Personal finance

Spending from the joint account: what’s legit?

23rd May 2024

Social media can help us stay in touch with friends, be entertained and also do business. But it’s also a place where scammers are active. Starling’s financial crime specialist Sarah Lenette shares what you need to look out for.

In the UK, one in every five minutes spent online is on social media platforms. They are where we catch up with friends, shop, job hunt, or even look for love with many of us using these sites/apps on a daily basis. Each day the average UK internet user spends 39 minutes on sites such as Facebook, Instagram, Tinder, WhatsApp and LinkedIn. Some of us may be spending even more time online as we find ourselves at home more often than we’d like to be. Unfortunately, some scammers are using the platforms that we know and trust to trick people into parting with their money.

We’ve compiled a list of the top four scams seen taking place on social media.

Facebook, Instagram and Snapchat are all amazing ways for us to keep up with our friends and families, especially in the current climate. They’re also where many people find the latest clothing trends, phones, or games console for what appear to be competitive prices. But how can you tell if these goods really exist and are going to be delivered?

We would normally recommend that you attempt to see the goods in person prior to sending any money as this is the only way to guarantee the items are real. Due to lockdown rules this may not always be possible, so you could attempt to see the goods over a video call to help ensure they are legitimate.

If you have to send money prior to receiving the goods, try and arrange to send it via a secure platform such as Paypal (and don’t use the friends and family feature if you are sending the funds to a stranger) or offer to pay a deposit before the item is sent. If a seller refuses, this may be an indication that it is a scam. If you’re looking at splashing some serious cash (such as for a car or holiday), we would recommend doing thorough research on the seller, such as checking to see if they have online reviews and also requesting to see documentation, such as an invoice before handing over any money. If the price seems too good to be true, then it probably is.

In recent weeks, there has been an increase in incidents involving scammers taking deposits for puppies and kittens that don’t exist on social media outlets. As of 6th April, ’Lucy’s Law’ came into effect to tackle the poor treatment of animals in ’puppy farms’, meaning that the only way to legally purchase a puppy or kitten is via a licenced breeder or rescue centre. For further advice on buying a new pet, you can check out the Government’s statement on Lucy’s Law.

“Hey, I need a favour. I’ve been furloughed and am struggling to pay my rent. Would you be able to transfer £300 to me and I’ll pay you back on payday? ”

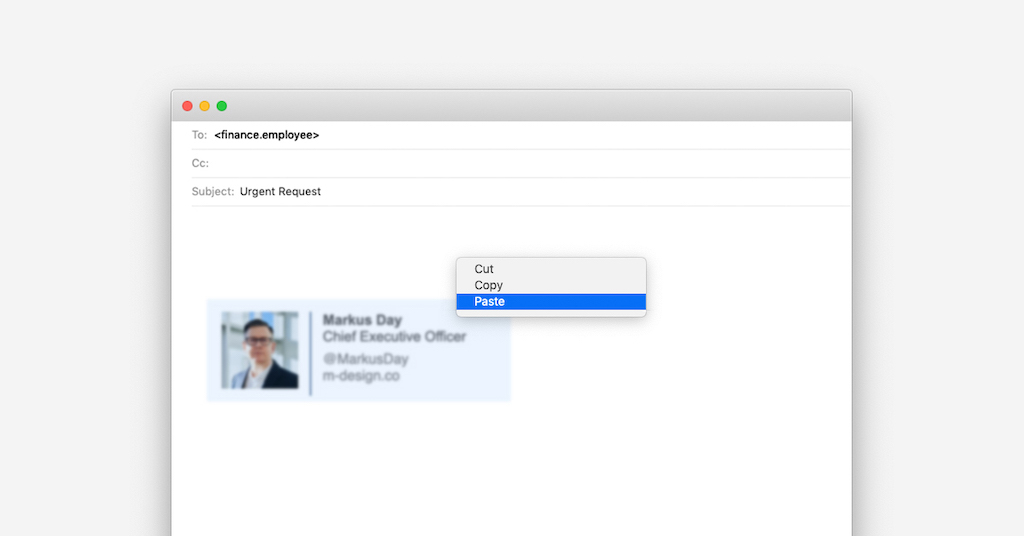

What would you do if you received this message via Facebook Messenger from a friend or family member? You’d want to help them if you could, but bear in mind that many social media platforms can be hacked, and fraudsters will reach out to contacts asking for money, appealing to people’s good nature. They may even read through previous messages sent by the hacked person’s account so they know how to mimic their tone of language, making their message seem even more convincing. The best way to avoid this scam is a good old fashioned phone call to your friend on a trusted phone number to confirm that it genuinely was them sending the request.

So you’ve swiped right on Tinder and found the perfect match for you! You have great conversations and spend weeks messaging back and forth. Then out of the blue, they ask you for £1,000 because they need to help a sick relative abroad with their medical bills.

This is just one scenario that a fraudster might use to try and persuade you to send them money. They may also play with your emotions by advising they are sick/in danger or try and convince you they are in love with you.

Scammers will often use pictures of models found on Google on their dating apps/website profiles to make them appear to be the ideal man/woman so if possible try and do a video call to make sure you are speaking with the person in the pictures. If they are avoiding phone or video calls with you, this could be an indication that they are not who they say they are.

Do some research on this person - you can check their Facebook, Instagram and Linkedin pages and if things don’t add up, this may also suggest you are not speaking to a genuine person. Anyone can fall for a romance scam, they are often complex and can take place over a long period of time, so don’t be embarrassed to express any concerns with a friend or family member.

’Get rich quick’ or ’double your money’ investment posts encouraging you to invest in foreign exchange (AKA Forex), cryptocurrencies and binary options are plastered all over social media, and are particularly prevalent on Snapchat and Instagram at the moment. These investments almost always don’t exist. Genuine investment companies would never approach clients over social media and would always be registered on the FCA register. You can find out more from our article on investment scams from back in April.

Personal finance

23rd May 2024

Personal finance

15th May 2024

Personal finance

13th May 2024

Money Masters

15th October 2024

Money Truths

10th October 2024

Money Truths

9th October 2024