Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

Starling Bank steps into 2022 with a year of strong growth, investor support and innovation behind it. We’ve opened over 2.7 million accounts to date, including 475,000 accounts for small and medium-sized enterprises. Our UK SME market share now tops seven per cent, almost half of Barclays’ share.

Our deposit base now stands at £8.4 billion, up from £4.8 billion this time last year, while we’ve expanded our lending from £1.9 billion to £3.1 billion.

Key milestones in 2021 include our purchase in July of Fleet Mortgages, a specialist buy-to-let lender that, like Starling, began life in 2014 with the aim of running a business its employees could be “proud to work for”. We made a commitment to offset our own carbon emissions, excluding lending and investments. We raised a further £322 million from some of the world’s biggest financial heavyweights. And we launched a host of new features including our Kite app for children aged 6 to 16, the first full generation of digital finance natives.

As a profitable, fast-growing fintech built on proprietary software and with a substantial loan book, a valuation in excess of £1 billion and a tightly controlled cost-base, Starling now stands in a category of one.

As we enter the new year we’re embarking on a new phase, starting with the launch of our Software as a Service, or SaaS, proposition, taking Starling’s software to banks around the globe.

With SaaS (or Starling as a Service, as we like to call it) we will offer our partners the benefit of Starling’s advanced technology to use as their own. If a bank wants a digital bank, they can have one up and running in months with Starling’s SaaS offering. It will be their licence, our technology.

We also plan a continued expansion of our lending. Expect a mix of strategic forward flow arrangements, organic lending across various asset classes and a targeted M&A strategy focusing on selected lending originators.

The world searched for “how to start a business” more than “how to get a job” in 2021, according to Google’s annual Year in Search report. I’m thrilled to see so many people starting businesses. The vast majority won’t seek external investment or funding because, today, you don’t need it. New digital businesses require very little capital in terms of servers, or even stationery.

So starting a business is not only for those with substantial personal resources or even the courage to go on Dragons Den. Now, it’s all about SaaS and plugging your business into software services, and online courses, that simplify the running of a company, from accounting and work-flow to customer retention and getting the most out of a team. All this can be done from the spare bedroom or a shared workspace.

In most cases, companies founded in this way will not need to raise finance until they come to scale. This is when founders seek to raise finance from external sources, such as venture capitalists. And this is where many will encounter a roadblock.

The proportion of venture capital raised by women founders dropped from a record 2.4% in 2020 to 1.1% in 2021, according to data from Dealroom cited by Atomico. Why are we going backwards, when all the evidence points to the enormous benefits of diverse teams?

Could it be that in so-called normal times, when there are fewer uncertainties, investors seem willing to “take a chance” on funding women? They do what is right because they know that people are watching. I suspect that changes during a crisis, in this case the pandemic. When all eyes are on clear and present dangers, do they expect less scrutiny and stop worrying about who is looking over their shoulder?

Happily for Starling, 2021 was a good fundraising year for us; but I believe it’s important to raise these questions in the interests of fairness and diversity - and for the wider benefit of the start-up ecosystem. I have always felt a bit of an outsider in my career and am happy for it. I’ve no doubt whatsoever that being an outsider can help you see the possibilities that others miss.

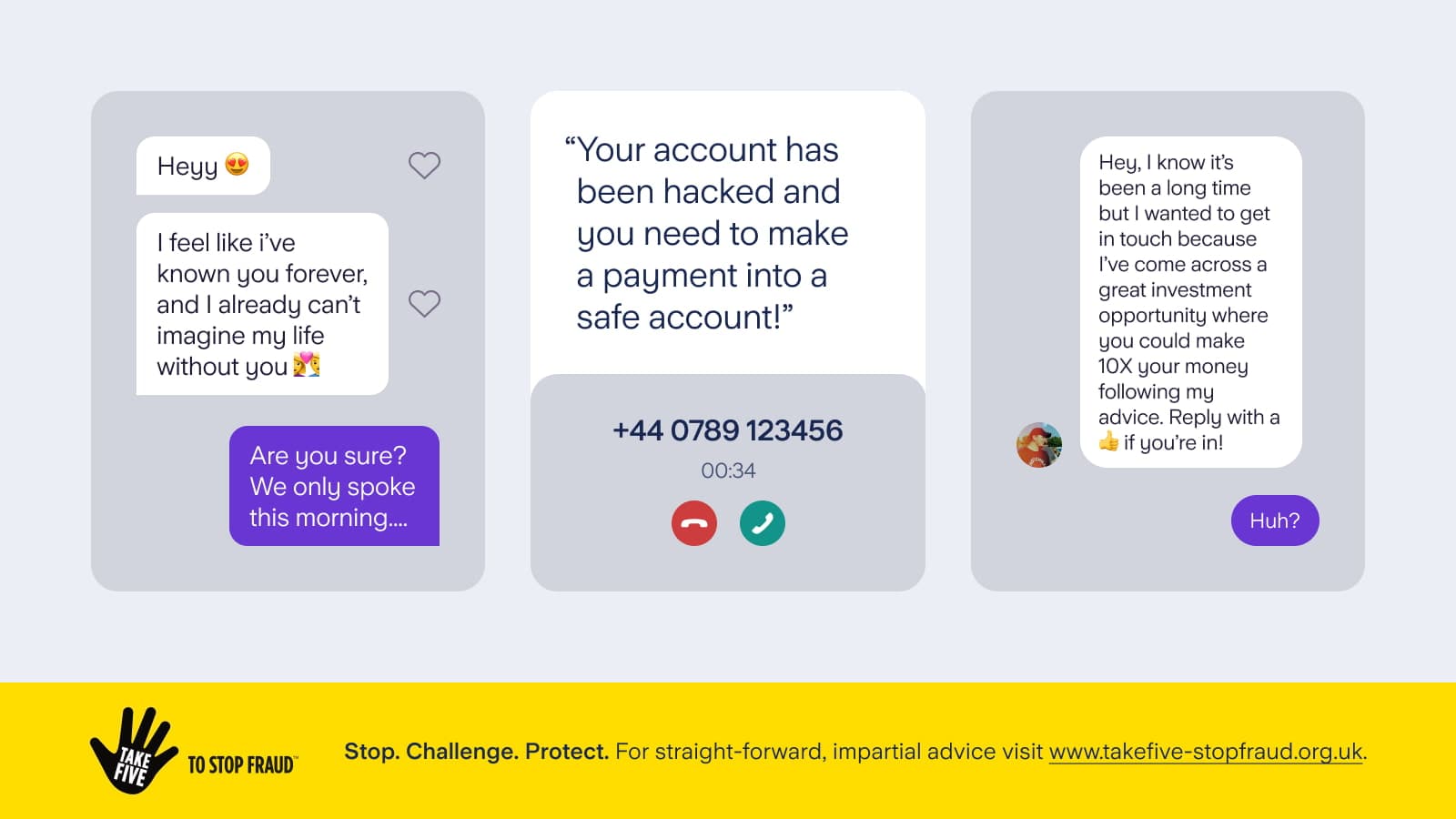

I have repeatedly called out the big tech and social media giants for allowing financial fraudsters to advertise and post content on their platforms that result every day in people being scammed out of their savings. Many others share this view, from consumer champions, such as MoneySavingExpert and Which?, to UK Finance and individual MPs. In August 2021, Google stopped accepting financial services advertisements unless the advertiser could demonstrate that they are authorised by the UK’s Financial Conduct Authority (FCA) or unless they qualified for certain limited exemptions. This represents a welcome, if long-overdue, step forward.

We’ve been urging other platforms to follow suit and have campaigned doggedly this year to get financial and economic crime included in the forthcoming Online Harms Bill, which I see has been renamed the Online Safety Bill without any apparent hint of irony. It cannot be right that these platforms profit from crime and yet remain beyond the reach of law.

Facebook (Meta) indicated in December that it will be doing something similar to Google to stop fraudsters advertising on its platform. This is good news. We are still waiting to find out when and how this initiative (from TechUK’s Online Fraud Steering Group) will happen. In the meantime, we’ve stopped all paid advertising on Facebook and Instagram.

We want to protect our customers and our brand integrity. And we can no longer pay to advertise on a platform alongside scammers who are going after the savings of our customers and those of other banks.

When I read that Facebook’s next big project, the Metaverse, is predicted to be the key driver of the growth of finance and DeFi (Decentralised Finance) in the 2020s and beyond, I know that this is likely to be both wrong and right.

Just look at how many “predictions” from the world of science fiction movies have come true; video phones and robot helpers in the home are now a reality, although they look very different to their fantasy versions of 50+ years ago. I also recall the time in 2006 when at least one big bank decided to open a branch in Second Life in its search for “the best way to establish personal contact with customers”. Fast forward a few years and see how much simpler it proved to be to provide 24/7 human contact via an app.

While Facebook (Meta) may hold out all sorts of promises for the future, I really hope its focus on the Metaverse doesn’t become a distraction from doing what is right today, here and now in the UK of 2022.

At Starling, just like other companies, we’re still figuring out the future shape of the workplace and of hybrid working.

Of course, we still need to get together in person to socialise, collaborate, innovate, create, learn, grow, take care of one another, nurture our mental health and much, much more. The pandemic has really taught us to cherish all this more than ever. But surely there has to be a more interesting way to use our buildings - and our time - than going into the office on Tuesdays, Wednesdays and Thursdays and leaving offices half empty the rest of the time?

Thanks to technology, we have a once in a lifetime opportunity to change the way we work and to make the workplace more inclusive, especially for people with disabilities and those with caring responsibilities. People’s lives are complicated. Disasters strike. Life can be unpredictable. We need to rethink when, where and how people work and how to implement change without worsening workplace inequality.

Maybe the weekend, a nineteenth century construct introduced for the benefit of factory owners and their workers, needs a total do-over? Maybe, the same goes for normal “working hours”. Let’s be honest, for all but a minority of people, there never was a long-lived golden age of nine to five working.

I don’t know the answers, but I find the prospect of change exciting. And in this I’m inspired by the new year’s poem for 2022 by the American poet Amanda Gorman: “Let us not return to what was normal, but reach toward what is next.” She may be speaking at a much higher level. But when it comes to the workplace, the sentiment seems apt to me.

As we all figure out what is next, I’m acutely aware that many of our personal and small business customers will be facing a big squeeze come Spring 2022. This is the moment the peak of the inflation wave is predicted to hit, the rise in the energy price cap will take effect and taxes are scheduled to go up. We’ll be watching closely to see how this affects the most vulnerable.

As always, I’d like to thank our customers and all of my colleagues and wish everyone the best for 2022.

Anne

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

12th December 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024