Join over 450,000 businesses banking with Starling

Running your own business is full of ups, downs and occasional surprises, and not all banks understand that – but we do. Starling’s business account is flexible and designed to make life easier, with no monthly fees. Switch today with the Current Account Switch Service.

Why switch your business bank account to Starling?

It’s free. Requesting to switch only takes a few minutes and it won’t cost a penny. Our business bank account comes with no monthly fees or UK payment charges so you could save money on your business banking. Find out how we stack up against other business accounts.

It’s easy. Our application is fully digital via our mobile app and once you’re verified, requesting to switch only takes a few minutes - so why not give it a go?

The best of British. You’re in good company. Join over 300,000 British businesses, and 150,000 sole traders already banking with us.

It’s seamless. We’ll do the legwork of moving outgoing payments, payees you’ve set up, Direct Debits and standing orders. Also, if anybody pays money into your old account it will automatically be redirected to your Starling account.

All your business finances in one place. By switching your business account to Starling, you’ll be able to understand and manage your business finances, all from one app.

You’re protected. Over 99% of UK current accounts are covered by the Current Account Switch Guarantee and every bank and building society offering the service follows exactly the same switch process. In the unlikely event that something goes wrong with your switch, we will refund any interest (paid or lost) or charges incurred on your old or new account as well.

Switch to Starling for better business banking

Multi-director access. Easily add directors to your account (directors must be registered at Companies House)

Multi-director access. Easily add directors to your account (directors must be registered at Companies House)

Multi-director access. Easily add directors to your account (directors must be registered at Companies House)

Already have a business account? Here’s how to switch...

-

In the app, tap the menu icon to bring up the account menu

-

Select switch to Starling

-

Enter your old account details

-

Select the date of your switch

-

Confirm your details

That’s it! We’ll handle the rest.

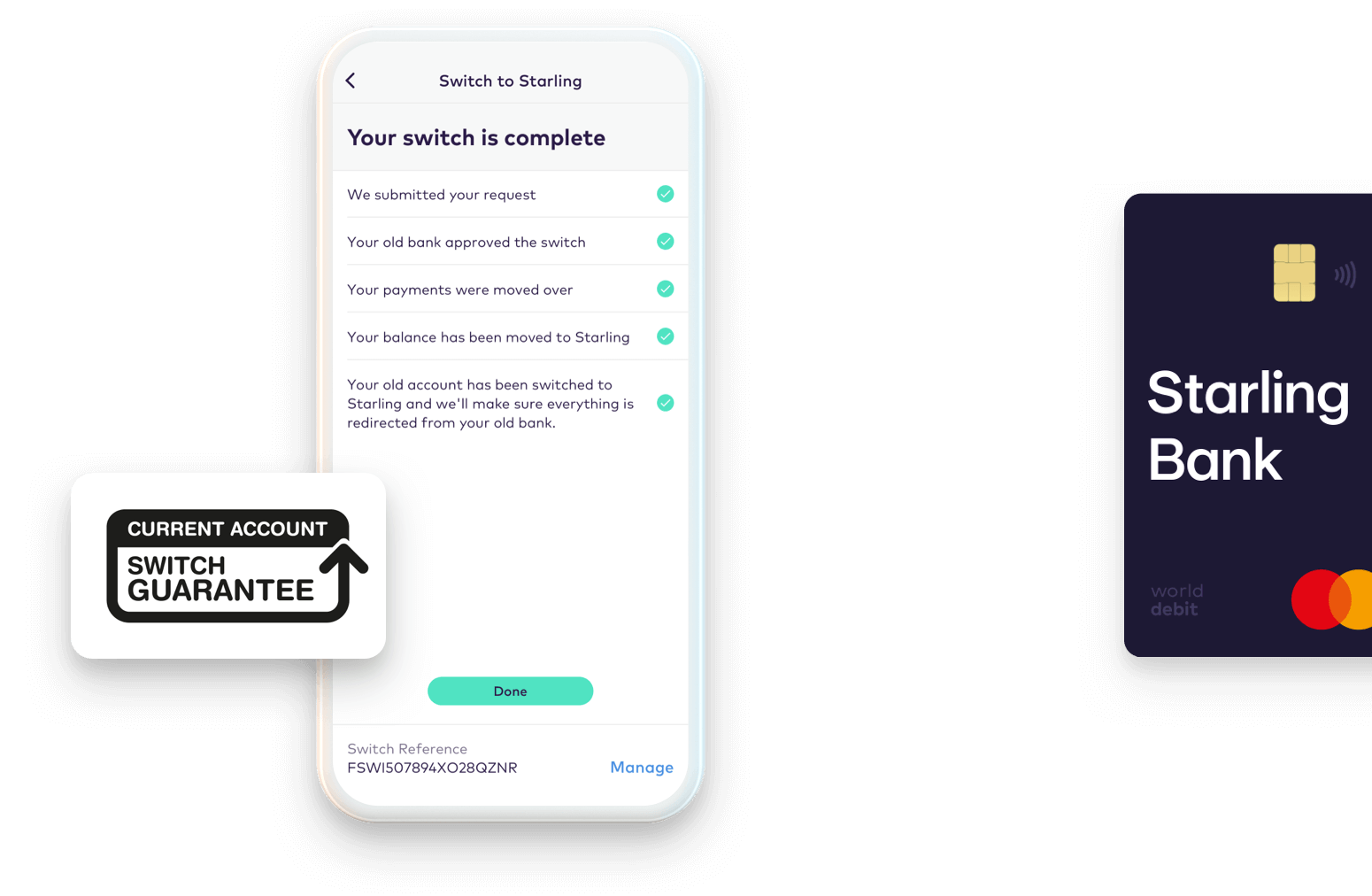

The Current Account Switch service allows you to move your business account from your current bank in a simple and stress-free way.

For multi-owner accounts, one user will need to initiate the switch from the app. All directors with access to the app will then need to approve the request (we’ll send them a notification explaining this).

Got an overdraft at your old bank?

Any overdraft balance on your old account will not be automatically transferred. You will need to agree a new overdraft facility with Starling Bank. You’ll have the chance to apply for an overdraft before you initiate your switch with us. If you can’t get an overdraft with us you’ll need to make separate arrangements to repay your existing overdraft with your old bank before you switch.

Don’t have a business account with us yet?

Download the app and apply for an account in minutes. Once you’ve been verified, follow the steps above to start the switch to Starling.

Please note: we do not support partial account switching.

Here’s what happens when you switch business bank accounts

The whole process is quick, safe and guaranteed.

Step 3

The business account you’re switching from will be closed on your behalf and your balance, salary, payees, Direct Debits and standing orders will be moved to your Starling business account.

Step 4

The switch is complete. Your old bank will make sure that any payments made to your old business account are redirected to your Starling business account.

Step 1

We’ll send a request to your old bank to confirm the switch.

Step 2

We’ll keep you updated every step of the way. You can also monitor the progress of your switch in the ‘Switch to Starling’ tab under the account menu.

Step 3

The business account you’re switching from will be closed on your behalf and your balance, salary, payees, Direct Debits and standing orders will be moved to your Starling business account.

Step 4

The switch is complete. Your old bank will make sure that any payments made to your old business account are redirected to your Starling business account.

Step 1

We’ll send a request to your old bank to confirm the switch.

Step 2

We’ll keep you updated every step of the way. You can also monitor the progress of your switch in the ‘Switch to Starling’ tab under the account menu.

Step 3

The business account you’re switching from will be closed on your behalf and your balance, salary, payees, Direct Debits and standing orders will be moved to your Starling business account.

Step 4

The switch is complete. Your old bank will make sure that any payments made to your old business account are redirected to your Starling business account.

Banking that means business.

Thousands of business owners have gone full Starling

Switch your business account to Starling

Existing customer? You can switch in-app by going to the account menu (tap the icon in the top right), then tap ‘Switch to Starling’ and follow the simple steps.

If you have given permissions to Third Party Providers to make payments on your behalf, or to access your financial data, access to these services won’t be transferred automatically to your new account as part of the Current Account Switch Service.

1. Before you close your old account, check whether you have any Third Party Provider permissions set up and if so, who with.

2. Once your new account is open you can give your permission to the Third Party Provider to access your new account by providing them with your new account details. You will need to contact the Third Party Provider directly yourself to set this up.

3. Please note, some Third Party Providers may not be supported by all banks and building societies. Check what Third Party providers we support.