Instant payment notifications

Instant payment notifications

What are instant notifications?

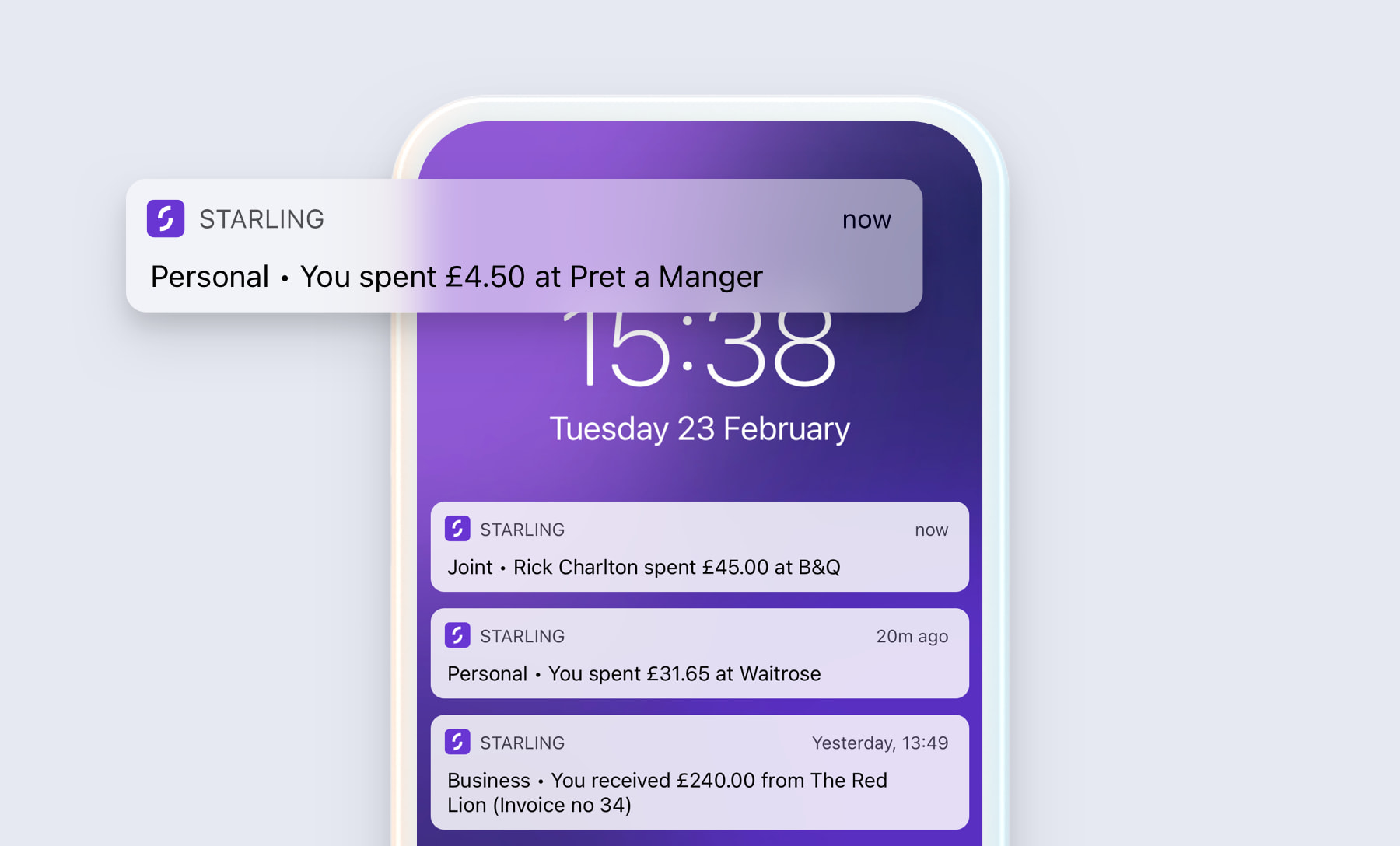

Get a push notification whenever there’s a payment-related activity on your account – whether it’s a card purchase, an ATM withdrawal, a Direct Debit, a standing order or someone sending you money.

Benefits

Find out instantly each time you make a purchase, a Direct Debit has left your account, or when your wages have gone in.

Security. With instant notifications, you can be 100% sure all the money leaving your account is legit – and you haven’t been overcharged. And if you do spot any unusual activity, you can quickly lock your card in-app.

How it works

No need to do anything. Each time you spend on your card or wallet, or you receive a payment, we’ll send a notification to your phone.

Too much information? Turn off alerts whenever you want with just one tap.