Fraud

Anyone’s identity can be stolen these days

1st November 2024

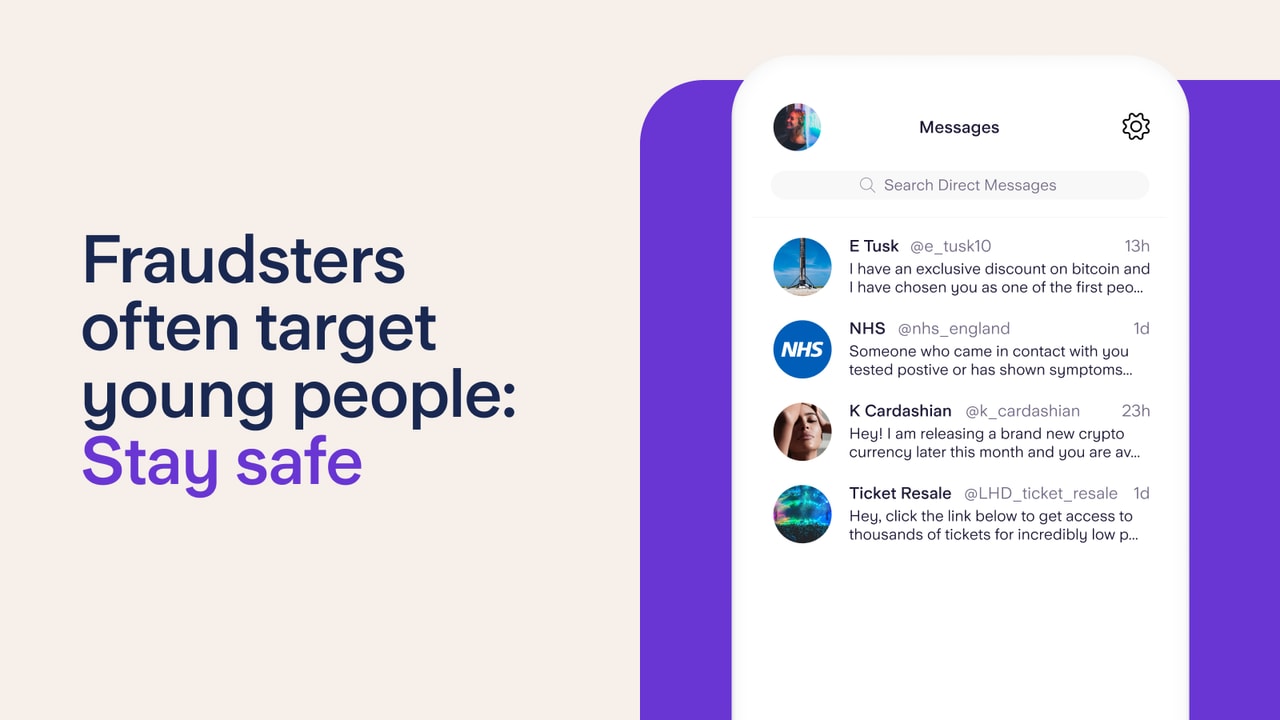

Fraudsters are extremely good at adapting their scams to try and steal money from anyone. In this blog, we’ll go through some of the scams currently targeted at people in their teens and early 20’s, and look at how to stay safe.

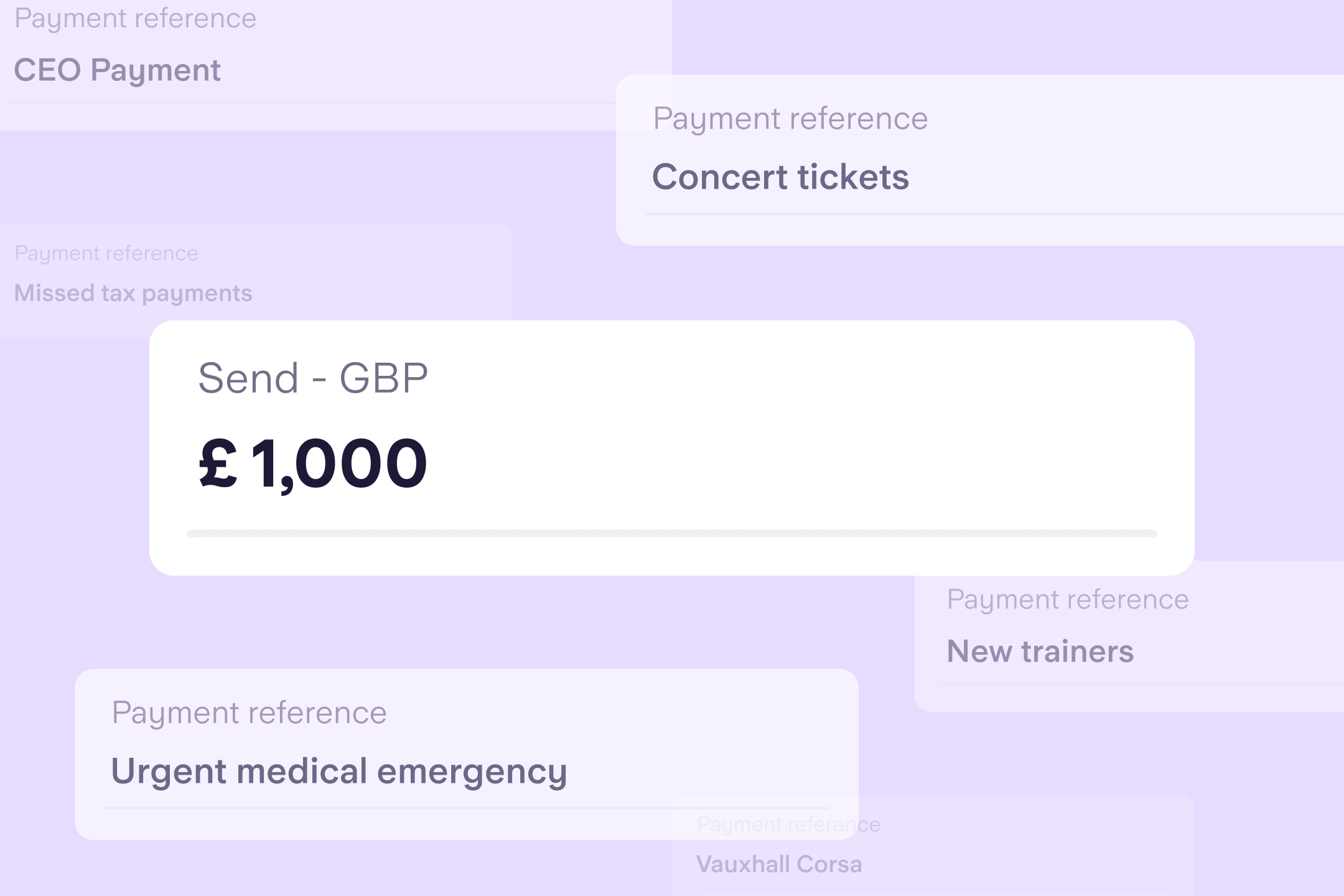

We all love a good bargain, and Instagram, TikTok, Facebook and Snapchat are filled with people selling phones, trainers or tickets to gigs and sporting events. But how do you know you’re going to receive what you’ve paid for?

Scams on these social platforms, as well as on selling platforms like Depop and Gumtree, are extremely common and many people find themselves out of pocket after purchasing items that don’t exist.

Here are some things you can do to help avoid getting ripped off:

See the items in person before paying. Without seeing the goods in person, there are no guarantees they’re real. You may wish to meet in a public space with a friend for safety reasons.

Is the price much cheaper than it would be if you were purchasing from an online shop? If so, ask yourself why someone would be selling something at such a low price

Are the tickets you’re purchasing meant to be resold privately? Remember that some tickets such as for football and some festivals, can only be resold on officially authorised websites. Find out more from The Society of Ticket Agents & Retailers

Lots of followers and comments don’t mean that a page is legitimate. It’s very easy to purchase these in an attempt to make a page appear genuine

Use a secure payment platform like Paypal, and don’t use the friends and family option for people you don’t know and trust, as you won’t be covered by the purchase protection

You may have also seen profiles advertising investments in cryptocurrency or foreign exchange (Forex) that offer risk-free and/or high returns, or had someone reach out to you in your DMs, offering to make you money. They might even use the name and images of legitimate companies or celebrities. But these offers are highly likely to be a scam. Even if they provide ‘evidence’ that other people have profited, this is often fake.

It’s important to remember that if you choose to invest your money, you should only do so with a FCA regulated firm or financial advisor. Most firms that offer cryptocurrencies are not regulated, so it’s very unlikely you will be able to recover your money if things go wrong. Go to the FCA’s Scam Smart page to check if an investment could be a scam.

Looking to make a bit of extra cash? Watch out for anyone offering money to use your online banking or asking you to move funds via your bank account - you could be committing a crime.

Criminals need to hide the origins of their profits, so they employ ‘money mules’ to avoid using their own accounts. Young people and students are often targeted for recruitment by organised criminals, in person or on social media, to assist them in moving the proceeds of human trafficking, drugs, terrorism or fraud.

By allowing illicit funds to be moved through your account, you are committing an act of money laundering. If caught, your bank accounts will be closed, and you may be unable to obtain various forms of credit, such as loans, mortgages or phone contracts. You could even end up with a 14 year prison sentence. Our ‘money mules’ blog tells you what to look out for and avoid.

If you’ve been approached by anyone wanting to use your bank account, contact Action Fraud (or Police Scotland), and let us know immediately if you think you’ve received illegal funds into your account.

For more information on how you can protect yourself, visit our friends at Take Five and remember to #StopChallengeProtect to avoid becoming a victim of fraud.

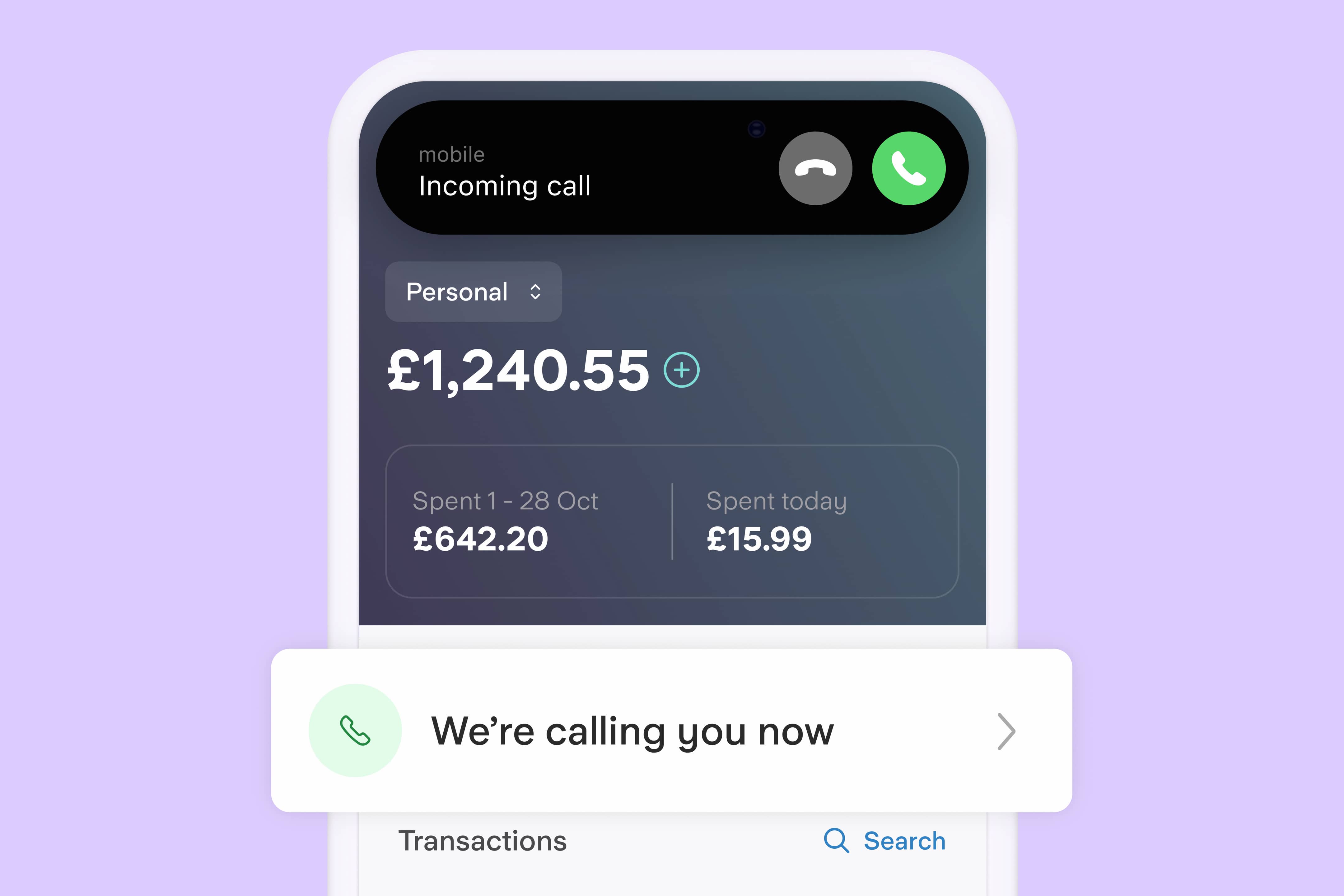

One scam, targeting foreign students studying in the UK, involves a call from someone claiming to be the police. The caller often states they’ve been implicated in a crime and to avoid arrest (or deportation), they must make a significant payment.

These calls can sound extremely convincing, with the phone numbers appearing to be genuine and the callers quoting people’s personal information. Criminals may get these details from fraudulent texts (known as smishing messages). The texts appear to be from a delivery company or the NHS - so keep an eye out for these and ignore them. You can read more about these scam texts on our blog.

It’s important to remember that:

A law enforcement agency will never demand a payment that would enable you to avoid being arrested or deported

They will never ask you to move money in order to assist with an investigation

A bank or any other organisation will never ask you to move funds to a new bank account or make a payment, to ‘keep your money safe’ - watch out for this very common ‘safe account scam’

If anyone asks you to approve a payment in order to receive a refund, this is a scam

Anyone telling you to ignore warnings or lie to your bank is a very likely to be a criminal

If you receive a call that sounds like any of the points above, or you’re suspicious at all, hang up. You can call your bank on 159 to check if it could be a scam. 159 is a hotline that will put you in touch with someone at your bank. They can help you determine if a call you’ve received is genuine or not.

One last scam worth mentioning is criminals impersonating friends or family members by hacking into social media pages or sending messages from unknown phone numbers, asking for money for urgent bills, or perhaps a medical emergency. Anyone can be targeted by this scam, so never send money unless you’ve verified who you’re speaking with - pick up the phone to speak with them directly or set up a family safeword to identify who you’re really talking to.

Article updated: 5 March 2024

Fraud

1st November 2024

Fraud

1st November 2024

Fraud

4th October 2024

Money Truths

2nd July 2025

Money Truths

1st July 2025

Money Truths

29th May 2025