Good with money

Game-changing banking. Life‑changing habits.

Apply for a bank accountMaster your spending.

Never ask ‘where’s it all gone?’ again.

Get instant notifications whenever you spend or get paid. Dive into your spending habits, and decide where to cut back or keep going. You’re in control now.

Apply now

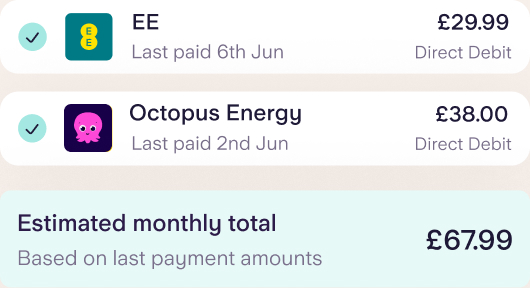

Relax about bills.

Always know exactly what’s coming up.

Put bills on autopilot, and pay them from a separate area of your app with Bills Manager. You’ll get a clear view of what’s left over for day-to-day spending.

Meet Bills ManagerOrganise your money beautifully.

Set aside money from your main account.

Spaces are separate pots within your app. Add titles and images to make it your own and set money aside for anything you like - fuel, commuting or the big shop, it’s up to you.

Split any bill with a quick tap.

And get paid back without the hassle.

Use Split the Bill to quickly work out anybody’s share of a payment. Then fire off a simple Settle Up link to friends, and get paid without swapping bank details.

Apply now

Never blow a budget again.

Spend directly from your Spaces.

Create budgets in the app, then assign virtual debit cards to spend from them online and in-person. If the money runs out, your virtual card will decline.

Tell me moreSpend fee-free on holiday.

Use your card abroad exactly like you do at home.

Unlike most banks, we have no foreign transaction or withdrawal fees, and we never mark up the exchange rate. Wherever Mastercard™ is accepted, we are too.

Apply nowHelp, I’ve lost my bank card

Okay, don’t worry.

You can ‘lock’ it in app with just a tap.

Oh, that’s a relief. Thanks!

Speak to us any time, anywhere.

Talk to our award-winning, UK-based teams 24/7.

Whether it’s the dead of night, or you’re on the other side of the world: if you need to speak to us, you can. And you’ll always get through to someone real.

Industry-leading app security.

We’ve built some of the world’s best banking security.

We’re a fully regulated digital bank, built from scratch with some of the world’s best banking security. Codes, face and fingerprint recognition are just a few of the ways we help to keep your money safe.

Keeping your money safe with FSCS protection

As you’d expect from your bank, your money is protected up to £85k, or up to £170k for joint accounts, by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme. This limit is applied to the total of any deposits you have across your Starling account, including Spaces.

More on FSCS protectionEverything you need.

- FSCS protection up to £85k

- 24/7 UK customer support

- Instant card locking

- Overdrafts (if eligible)

- Fully regulated UK bank accounts

- Scan cheques in-app

- Instant notifications

- Use with mobile wallets

- Cash deposits

- Direct Debits

- 100% digital sign up

- No fees abroad

- Split the bill with friends

- Virtual cards

- World-class security

Nothing you don’t.

- No card-readers

- No hidden fees

- No branches - no branch queues

- No fees for spending abroad

- No call time targets

- No bots

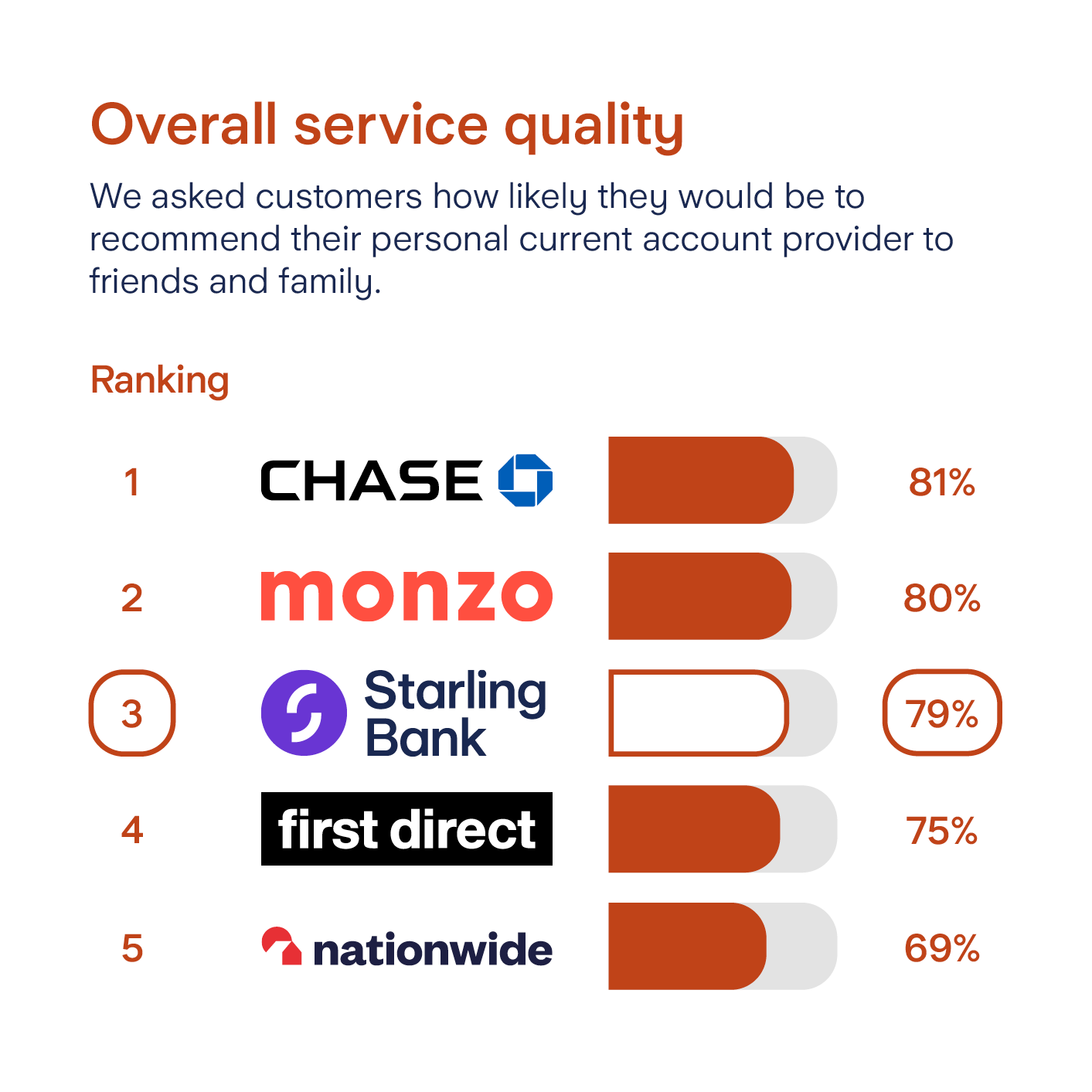

Independent service quality survey results.

Personal current accounts, Great Britain

Published February 2025.

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

The requirement to publish the Financial Conduct Authority Service Quality Information for personal current accounts can be found here.

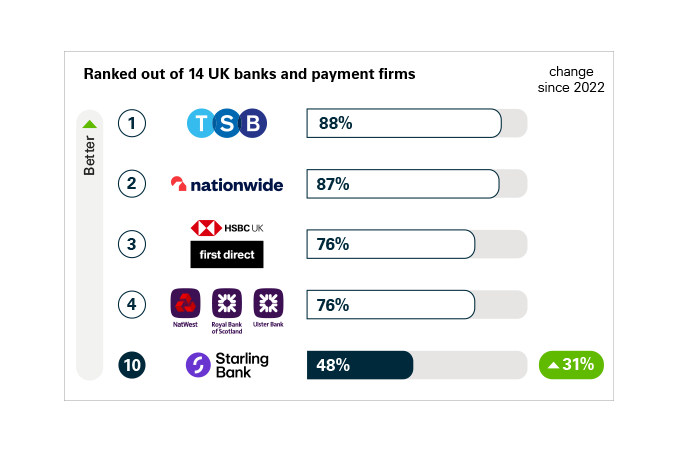

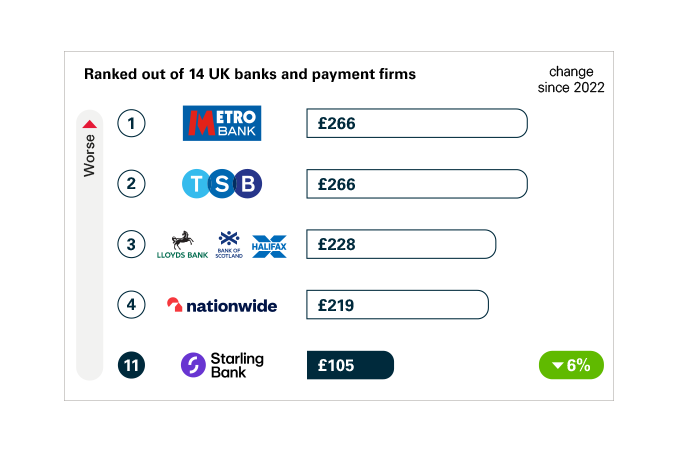

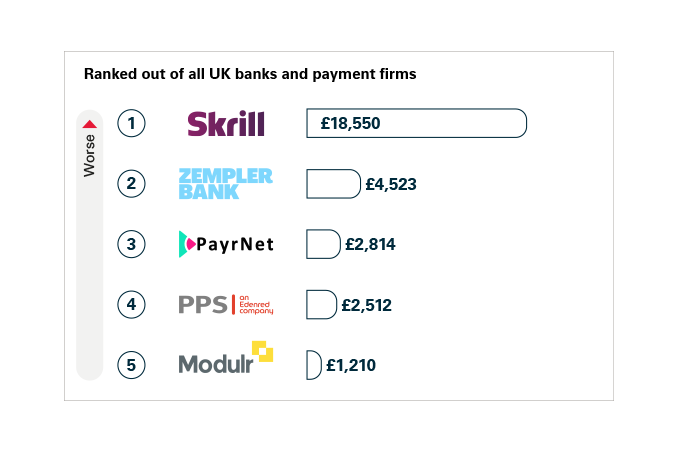

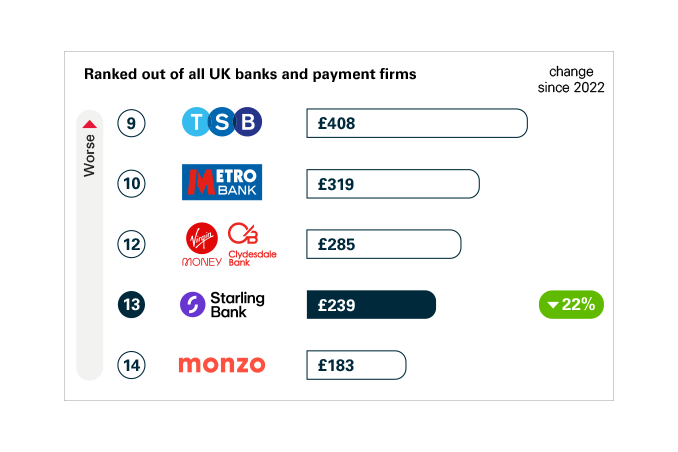

Authorised push payment (APP) fraud rankings in 2023

Authorised push payment (APP) fraud happens when someone is tricked into transferring money to a fraudster’s bank account.

These charts use data given to the Payment Systems Regulator (PSR) by major banking groups in the UK in 2023.

You can read the full report by visiting the PSR website.

Share of APP fraud refunded

This is the proportion of total APP fraud losses that were reimbursed, ranked out of 14 firms.

APP fraud sent per £million transactions

This is the amount of money sent from the victim’s account to the scammer, ranked out of 14 firms. For example, for every £1 million of Starling Bank transactions sent in 2023, £105 was lost to APP scams.

APP fraud received per £million transactions: smaller UK banks and payment firms

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms. For example, for every £1 million received into consumer accounts at Skrill, £18,550 of it was APP scams.

APP fraud received per £million transactions: major UK banks and building societies

This is the amount of money received into the scammer’s account from the victim, ranked out of all UK banks and payment firms. For example, for every £1 million received into consumer accounts at Starling Bank, £239 of it was APP scams.

Apply for a bank account in minutes from your phone.

Award-winning everyday bank accounts with no monthly fees, industry-leading security features and a Mastercard™ bank card.

Apply now