Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

22nd February 2023

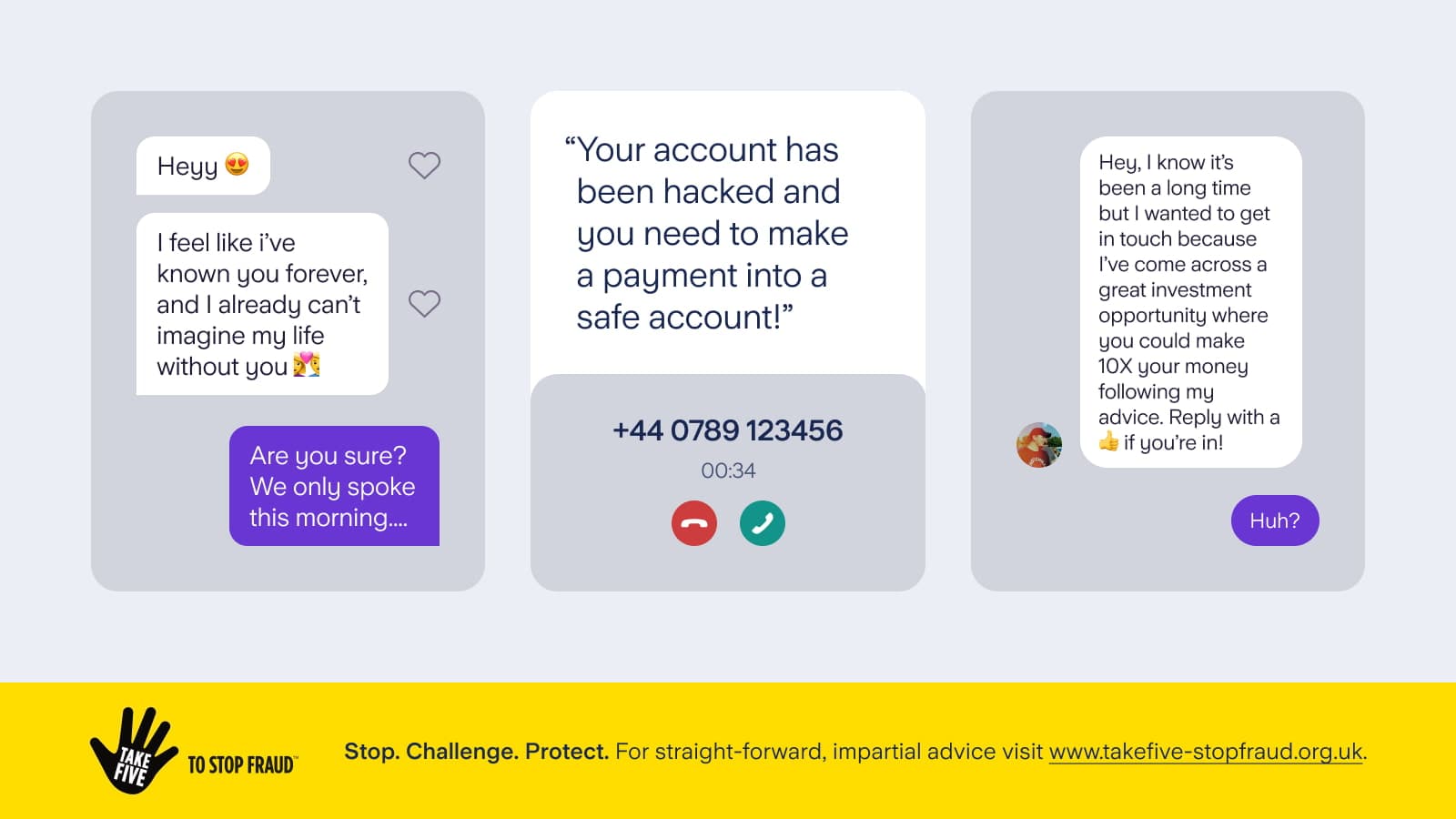

For many of us, our lives are organised and lived through our smartphones, which is why it’s never been more important to keep these devices secure.

Depending on your phone, you may be able to secure it with a PIN, passcode or biometric lock (fingerprint or Face ID). Without this security in place, if your phone were to be lost or stolen, a fraudster could access your social media, email accounts and other personal apps on your device, all of which may contain information they could use to impersonate or steal your money.

With an unsecured phone, if you have stored passwords in your browser, a fraudster could access these and then break into further accounts. Instead of saving passwords in a browser, you could use a password manager instead.

It’s not just your devices that need protection. Certain apps, such as banking apps, must also be secured with a lock. The PIN/password/pattern that you use for your banking app must be unique. Don’t ever use the same code for your banking app as for your mobile phone. This principle applies across all devices, accounts and apps: each one needs its own unique password.

If you use the same code for the phone and for a banking app, it’s much easier for criminals to gain unauthorised access into your bank account.

When it comes to deciding how to lock your device there are four ways that can be used, depending on the type of phone you have, each of which have their pros and cons.

Biometrics - If your device supports Biometrics you can often use your fingerprint or FaceID to unlock your device. This method is used on top of your PIN, passcode or pattern. Your device will require you to pick one of the other available locks as an alternative way to unlock your device.

Numeric Code/PIN - This is a numerical code that you can use to lock your device, similar to the Personal Identification Number (PIN) you would use to pay for something using chip and PIN. It’s usually four digits long but we recommend making it at least six digits long.

Pattern - If you find it easier to remember shapes, rather than a PIN or password, you can unlock your device by drawing a pattern. We encourage you to use a complicated shape and always enter them quickly. Avoid easy patterns like 🟥, 🔺, S, L and Z as they are easy to guess and easy for a stranger to look over your shoulder and copy.

Password - similar to how you secure your online accounts, your phone may also allow the use of passwords to lock your device. A password can be more secure than a Numeric Code/PIN, but it can be harder to remember. You can find out more about how to choose a memorable one in our blog on PINs and passwords.

Regularly clean your screen to wipe away fingerprint indicators of which lock you use

If using a PIN, password, or pattern make sure you use a different combination for each device and application you use

Do not share your PIN/password/pattern with anyone, especially when it comes to your banking app

Watch out for people looking over your shoulder. When in public, cover the screen with your hand if typing a PIN/password

Make sure auto lock is enabled on all devices, meaning that your device will automatically lock after a certain number of minutes

Don’t store passwords on your browser or device, instead password managers are a good way of storing passwords and PINs. They can help create unique passwords, which can be accessed with a single password

You could also consider using a SIM lock to protect your SIM card with a pattern or passcode. It should prevent a fraudster from accessing your data or using the SIM in another phone. If a SIM code is entered incorrectly three times, the SIM card won’t work any more - so a SIM lock should only ever be used with very great care

If your phone is ever lost or stolen, you should notify us right away, using the telephone number on your card. The sooner we are aware, the quicker we can ensure that the banking app is secure and that it can’t be accessed.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

12th December 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024