Business Spending Insights

Business Spending Insights

What is Spending Insights?

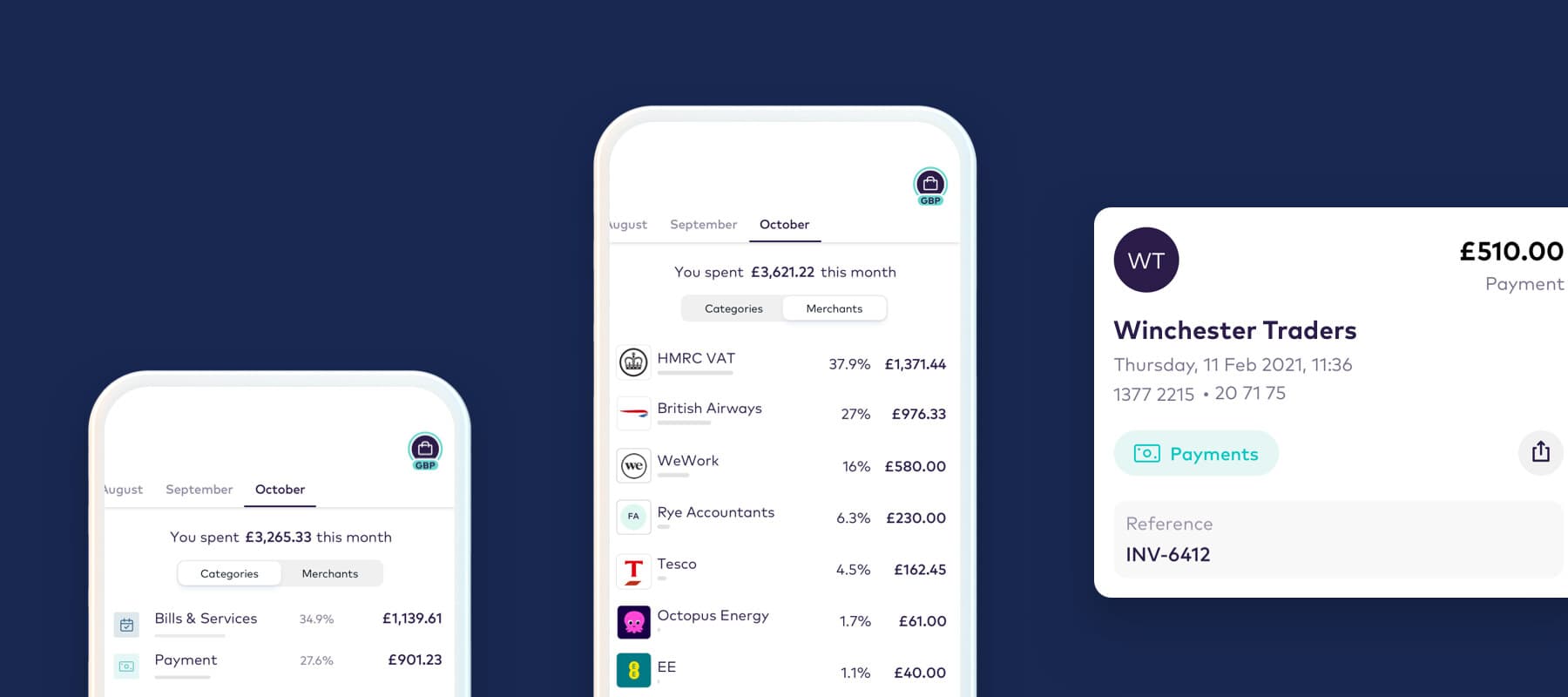

When you run a business, there are all kinds of things to pay for – and keeping track of them can be a whole other job in itself. With Spending Insights, Starling does all the admin for you; see what you’ve spent, where you’ve spent it and maybe even where you could cut back.

New feature: Spending Intelligence

Ask good questions, build good habits. Ask our AI-powered search bar a question about your spending habits and get an instant answer in-app. Deepen your knowledge and start making more informed money decisions.

Benefits

Get a handle on your business outgoings. You can:

Get a full breakdown

We’ll show you which companies you spend the most with and how your outgoings compare month-to-month.Keep receipts

Upload written notes and photo receipts to transactions – which makes life easier when it comes to logging your expenses.Organise your outgoings

With our helpful spending categories – like ‘Marketing’ and ‘Self-Assessment Tax’ – it’s easy to see where your money’s going.

How it works

Just toggle between category or merchant to view either. To see more detailed information about an individual transaction, just tap on it. You can also use Spending Insights to split bills retroactively.

Spending Insights shouldn’t be used as an accounting tool. To help you stay on top of tax, invoices and bills, try Toolkit!

Get more out of Starling

Already got a business account? Add a personal account to your lineup in just a few taps. You’re already all set up, so it’ll take seconds.

Find out more