Accountancy

How to improve your cashflow

Cashflow refers to the money flowing in and out of your business either as cash, or through your bank. Many small businesses fail because of insufficient cash, so it’s important that you always have enough money to settle your debts as they fall due.

Cash vs profits

It’s possible to have cash in the bank when you’re making a loss or to have an overdraft when running a profitable business. This is often due to a timing difference, between when you receive payments from your customers and when you have to pay your expenses (e.g. staff and inventory).

A business will be considered to have a “positive cashflow” cycle if you receive cash before you have to pay your expenses. This may be because you receive a deposit or receive payment for goods before you have to pay for them. For example, you could receive payment for goods you sell immediately but only have to pay your supplier in 30 days time.

On the other hand, a business would have a “negative cashflow” cycle if you need to pay your expenses before you receive payment. For example, you may need to pay rent, utility and staff before you can bill a client for a project, or you may sell goods and only receive payment for them after you have paid your suppliers.

Cashflow in a fast growing business

If you’re growing quickly you may be short on cash because you’re paying expenses before you receive the cash (e.g. buying inventory in advance, or selling goods or services on 30-60 day payment terms). But you may still be profitable if you’re able to generate a margin on those sales.

Fast growing, profitable businesses can often be the most short of cash if they have upfront costs to generate revenue, such as marketing or inventory. Instead of cash you’ll have other short term assets such as stock, prepaid goods or debtors (people who owe you money).

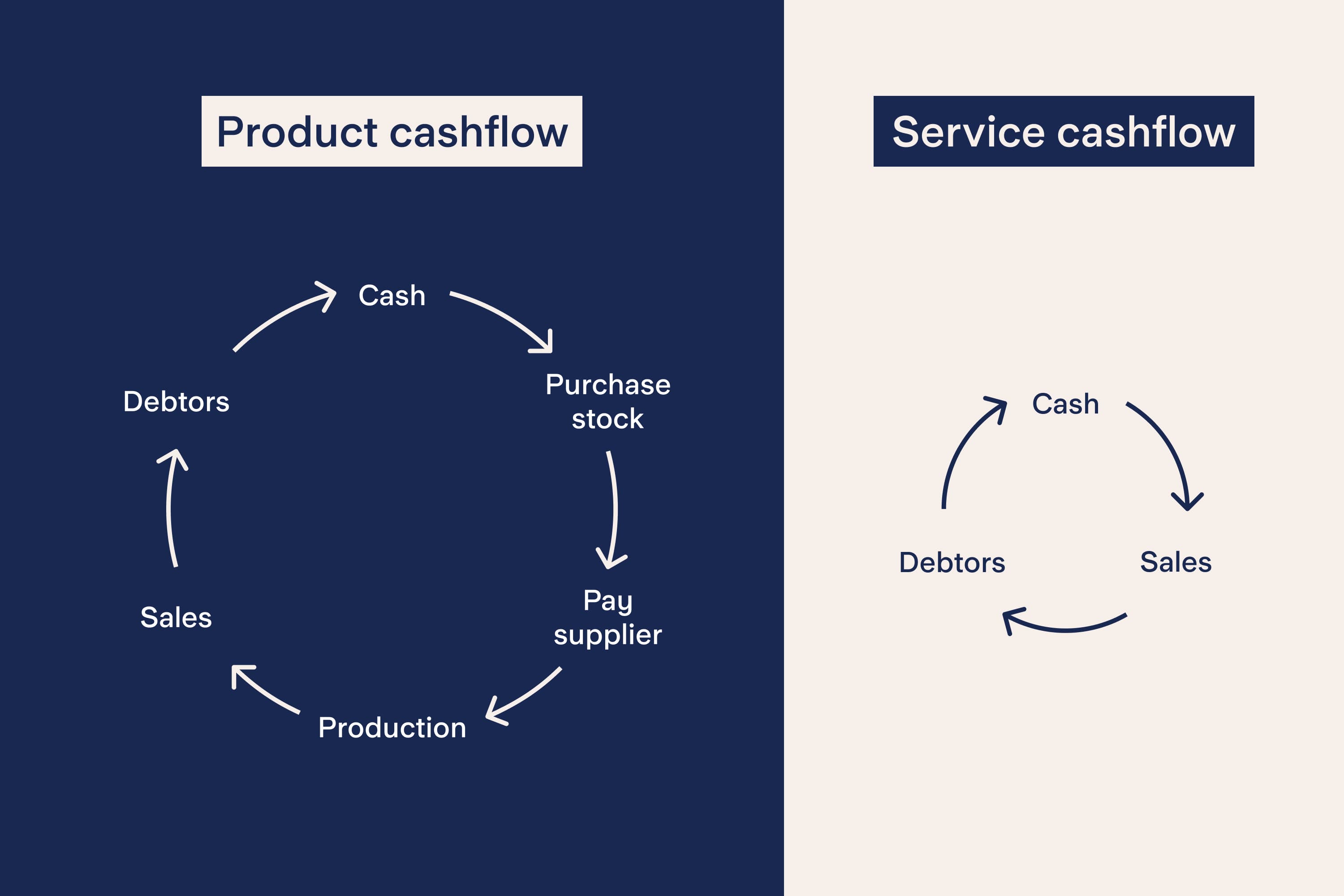

The cashflow cycle

It’s important to understand your cashflow cycle so that you don’t get caught out with too little cash. You may need to retain a buffer of cash in your account, or you may need a loan or to manage your growth, to ensure you have sufficient cash.

For example, if you pay for inventory upfront and it typically takes 20 days before it is sold, and if you typically are paid on 30 day terms - you have 50 days between when you pay out cash for the inventory and when you receive cash from your customers (your “cash conversion cycle”), and you will need to plan accordingly. You can shorten this time frame in three main ways:

Selling your inventory faster (reducing “inventory days” - how long your goods are “stock” before being converted into sales)

Being paid for your goods or services sooner (reducing your “debtor days” - how long it takes your debtors to pay you)

Delaying / reducing the amount you pay upfront (increasing your “creditor days” - how long it takes you to pay your suppliers)

The shorter your cash conversion cycle, the quicker you convert your goods and services into cash, so you can use that cash to reinvest in driving more profitable activity (e.g. more stock, marketing campaigns, people).

If you don’t keep an eye on your cashflow and the timing of different expenses, you may have to make decisions which impact your profitability - such as selling goods at a discount in order to convert them into cash sooner.

Cashflow and forward planning

The other thing to look at is timing. You may appear to be fairly profitable and cash rich, but have a big salary bill or a loan instalment to pay at the end of the month.

When reviewing your cash balances, always look ahead at what you still need to pay out. It’s very easy to forget about your annual tax bill or even a quarterly VAT bill that will be due soon.

The Starling Spaces feature can help you set money aside when you’re trading, for things like VAT, corporation tax or even rental payments.

Ways to improve your cashflow

The main way to improve your cashflow is to try and reduce the time between when you make payments and when you receive income (the time taken for your customers to pay you). This also relates to the amount of inventory or stock purchased upfront and held on your balance sheet.

Look to review how you can minimise what you pay for upfront - such as inventory or contracted services - you may have the option to pay a deposit or in monthly installments (e.g. insurance) rather than the full amount all at once, though you may need to weigh the benefit of this up against any discounts available for paying in full early. There will be commercial constraints on how much you can do this, but you should review your position each month, or more frequently, if cashflow is a problem for you and your business.

Debtors (people who owe you money)

You can improve your debtors position with the following actions:

Have clear terms and conditions of payment and stick to them

Have the shortest payment period acceptable within your industry

Consider offering discounts for prompt payment, but make sure to weigh this up against the impact on your overall margin, and be aware that many customers will take these discounts but still pay you when it suits them

Conversely you can charge customers interest for late payments (though this can be hard to enforce and unpopular)

Invoice promptly. It’s possible to raise invoices directly online with most accounting software. Sending the invoice is the first part of getting paid. Some software allows you to raise recurring invoices for ongoing services, which could save you time

Chase all debts promptly when due (set yourself automatic reminders and send invoices as soon as you can)

If you have low volume sales, then you may want to contact debtors ahead of the due date, to ensure that the customer is happy that they’ve received everything as promised and that they’ve passed your invoice to the correct department for payment. Not only is this good customer service, but you should have time to fix any problems before the invoice is due to be paid

Check early on whether your customer requires a purchase order or any particular documentation in order for you to get paid. Understand how their payment system works and when they run their payments each month. Get into the habit of asking for purchase order numbers before invoicing

Make it easy to pay you by having your bank details on your invoice and perhaps a facility to pay by card.

Creditors (people you owe money to)

You can improve your creditors position with the following actions:

Negotiate the longest payment terms practical in order to conserve your cash balances, but remember that your suppliers also need cash to run their businesses. If you need to pay upfront, perhaps you can arrange to pay a deposit instead or in instalments.

Once you’ve agreed payment terms, do pay promptly rather than exacerbate somebody else’s late payment problems

If you think you may not be able to pay your creditors in time, get in touch with them early and you may be able to agree a payment plan that more closely matches when you expect to receive cash

Inventory or stock

You can improve your inventory/stock position with the following actions:

Track your sales volumes to ensure that you have the right amount of stock to fulfil orders but not so much that it is taking up space and cash

Look for suppliers who can deliver quickly. If they can deliver to you the next day then you don’t need to hold more than one or two days supply

When purchasing in bulk in exchange for discounts don’t forget to allow for the impact on your cashflow. See if you can delay payment terms, pay in instalments or on a consignment basis (when the goods are purchased from you)

Other cashflow problems

There are some common ways that new businesses can find themselves in financial difficulty.

Do ensure that you set aside money to pay taxes, especially those collected on behalf of HMRC such as VAT and PAYE. Also take into account your annual corporation tax and/or income tax on your business profits and on any dividends that you have taken out of the business.

New business owners sometimes see a high cash balance and decide to take a dividend or director’s loan or drawings without checking that there’s sufficient cash left in the business to meet other bills as they fall due.

Remember that good cashflow management requires careful monitoring of your business finances and early intervention if you think you’ll run short.

This article is intended as general information only and does not constitute advice in any way. For any specific questions, you may want to consult your legal advisor or accountant.