Last Digit Widget

Stimulus. Routine. Reward.

By Vicky Reynal

Good with money

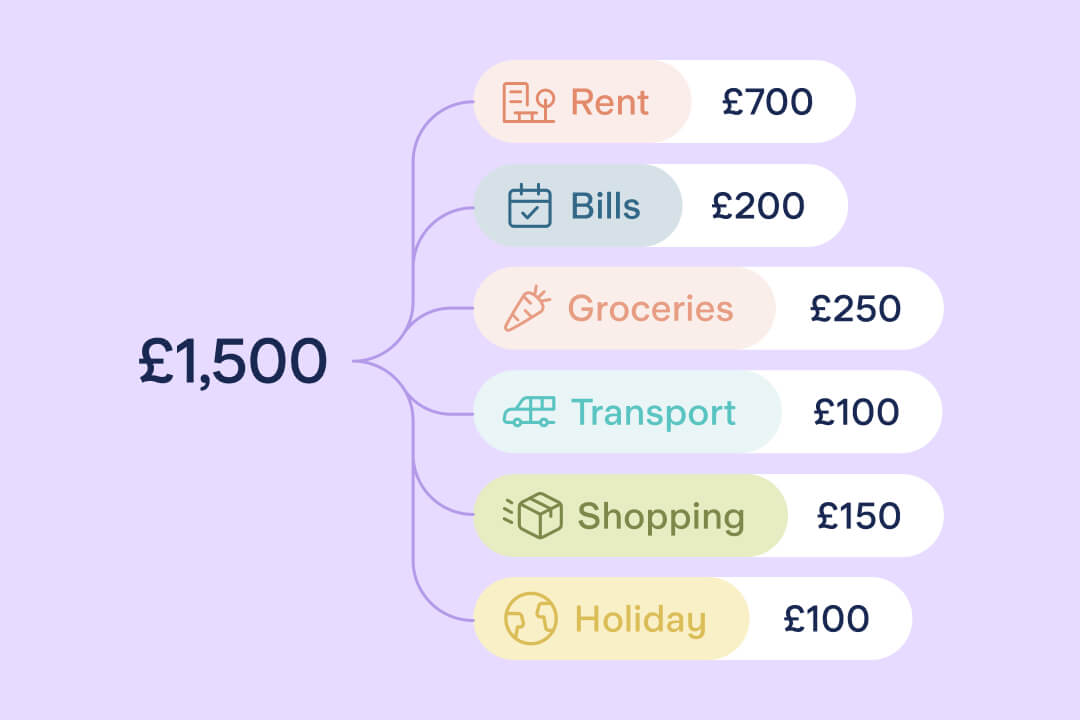

Zero-based budgeting is a way to plan your money so that every pound of your monthly income is allocated into categories that work for you. It gives every pound a purpose – no set percentages, no set categories.

Compared to some other budgeting methods, such as the 50/30/20 rule, zero-based budgeting breaks down spending in a more detailed way. It can also feel more bespoke and flexible, fully adjusted to how and where you live.

Similar to other budgeting methods, zero-based budgeting works by looking at your income and allocating certain amounts to particular categories, for example rent or mortgage, groceries or debt repayments.

Zero-based budgeting, also known as ZBB and zero-sum budgeting, was originally used by businesses as an alternative to traditional accounting. But it can also be used for personal finance.

First, check how much money you have coming into your bank account each month. Then look through your bank statements or banking app and take a note of how much you think you’ll need for everything in the upcoming month: remember there’s no such thing as too much detail. Include all the basics – rent or mortgage, food, childcare – plus all the extras: coffees, cinema trips, drinks with friends.

If you bank with Starling, use our Spending Insights feature to help you choose realistic spending categories and targets, based on your previous spending. You could also use Spending Intelligence to help you calculate a monthly average for how much you spend at the supermarket or on your pets. Simply ask how much you’ve spent on a certain category in the last three months and then divide the total figure by three.

Starling’s free online Budget Planner can also help you with these steps. It can be used by anyone, not just Starling customers, and suggests various budget categories.

No matter which categories you choose and how detailed you go, remember to include financial goals in your budget. This could be paying off debt or saving towards a holiday, a flat deposit or a big birthday.

It’s also a good idea to allocate money for occasional or unexpected expenses, such as haircuts or replacing your glasses if you lose them. You might also want to build in a buffer for variable spending categories, such as food shops.

| Category | Amount |

|---|---|

| Rent | £250 |

| Bills | £200 |

| Groceries | £250 |

| Transport | £100 |

| Shopping | £150 |

| Entertainment | £100 |

| Eating Out | £100 |

| Gifts | £50 |

| Charity | £10 |

| Buffer | £140 |

| Holiday | £100 |

| Emergency fund | £100 |

| Total not allocated | £0 |

If you’re a Starling customer, you could set up Spaces to allocate money for various categories. Our Spaces feature allows you to ring-fence money and name its purpose. For costs associated with your home, you could set up a Space and arrange an automatic top-up for the amount you need each month. You could then pay Direct Debits and standing orders, such as your rent, mortgage, energy bills and council tax straight from that Space using the Bills Manager feature.

You could also have Spaces for Shopping or Groceries, which you can connect to virtual cards. Virtual cards enable you to spend straight from a Space with your digital wallet or through online payments.

If, at the end of the month, you find that you have money left in your account, you could either set it aside as savings or make a bigger buffer for next month.

What are the advantages and disadvantages of a zero-based budget?

The benefit of zero-based budgeting is that it provides a granular view of your finances. You can see exactly how much you’re spending where – and then make adjustments to prioritise whatever you’re aiming for.

A disadvantage is that it can be time consuming to set up and track, although this can be simplified through digital tools and apps. The other downside is that if you haven’t created a big enough buffer, it could be thrown by needing to spend more than expected on one category – but this is where a quick review can help so you can make sure your plan is more realistic for the following month.

It’s also probably not the best method for someone with variable income as it would need to be constantly adjusted at the start of every month – although if you’re up for that, go for it.

Zero-based budgeting gives a very detailed view of your spending

It involves allocating money into many different categories, which can be time-consuming

Each month, income minus expenses and savings equals zero

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.