Budgeting

“Bills, Bills, Bills” – Sorted in three simple steps

By Esmeralda Dyer Bray

A better understanding of your money and where it’s going can help you feel more in control of it. Here, we share budgeting and money insights from Fairstone Chartered financial planner Elizabeth Webb, and Nicholas Hill, a money expert at MoneyHelper, the government-approved free guidance service.

Sharing money worries with a trusted friend, family member, partner or a recognised financial advice service can relieve anxiety and result in the support you need, especially as the cost of living rises.

“You don’t have to feel isolated,” says Nicholas. “There is free, independent guidance available through the MoneyHelper website, where you can learn more about money or speak to one of our experts.”

Looking through your bank statements might feel overwhelming, but it’s a key step in gaining a clear picture of where you’re at. How much money do you have coming in each month? What do you need for your rent or mortgage, council tax and household bills? What do you spend on food and transport to and from work?

If you’ve tried our Budget Planner, you may already have your answers. If not, find time to go through your statements and make notes on your income and outgoings as you go.

“Include credit card statements and look at the tax code on your payslip to make sure that HMRC are taking the right amount of tax,” says Elizabeth.

“I’d always encourage people, particularly those on a lower income, to use a benefits calculator and check whether they’re getting all the state benefits they’re entitled to,” says Nicholas.

If you find you’re entitled to a benefit you’re not currently receiving and decide to make an application, you might want to ask how long it usually takes for it to be reviewed. That way, you’ll know when you might be able to adjust your budget.

“Budgeting is one of the cornerstones to managing your money. It can put you in the driving seat, so you can choose where and how to spend your money,” Nicholas says.

Once you’re sure how much money you have coming in after tax (including benefits) and your monthly costs, set targets for your spending with a budget. In the past, some people have followed the 50/30/20 budgeting rule and allocated 50% of their income for essentials (such as rent, food and household bills), 30% for things they want or like to do and 20% for savings and paying off any debt. This will not be realistic for many people right now, but some may find the general principle of allocating set proportions to different types of spending helpful.

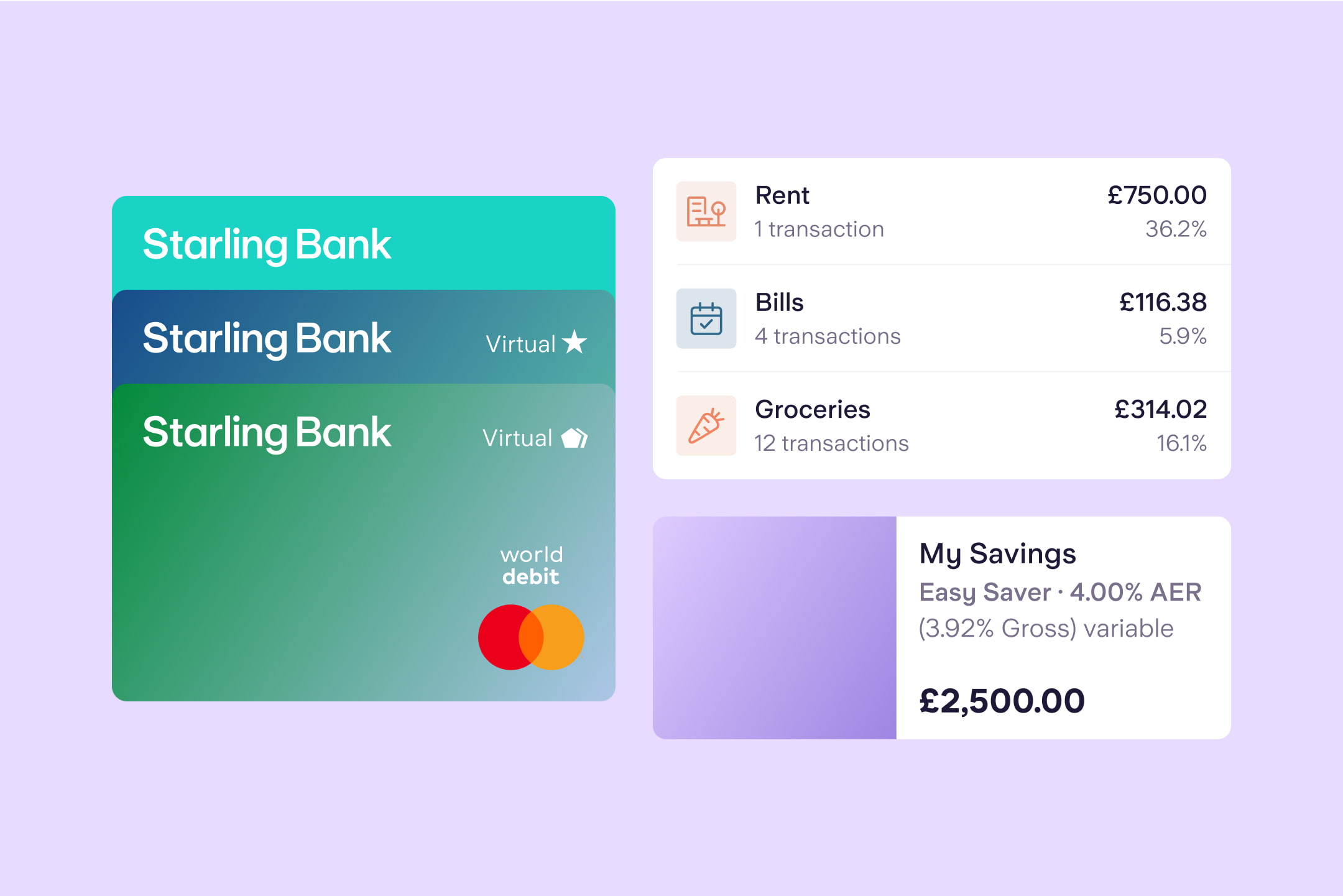

You could choose your own percentages or plan your spending with more detailed categories, such as rent, utility bills, family, groceries, fitness, eating out, savings and debt repayments.

Whatever budgeting method you choose, you may find it helpful to separate money for different purposes into different places. “Set up direct debits to somewhere else as soon as your money comes in,” says Elizabeth.

For example, if you’re a Starling customer, you could create different Spaces within your app to keep your money for bills or groceries separate from your main balance.

With Spaces, you have the option to set up automatic top ups on a particular day each month (for example sometime after payday). You can also set up direct debits and standing orders through the Bills Manager feature to pay your bills straight from a Space.

Once you have a budget, it’s easier to see where you might be able to save money. “Pick one monthly outgoing and choose to reduce or remove it,” says Elizabeth.

It’s worth paying attention to:

Subscriptions (some can be reduced by moving to a shared or family plan)

Memberships (gym, clubs, cultural organisations)

Broadband bill (if coming up for renewal)

Phone bill (if you’re out of contract, moving to SIM only might cut your bill)

Insurance (check you have the right cover for your needs)

If debt is your biggest money worry, you can use MoneyHelper’s free debt advice locator. “There are experts who can help you make a budget and government schemes designed to help,” says Nicholas.

“For example, the ‘Breathing Space’ scheme could provide temporary protection from creditors. This may be something that could be offered after discussions with a debt adviser. When in place, your creditors won’t be able to contact you about your debts or add interest or charges while you make repayments, for a minimum of 30 days.”

You can also receive free and confidential support and advice from Debt Advice Foundation or StepChange.

Nicholas also recommends leaving online purchases in your basket for 24 hours before deciding on whether you really want a particular item.

“It’s all about taking things one step at a time,” he says. “But remember that the sooner you start, the sooner you’ll feel in control.”

One step you could take, if you haven’t already, is to gather together your bank statements and try out our Budget Planner, it only takes around 10 minutes. The tool has been designed to give you a clear picture of your finances.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

Budgeting

By Esmeralda Dyer Bray

Expert interviews

By Vicky Reynal

Budgeting

By Charlotte Lorimer

Saving

By Matt Poskitt