US dollar business account

A US dollar business account in the UK

A US dollar business account in the UK

We’re not accepting applications for US dollar business accounts at the moment. They’ll be available to apply for again soon.

What is the USD business account?

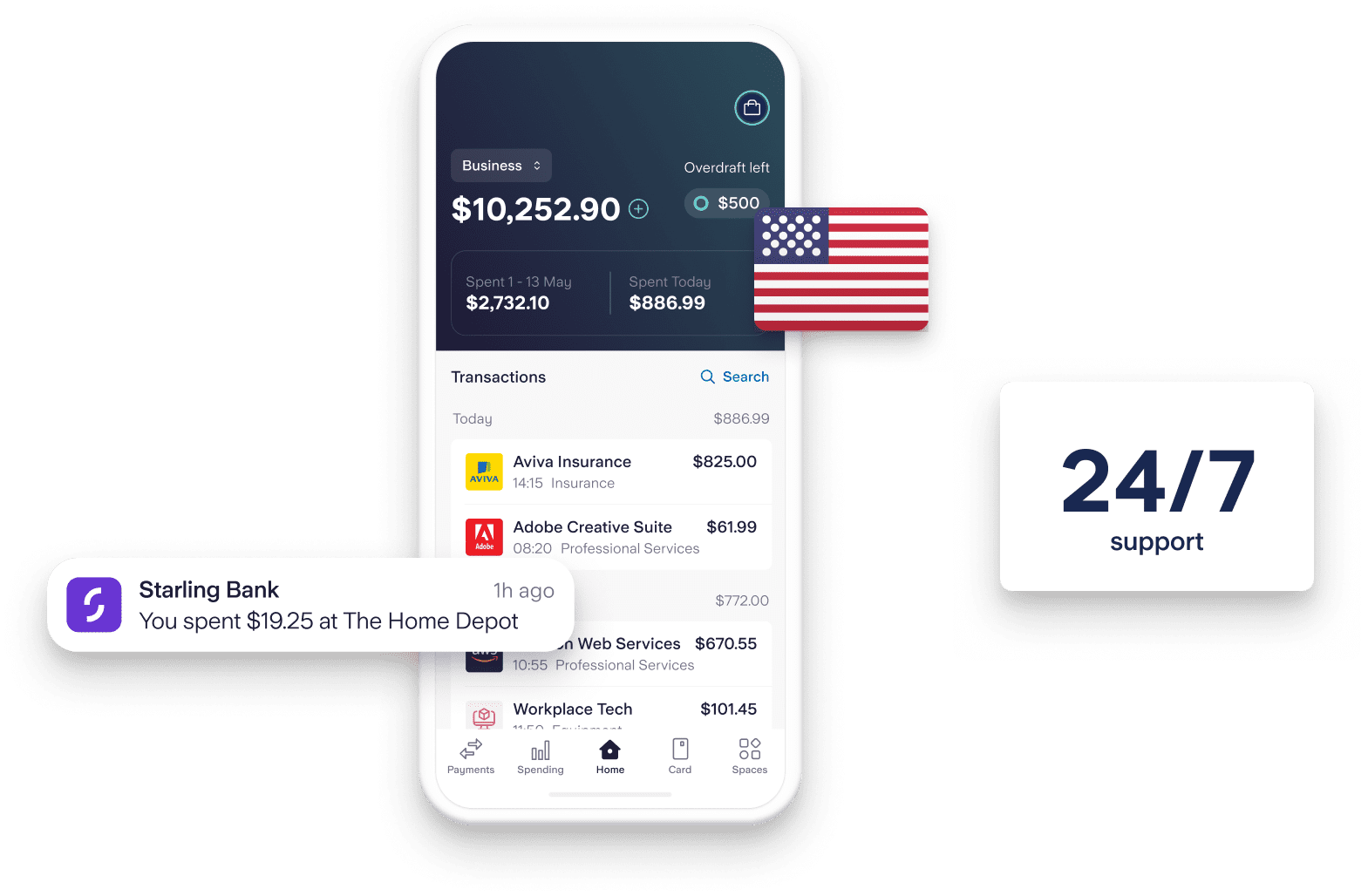

So you’ve taken your UK business stateside? Nice work. Now give it the right support with Starling’s US dollar business account.

For just £5 a month, you can hold, send and receive USD, and manage them with our award-winning app – plus you can spend from your business USD account using your regular Starling business card, too. USD business accounts are only available to limited companies, are subject to eligibility criteria and will only be visible in the app to eligible businesses.

Want to convert your USD into GBP or vice versa? Make it happen with a tap.

You’ll get the current exchange rate with a 0.4% conversion fee added on top. No hidden commission or sneaky extra charges. Since currency markets are closed on weekends, we set the exchange rate, factoring in possible fluctuations. But don’t worry, you’ll always see the rate before making a payment.

Why our US dollar business account is great

More than currency

Starling’s USD business account comes with its own unique US addressable account number and helpful money management tools that’ll help your business grow – like instant payment notifications, spaces for separating tax from overheads and 24/7 support.

One-card wonder

Use a single debit card to manage your USD and GBP business accounts. If you want your USD card transactions to come from your USD account, go to the ‘Card and Currency Controls’ section in the app and turn it on with a tap.

Secure

Your USD business bank account will come with its own unique account number as well as an Automated Clearing House (ACH) routing number. And because Starling is a fully-licensed bank, all your eligible deposits are covered up to £85,000 (or equivalent) by the Financial Services Compensation Scheme.

Hold currency locally

If you deal mostly in USD, then do just that – without having to convert each transaction back into GBP, unless you want to.

Weekend transfers

Transfer money between your GBP, EUR and USD accounts 24/7, even on the weekend. You’ll always see the set weekend exchange rate before the conversion is made, so you have the option to wait until Monday morning.

Payments

You’ll be able to make and receive as many payments as you like via the ACH payment network, with no additional charge/fee per payment. Unfortunately, we cannot support incoming or outgoing SWIFT payments (find out more about supported payment types under ‘Some things to note’ below).

Speedy same day payments

Send up to $25,000 on the very same day via ACH.

Easy transfers, no extra fees

No additional fees or charges for unlimited transfers: make them, receive them, revel in them – in USD with your USD business account.

Who is the USD business account for?

Suppliers in Seattle, customers in Colorado – whatever your reason is for doing your business banking in USD, make life a little easier with Starling. It’s available to any limited company, but it’s especially useful to consider if you:

Pay overseas suppliers using a US account number and ACH routing number. Please note SWIFT payments are not possible to or from these accounts

Receive payments from overseas customers with a US account number and ACH routing number. Please note SWIFT payments are not possible to or from these accounts

Rent out property in the US as a business

Some things to note

At the moment, USD business accounts are only available to limited companies (apologies to sole traders!).

Payments under $25k will be processed by Starling Bank the same day, but may take longer to arrive in the recipient’s bank if they are not a direct participant of the ACH payments network.

The bank account of the remitting and/or receiving account will need an ACH routing number and a US account number. With the business USD account, you won’t be able to send or receive wire transfer payments, SWIFT payments, cheques, or international payments. You can still send wire and/or international payments from your GBP account.

Need more information about our US dollar account?

Find out more about the business US dollar account in our help centre, including information on currency conversion, making payments and features of the account.

Visit our help centre