Budgeting

“Bills, Bills, Bills” – Sorted in three simple steps

By Esmeralda Dyer Bray

Budgeting

Do you believe life was simpler in days gone by? Back when money was something you could hold and see, your grandparents may have had some classic lessons to teach you, such as dividing your earnings into different envelopes: one for rent, one for food, one for fun.

But here’s the thing: digital budgeting can replicate that way of managing your money. And that oh-so-organised feeling that comes with it, especially if you add something to a savings account each month.

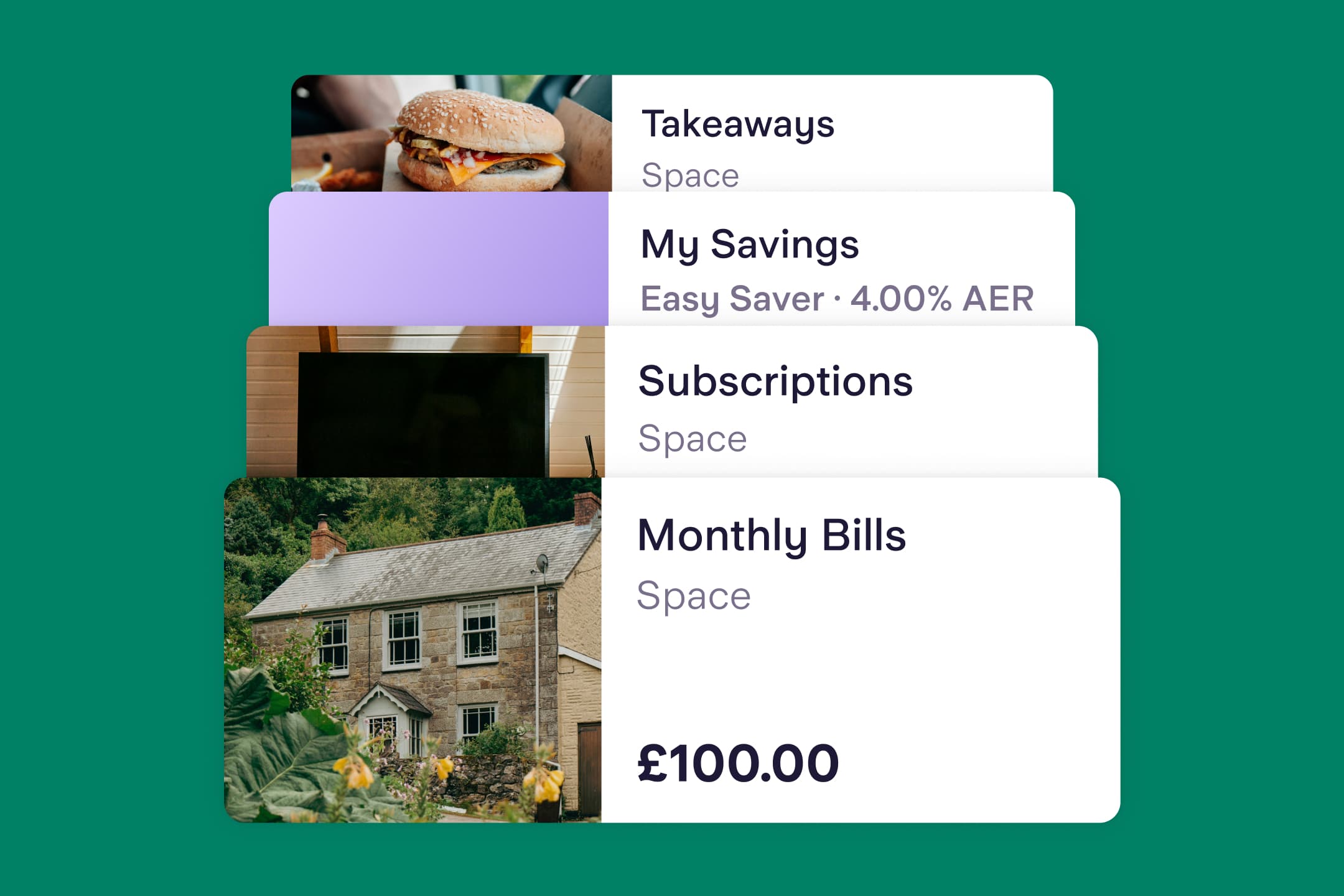

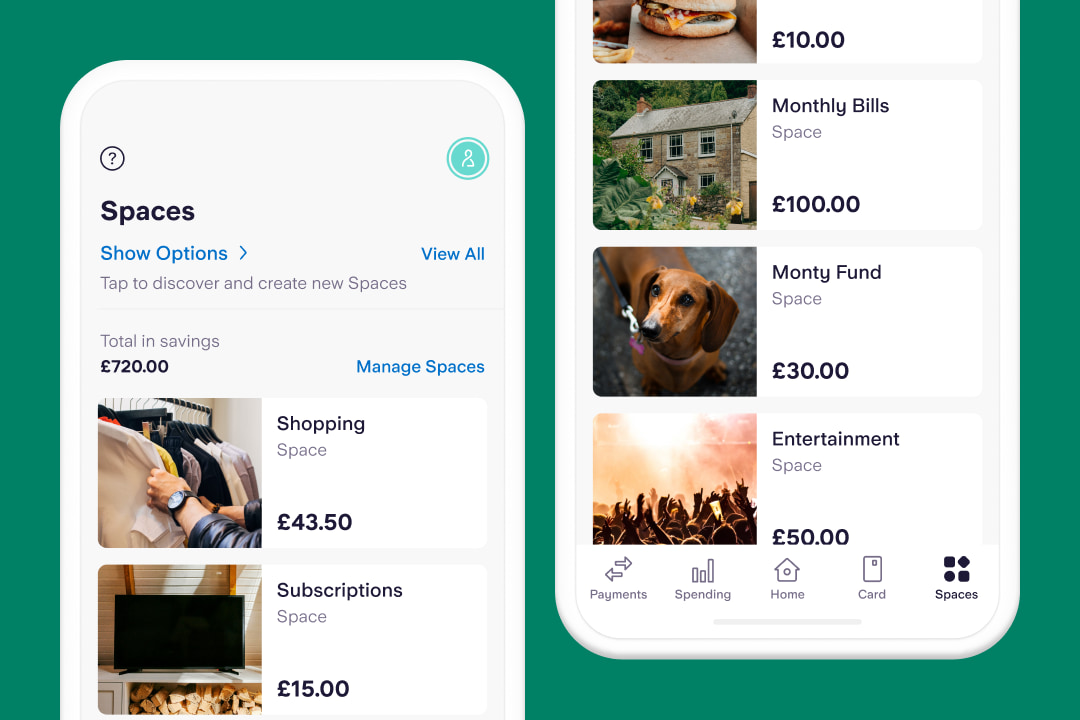

The envelope method, also known as ‘cash stuffing’, can be adapted for digital banking through Spaces, the feature that allows Starling customers to set money aside from their main balance. Instead of separating physical cash into different envelopes to budget for different expenses, you divide money into different Spaces within your Starling app, each with a specific spending allowance.

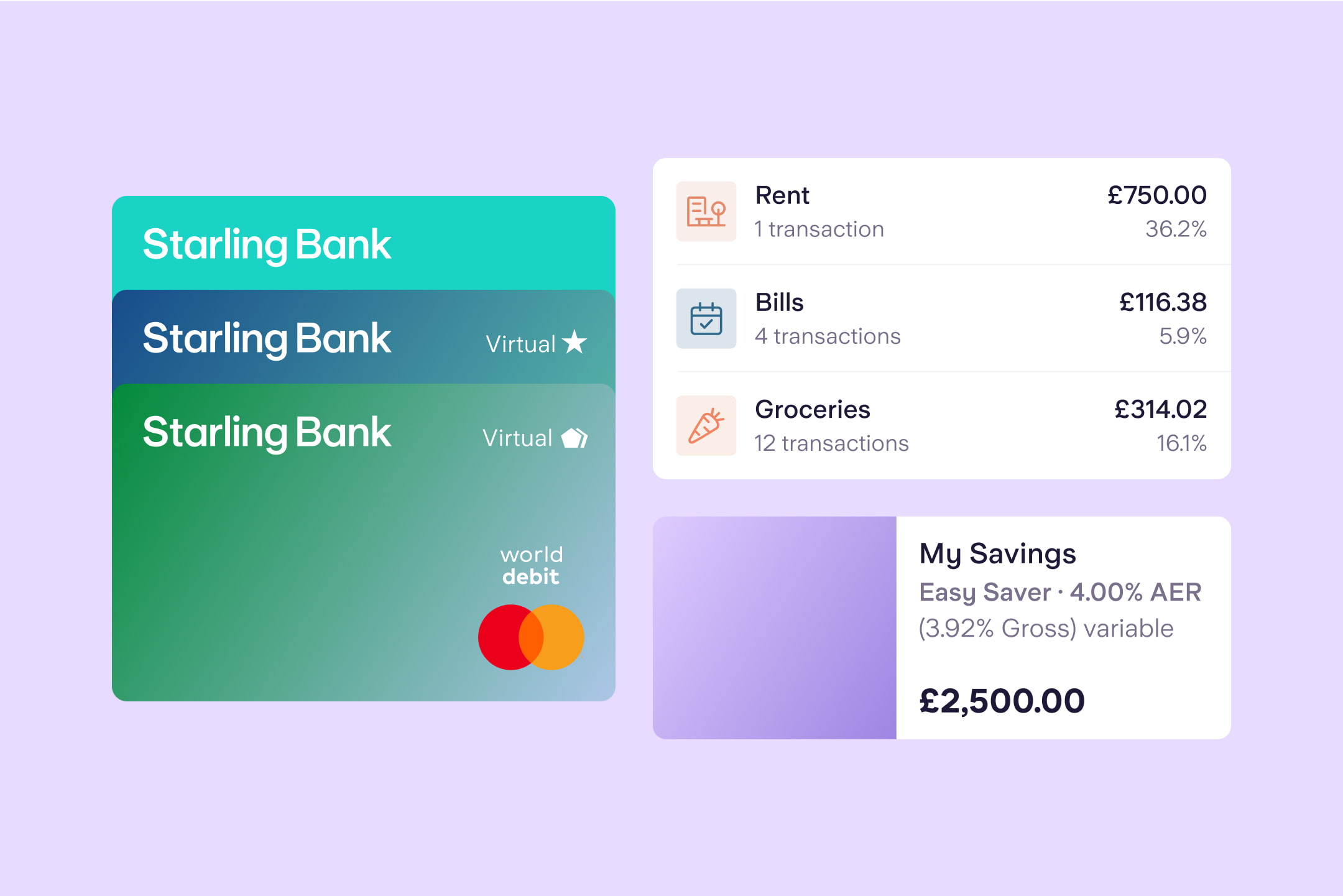

For example, you could put £25 into your ‘Subscriptions’ Space, £100 into your ‘Entertainment’ Space, and so on. You can even pay Direct Debits and standing orders from specific Spaces and spend directly from a Space using virtual cards (digital debit cards that have their own card details but only exist in your app and on your phone).

The Spaces section of the app is also where you can open a separate savings account, such as our Easy Saver (subject to eligibility). Starling’s Easy Saver is available to UK residents over the age of 18 with a Starling personal current account. The variable Annual Equivalent Rate (AER) is 3.75% and the gross variable rate 3.68% interest is calculated daily and paid monthly.*

You can move the money you put into an Easy Saver back into your current account whenever you need it, so you could use it as your emergency fund or a place to keep your savings for a financial goal, such as building up a deposit to buy a property. If you’re not sure whether you can afford to save something each month, making a budget could help with this. Here’s how:

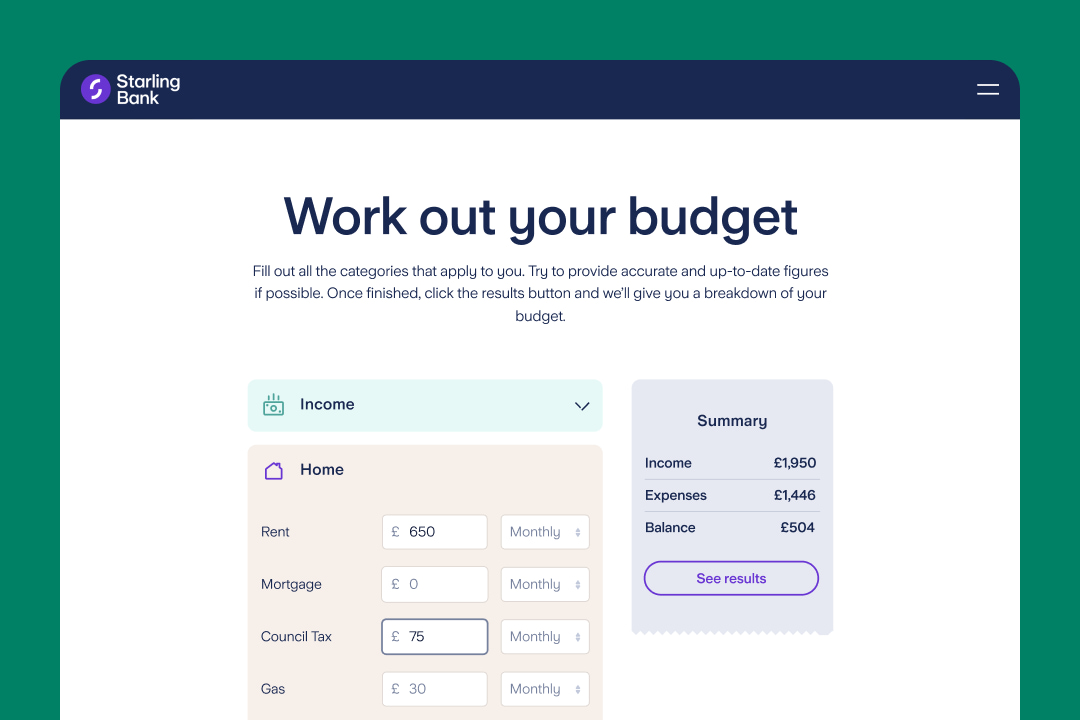

To make my budget, I used our Budget Planner. It’s a tool anyone can use on our website – you don’t have to be a Starling customer – and it’s a great starting point for anyone making a budget.

The first step is to enter your monthly income and essential monthly bills. These could include:

Mortgage

Council tax

Energy

WiFi

TV licence

Phone bill

Home insurance

Pet insurance

You can then enter what you expect to spend on essential costs that vary month to month, such as groceries.

To work out how much to set aside in my budget for groceries and food for my dog, I used the Spending Insights section of my Starling app to look back over what I’d spent in the last three months. I then divided this total by three to calculate a monthly average and rounded this figure up to give myself a buffer.

Next step? Working out what you want to use your remaining income for – categories can help with this. For me, these include:

Subscriptions

Restaurants and takeaways

Entertainment

Shopping

Charity donation

Wellbeing (hairdresser, dentist, cosmetics)

Transport (petrol, trains to see friends, taxis)

Celebrations (gifts, birthdays, Christmas)

Holidays

Once you’ve entered all your costs, our Budget Planner will give you a suggested amount that you can try and set aside as savings each month. If the amount is lower than you’d like it to be – or need it to be – go back and adjust some of your variable costs. For example, you could cancel a subscription, change your monthly subscriptions total and increase how much you plan to save each month.

When I’d worked out how much of my monthly income I could afford to save, I topped up my Easy Saver, confident that I could transfer money back to my main balance if the boiler broke or if an unexpected bill came through the letterbox.

I put the rest of my budget into action by creating Spaces for my ‘Home’ (energy, council tax, WiFi, phone bill), ‘Shopping’, ‘Celebrations’ and so on. I then arranged automatic transfers for the amount I aimed or expected to spend for each category, scheduled for the beginning of each month.

I also used the Bills Manager feature to connect specific Direct Debits to specific Spaces. For example, I arranged for my energy bill, council tax and home insurance to be paid from my ‘Home’ Space and my pet insurance to be paid from my ‘Dogs’ Space.

The final step was to set up virtual cards so that I could pay for things straight from these particular ‘envelopes’. Each virtual card is connected to a specific Space and allows you to spend from it, either with a mobile wallet or by entering the card details online.

For example, my virtual cards are connected to my Spaces for ‘Groceries’, ‘Restaurants’, ‘Subscriptions’ and ‘Wellbeing’. You can create up to five virtual cards in a Starling personal account and another five in a Starling joint account.

You may think that all of this sounds like a lot of effort. But it was all done in about an hour (a lot of which went on choosing the photos for my Spaces…).

And I barely need to spend time on my budget going forward, now that my automatic transfers are set up for different Spaces post payday.

In fact, the only time I spend related to my budget is taking a few seconds to check a certain Space before I say yes to a cinema trip or when making my shopping list, much like someone might have checked how much cash was left in a certain envelope before heading out.

It’s the fear of the unknown – the question ‘Where is my money going?’ – that can be so worrying for so many of us. And it’s exactly this pain point that budgeting can ease, especially when envelopes become Spaces.

* Rate accurate as of 16th May 2025. AER stands for Annual Equivalent Rate and shows what the interest rate would be if interest were paid and compounded once each year. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

Add to your savings and fall back on them when you need to, all while earning interest.

Explore our Easy Saver

Budgeting

By Esmeralda Dyer Bray

Expert interviews

By Vicky Reynal

Budgeting

By Charlotte Lorimer

Saving

By Matt Poskitt