Product news

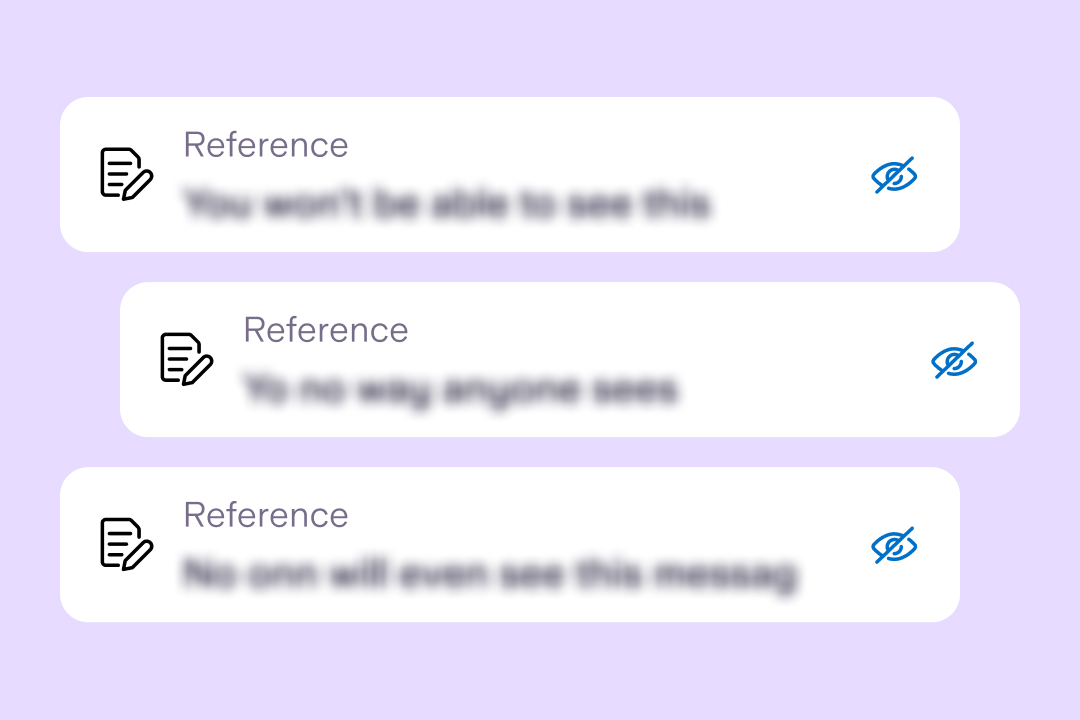

Helping economic abuse survivors with our new feature, ‘Hide references’

6th June 2023

Setting a budget can help you feel more in control of your money and plan ahead. To make budgeting easier, we’ve created an online tool that does lots of the legwork for you. It’s free, easy to use and has been designed to give you a better understanding of your finances.

Our Budget Planner compares how much money you have coming in with how much you’re spending. It also provides a breakdown of your finances. And highlights where the highest portion of your money is going – after your rent or mortgage payment.

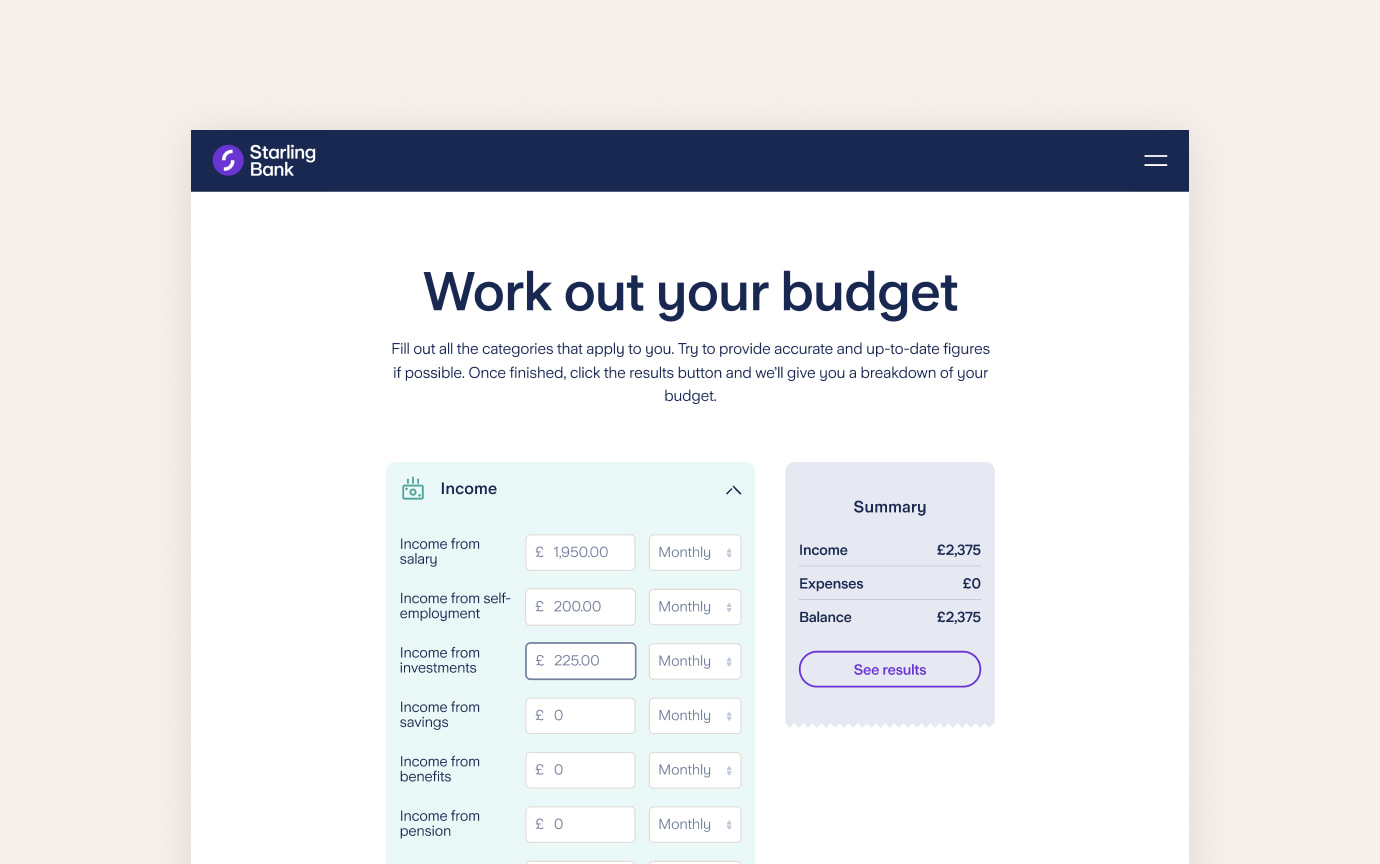

The tool takes around 10 minutes to use. Make sure you have your banking app or statements to hand before you start.

The first step is to enter your monthly income – after tax. If you’re self-employed, this could be what you earn on average each month. To calculate a monthly average, add up your earnings for a year and divide this number by 12.

Add in how much you spend on bills and services, transport, groceries and shopping. For some categories, you have the option to enter the details of particular purchases for each category, for example how much you spend on home insurance or fitness. You can select your own time period for spending: monthly, fortnightly or weekly.

If you’re a Starling customer, you could use the Spending section of the app to choose a date range, (for example, last month) and go through your spending for particular categories. You can view individual transactions by tapping on a category. For example, tapping on ‘Groceries’ would bring up a list of transactions made at various supermarkets or local food shops.

Once you’ve entered how much you spend in each category, add any additional items you want to include in your budget, for example, what you need to set aside for tax if you’re self-employed.

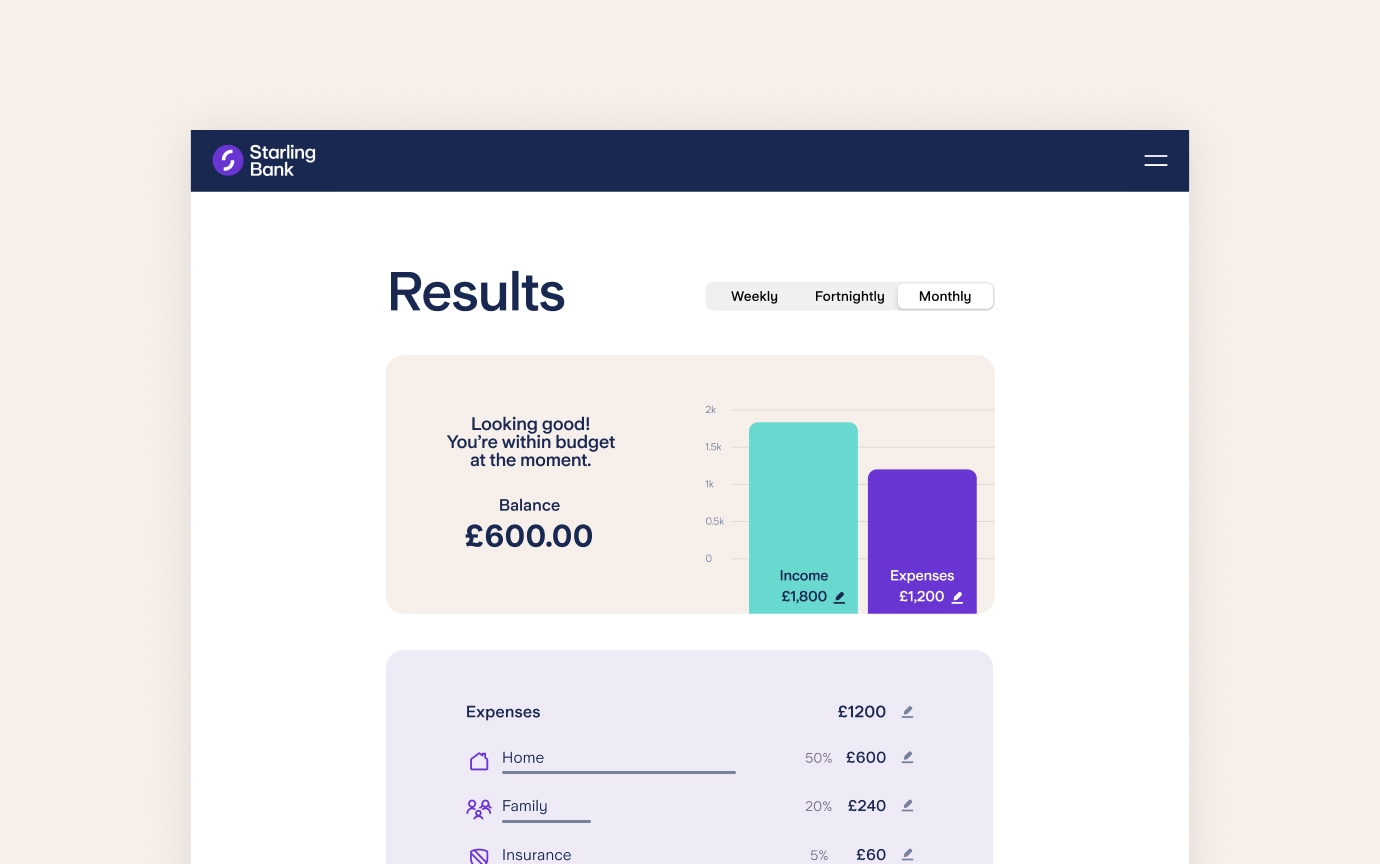

Our Budget Planner crunches the numbers for you and brings up a personalised summary of money in, money out and any remaining balance. We won’t store any of these details or share them with anyone else.

If you’re within budget (i.e. you’re earning more than you spend), we’ll show you what you might be able to save each month towards a financial goal, such as a family trip or rainy day fund. You can enter your target amount, how much you’d like to save each month and we’ll work out a target date for reaching your goal. Depending on what you’re saving for, you may want to set up a separate savings account, such as an Easy Saver (subject to eligibility), where your money can earn interest.*

If you’re over budget (i.e. you’re spending more than money coming in) we’ll outline further money management resources, provided by government-approved services such as MoneyHelper.

Whatever your results, we’ll spotlight a few features of the Starling app that can help you budget. For example, with Spaces you can set money aside for a particular purpose, such as a holiday or your monthly bills. You can also use Bills Manager to set up direct debits and pay your rent or council tax straight from a Space. That way, you can set funds aside for essential expenses on payday, so you don’t accidentally dip into them.

If you’re struggling with money worries, remember that talking about it with a trusted friend or family member can be a key step towards feeling more in control of your finances. Our Welfare team is also on hand to guide you towards free resources and listen to whatever’s troubling you.

*The interest rate for the Easy Saver is 3.75% AER (3.68% gross) variable, correct as of 16th May 2025. To apply, you must be a UK resident over the age of 18 with a Starling personal current account. Once set up, you’ll be able to add money to your Easy Saver and withdraw money from it as often as you like. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, you should speak to an independent financial advisor.

Product news

6th June 2023

Product news

5th June 2023

Business

3rd October 2022

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025