The bank

built for you

Master your money with award-winning banking on your phone.

Apply now

Who says interest is just for savings?

Earn 3.25% AER* (3.19% gross) variable interest on personal and joint current account balances, up to £5,000 per account. That’s your day-to-day money earning interest, not just savings. Interest is calculated daily and paid monthly.

Apply now*AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law. See illustrative example.

Master your spending.

Never ask ‘where’s it all gone?’ again.

Get instant notifications whenever you spend or get paid. Dive into your spending habits, and decide where to cut back or keep going. You’re in control now.

Apply now

Relax about bills.

Always know exactly what’s coming up.

Put bills on autopilot, and pay them from a separate area of your app with Bills Manager. You’ll get a clear view of what’s left over for day-to-day spending.

Meet Bills ManagerLay out budgets beautifully.

Save for anything, and track progress effortlessly.

Saving Spaces are separate pots within your app. Add titles, images, and set a target. Or just set money aside for things like fuel, commuting or the big shop.

Have some savings already?

Make the most of it. Earn 4.48% AER/gross interest with a personal account Fixed Saver.

Split any bill with a quick tap.

And get paid back without the hassle.

Use Split the Bill to quickly work out anybody’s share of a payment. Then fire off a simple Settle Up link to friends, and get paid without swapping bank details.

Apply now

Never blow a budget again.

Spend directly from your Saving Spaces.

Create budgets in the app, then assign virtual debit cards to spend from them online and in-person. If the money runs out, your virtual card will decline.

Tell me moreSpend fee-free on holiday.

Use your card abroad exactly like you do at home.

Unlike most banks, we have no foreign transaction or withdrawal fees, and we never mark up the exchange rate. Wherever Mastercard™ is accepted, we are too.

Apply nowHelp, I’ve lost my bank card

Okay, don’t worry.

You can ‘lock’ it in app with just a tap.

Oh, that’s a relief. Thanks!

Speak to us any time, anywhere.

Talk to our award-winning, UK-based teams 24/7.

Whether it’s the dead of night, or you’re on the other side of the world: if you need to speak to us, you can. And you’ll always get through to someone real.

Industry-leading app security.

Your money is protected up to £85k by the FSCS.

We’re a digital bank, built from scratch with some of the world’s best banking security. Codes, face and fingerprint recognition are just a few of the ways we help to keep your money safe.

Everything you need.

- FSCS protection up to £85k

- 24/7 UK customer support

- Instant card locking

- Overdrafts (if eligible)

- Fully regulated UK bank accounts

- Scan cheques in-app

- Instant notifications

- Use with mobile wallets

- Cash deposits

- Direct Debits

- 100% digital sign up

- No fees abroad

- Split the bill with friends

- Virtual cards

- World-class security

Nothing you don’t.

- No card-readers

- No hidden fees

- No branch queues

- No fees for spending abroad

- No call time targets

- No bots

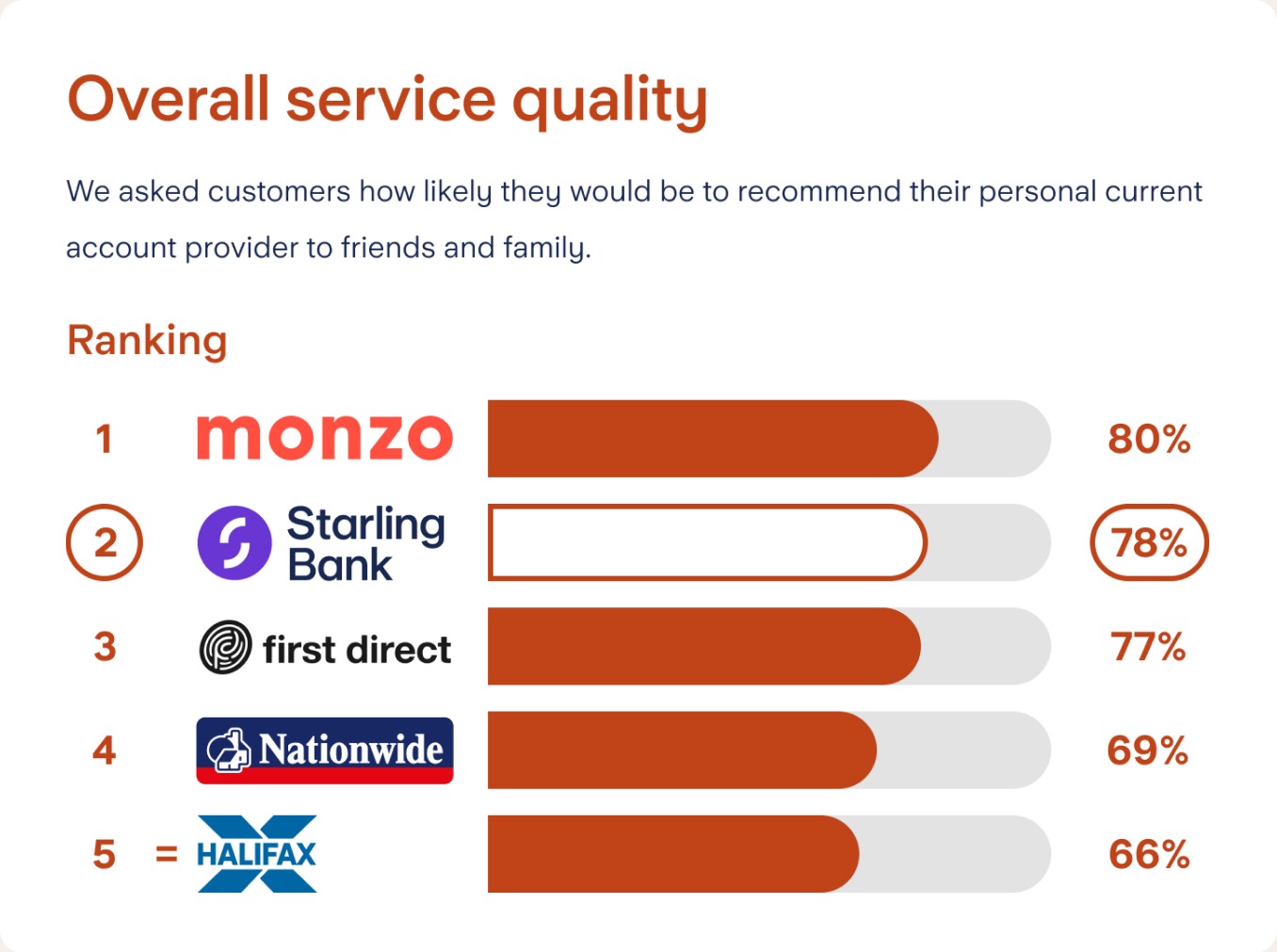

Independent service quality survey results.

As part of a regulatory requirement, independent surveys were conducted to ask customers of the largest personal and business current account providers in Great Britain and Northern Ireland if they would recommend their provider to friends and family. See Starling’s results for personal accounts and business accounts

Apply for a bank account in minutes from your phone.

Award-winning everyday bank accounts with no monthly fees, industry-leading security features and a Mastercard™ bank card.

Apply now