Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

Our Money Explained series explains the basics of money, for all the household. Here, we look at how to help keep you and your children’s money safe.

Once your children have started getting their own money, such as pocket money or gifts from friends and family, it’s important to make sure they store and spend it safely. Whether they’ve got cash or are perhaps using Starling Kite, our debit card for kids, there are several things you can talk through with them to help keep their money safe - and they are things you can do too.

This applies to any bank, debit or prepaid cards. You should never write down your security information, or share the details with anyone. Always have a unique password for each different account or website and it should be at least 10 characters long. Don’t use something obvious like your name or your pet’s name. For a PIN, never use anything easy like 1234. In fact the Starling Kite card helps solve the PIN-remembering issue because when you open the Kite Space you can view the PIN associated with the card.

Your passwords need to be a big mix of capital letters, numbers and punctuation like !, & or % added. And sadly yes, that can make a strong password quite hard to remember. One trick is to think of a memorable sentence then use the first letters from each word and the punctuation too.

So: My dog Rover, born in 2019 - he is 1!

Gives a password of MdR,bi2019-hi1!

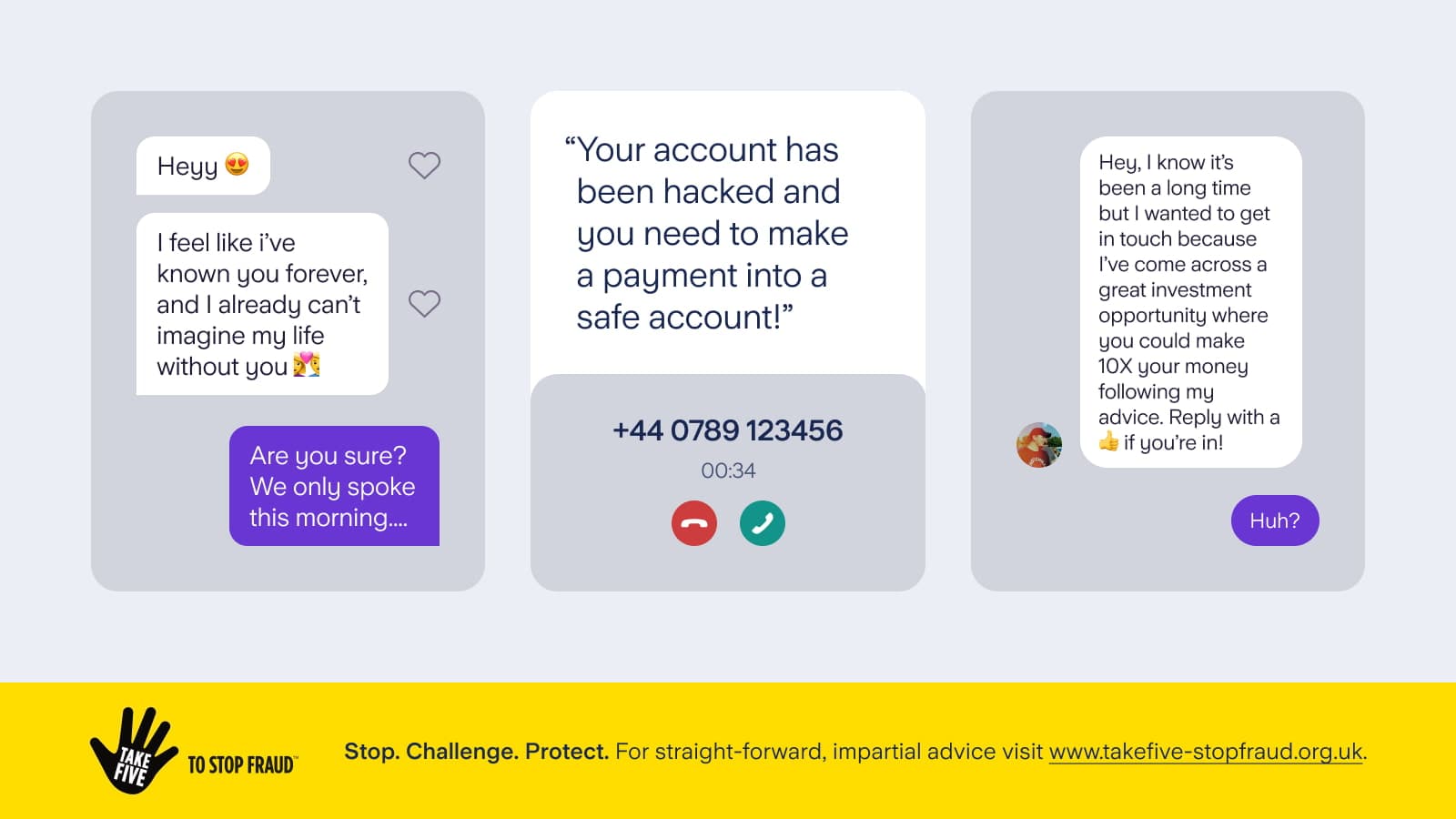

Remember, your bank or card provider will never contact you asking to confirm the card details or to disclose or verify the PIN. If you have the Starling Kite card, and you think there may be a security problem, you can always lock the card in your Starling app and let our customer service team know as soon as possible. If you are shopping online and get a one time passcode to let you buy - don’t share that either.

If your child’s a bit older and has any social media accounts, explain why they should not share details like their birthday, hometown or pet names. These kinds of things are commonly used as passwords and can make it easier for fraudsters to target people. It’s also worth having a conversation with your child about not using easy to guess passwords.

It’s very important that you don’t share your card details with anyone. And your children must not share their card details with their friends. If someone does take their card and uses it, then they must be sure to tell an adult as soon as possible, because an adult might end up responsible for spending that was made on the account without permission. Watch out for bullying because that may be involved.

Be conscious whenever you’re buying something online – always check the website you’re on and only enter your card details on secure/encrypted sites. If a website looks suspicious, then leave it. How did you find the website? Did you get there through a random link or email? It could be dangerous.

Explain that the numbers on the card are linked to their bank account, and if anyone else has them, it can lead to money being taken. This could be by criminals you don’t know, or even by a not so nice friend, or people within their social networks that they think they can trust.

A card should not be sticking out of a back pocket or near the top of an open bag - it can be easy for someone to swipe it while no one’s looking. Instead, keep it in a card wallet or purse which is well hidden. Or the adult could look after it, if out and about with the kids.

Take a good look around you first. Make sure that everyone in the household knows to make sure no one’s looking at the PIN, or hovering behind the ATM. To help stay safe, it’s a good idea to shield the keypad with your free hand when you are typing in the PIN.

Make sure to check your account regularly to ensure that you recognise the transactions. If you have a Starling Kite card, you will be able to see the transactions in the spending feed of the Kite Space. You will also receive notifications when the card is used and if you don’t recognise a transaction such as the location or the merchant, you can instantly block the card in your Starling app. If you think it’s fraudulent, call us directly from your app or if you don’t have your phone to hand call us on 0207 930 4450 so we can investigate.

Let’s say your child gets £35 for their birthday. They could be tempted to carry it all around, but it’s really best to only take what may be spent and leave the rest at home. Another option is to use the Starling Kite Space on your account, where you can load the money from your Starling account so it can’t easily be dropped like cash. And you can keep an eye on your child’s day to day spending.

Read the other articles in our Money Explained series:

Saving up for something special

The pros and cons of pocket money

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

12th December 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024