Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

In the latest of our Money Explained series, we look at how you can help your kids save up for that special something. We believe it’s important to talk about money as a household, and with children from an early age, to help build confidence and money skills. Our series helps these conversations by breaking down money concepts into the basics.

So, your child comes to you one day and wants you to buy them a new Lego set, a high street fashion item or perhaps a game controller. Something that costs about £50. Instead of simply coming up with the money or saying you can’t afford it, why not work with them to see how they could save enough to buy it themselves?

Here we share some ideas on talking through how to save. But before starting to save, it’s worth having a conversation about how to resist the temptation to spend the money immediately. This can be a challenge for all of us. But the benefits of saving up are huge - you get to buy that special something. Discuss the rewards of a long-term plan vs the very brief pleasure of spending on impulse.

If they keep all their saved cash in a purse or wallet, it could be tempting and easy just to spend the cash right away. Instead, a good idea would be to get a change jar and put the money saved into that, making sure not to take any out until there’s enough to buy that all important fashion item/Lego space station/essential game controller.

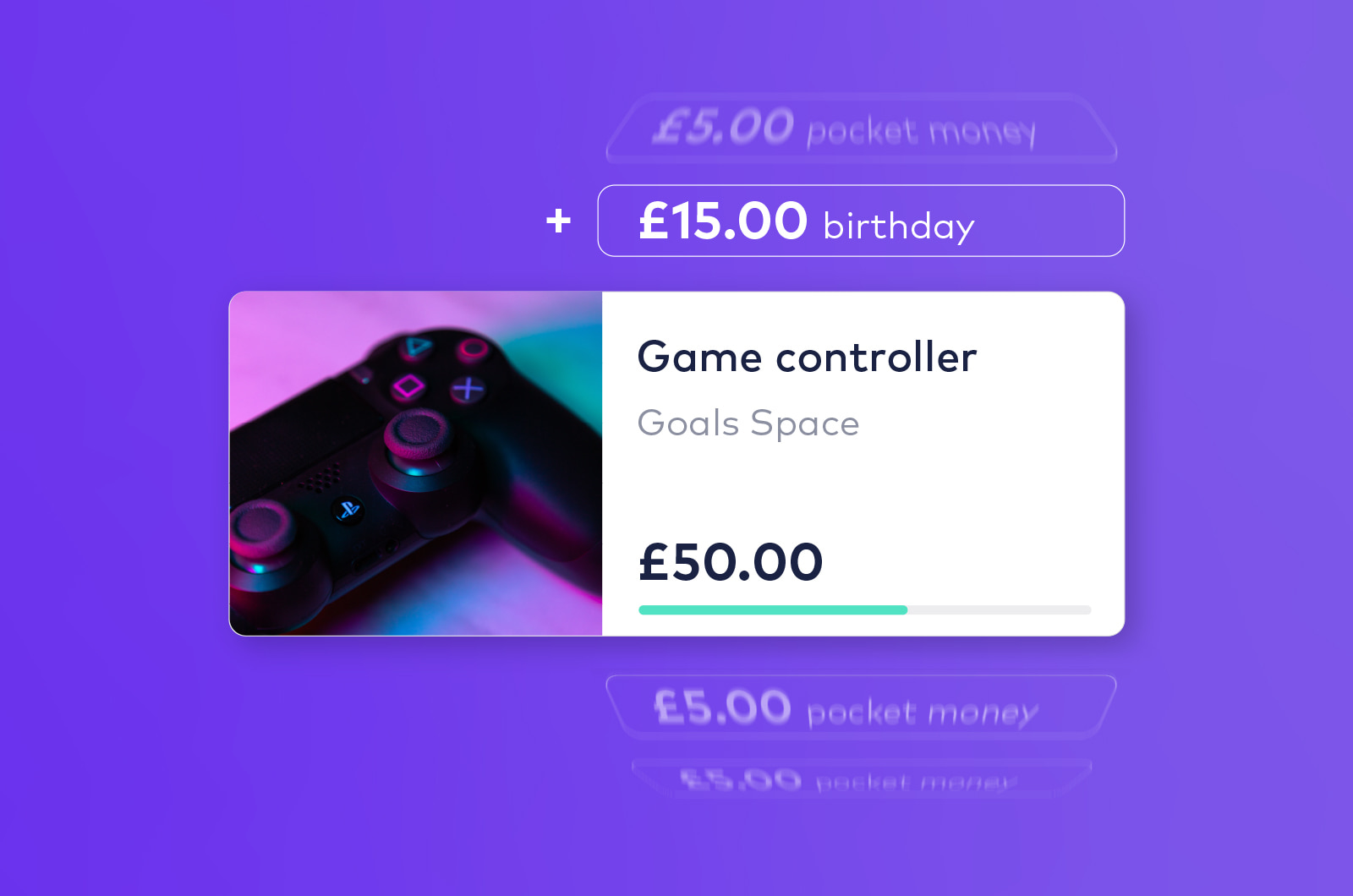

Another option would be to use Goals in your Starling app - these are separate buckets of money that you can set aside from your main account balance. Talk through setting up a new Goal with them, labelled ‘Games’ or similar. Money saved can be moved into the Goal you create together.

Be sure to show them the Goal regularly so they can keep track of the money. Why not ask them to choose a cool picture that you can attach to the Starling Goal you set up - such as an image of exactly what they want to buy.

Let’s say your child gets £8 a week pocket money. They probably want to spend some of that on things like snacks or games. But to reach the savings target of £50, they’re going to need to put aside a set amount each week.

You could suggest they save £5 pocket money per week and therefore should have enough to buy their heart’s desire in ten weeks.

If one week they don’t spend any pocket money, or get some extra money, maybe the odd fiver from a grandparent or family friend, you could encourage them to put it all into savings and get there even quicker.

Any Christmas or birthday money could be sent straight to your Starling account for you to move into the Games Goal you set up for them. You could even share a link to your account with the friend or family member. Make sure you talk through all this with your child, so they can see the progress they’re making.

For longer-term goals, try our Fixed Saver – lock away savings and let them grow over time.

It’s all very well saving up, but it’s impossible to know if they can actually afford to buy the thing they’ve been saving for, without knowing how much has actually been put aside. It’s good to use visuals to help explain. You could make a colourful chart and put it on a wall to help track how much is in the change jar, or encourage them to track it themselves if they’re a bit older, for example by checking the Goal every week.

Another way to encourage your child to reach that £50 more quickly, is to give the option of doing some extra chores around the house, to earn a bit more. It could also be a great opportunity to help start teaching about the value of work.

Why not strike a deal with your child that if they manage to save £10 and not spend it straightaway, you’ll top it up to £20? The promise of double the savings could help them set more money aside and be less tempted to spend it all.

This may also be a good time to introduce the concept of savings and earning interest. And even that magical thing, compound interest. We aim to make each episode of Money Explained short and very easy to read, so we’ll cover the area of interest in a separate and future article.

Read the other articles in our Money Explained series:

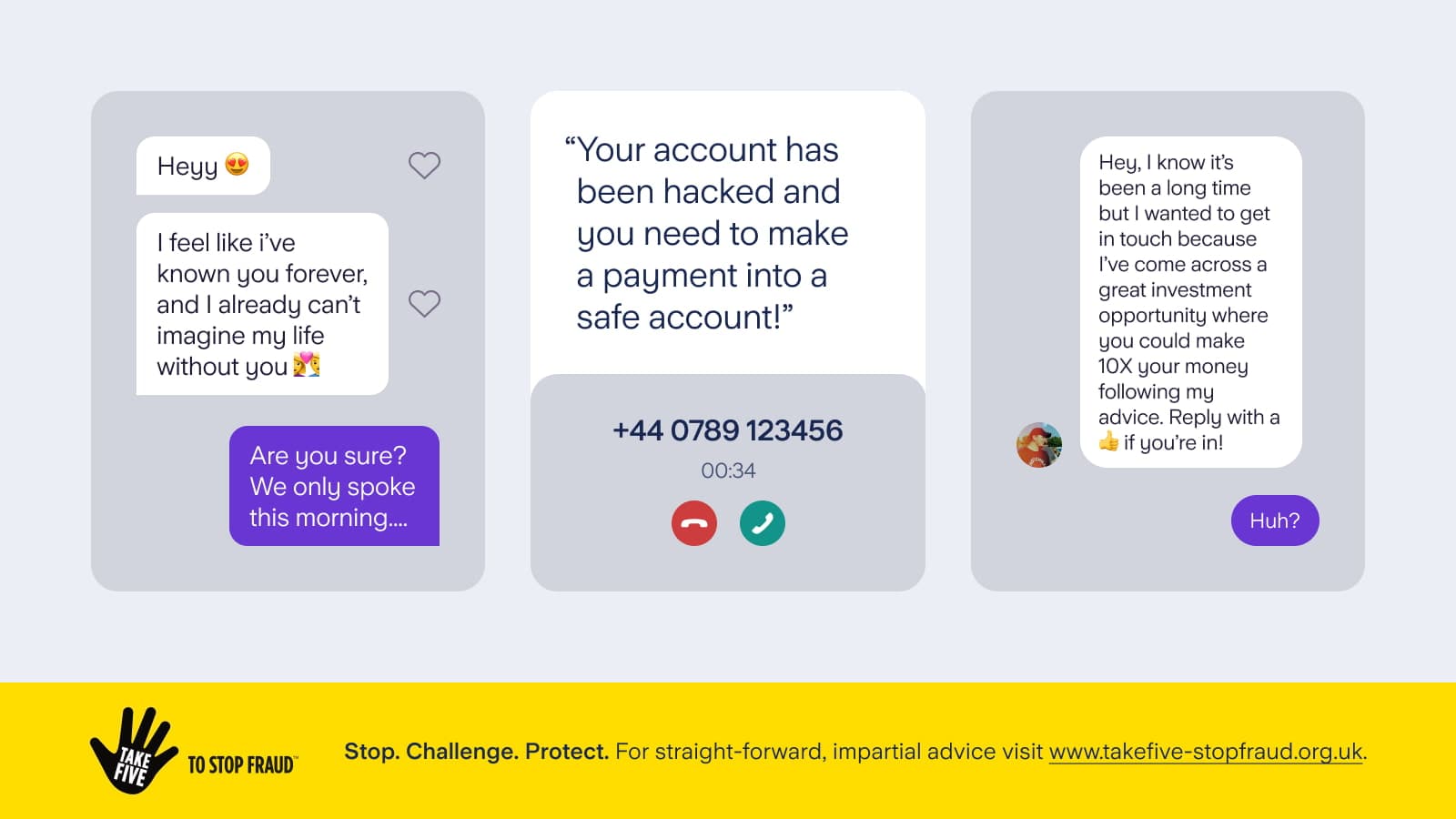

Teaching kids how to stay safe with money

The pros and cons of pocket money

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

8th July 2025

Money Truths

2nd July 2025

Money Truths

1st July 2025