Budgeting

“Bills, Bills, Bills” – Sorted in three simple steps

By Esmeralda Dyer Bray

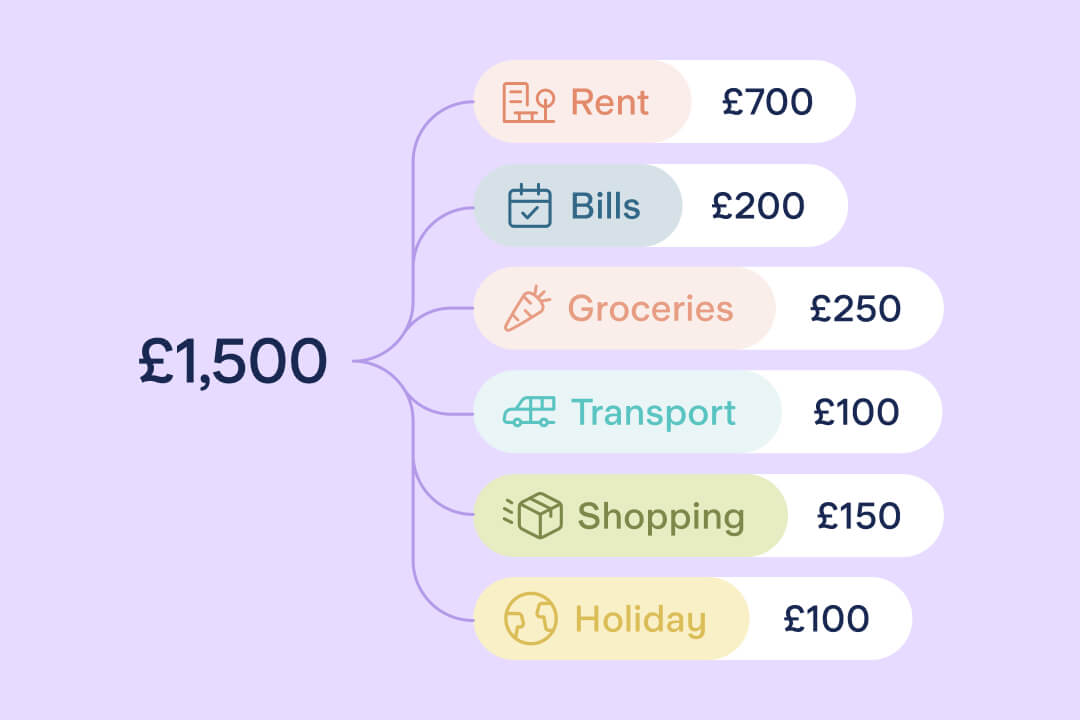

Zero-based budgeting gives every pound a purpose. It’s a way to plan your money so that every pound of your monthly income is allocated into categories that work for you, such as energy, shopping or savings.

Compared to some other budgeting methods, such as the 50/30/20 rule, zero-based budgeting has a more detailed breakdown of spending.

Similar to other budgeting methods, zero-based budgeting works by looking at your income and allocating certain amounts to particular categories, for example rent or mortgage, groceries or debt repayments.

Zero-based budgeting is also known as ZBB and zero-sum budgeting. It was originally used by businesses as an alternative to traditional accounting, but can also be used by individuals for personal finance. In business, the biggest difference between traditional based accounting vs zero-based budgeting, is that a ZBB budget starts off at zero, then business areas compete to add on spending. This differs from traditional accounting approaches, where the starting point is not zero, but the previous year’s budget.

First, check how much money you have coming into your bank account each month. Then look through your bank statements or banking app and take a note of how much you think you’ll need for everything in the upcoming month, from rent or mortgage to food, childcare, pets and drinks with friends.

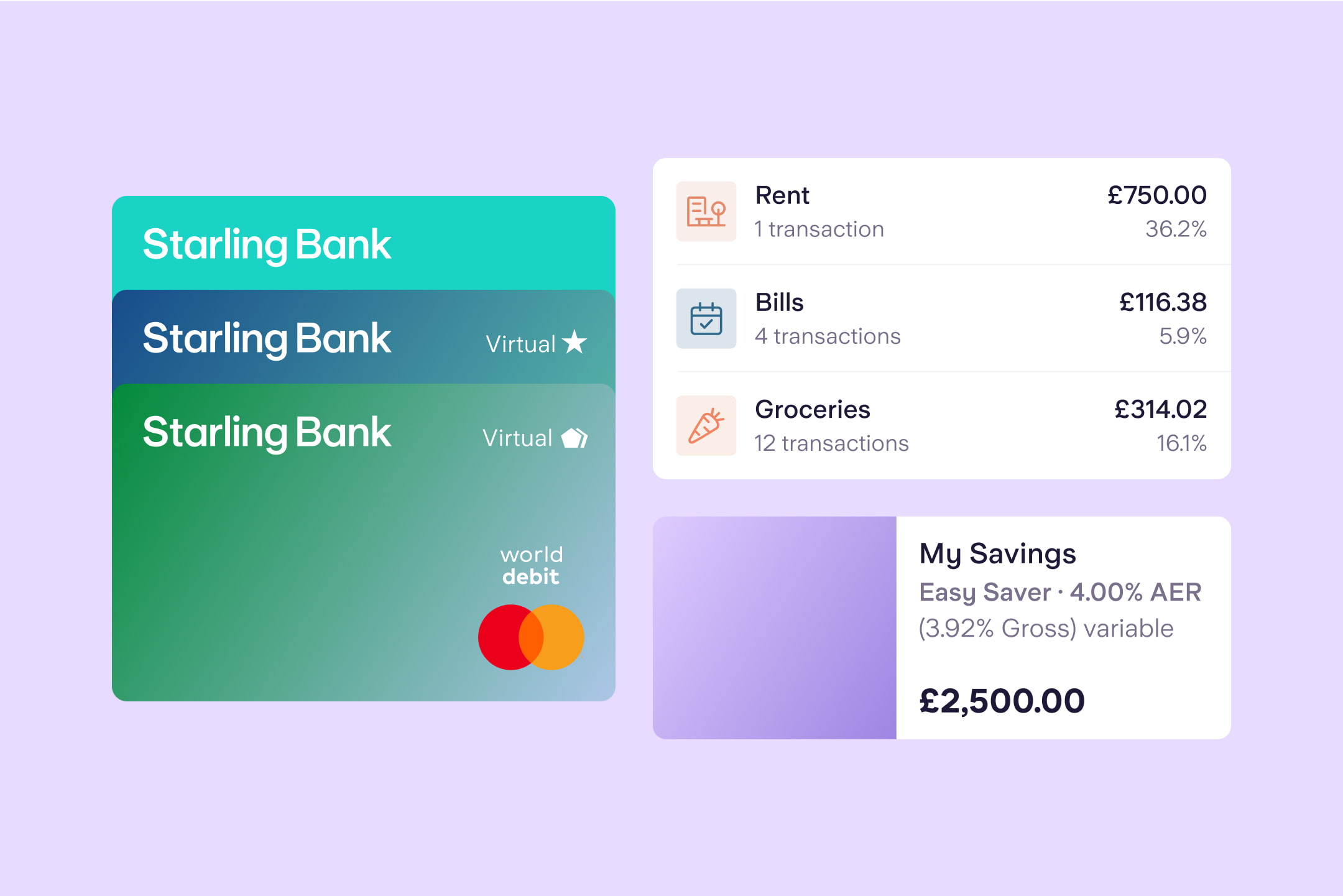

If you bank with Starling, you could use the Spending Insights feature to help you choose realistic spending categories and targets, based on what you’ve previously spent.

It’s important to include your financial goals into the budget. For example, saving towards a holiday or even house deposit, or paying off credit card debt. And it’s a good idea to allocate money for occasional or unexpected expenses, such as haircuts or replacing a pair of glasses. Build a buffer into your budget to give flexibility for things where spending varies, such as groceries.

Starling’s free online Budget Planner can help you with these steps. It can be used by anyone, not just Starling customers, and suggests various budget categories.

| Category | Amount |

|---|---|

| Rent | £250 |

| Bills | £200 |

| Groceries | £250 |

| Transport | £100 |

| Shopping | £150 |

| Entertainment | £100 |

| Eating Out | £100 |

| Gifts | £50 |

| Charity | £10 |

| Buffer | £140 |

| Holiday | £100 |

| Emergency fund | £100 |

| Total not allocated | £0 |

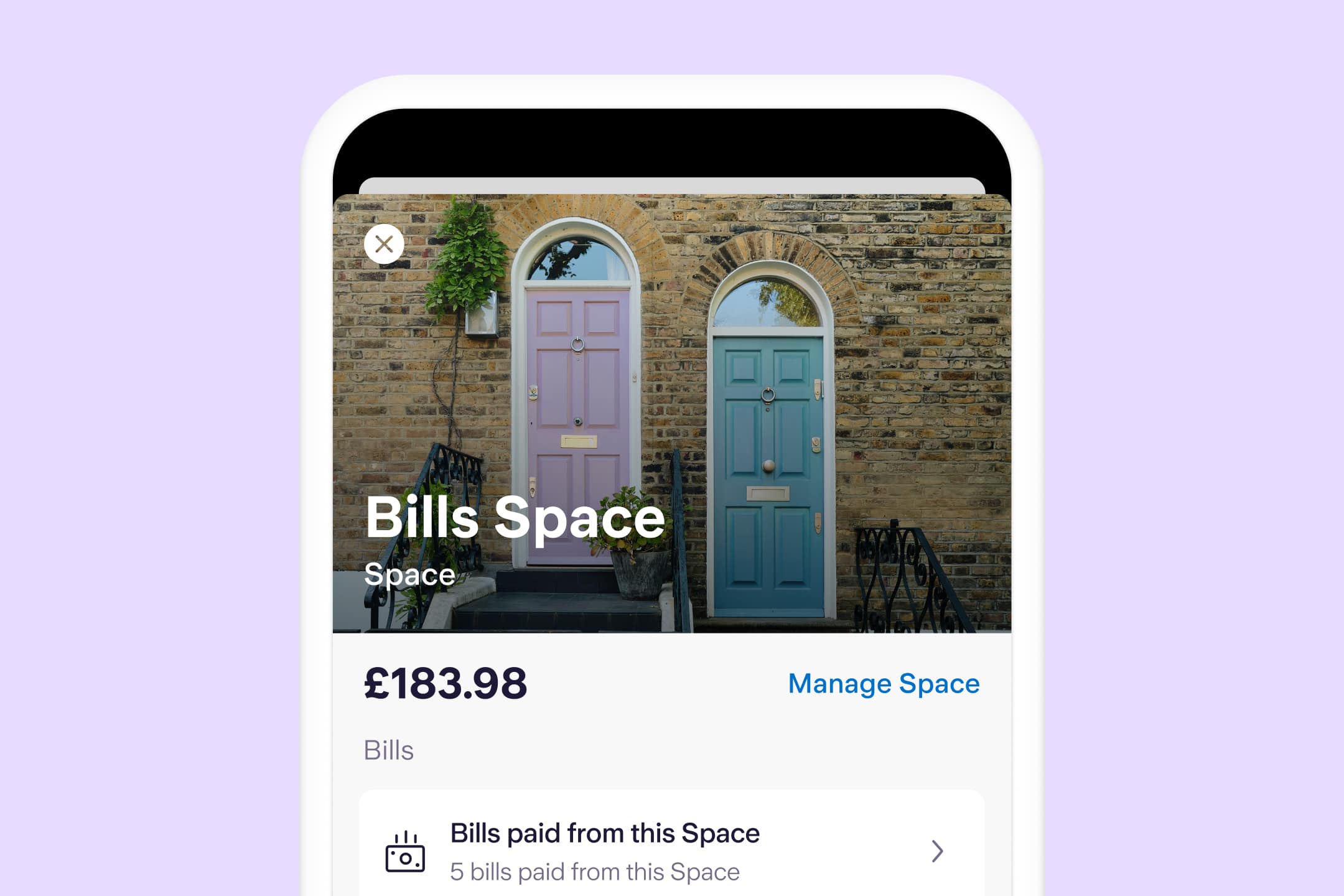

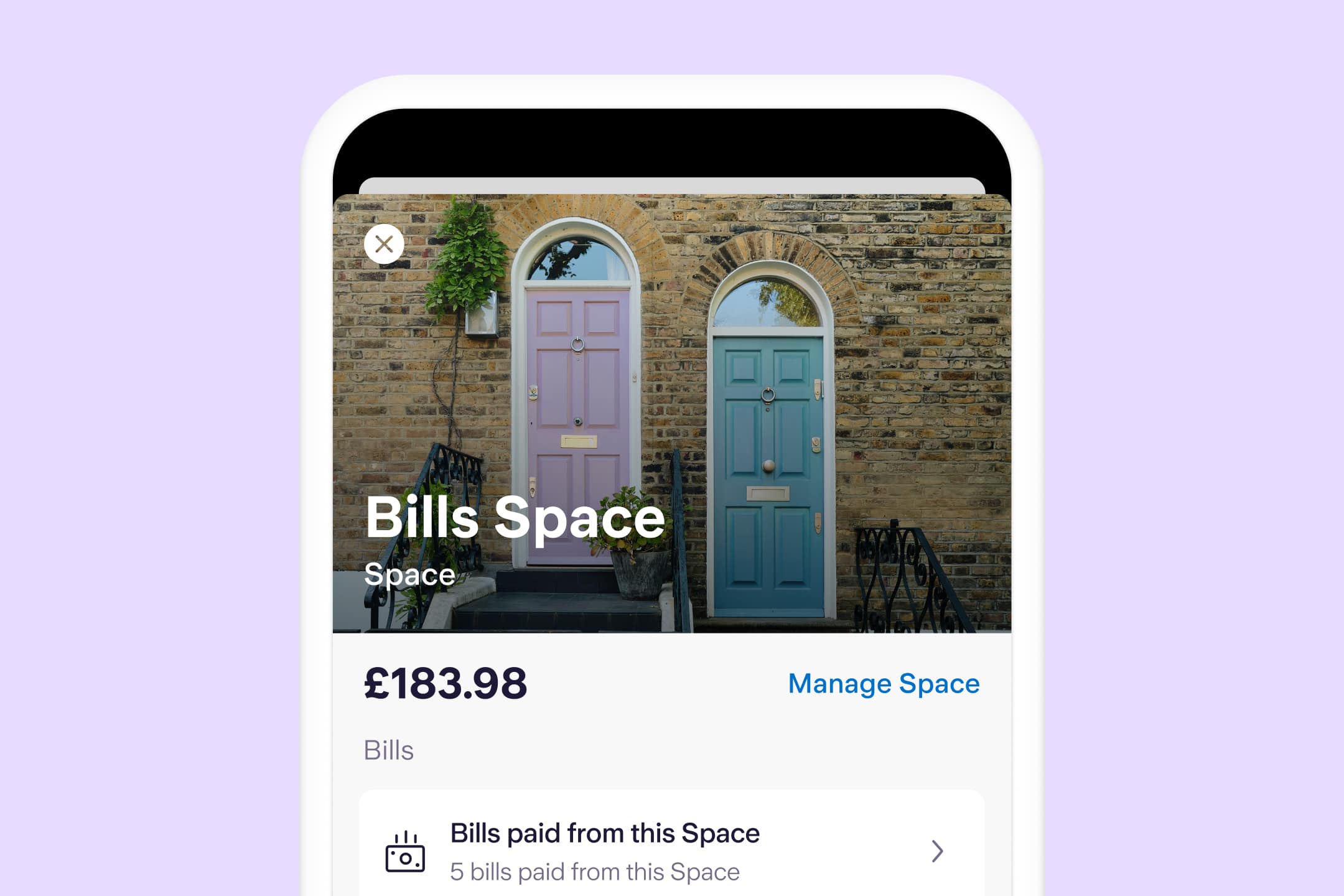

If you’re a Starling customer, you could set up Spaces to allocate money for various categories. Our Spaces feature allows you to ring-fence money and name its purpose. You could set up a Space for costs associated with your home and arrange an automatic top-up for the amount you need each month. You could then pay Direct Debits and standing orders, such as your rent, mortgage, energy bills and council tax straight from that Space using the Bills Manager feature.

You could also have Spaces for Shopping or Groceries, which you can connect to virtual cards. Virtual cards enable you to spend straight from a Space with your digital wallet or through online payments.

If, at the end of the month, you find that you have money left in your account, you could set it aside as savings or make a bigger buffer for next month.

The benefit of zero-based budgeting is that it provides a very detailed view of your finances. You can see exactly how much you’re spending and where. It can clearly show how much you have for your financial goals.

A disadvantage is that it can be time consuming to set up and track, although this can be simplified through digital tools and apps. And inevitably, there will be things you need to spend money on that you didn’t plan for (that’s where your buffer comes in).

ZBB can be more complicated if you have variable income as you’d probably need to adjust your budget at the start of every month.

Zero-based budgeting gives a very detailed view of your spending

It involves allocating money into many different categories, which can be time-consuming

Each month, income minus expenses and savings equals zero

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

Budgeting

By Esmeralda Dyer Bray

Expert interviews

By Vicky Reynal

Budgeting

By Charlotte Lorimer

Saving

By Matt Poskitt