Product news

Helping economic abuse survivors with our new feature, ‘Hide references’

6th June 2023

If you’re running a business and need to make several payments in one go, our Bulk Payments feature is for you. It can be used for payroll, reimbursing staff for expenses or paying suppliers - pay multiple people through one simple system.

The new Bulk Payments feature is available to limited companies with a Starling business account and can be accessed through our Online Banking web browser. When you sign up to use Bulk Payments, your first month will be free. After that, the feature costs £7 per month (VAT exempt) per business account. Bulk Payments is an optional add on, there are no monthly fees for Starling’s standard business accounts.

The Starling Bulk Payments feature is designed to save Starling business customers time and effort when making payments to multiple recipients.

The feature enables you to enter different amounts for each recipient and you don’t need to set them up as a payee before including them in a bulk payment. Simply (but carefully!) enter payee details and the amount you want to pay them into our .csv template. Then upload, review and confirm.

“It’s time saving and has a lower risk of error than entering the payment details manually,” says Paul Freestone, one of the directors of consultancy ChangeNet Solutions. “We can effectively copy and paste what our accountant provides us, rather than typing in the various amounts that need to be paid.”

ChangeNet Solutions opened a Starling business account in 2020. It works with large global companies to support them with strategic changes to their business. ChangeNet Solutions has 30 staff members. “Payroll previously took about an hour. Bulk Payments means it takes around a quarter of that time.”

Each month, you can use the Bulk Payments feature to make up to 250 payments. For example, you could organise your monthly payroll for 200 employees and make weekly payments to 10 suppliers. The number of remaining payments you can make that month with Bulk Payments is shown on your Online Banking dashboard.

Existing Starling business customers with a limited company account can subscribe by going to the Subscriptions section in the main menu of their Starling app.

Those who are new to Starling can download the app, apply for a business account and sign up for the Bulk Payments feature once the business account is verified and open.

The Bulk Payments feature is only available for UK business accounts, not euro or US dollar business accounts. If you have multiple UK business accounts for different businesses you will need one subscription per business.

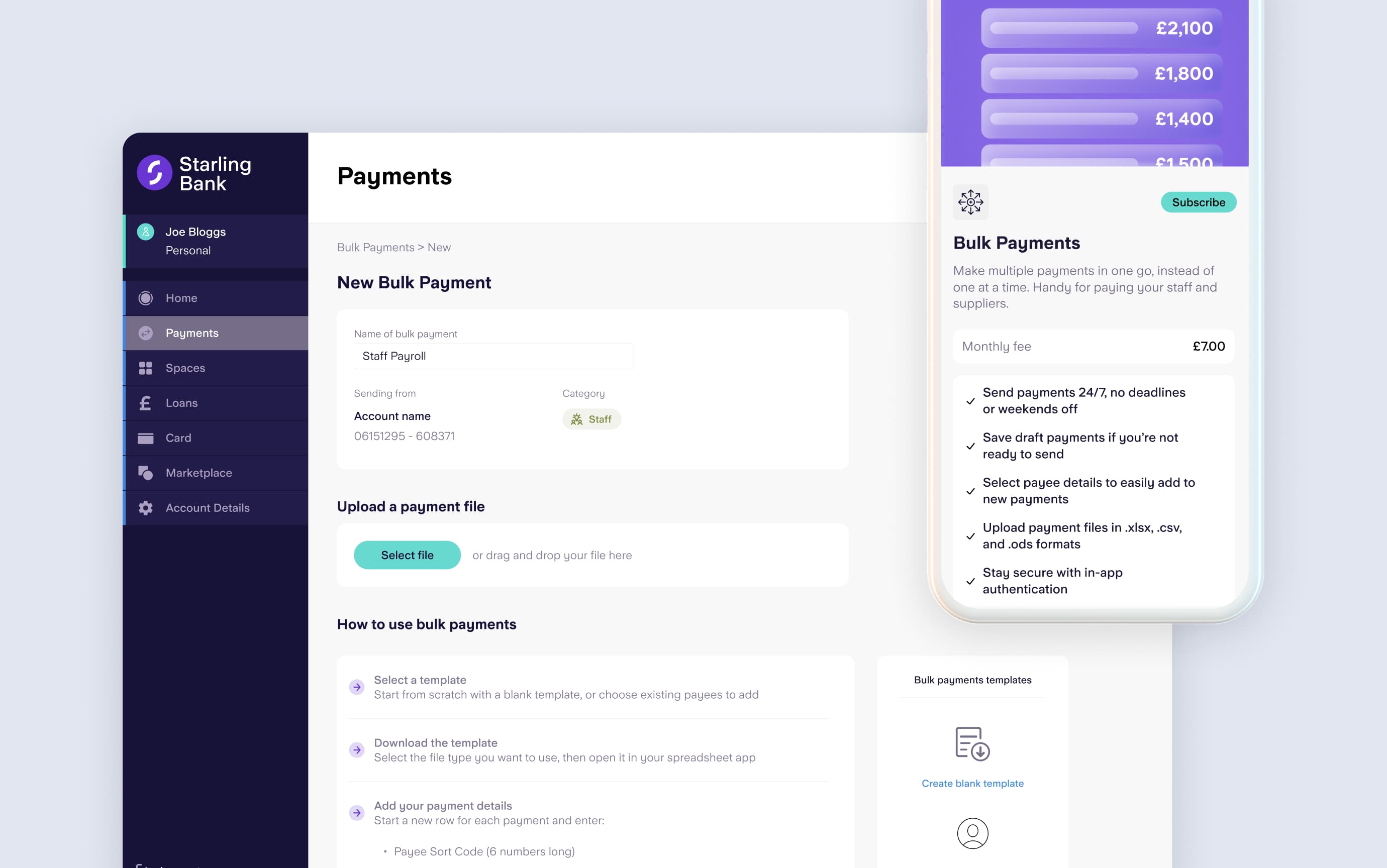

Once subscribed, you can make a bulk payment by logging on to Online Banking on your laptop or desktop, heading to the Payments section in the left menu bar and selecting Bulk Payments.

If you already have recipients set up as payees, you can select all the relevant people to generate the .csv template you need to make the bulk payment, and add how much you would like to pay each of them.

Alternatively, you can download the .csv template and enter the names of the individuals or businesses you are paying, their account details and how much you want to pay them. You also have an option to add payee and payment details to your own .csv, .xlsx or .ods file and upload this to make a bulk payment.

Once a file has been uploaded, you can review the payment summary, action any error messages or suggestions, and click ‘Authorise bulk payment’.

To complete the bulk payment, you’ll need to confirm that everything is correct by tapping ‘Approve’ in your Starling app. If you set up a bulk payment but find you’re not ready to submit it, you can save it as a draft and pick it up later.

Say goodbye to multiple transactions ahead of payday. And say hello to Bulk Payments.

Product news

6th June 2023

Product news

5th June 2023

Business

3rd October 2022

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025