Product news

Keeping it simple: How to use Bills Manager

30th April 2024

This week, we begin rolling out Starling euro accounts. Kjersti Larsen, one of our product managers, explains how it works.

Being a Starling customer just got even better. From this week you can hold, send and receive euros for free with a Starling euro account.

Our euro account is a secure and fast way to send and receive euros on a regular basis. It also marks the first step in spreading our wings beyond Britain.

Our euro account has been designed for UK residents who:

are European expats living in the UK and sending money back home

work in the UK, but are paid in euros

travel frequently to and from Eurozone countries

have family and friends living in Europe

own property in Europe

make regular payments in euros for a pension or mortgage in another country

are UK residents working in Europe for a defined period

Whatever you need euro payments for, Starling’s account will make it easier to manage them.

For those who conduct a lot of transactions in euros, the new Starling euro account can also help reduce exchange rate risks.

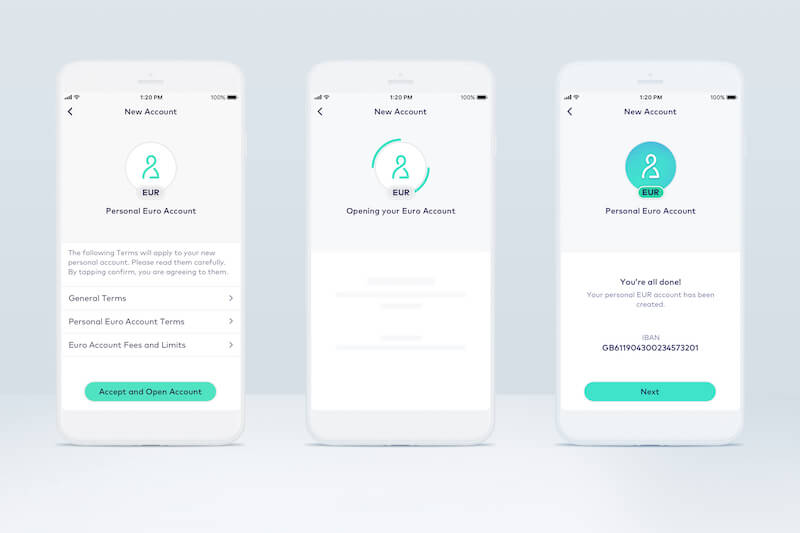

Euro accounts will be available to existing Starling personal account holders. To apply for a euro account, open your Starling personal account and tap ‘Get another account,’ just as you would if you wanted to open a joint or business account.

Once you’re up and running, you’ll have a unique International Bank Account Number (IBAN). You won’t need this to transfer money from your Starling personal account though. We’ve made transferring money between Starling accounts super easy with our new transfer feature.

There are no monthly fees or hidden costs to set up a Starling euro account. Transfers into the account are made at competitive rate that is clearly shown in the app with no additional fees for making a transfer. The ability to pay in euros using Starling’s debit card will be added later in 2019.

We are a fully-registered UK bank. So as with all Starling accounts, our euro account is protected by the Financial Services Compensation Scheme (FSCS) up to £85,000. This threshold is spread across all your Starling accounts. So if you have £15,000 in your Starling personal current account and £5,000 in your joint current account (a total of £20,000), up to £65,000 (roughly €74,600) of euro deposits would be covered.

Later this year, Starling personal account debit cards will be enabled to work with the euro account. We’ll also be making euro accounts available to our business customers. Launching our euro account sets us further on the path of bringing Starling to people living outside the UK. This year is going to be our biggest yet - watch this space.

From 1 September 2019 Starling customers with a euro account can convert the pounds in their personal account into euros – or euros into pounds – all at the real exchange rate with a 0.40% fee. No hidden commission, no hidden fees, no hassle.

Article updated: 17 January 2024.

Product news

30th April 2024

Product news

6th June 2023

Product news

5th June 2023

Money Truths

12th December 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024