Last Digit Widget

Stimulus. Routine. Reward.

By Vicky Reynal

Good with money

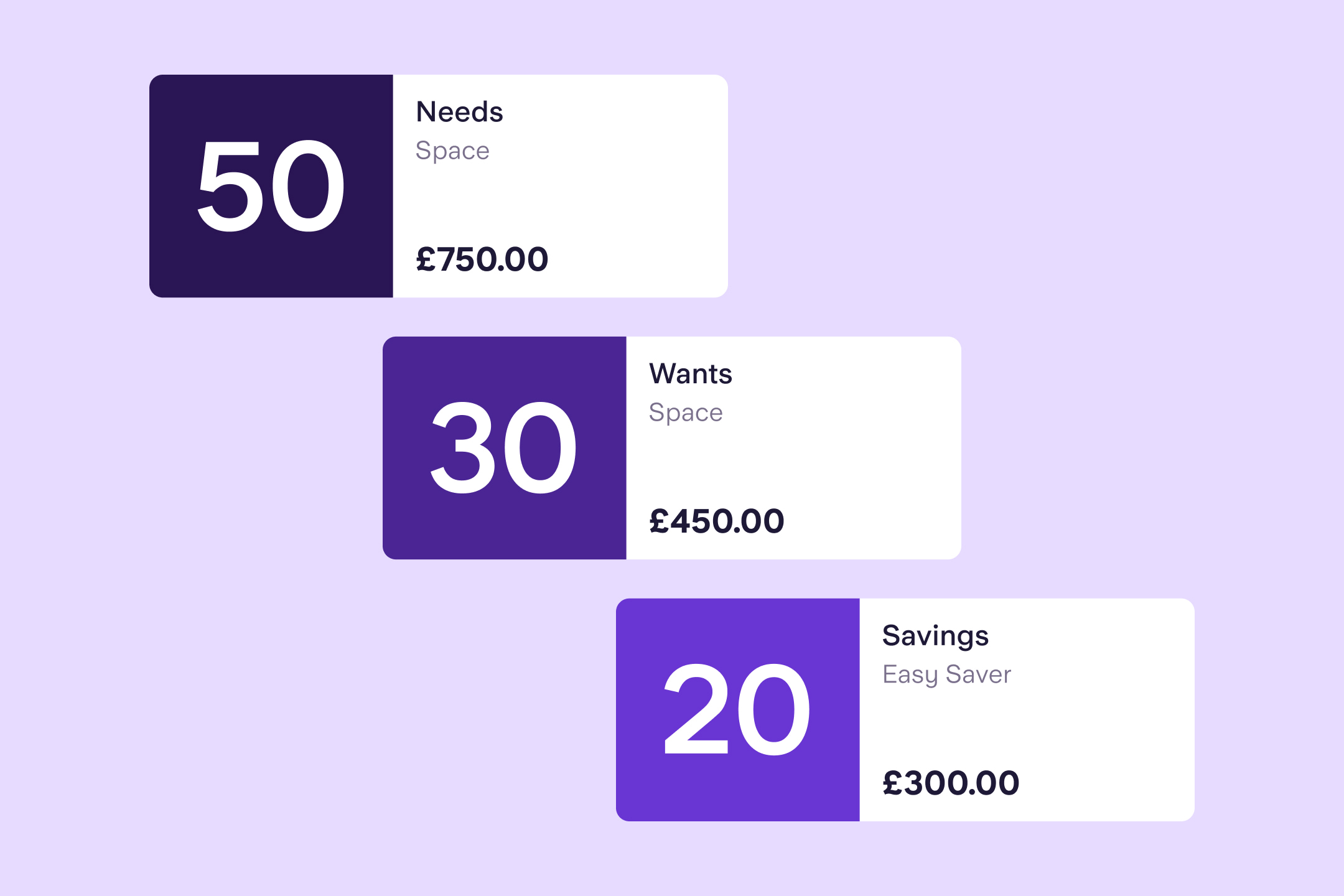

“A 50/30/20 budget is a simple way of making a plan for your income and allocating your spend,” says financial coach Selina Flavius. “There are clear and distinctive categories – 50% for needs, 30% for wants and 20% to put aside as savings.”

If £1,500 comes into your account each month, this means £750 would go towards your ‘needs’ – rent, council tax, energy bill, food and transport to and from work. This would leave you with £450 to spend on what you want and £300 to pay down credit card debt, or set aside for an emergency fund, in case something expensive breaks and you urgently need to fix it. Money for trips away or birthday presents for friends can come either from your ‘wants’ money or savings – it’s up to you.

“Some people find that it’s not possible to get all essentials into the 50% bracket, especially if they’re living in a central city,” says Selina. The increased cost of energy and groceries may also mean that essentials come to considerably more than 50% and that saving 20% simply isn’t possible.

To put the 50/30/20 method into action, you’ll need to look at what you usually spend and decide what’s essential and what’s non-essential.

“What do you need to live in your home, be fed, watered and clothed and feel financially secure? What could you live without? What couldn’t you live without?” asks financial planner and coach Catherine Morgan.

If you bank with Starling, you can use our free AI Spending Insights bar to help figure out how much you usually spend on groceries or going out. You can then note down various expenses in a spreadsheet or document so that you can categorise them into ‘needs’, ‘wants’ and savings. This will give you a clear idea of whether the 50/30/20 split could work for you – and if you need to adjust it or try a different method.

If you’re looking for a budgeting method with no set percentages and more categories than ‘needs’, ‘wants’ and savings, you could try the envelope method.

“It comes from when people were paid cash-in-hand and would separate money out into different envelopes,” says Selina. “And it can work digitally if you have a bank like Starling with Spaces.”

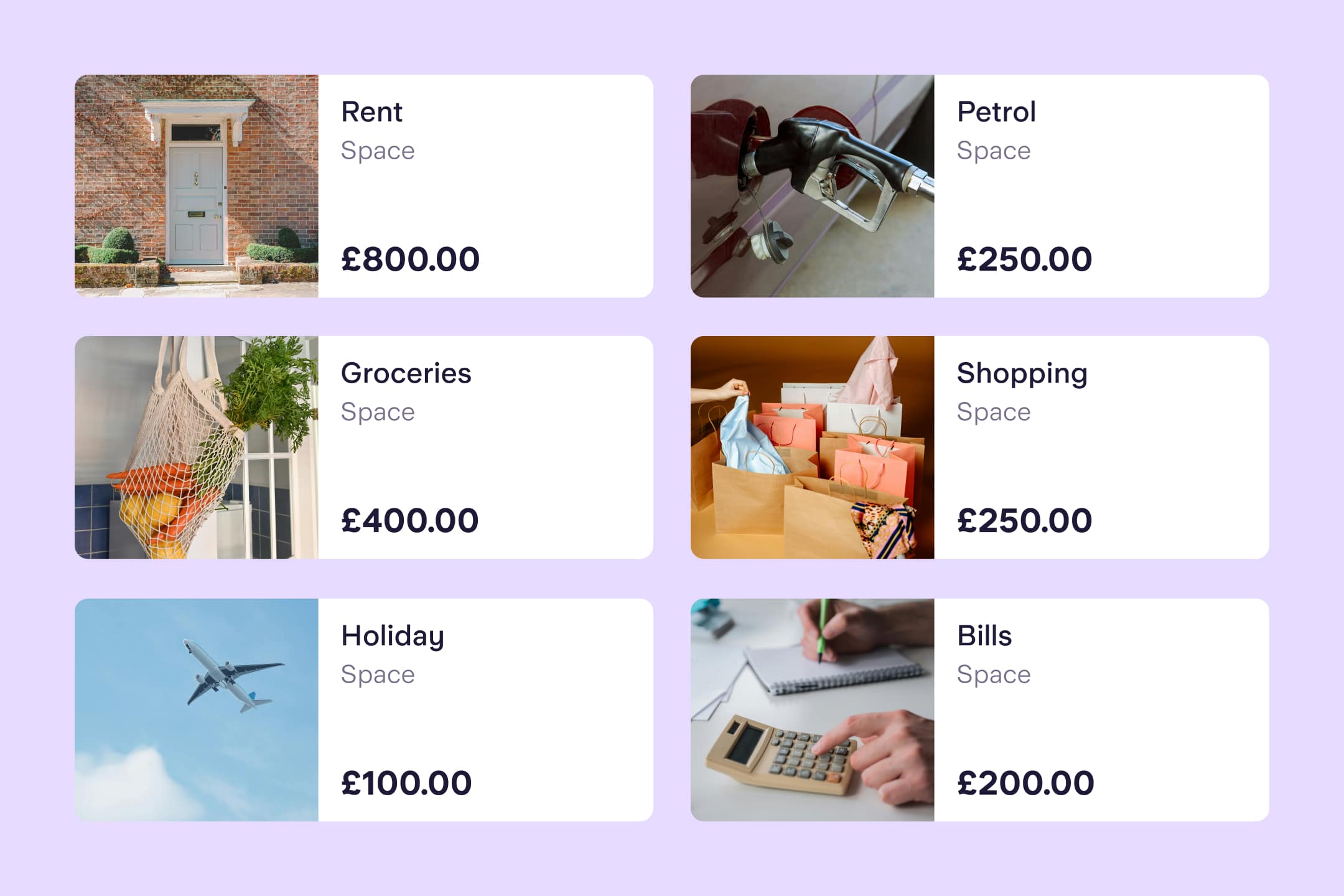

Spaces is the feature in the Starling app that enables you to set money aside for particular purposes. For example: you could create Regular Spaces for your rent, utility bills, insurance, food, transport, and top up each Space with the amount you need to spend that month. You could then set up direct debits with the Bills Manager feature to pay bills directly from a Space.

You could also have Spaces for celebrations, coffee or takeaways and then set up virtual cards to spend straight from those Spaces using your digital wallet. You’ll only be able to spend what’s in your Space, which can help you stay in budget.

“I love Starling Spaces,” says Catherine. “You can bring everything to life with photographs and names.”

You could also have Spaces for celebrations, coffee or takeaways – all of which are Spending categories available in the Starling app.

“I love Starling Spaces,” says Catherine. “You can bring everything to life with photographs and names.”

If you don’t have a bank with digital Spaces, or an equivalent feature, and don’t want to use physical cash or envelopes, you could outline your own categories and spending targets in a spreadsheet.

There are a number of apps, such as Emma or Money Dashboard, that can digitise this process and make it easier to check in on your budget.

If you allocate 100% of your income to various categories so that you have a balance of zero at the end of each month, you’ll be doing what’s known as zero-based budgeting. “You give every pound a purpose,” says Catherine. You might want to use one category for savings and another as a buffer to cover unexpected expenses.

Ultimately, there’s no one-size-fits-all approach when it comes to budgeting. It all depends on your income, fixed costs, financial goals – and what feels realistic for you.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

To get started, you may want to try our Budget Planner tool. It crunches the numbers for you so you can set realistic targets – no matter which budgeting method you choose.

Try our Budget Planner