Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

Educational psychologist Professor Tim Jay talks about the Starling campaign to #MakePocketMoneyEqual and what it means during the festive period.

Did you know that in the UK boys receive 20% more pocket money than girls? And that toys designed for girls are 5% more expensive than toys designed for boys?

These are the findings from our study with Loughborough University. And the reason we need to #MakePocketMoneyEqual, especially during the festive period when parents, caregivers, grandparents, family members and friends are sending money as Christmas presents, or buying children toys or gifts.

Here, we run through some of the things you can do to #MakePocketMoneyEqual.

Through our research, we found that pink toys are 5% more expensive than toys marketed as gender neutral. Toys that are classified as being ‘for girls’ are also more expensive than those classified as being ‘for boys’.

“You can’t change the amount that shops are charging for things. But having an awareness that if you’re buying, bluntly, pink toys, you might be paying a premium, could encourage you to buy less gendered toys,” says Prof. Tim Jay. “Be a critical consumer and share that with your family.”

Make sure that your children and other family members and friends are aware of this ‘play gap’. You may also want to talk to your children about how advertising and packaging can influence their spending and how it can make toys look more exciting than they actually are.

If you take your children shopping when you’re buying presents for family members or friends, you could get them to spot the difference in prices between products marketed to girls and boys.

In the run up to Christmas, you could also start conversations about money and saving, by voicing your decisions in the supermarket about why you’re buying one thing and not another. For example, you may be choosing supermarket own brand products to save money, which could then be used if you do a big shop for Christmas dinner.

Encouraging parents and children to talk about money is a big part of our campaign. “It can be difficult for parents to talk to their children about money if they are struggling to make ends meet and I wouldn’t recommend that adults burden their children with all their money worries. However, talking to children about prices and involving them in family shopping decisions can be a helpful way to introduce children to the subject of money management.”

When it comes to choosing how to manage pocket money, why not talk with other parents and caregivers about how they do it? You could discuss how much they give each week or month and whether they link it to doing chores or schoolwork.

“In the survey responses, we found that boys are receiving more pocket money than girls. Talking to other parents can give you a lot more confidence in the decisions you’re making on pocket money.”

It’s important to discuss your approach to pocket money with all caregivers, including grandparents, family members or a partner you’re separated from. By talking together, you can agree on a pocket money plan that works for everyone.

“If grandparents or family members give your child a large amount of money each time they see them, this could undermine what you’re trying to do, especially if you’ve chosen to link pocket money to chores to teach children the value of work and earning money,” says Tim. “Similarly if there are issues of fairness between different children, that’s also something to talk about.”

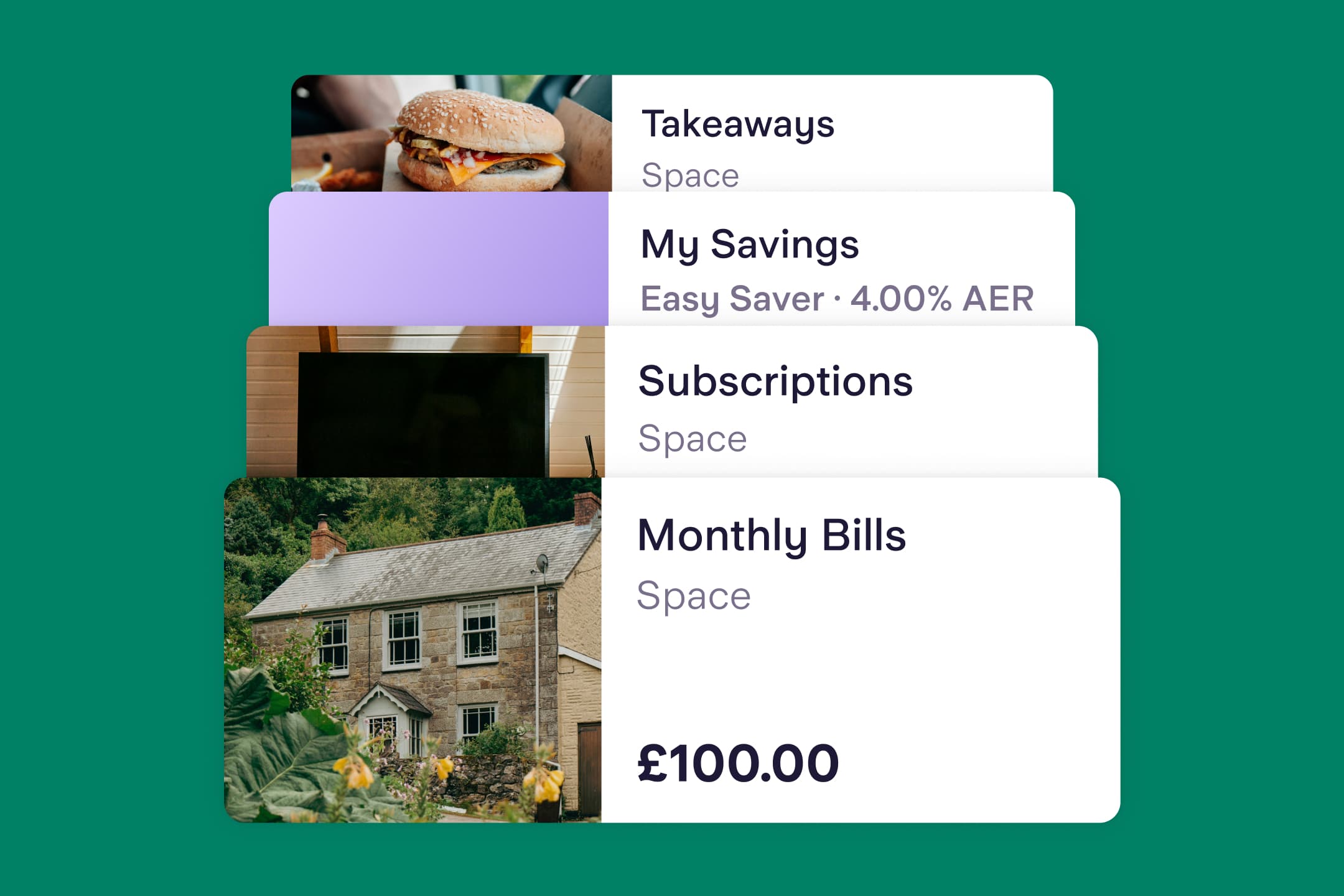

If you wanted to move away from pocket money being given or saved as cash, you could try Kite, a debit card for children aged 6 - 15. Children with a Starling Kite card can check their balance quickly and easily by using their own version of the app, which they can have on their tablet or phone.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024

Money Masters

3rd December 2024