Last Digit Widget

Stimulus. Routine. Reward.

By Vicky Reynal

Good with money

Adulthood: a private members club you wish you never signed up for. Turns out, you’ve just subscribed to a lifelong commitment of admin and a neverending game of whack-a-bills – once you’ve paid one, another crops up.

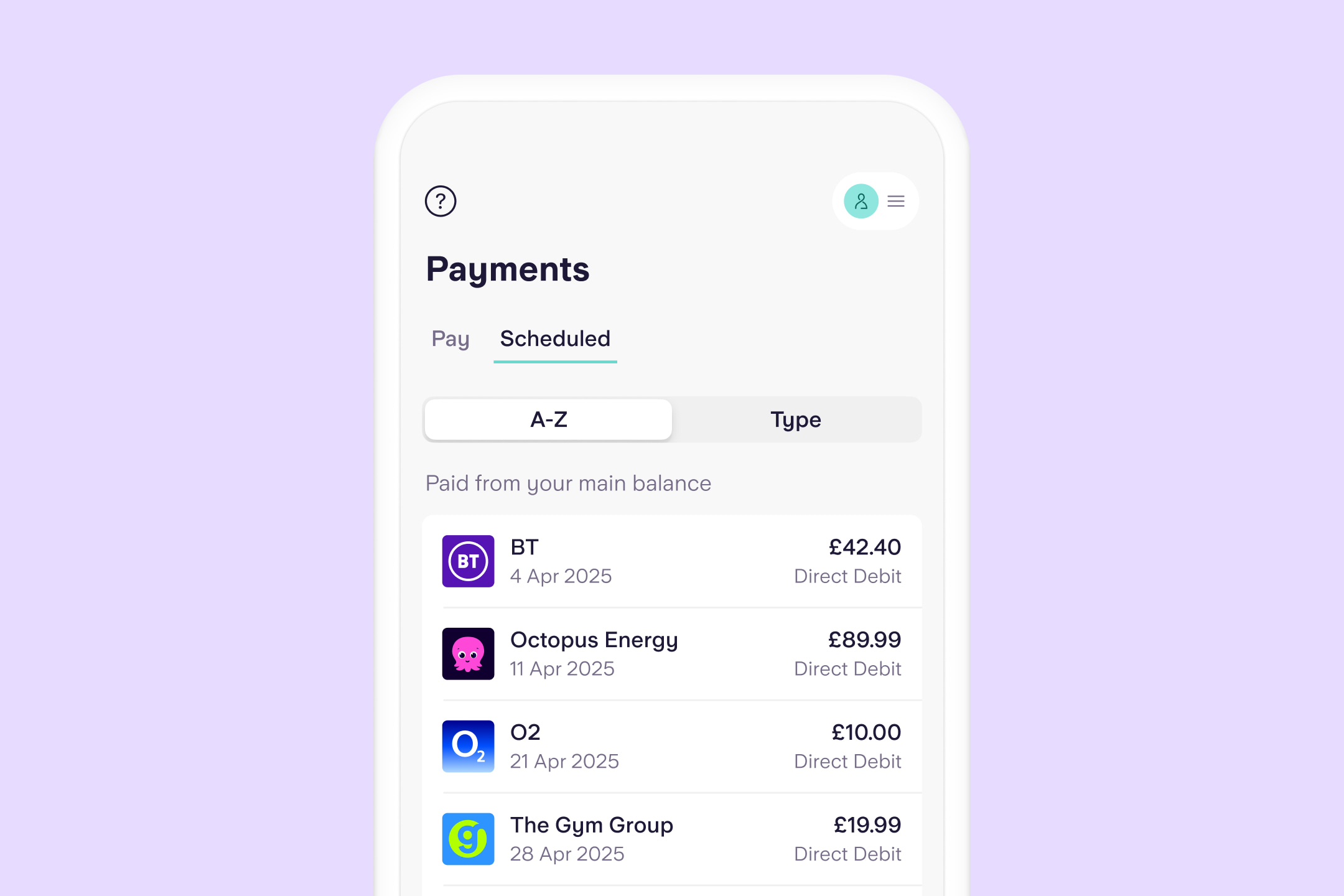

Phone bill due on the 6th, rent on the 18th, electricity and gas on the last Thursday of every month… and it goes on. Keeping up with which bills you’ve paid – and how much you have left – is a juggling act that no one enjoys. Cue: Bills Manager.

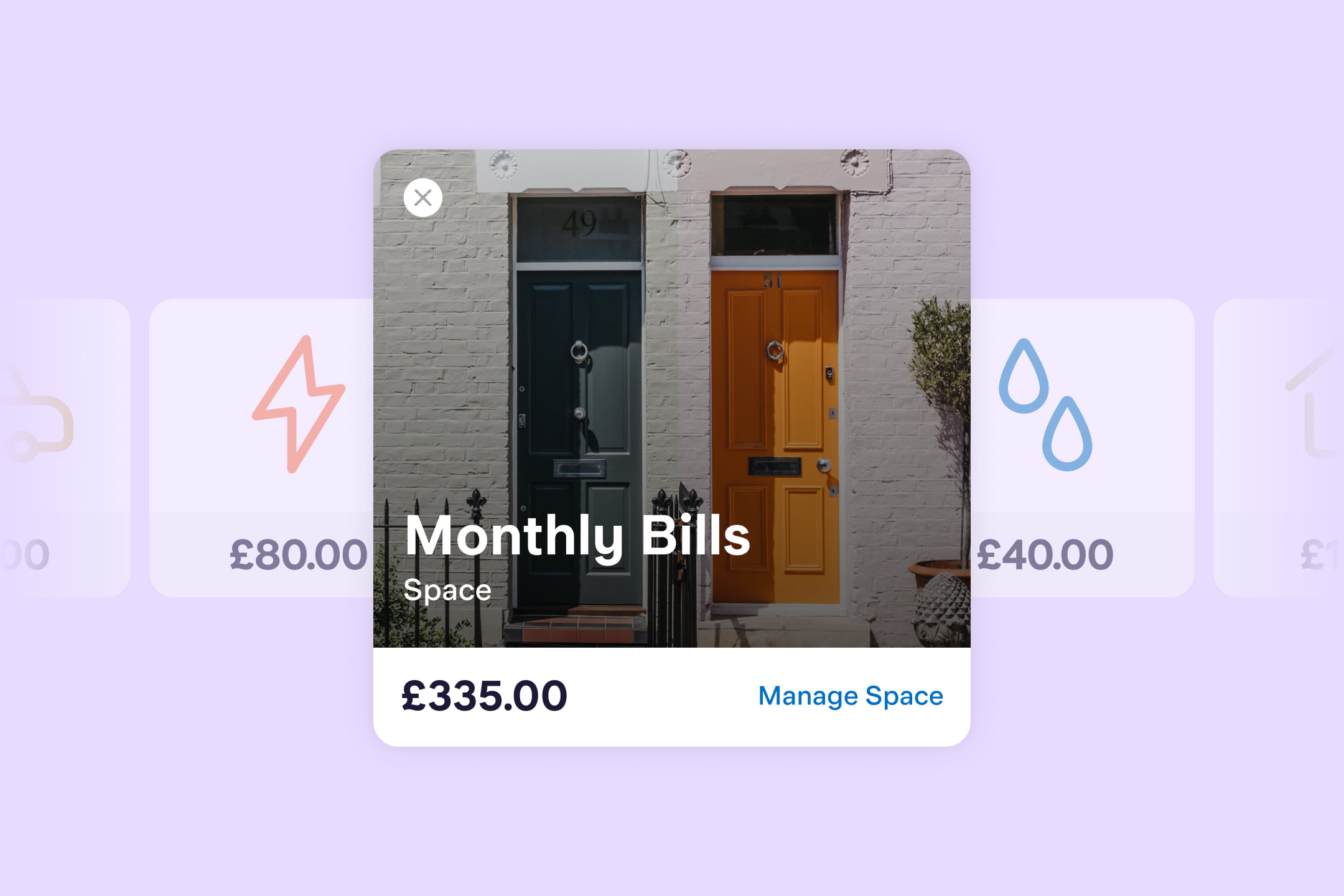

Bills Manager is a fan favourite feature that comes free with our app. The name says it all, but in a nutshell: it allows you to pay all your bills (e.g. Direct Debits and standing orders) from a separate Space in your app. Meaning you never have to worry about spending money that’s already been earmarked.

Add up all your Direct Debits and standing orders for the month – these could be for your mortgage or rent, energy, council tax, phone bill and TV licence.

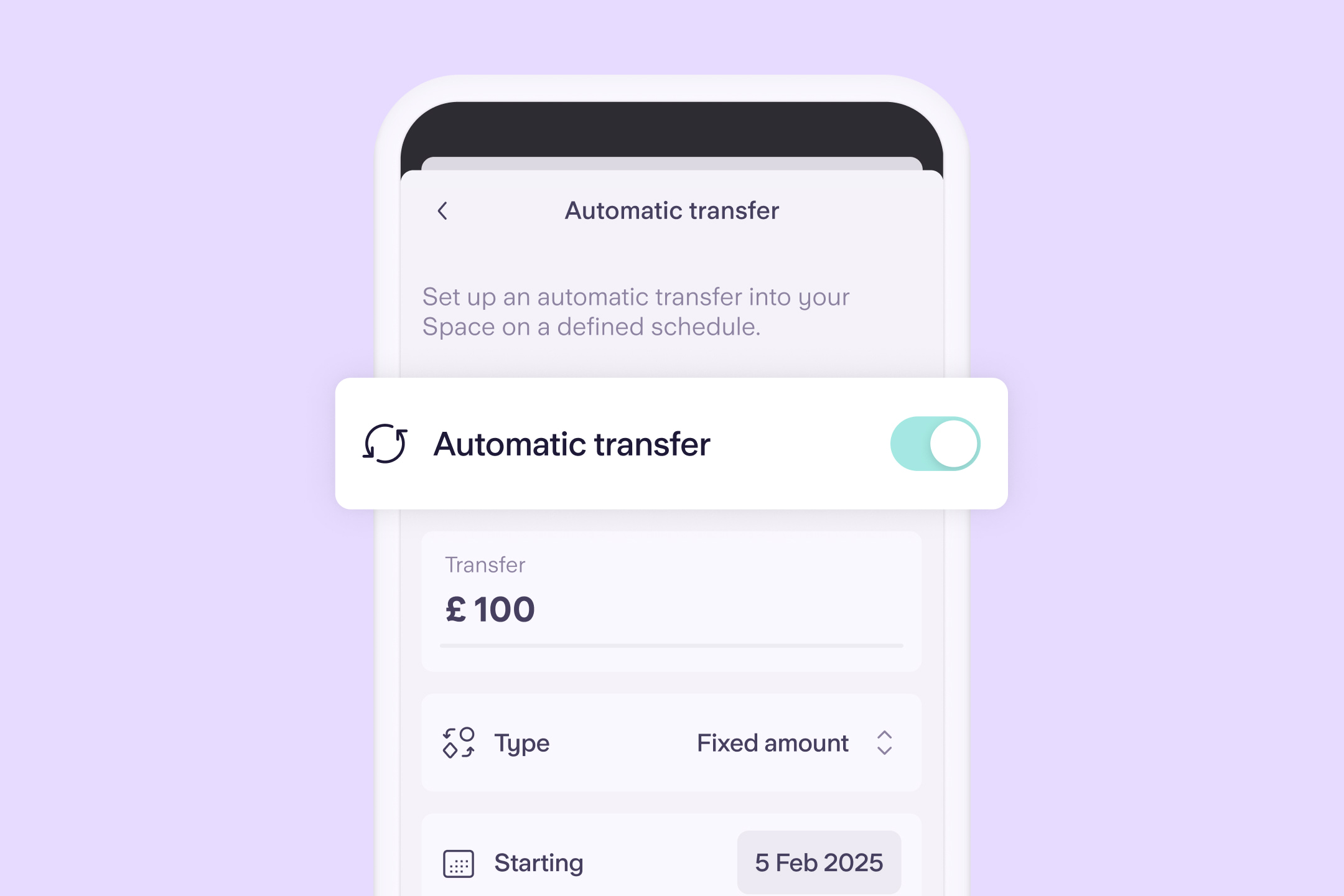

Once you know how much your monthly bills cost, you can set up a recurring payment from your main balance into a dedicated Space in the app. Do this every month on payday so that when money comes in, enough is automatically set aside for bills.

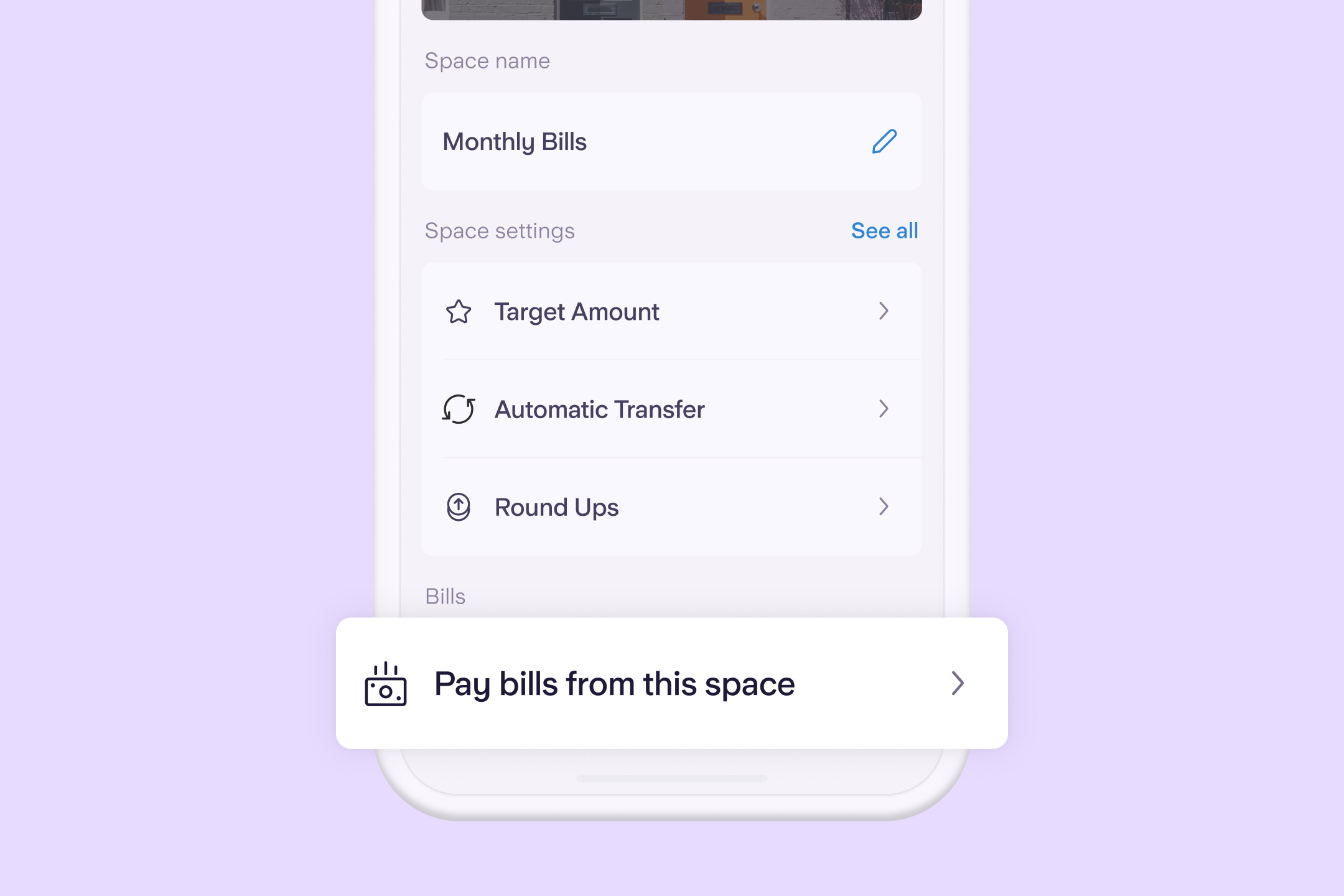

Create or choose the Space that you want to regularly top up, then click ‘Manage Space’ followed by ‘Automatic transfer’. The amount, frequency, start and end dates are entirely up to you.

Next, put Bills Manager to work. Go to the dedicated Space you’ve set up, tap ‘Manage Space’ then ‘Pay bills from this Space’ to select which Direct Debits and standing orders you’d like to be paid from the Space. Et voilà, you’re all done!

As long as your app notifications are turned on, if there’s anything you need to know – like if a Direct Debit is due – we’ll let you know, in the app. We’ll also tell you if you don’t have enough money in the Space to make the payment, so you have time to top it up. You have until 4pm that day, otherwise the payment will be declined. You’ll also be told when a payment has been made, and which Space the payment came from.

A heads up: When Bills Manager is turned on and you’ve selected a certain bill to be paid from a Space, it can only be paid from that chosen Space – and we can’t draw on money from your main balance if there isn’t enough to cover it.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

Bills Manager is just one of many smart money management tools, free with a Starling account.

Explore our current account