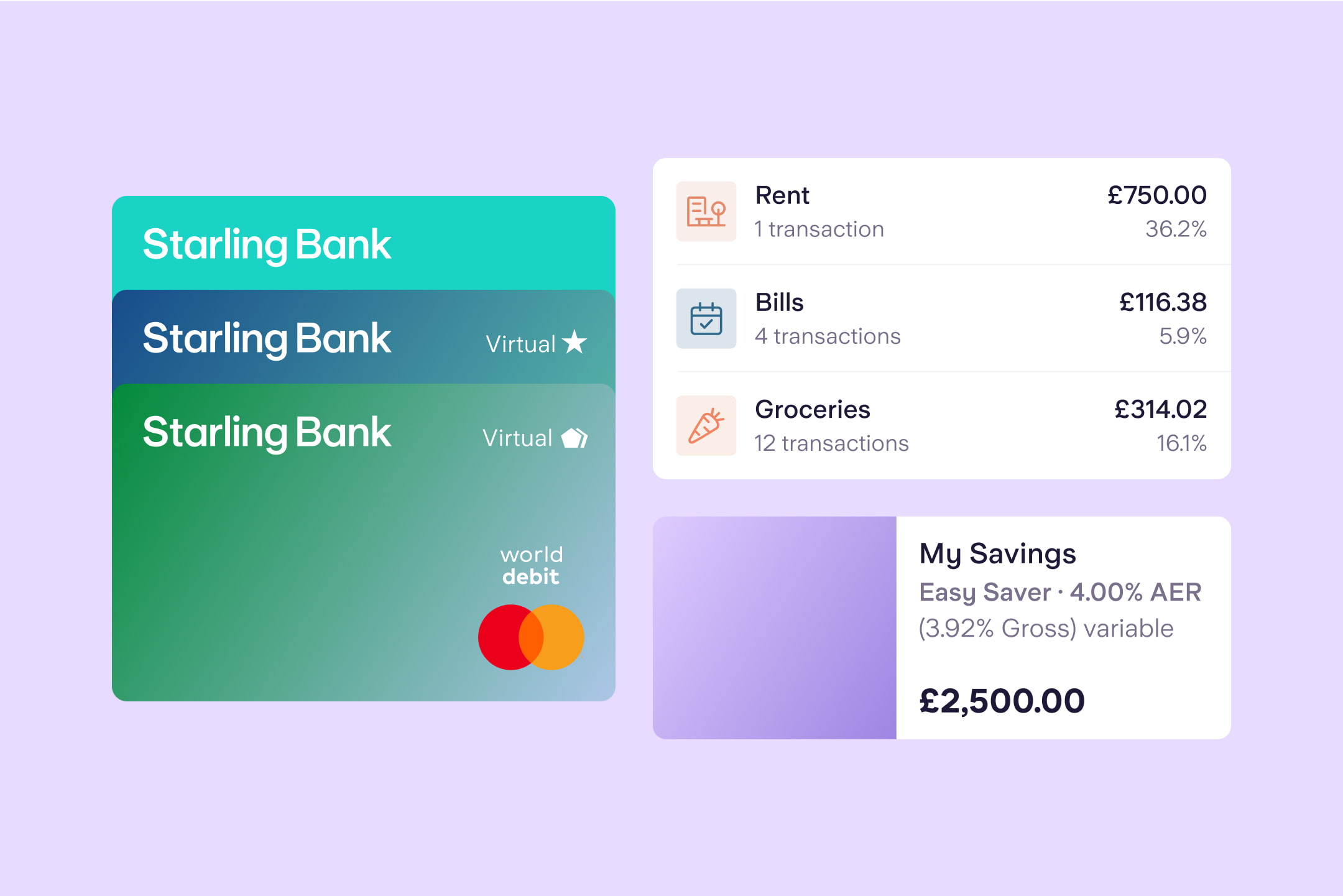

As you’re getting ready, you may want to set up a virtual card for your holiday Space. That way, your holiday transactions can be kept separate from your main balance. Virtual cards exist in the Starling app and in your digital wallet, rather than as physical cards.

Whenever you pay with your card abroad, or withdraw cash, Starling won’t charge you extra fees. And Starling passes on Mastercard’s real exchange rate, so that you don’t go paying over the odds.

It’s helpful to have a rough daily spend target, to stay within your holiday budget. For example, £15 for lunch, £30 for dinner and something for hiring a sunbed might mean a daily budget of about £50.

That said, do build in some flexibility. You’ll probably have a day or two where you have a picnic and spend less on lunch, and an evening where you go somewhere special for dinner. But having a daily figure can act as a guide.

With the Starling app, you can easily track your holiday spending as you go along. Every time you spend from your Starling account, the app automatically categorises the transaction, for example as ‘Eating Out’ or ‘Holidays’.

You can also re-categorise transactions, for example from ‘Shopping’ to ‘Gifts’, to make your Spending Insights even more personal.

The more you understand your spending, the easier it will be to keep to your budget - and hopefully breathe easier on holiday.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

Budgeting

By Esmeralda Dyer Bray

Expert interviews

By Vicky Reynal

Budgeting

By Charlotte Lorimer

Saving

By Matt Poskitt