Product news

Helping economic abuse survivors with our new feature, ‘Hide references’

6th June 2023

Our virtual cards are designed to make budgeting easier and improve security. Virtual cards are similar to physical debit cards - they have their own card number, CVV and expiry date, but they don’t arrive in the post. Instead, the card exists on your phone and enables you to spend from your chosen Starling Space.

You can set up multiple virtual cards for free and use them to make payments in person using a mobile wallet, such as Apple Pay or Google Pay. You can also use your virtual card online by entering your card details into a website on a laptop or phone.

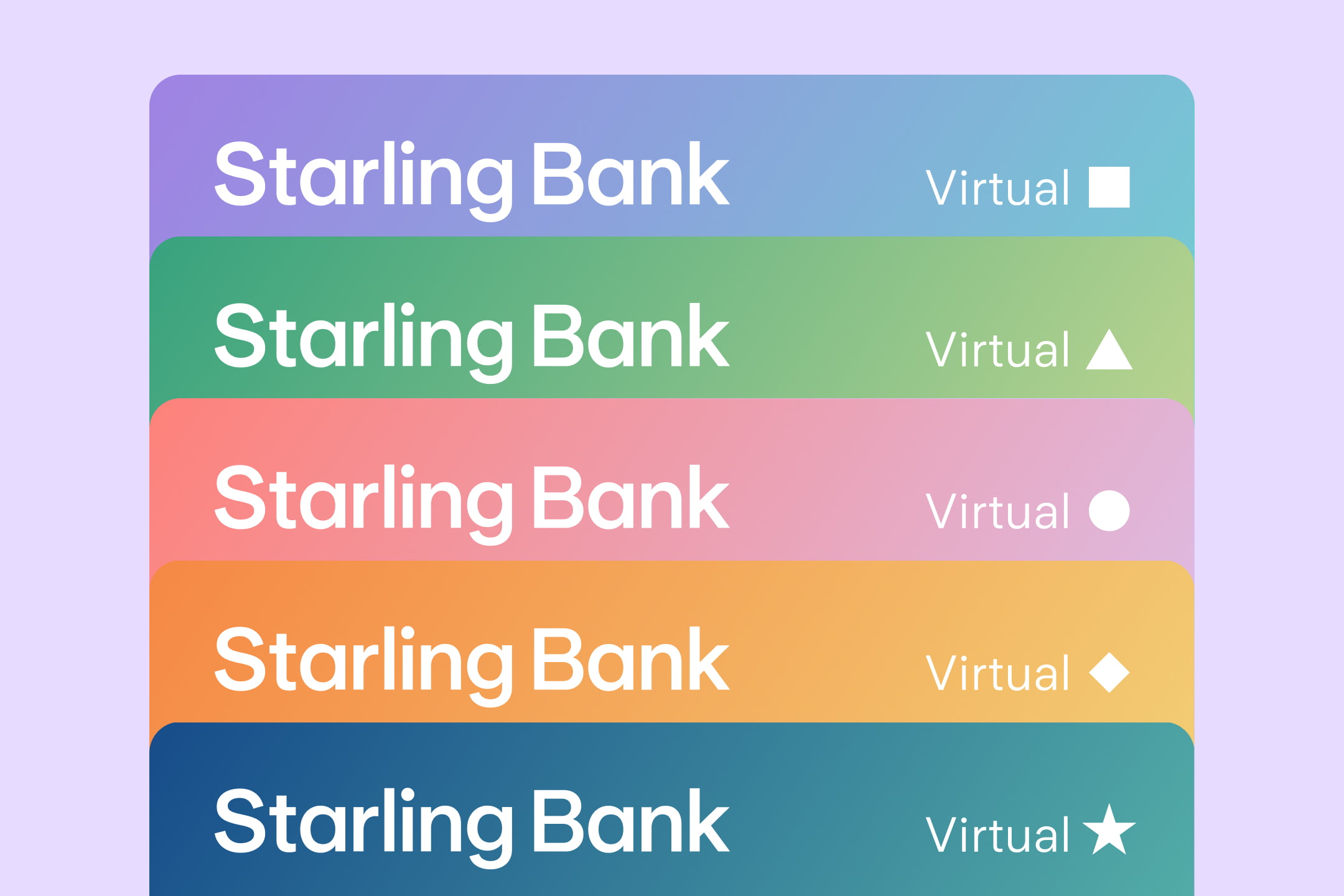

Customers with a Starling personal account or joint account can create up to five virtual cards for each account and choose a different colour for each card. There are ten possible colours - five for personal accounts, five for joint accounts - and each associated with a small shape, such as a circle or triangle, found in the top right corner of the virtual card.

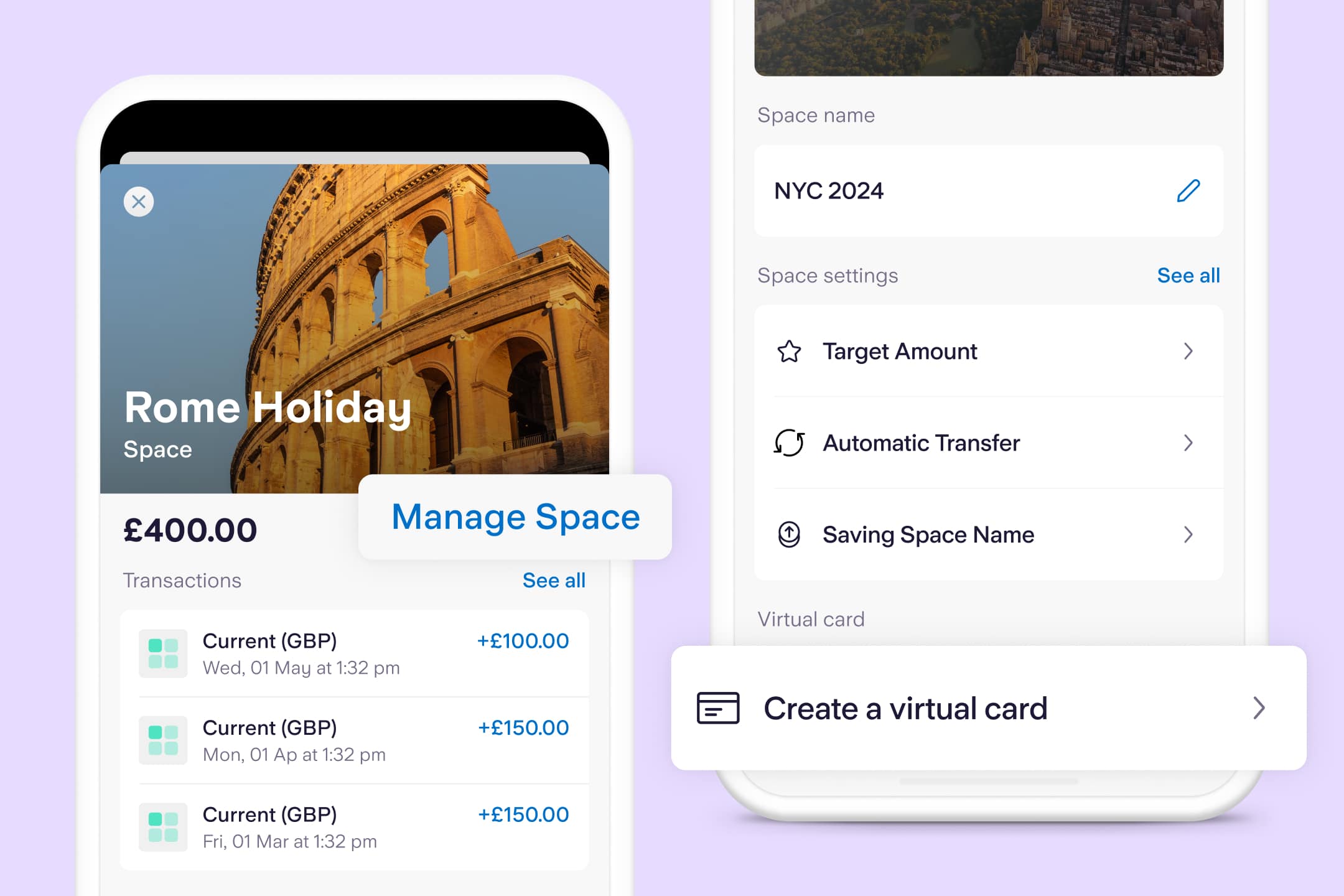

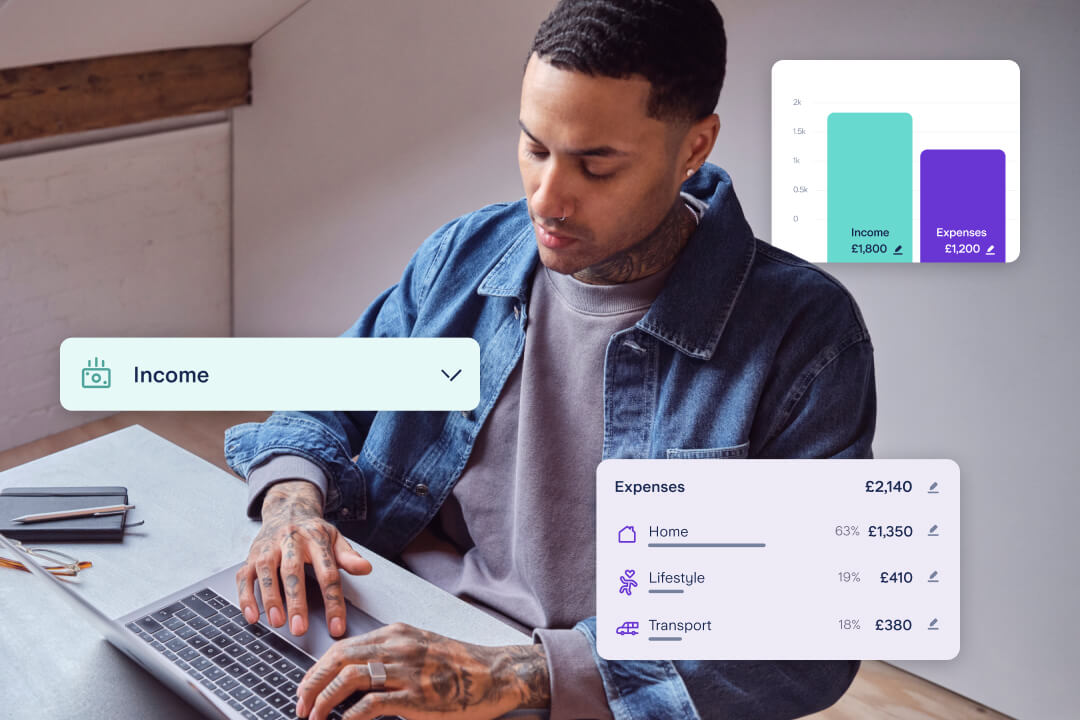

With the Spaces feature, you can budget by allocating money for different purposes, such as ‘Groceries’, ‘Holidays’ or ‘Pets’. Spaces keep your money separate from the main account. Simply create a Space, top it up, then set up a virtual card so that you can spend straight from that particular Space. A list of transactions made with a virtual card can be seen by tapping the Space it’s connected to.

You can only spend what’s in your Space, something that can make it easier to stick to your budget. Every time you spend from a Space or if a payment is declined from a Space, we send you an instant notification to let you know. If your virtual card is connected to a Starling joint account, both people with the account will receive notifications related to virtual cards.

Spaces can be topped up any time through a one-off transfer. You can also set up a weekly or monthly transfer. That way, you won’t have to remember to top up certain Spaces with your allocated spend - it can all happen automatically.

You could already use our Bills Manager feature to pay Direct Debits and standing orders from a particular Space. Virtual cards mean that you can also pay for subscriptions straight from a Space.

If you set up a ‘Subscriptions’ Space and virtual card, you’ll be able to see all your payments for streaming platforms, magazines and apps in one place. This can make it easier to review them or arrange to cancel one if needed.

To update the payment details for your subscriptions to your virtual card, open the Card section of the app and enter the card details and CVV for your virtual card into each subscription website.

If you want to buy something from a new website, you could use a virtual card for extra peace of mind. That way, you won’t be spending money from your main balance or sharing the details of your physical debit card.

Virtual cards can’t be used to make money transfers, for example with Western Union or PayPal. They will also block transactions with merchants associated with gambling or betting.

You can set up a virtual card by creating a new Space or going to an existing Space and tapping ‘Manage Space’.

To add funds, top up the Space connected to the virtual card. And to make a payment, add your virtual card to your mobile wallet or look at its card details in the Card section of the app.

If you delete a card, it will be removed permanently. You could then set up a brand new one in its place. You can have five active virtual cards for a personal account and five active virtual cards for a joint account at any one time.

Article updated: 5 June 2023

Product news

6th June 2023

Business

3rd October 2022

Product news

21st September 2022

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025