Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

In many ways, the Starling Bank personal account is all about being as frictionless as possible – our Marketplace allows you to connect to Insurance or an ISA in a few taps and you can pay friends or family through secure passcodes and fingerprint technology rather than physical card readers.

However, sometimes friction is positive. It can provide that extra moment to stop and think. A moment to reflect.

This can be particularly helpful when it comes to activities such as gambling. According to the Gambling Commission Annual Report published in February 2018, 45% of respondents had participated in some form of gambling in the previous four weeks, including playing the National Lottery. * Of those who gamble online, 51% have gambled using a mobile phone or tablet, a figure which has increased this year. Most people don’t have a gambling problem: less than 1% of respondents were identified as high risk, and 3.9% were identified as low or moderate risk gamblers. While these are small percentages, this adds up to hundreds of thousands of people. And the impact on their financial, physical and mental health and that of their friends and family is huge.

Technology has made access to gambling easier. People can gamble online 24/7, plus the levels of advertising have increased through text messages and online ads that follow you around the internet, detailing special offers. But technology can also help.

At Starling, the transaction codes that allow us to categorise your spending are the same ones that allow us to identify gambling establishments. This means that we can give our customers the ability to go into the app and block certain card payments, including those associated with gambling or betting. And that’s what we’ve done.

Right now, the process for people who want to address a gambling problem by blocking transactions on their debit card, involves contacting several different companies by phone or even in person. To make it easier, Money and Mental Health, an independent charity committed to breaking the link between financial difficulty and mental health problems, is encouraging all banks to take practical steps to help customers when it comes to gambling.

The charity found that placing an obstacle between people and sites they find problematic can be a useful first step in helping users regain control over their financial lives. This research, combined with conversations with customers, has led us to release this feature that gives all customers the choice to block spending by card on gambling and betting. This includes betting shops and horse racing tracks, as well as gambling websites such as online casinos and betting exchanges. We are proud to be the first UK bank to offer this feature to all our customers.

“Both as the minister responsible for gambling and as a constituency MP, only too often I hear of the heartbreak that can be caused by gambling debt. The ability to create a moment of friction could have such a lasting impact on people’s lives. We support Starling’s forward thinking on this issue and hope to see others doing the same.”

– Mike Penning, MP

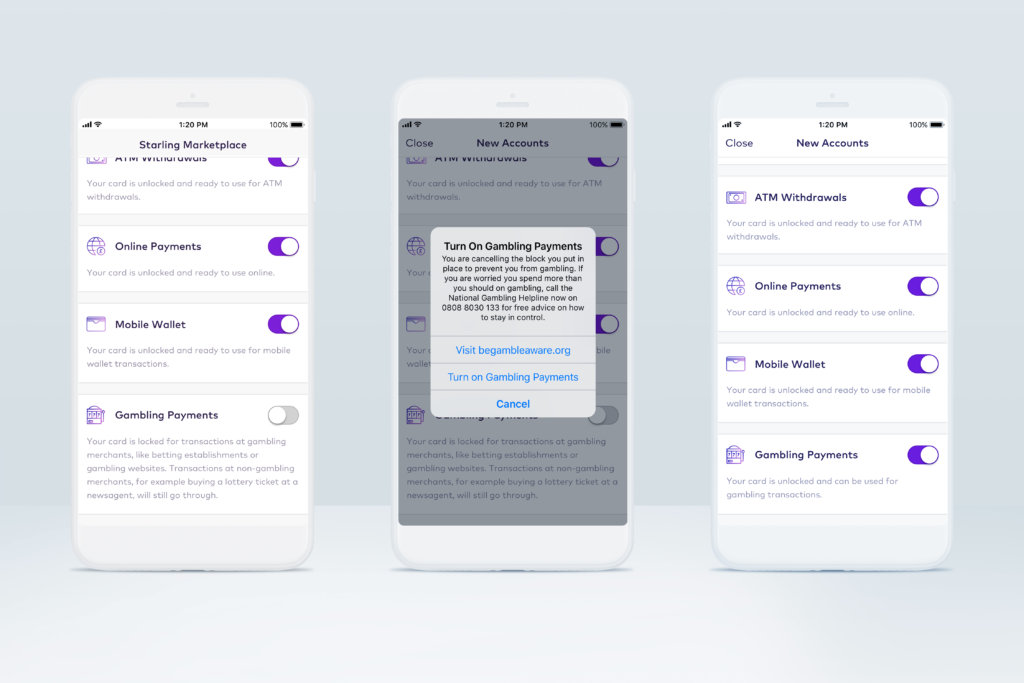

Our new feature under the Security section of our app will allow customers to toggle a block for card payments made at gambling establishments. Once you’ve selected this, you’ll be sent a message to confirm that the block is in place.

If your card is used to make a payment to a gambling establishment while it is blocked, you’ll receive a message to say “Your £[Amount] transaction at [Merchant] was declined because you have asked us to block transactions at gambling establishments.”

Customers who wish to re-enable card payments from gambling institutions will receive the following message: “You are cancelling the block you put in place to prevent you from gambling. If you are worried that you spend more than you should on gambling, call the National Gambling Helpline now on 0808 8020 133 for free advice on how to stay in control.”

"By giving its customers the ability to block gambling transactions, Starling Bank gives them the chance to think twice, and better still, provides contact details for the National Gambling Helpline which offers advice and free treatment. GambleAware warmly welcomes this innovation and hopes all other banks will follow this example as soon as possible.”

– Marc Etches, Chief Executive of GambleAware

Sometimes talking to someone you’ve never spoken to before can be easier than talking to your closest friends and family and we want to link our customers to this support.

“We are a responsible and responsive bank. We aim to provide our customers with the tools to help them manage their money. The conversations I’ve had with customers are guiding our product. By listening to our customers about their problems and working with expert organisations such as The Money Advice Service and Money and Mental Health, our team have been able to bring this feature to customers and make a positive impact on their financial lives.”

– Sarah Williams-Gardener, Head of Public Affairs at Starling

Merchant blocking has its limitations. It can be uninstalled. But it does increase friction and therefore time for reflection when it comes to gambling and betting. We want to provide customers who want to change patterns of behaviour with a tool that can act as a nudge or reminder about where they spend their money.

* The Gambling Commission report presents annual estimates of gambling behaviour in Great Britain in 2017, and constitutes the Gambling Commission’s regular tracker of gambling participation. The datasets have been gathered via a combination of telephone and online surveys with people aged 16+, conducted independently by Populus.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

12th December 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024