Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

Rosie Hopegood, freelance journalist and editor, shares a smart way to help organise your monthly budget.

I’ll start with a confession: I’m a reformed bad money person. In my late twenties, I had a staff job at a national newspaper and despite being on an okay salary, I tended to bury my head in the sand about what was going on in my bank account. I would spend freely for the first three weeks of the month, and then be horribly skint in the last week before payday. Sometimes, I wouldn’t realise that I had gone over my overdraft limit until I received a text message from my bank.

Looking back, I’m embarrassed by how little control I had over my finances at that time. I wasn’t spending wildly or extravagantly, but London is expensive and journalism salaries are notoriously low compared to many other professions. The app for my high street bank was clunky and slow, so I rarely opened it – hardly conducive for keeping tabs on what I was spending.

Everything changed when I switched to a digital-only bank. Straight away I could see a breakdown of where my money was going. Pret and Uber, for example, were taking up more than their fair share of my resources. Just being able to see my spending, laid out in neat categories, really helped me get a handle on what I was spending and where. This was a huge wake-up call in managing my money (and my caffeine consumption).

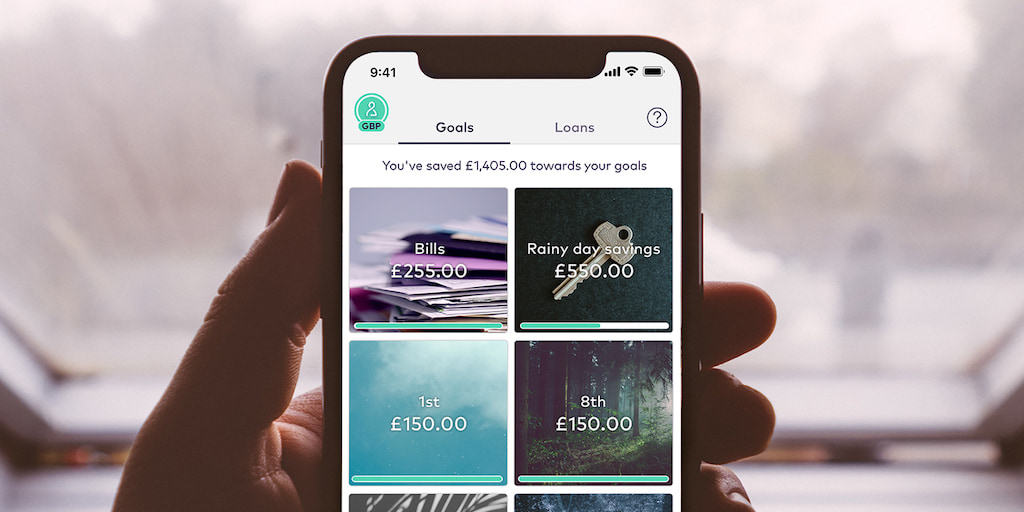

But one of the biggest changes I made was dividing my salary up on the day I got paid each month, to help me budget. At first, I did this organically, but I later found out from the MoneySavingExpert website that this is actually a recognised personal finance technique called Piggybanking. Starling’s Goals feature is perfect for this: rather than having multiple current and savings accounts, Goals is an easy way to save money by ring-fencing chunks of money. If you’re a visual person like me, you can even change the image for each Goal to brighten things up.

It’s easy to create a Goal – just click on the Spaces tab in the app and take it from there.

You can get your account Piggybank ready in a few minutes. You should figure out exactly how to make the method work best for you, but I like to organise my account with seven Goals. I’d recommend this as a good place to start.

First of all, you need to work out your monthly budget. Tot up all your monthly expenses, including the big hitters like rent and household bills, as well things like gym membership and car insurance and travel cards. Don’t forget to add all the subscriptions you have: Netflix, Spotify, and Audible, for example. This also a good time to cancel those subscriptions you don’t use – I’m the queen of signing up for trials of magazine subscriptions and paid-for apps, before promptly forgetting all about them. Ditch them!

Your first Goal will be for Bills, so name it accordingly. In an ideal world, we’d all have our Direct Debits coming out on one day (the day after payday!) but it’s not always possible to change every single one. With this method, it doesn’t matter when the bill comes out, because you’ll always have the money set aside.

Your weekly spending should include absolutely everything you spend day to day, such as food shopping, coffees, meals/drinks out and any kind of entertainment you might pay for (don’t worry about including things like clothes or gifts, those go in a separate pot). Jot down the figure.

Start by making four Goals, one for each week of the month. Label each one with a date e.g. if you get paid on the 1st of each month, they should be 1st, 8th, 15th and 22nd. Then transfer the amount that you’ve calculated you need for your weekly spending into all four. Make one more Goal and name it ‘Last Bit of the Month.’ Stash a bit extra for those last few days before payday.

To make the technique work, you then top up your current account at weekly intervals, withdrawing from each of your Goals in turn. I find it really reassuring to see the separate pots of money all marked out.

This is for all the extra things you might want to buy that aren’t essential. It could be anything from clothes to toiletries, the hairdresser, birthday presents or spending money on a weekend away. I’m currently spending all my extra income on my upcoming wedding (who knew canapés were so expensive?), so sadly my monthly extras Goal is rather sorry looking. But in the past my monthly extras pot has come in handy for everything from new outfits to Mother’s Day presents. When you spend on an extra, you then transfer that amount from the Goal to the regular account.

It’s up to you how much you put in Monthly Extras – you know how much you’re likely to spend and how much extra you can get away with. The good thing about this pot is you can keep tabs on how many treats you’re allowing yourself each month, without letting things escalate into a full-blown splurge.

Hopefully, after paying your bills, spending a set amount each week and indulging in a few extras, there should be something left over to save. Calculate how much you can afford to save each month without living a miserable existence, and set this aside on payday each month.

Whatever you do, absolutely do not wait until the end of the month to see what you have leftover – that might work for a select few, but most of us will end up spending it.

You may want to have multiple savings pots for things like holidays or Christmas. You may even want to set up a pot for rainy days - the current Coronavirus situation shows just why that can be important. Try not to dip into these savings pots unless you absolutely have to.

I’d love to say I’m organised enough to have a Christmas fund on the go all year, but that would be a lie. I do like to have something put aside for weekends away though – what’s the point in going away if you have to watch the pennies while you’re there?

Piggybanking helped me get control over my spending and know where my money was going. It also helped me get out of the red and set aside savings each month. I can’t pretend I’m suddenly some sort of financial guru – I still overspend sometimes. But the end of the month is now a bit less stressful, and I know I should always have enough to cover day to day life, with something left over for a rainy day.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

12th December 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024