Budgeting

“Bills, Bills, Bills” – Sorted in three simple steps

By Esmeralda Dyer Bray

Budgeting

Among family and friends, I’m ‘The Planner’. Whether it’s booking the table for a pub quiz or organising the annual group holiday, I’m on it – confirming numbers, pinning down dates, making it happen.

I invited family friends to spend Christmas with my brother and I way back in May – I wanted to lock it in before they could get another invite.

With the plan set, I had every intention of holding off on details until at least November. But then I saw that my tiny local supermarket was selling mince pies – in September. Like most people, my initial reaction was to roll my eyes. But on my walk home, my true nature got the better of me and I started thinking about all the benefits of planning ahead for Christmas, especially when it comes to saving money.

If you’re travelling by train to stay with friends or family over Christmas, you could save a lot of money by booking in advance. For example, a one-way train from Edinburgh to London for October cost me £46 when booked in August (with a railcard). Whereas, if I booked today, it would be more like £70.

It’s the earliest I’ve ever done it but today, more than two months out, I pitched that the adults do a Secret Santa for Christmas Day. We set a price limit of £20 and agreed to use a free online tool to work out who would be buying for who.

Is it horribly early? Yes. But it avoids a scenario where one person starts looking for everyone, meaning the whole group feels they have to do the same, and ends up wasting money.

Other than Secret Santa, who else do you want to buy for? Is there an age where everyone agrees to stop buying presents for grandchildren, godchildren or nieces and nephews? Are some kids in the family at an age where they’d prefer money? Factor this into your budget and if they have Kite cards, use KiteLink for their Christmas transfer.

My current plan is to find things for friends on Black Friday, when discounts could mean I can afford to get them something nicer than I otherwise could. Another idea: batch buying scented candles or beauty products. You could even team up with family members to make savings as a group, for example through 3-for-2 offers on books. Doing this can also help pace your spending.

How are you going to divide the tasks and expenses of Christmas Day itself? There’s all the food to think about, but there are also table decorations and crackers – if you get them early enough, they could be on sale.

I don’t eat meat so I’m not keen on splitting the cost of the turkey. But I am happy to cover lots of the trimmings and the tree (usually £40 from Caring Christmas Trees, a project in partnership with an Edinburgh homelessness charity).

Check who can afford what. Will everyone be expected to bring a bottle or two? And if yes, will you tell students or those earning less not to worry?

When you add everything up, starting conversations early and doing a little planning could really cut down the overall cost – and make saving for Christmas a lot easier.

If you’re a Starling customer, you could even set aside the money you saved on advance train tickets or Black Friday deals in a Space – think of it as a future-you reward. Lots of people get their December pay early, which can be great for some last minute Christmas shopping, but can also make January feel like a very long month. That extra buffer could be a welcome relief.

You could even start a New Year’s saving habit and follow in the footsteps of Tim, a Starling customer: “The Christmas Space in my Starling account makes a world of difference. I top it up each month throughout the year (set aside using the automatic transfer facility) so I build up a reasonable balance to help cope with Christmas spending, including presents and Christmas dinner. I’ve customised the picture for the Space to show a Christmas tree so it’s easily recognisable!”

Friends may tease me (and possibly Tim) about it but I promise you – advanced planning pays off.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

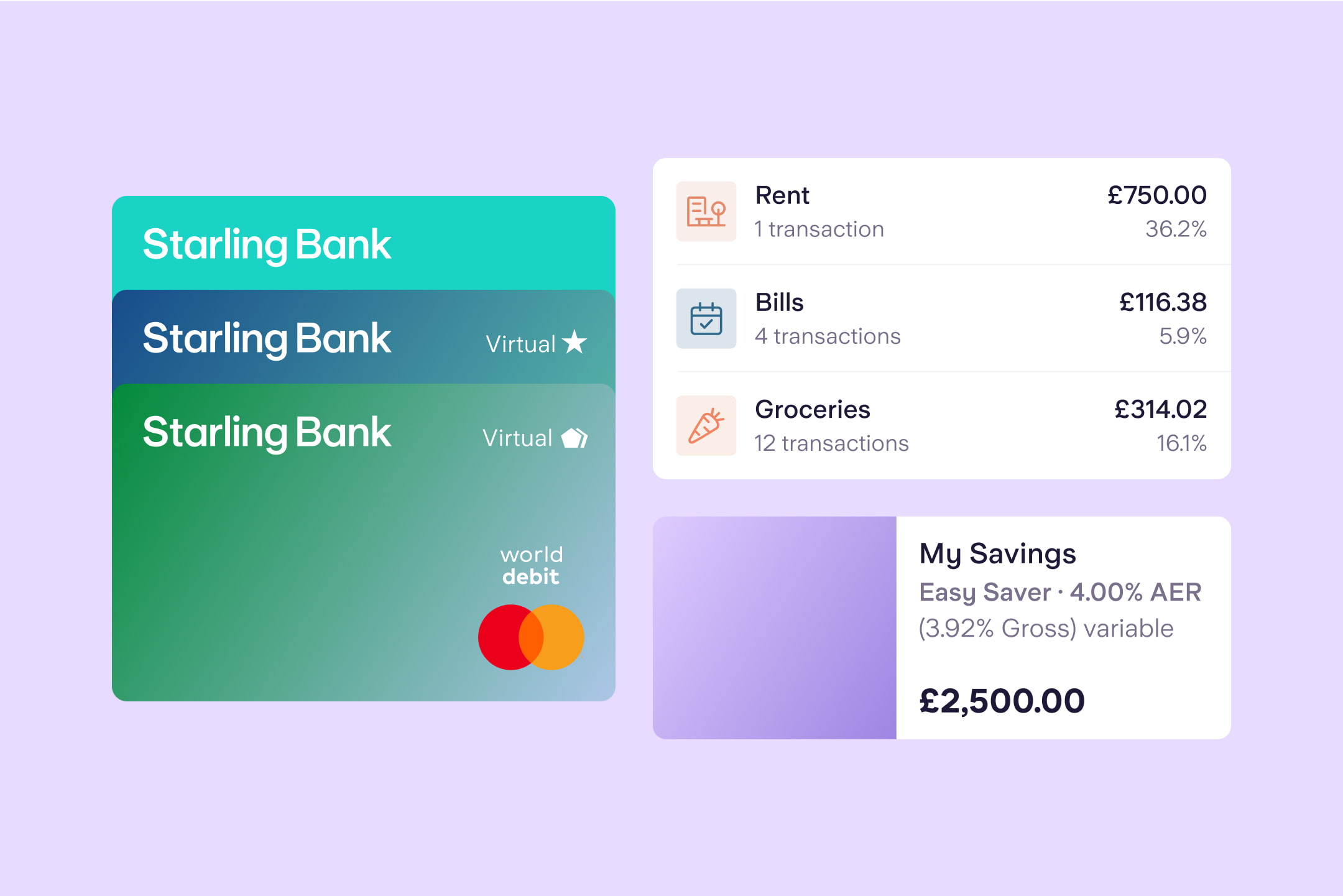

Keen to keep track of your Christmas spending? With Starling, you can choose from more than 30 categories to gain an accurate snapshot of your spending. Categories include ‘Celebration’, ‘Family’ and ‘Gifts’.

Explore our current account

Budgeting

By Esmeralda Dyer Bray

Expert interviews

By Vicky Reynal

Budgeting

By Charlotte Lorimer

Saving

By Matt Poskitt