Business

“Becoming a mentor helped me see my own value.”

6th March 2025

Lots of banks talk about ‘innovation’ but at Starling, we walk our talk. Read on to learn about six changes we’ve made in six months to make banking even better.

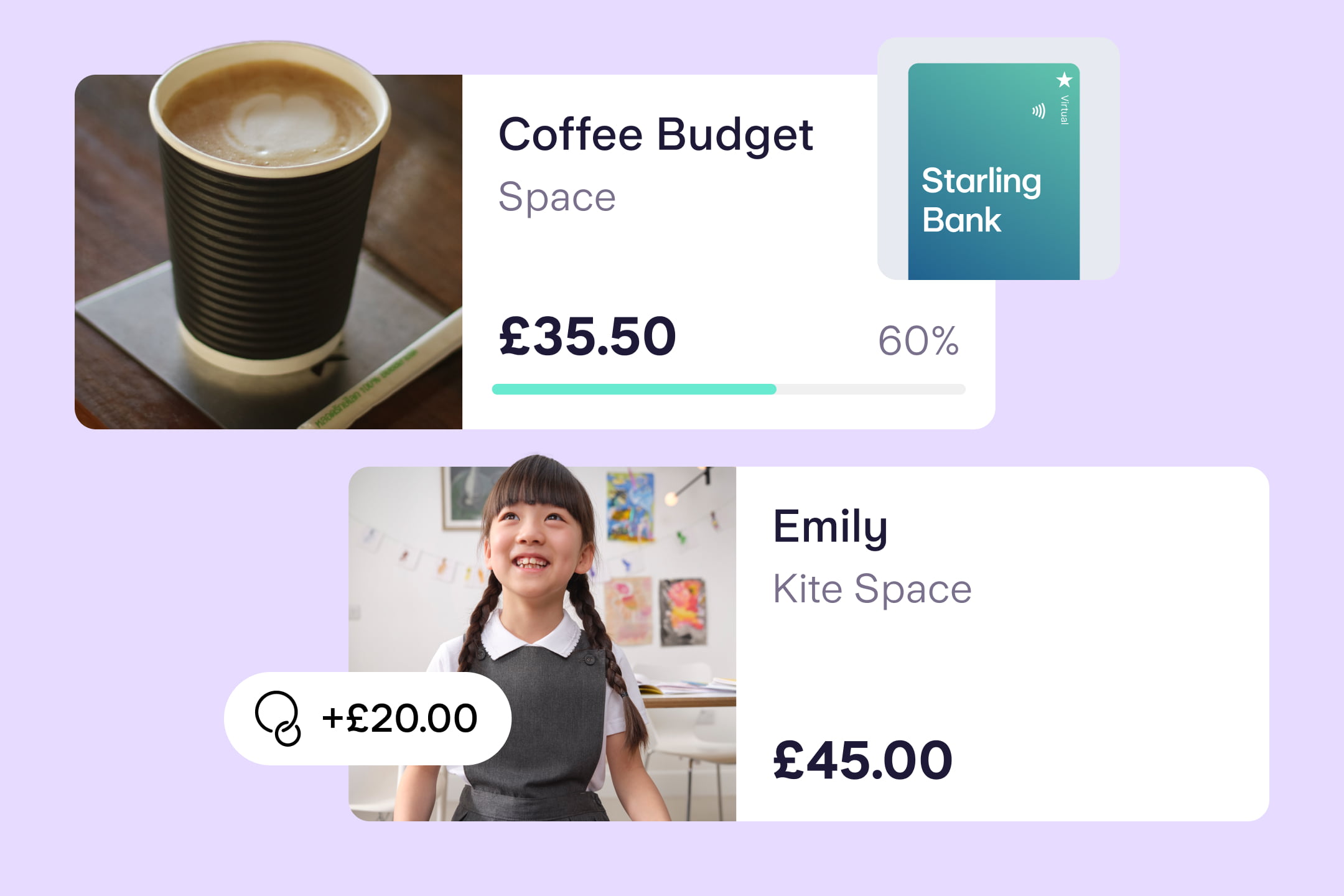

We launched virtual cards to help our customers organise their money and budget. Like debit cards, virtual cards are free and have their own card details and CVV. The difference is that they aren’t posted to you. They exist in your Starling app and in your digital wallet, and you can set them up for a particular spending category in your budget, such as ‘Subscriptions’ or ‘Takeaways’.

Each virtual card is connected to a Space, the feature that enables you to set money aside from your main balance. Once set up, a virtual card allows you to spend only what you have in that specific Space. You can have up to five virtual cards at any one time and cancel them whenever you like. We launched virtual cards as a result of customer feedback, something we’ve done for several features in the app.

Our 1-Year Fixed Saver enables Starling customers, to set aside money for 12 months and receive a fixed amount of interest at the end of the year. As of 10:00 on 10 June 2025, the interest rate on Starling’s one-year Fixed Saver is 3.80% AER/Gross for Starling personal current account customers. Terms and conditions apply.

There is a minimum deposit of £2,000 for both personal and business customers looking to apply for a Fixed Saver, which you can do in the Starling app by going to ‘Spaces’.

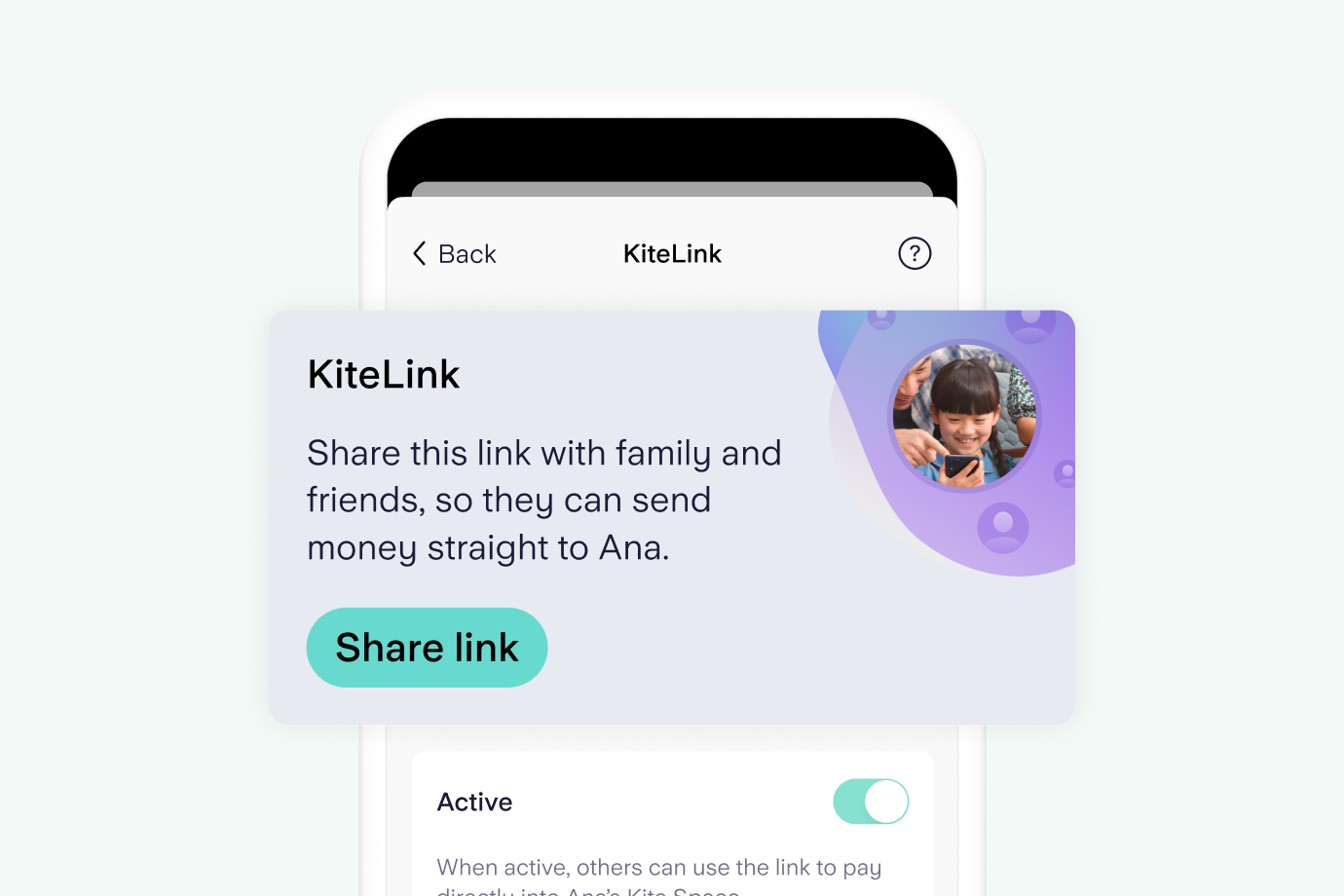

Ever wanted to send birthday money straight to your seven-year-old niece without a cheque book or transfer to their parents? Now you can. Kite Link enables trusted friends and family members to top up a Kite debit card through a secure link.

A Kite debit card can be set up for your child from a personal or joint Starling account. As part of the process, you'll need to upload a picture of your child’s ID document (such as a passport or birth certificate).

Settle Up, now part of our joint accounts, is the feature that allows you to split the bill or ask a friend to pay you back for something. The person that owes you won’t need to set you up as a payee, they can simply transfer from their Starling account or if they’re not a Starling customer, enter their card details by following the Settle Up link.

Our joint accounts can be set up in-app between two people with Starling personal accounts, provided they’re nearby. No need for a branch visit - you can be anywhere with an internet connection, be that a beach, a train or a nice, squishy sofa.

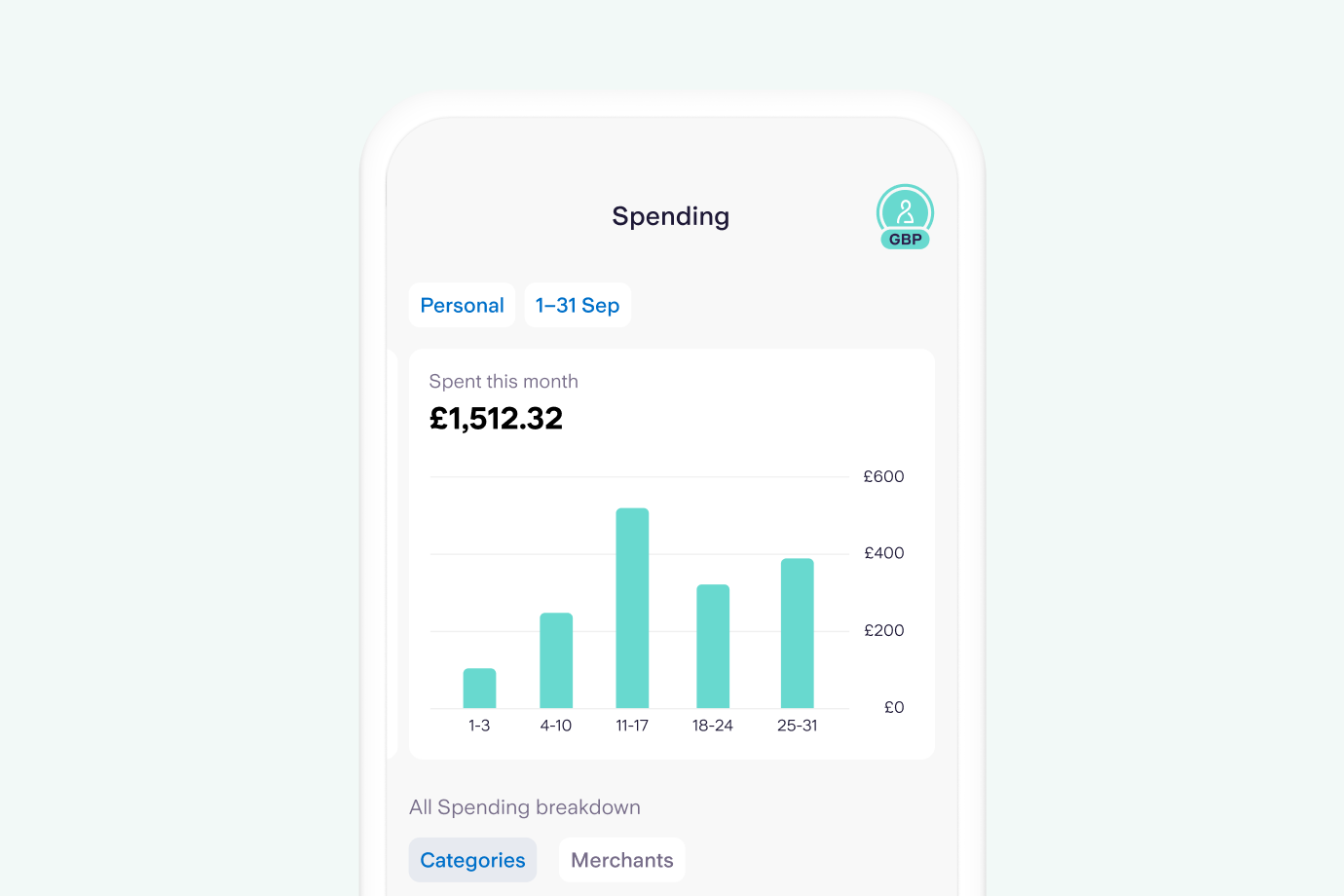

You can now see your Spending Insights for whichever date range you choose. For example, you can look over the last three months of spending if you’re creating a budget. Or you can look at spending for the last financial year if you’re filing your tax return. It’s your choice.

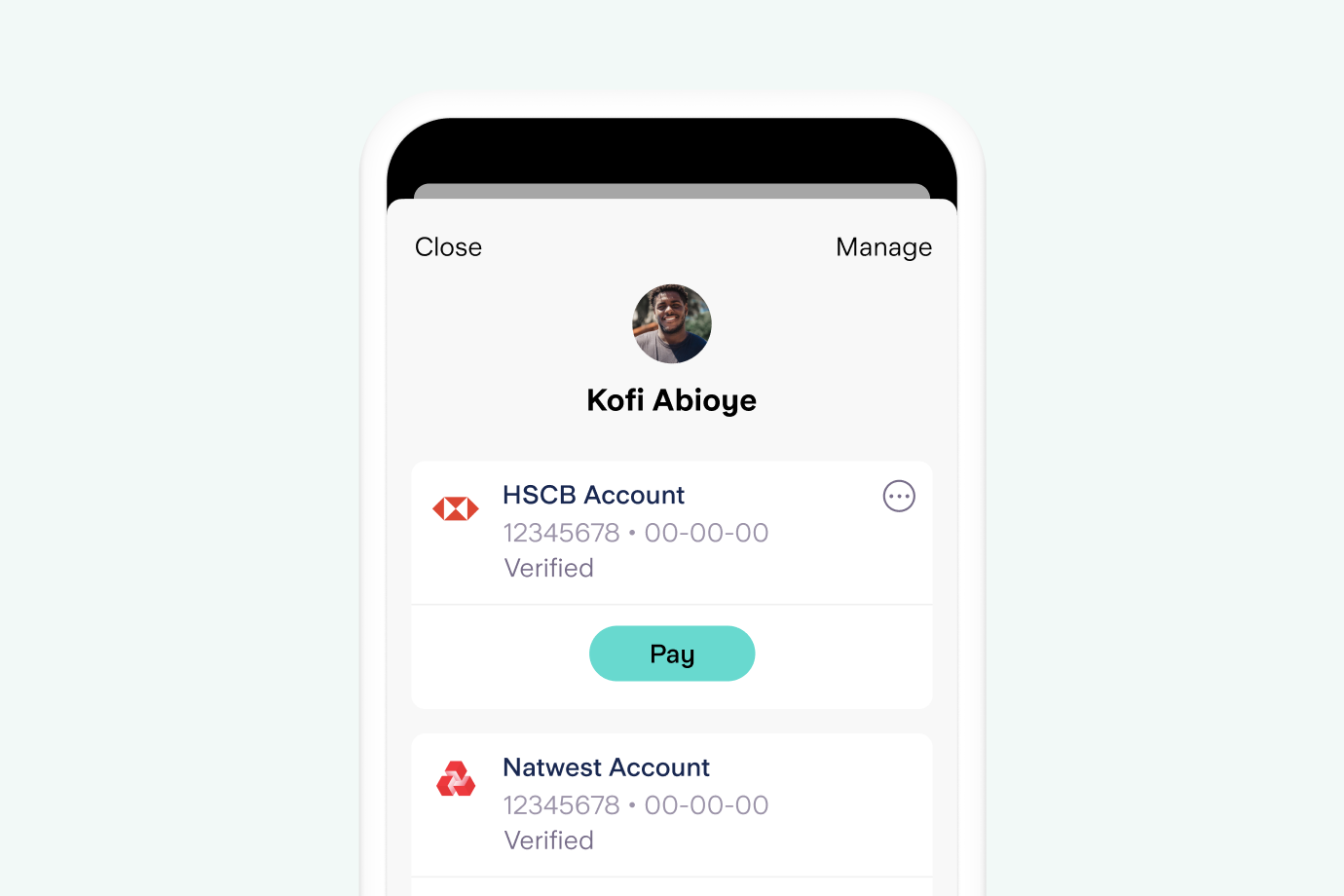

We’ve also redesigned the payee section of the app. You can now see the logo of the bank that an account is with, something that’s especially helpful if a payee has more than one bank account. You can also add a profile picture of your choice for payees.

And remember, if you’re showing a friend or family member some of these new features, you can always hide your balance while you walk them through the app. Simply hold your finger down on your balance and tap ‘OK’ when the message appears.

Article updated: 19 September 2024

Business

6th March 2025

Business

24th May 2024

Business

24th May 2024

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025