Apply to open a bank account online with Starling

Apply to open a bank account online with Starling

Meet your new bank account. From personal to business, start your money MOT with powerful money management features and insights into your spending.

Apply now

Our online bank accounts for personal use

Current account

Free to open and easy to manage, with instant notifications, spending insights and no monthly fees.

Learn about our current account

Joint account

Spend, save and manage your money together, from the same app-based account. Apply online in minutes.

Euro account

Hold, send and receive euros for free, and make transfers back into pounds 24/7.

Teen account

It’s designed for 16 and 17 year olds, and can be applied for with just a passport as ID.

To apply to open a joint account, both parties need to have a Starling current account.

To apply to open a euro account, you first need to have a Starling current account. We’re limiting new applications for euro accounts at the moment. If you’re eligible to apply, you’ll see the option to do so in the app. You can view the full eligibility in our terms and conditions.

Apply for a bank account online in minutes

Apply for personal accountOur online bank accounts for businesses

Business account

Enjoy no monthly fees and clever features to help your business grow.

Learn about our business account

Sole trader account

It’s free to apply, easy to set up and you’ll benefit from 24/7 support.

Euro business account

Hold, send and receive euro payments, all for just £2 a month.*

USD business account

For £5 a month, you can hold, send and receive dollar payments.*

To apply to open a euro business account, you first need to have a business or sole trader account.

To apply to open a USD business account, you first need to have a business account. We’re not accepting applications for euro or US dollar accounts at the moment, but they’ll be available to apply for again soon.

*Multi-currency business accounts are subject to eligibility criteria and will only be visible in the app to businesses that are eligible. Unfortunately, we are unable to confirm if you will be eligible until you have opened a business account.

Apply for a Starling bank account online today

Apply for business accountWhat do I need to apply for a bank account online?

A smartphone (and signal)

A valid photo ID (passport or driving licence)

About 5-10 minutes of your time

To apply for a business account, please read the full eligibility requirements.

It’s easy to switch to Starling

Already have an account with another bank? No problem. Use the Current Account Switch Service and switch your bank account to Starling. Seamlessly move existing payees, direct debits and standing orders.

We’ll take care of everything for you, within seven working days.

Apply online for a Starling account today and enjoy app-based banking at its best.

Start your applicationWhat happens after I’ve opened my bank account online?

Read our article explaining bank accounts.

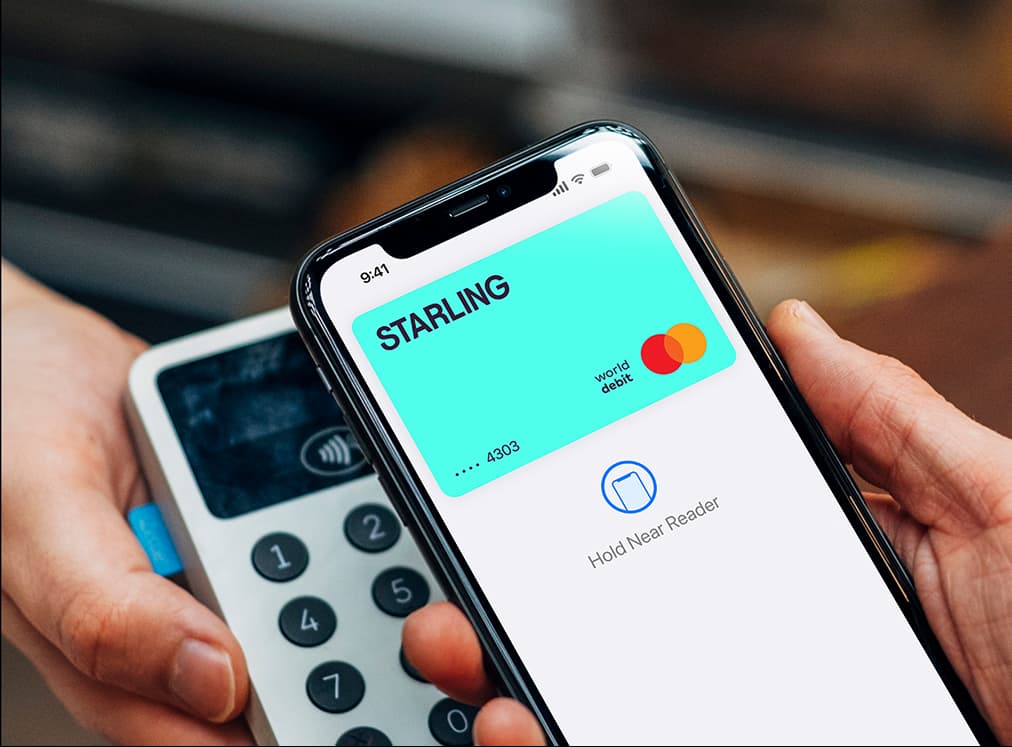

Once your account has been opened, you can order your new contactless Mastercard debit card from within the app and it should arrive in 5-7 working days.

If you want to start spending straight away, you can set up your card in your Apple Pay wallet or Google Pay before your physical card arrives in the post. Samsung Pay and Garmin Pay can be set up once your card has arrived.

The small print

When you apply for a current account with us, we’ll carry out some quick checks at a UK Credit Reference Agency. The initial checks leave a soft footprint on your credit file, and the overdraft check leaves a hard credit check footprint. If we need additional proof of address information we’ll get in touch via the app.

Apple Pay, Apple, Apple Wallet and Touch ID are trademarks of Apple Inc. registered in the U.S. and other countries and regions. Android™, Google Pay and Google Play are trademarks of Google LLC.

Business and sole trader accounts are subject to eligibility checks, which include looking at credit data and understanding the nature of your business.

To open a business account, submitting documents which confirm the nature of your business at hand will help support your application. Examples could be a trade registration or bank statement which shows your business activity. Then it’s over to our team to approve your details and open your account. Read the full eligibility requirements.

The Financial Conduct Authority requires us to share service information about opening an account with us:

Personal current account service information.

Business account service information.