Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

In the latest of our Money Explained series, we look at the different ways you can pay for things.

If you want to buy something, you’ll need to pay for it. There are lots of different ways of doing this, from plain cash to digital and contactless.

Cash usage is on the decline – UK Finance has reported that the number of people who don’t use cash, or use it just once a month, was 7.4 million in 2019, up from 3.4 million in 2017. A survey by YouGov from November 2020 revealed that about half of the people in the UK now use significantly less cash and notes, due to the pandemic.

To many children, the importance of physical cash is easier to explain than digital payments. That’s because the money is right there in your hand. Talking through and demonstrating the different kinds of payment can help. But as the adult, you’ll also want visibility and control. One way to do that is with the Starling Kite debit card for kids, which allows you to set spending limits and receive notifications when the card is used.

Here’s a rundown of the different ways of paying:

This means the physical coins and notes that you hand over in a shop. Your children may get cash for pocket money or birthday presents, and it’s often the thing they’ll use when they first buy something. In the current situation, the use of physical cash has become less popular with some people, who’ve preferred contactless payments.

With Starling, you can pay cash into your bank account at the Post Office.

Using a card is the most common way of paying these days and there are different types of card. In 2019, card payments made up over half all payments (51%) for the first time in history. Your children may have their own debit card such as Starling Kite or one through our Teen Bank Account. For Kite, you can use your app to show them how their money is being spent. Another card payment option on the market would be a prepaid card.

With a card, you can either pay by putting it into a machine and tapping in your PIN (a four-digit number that only you know) or if it’s under £45 you can use ‘contactless’ - where you hold your card near the machine and it takes the payment that way.

Another form of card is a credit card, which your kids can’t have until they turn 18 - these let you borrow money and pay it back later, though generally unless you pay it off in full every month you’ll pay extra money back to the credit card company in the form of interest.

These are regular payments that you send straight from your bank account. They’re often used to pay bills like electricity and internet, or for things like swimming lessons.

Most phones now have ‘mobile wallets’ – these let you store your card information in them so you can use the phone to pay, meaning you don’t need your physical card with you when you buy something. You can use your Starling debit card with Apple Pay, Android Pay, Samsung Pay and Garmin Pay. We’ve also launched our app in the Huawei gallery.

Lots of video games have their very own virtual currency, but you may have to spend real money to get it. Unfortunately, when you’re engrossed in the game, it can be very easy to feel as if this virtual money isn’t real money. This effect can be even more confusing when a 1000 units of a virtual currency costs, say, £4.68 real money. So you never really know how much your game currency is worth in the real world. We’ll cover this more in another article.

If your kids are gamers, it’s important to be aware that they may actually be spending real money. Lots of games make it easier to go up to higher levels in the game, to progress, if you spend real money. Or the game may offer special items you can only get by buying them, such as fancy battle gear or special looks for your character.

Spending money in video games is a very tricky area. If you do allow it, then do make sure that strict spending limits are set and that everyone is aware that real money is being spent.

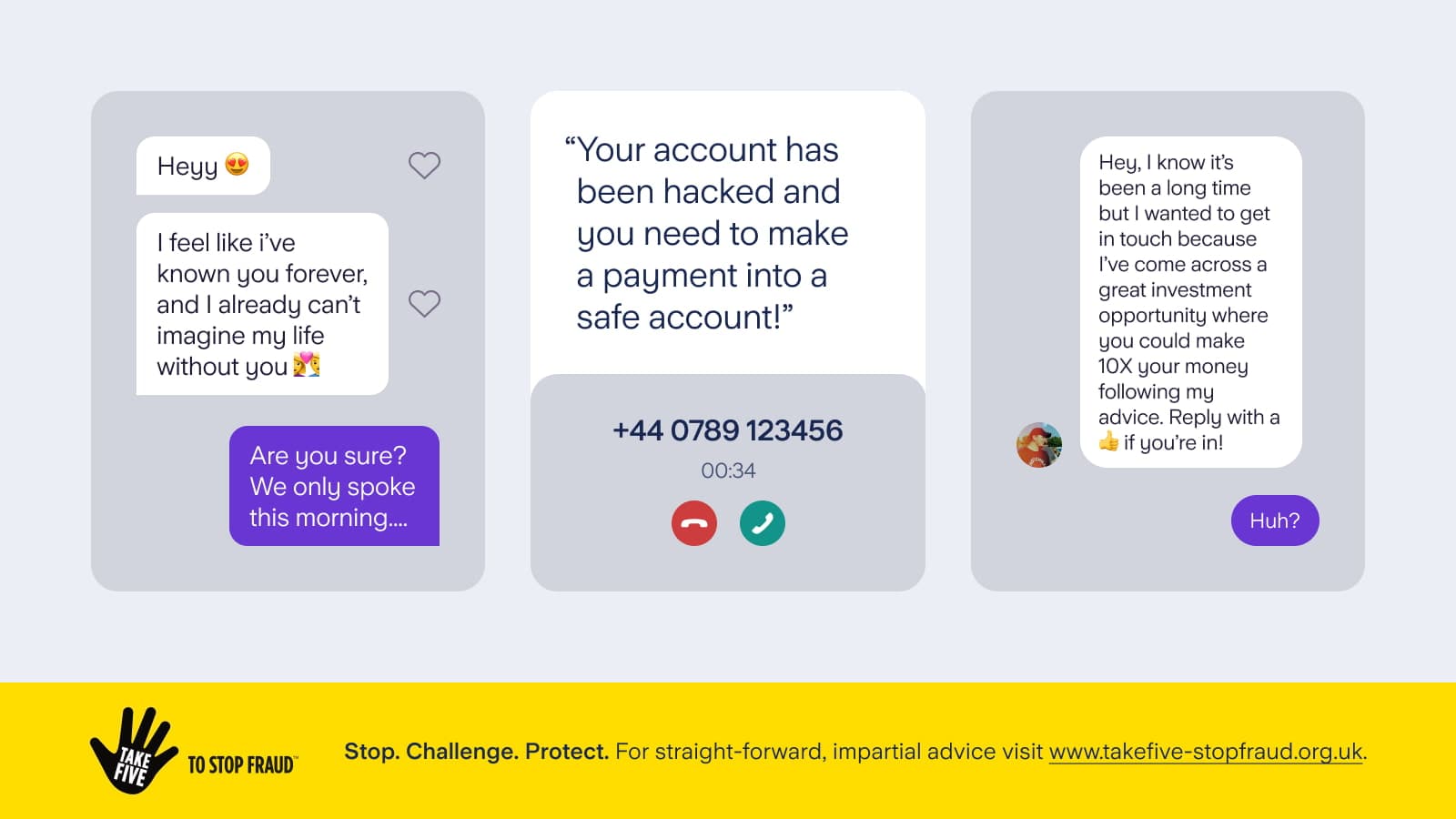

If you’re buying something online, you’ll often have to input your card details including the long card number, the card expiry date and the security code. Always take time to think whether the purchase is safe, or if there may be a scam involved. Do you really trust the website? Teaching your kids to stay safe online is essential. Remember, if a deal looks too good to be true, it’s probably not safe.

These can be spent at specific shops or websites, for example Waterstones, Lego or Nintendo, and are often given as gifts (hence the name). You might get one on your birthday for a set amount, say £20, and you can often then choose to top it up. Gift cards can be either physical or digital.

It’s worth talking through all of the ways to pay options with your kids. A good way to start the conversation, is by looking at examples of different things they might want to buy, and the ways they think they’d pay for them.

Read the other articles in our Money Explained series:

The pros and cons of pocket money

Teaching kids how to stay safe with money

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

8th July 2025

Money Truths

2nd July 2025

Money Truths

1st July 2025