Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

Keeping track of your money can be tricky. Bills, food, late night online shopping, IOUs, birthday presents - there’s so much to think about. That’s why we built several features into the Starling app to help you understand where and how your money comes and goes. Here, we run through some of these features.

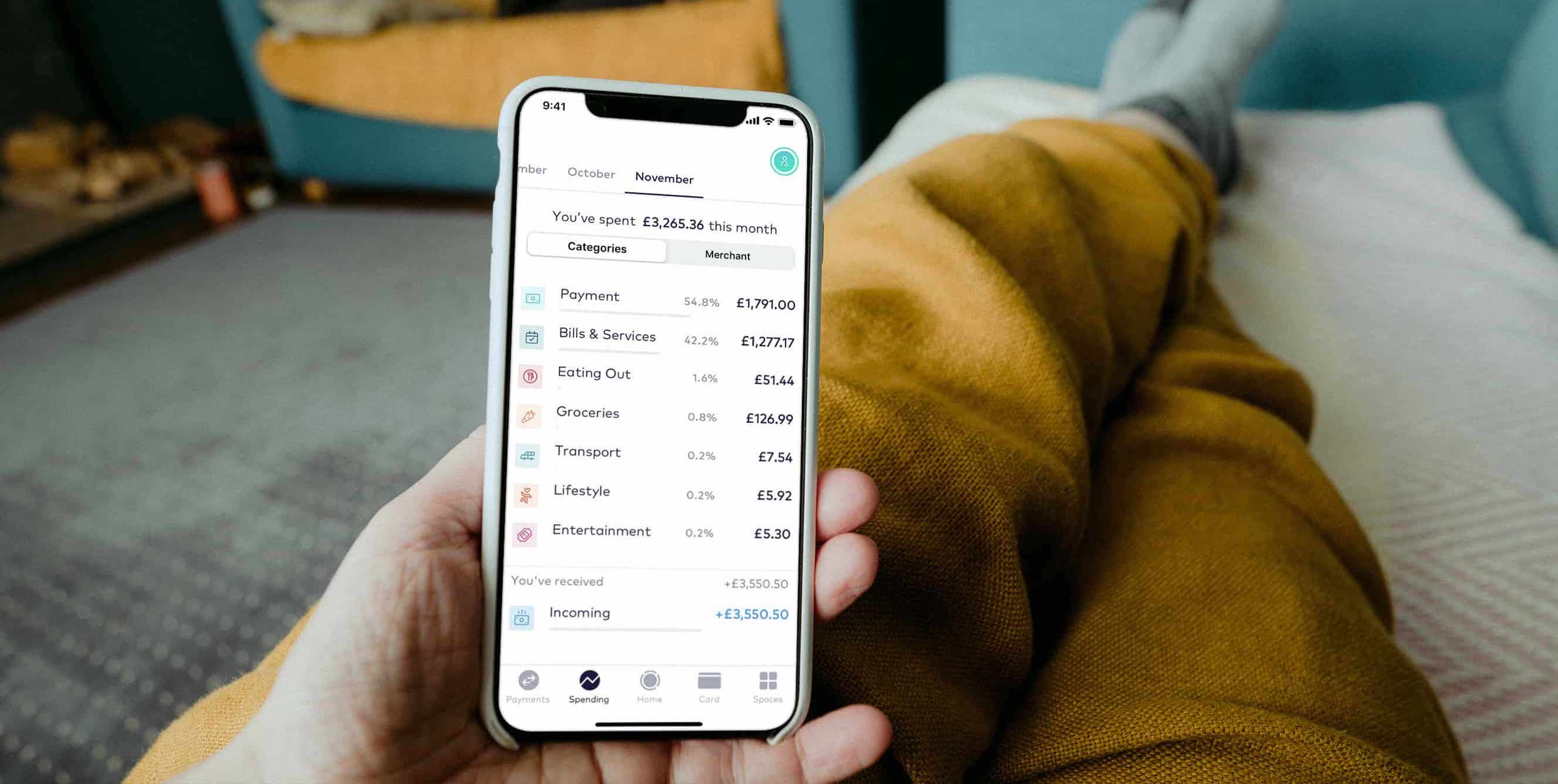

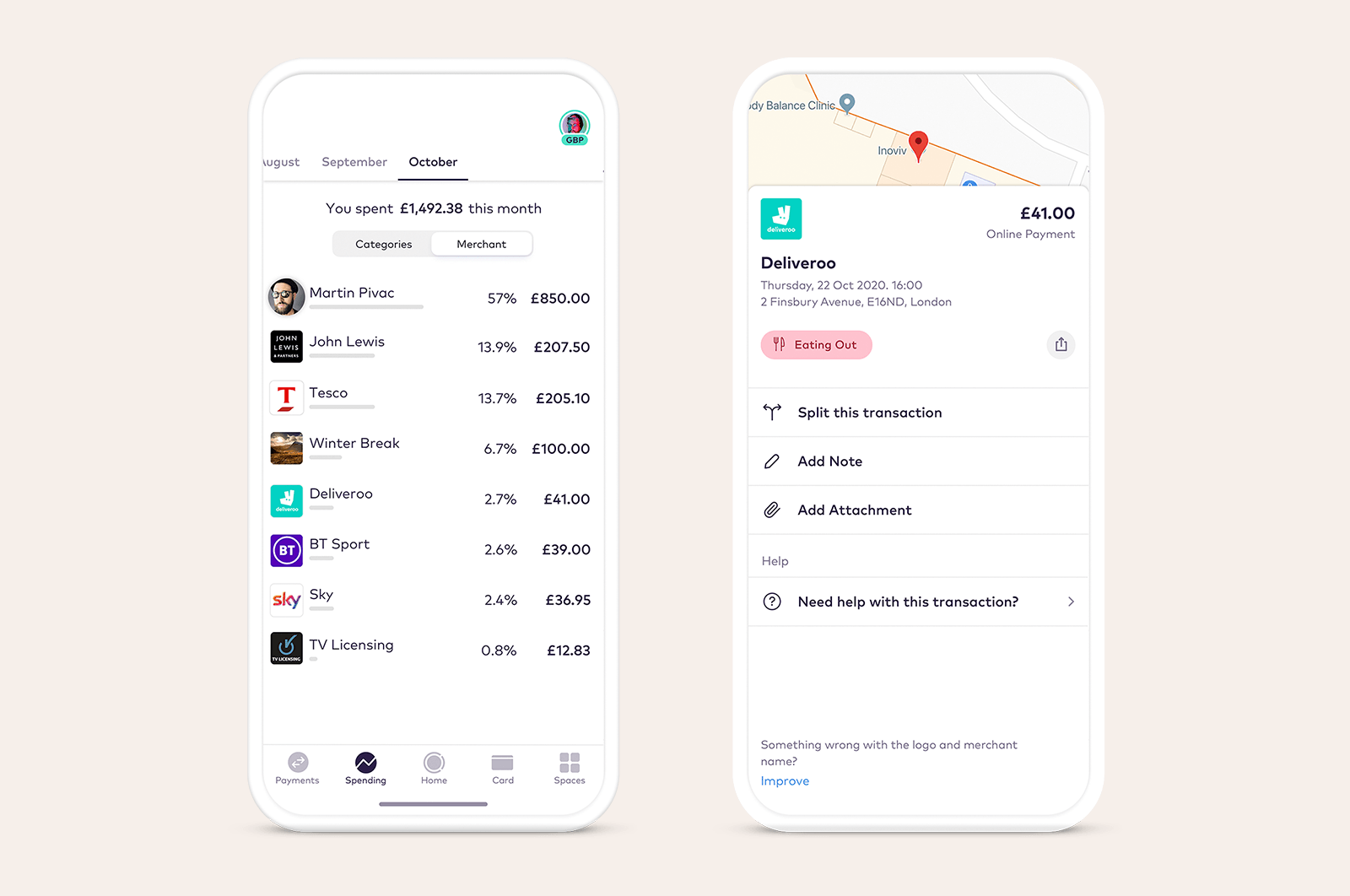

The Spending Insights feature automatically categorises your transactions so you know how much you’ve spent on Groceries, Bills & Services or Entertainment. It also identifies the location of the merchant and works out the percentage of money going to each retailer and category. Spending Insights is a tool for all Starling customers - personal, business, joint and euro.

If you make a payment and the category isn’t quite right, you can change it. For example, you could move a transaction from ‘Shopping’ to ‘Gift’. In the Spending tab, select the transaction details for an individual merchant, then tap on the category label under the name of the merchant. You can also customise each transaction by adding a note or a photo of your receipt.

Having easy-to-understand categories, such as Eating Out or Pets, makes it simple to see what you’ve spent your money on. And knowing exactly where you’ve spent your money and on what helps you control your spending and stick to your budget.

You no longer have to estimate how much you’ve spent or fill in an excel spreadsheet - Spending Insights puts the full picture into the palm of your hand.

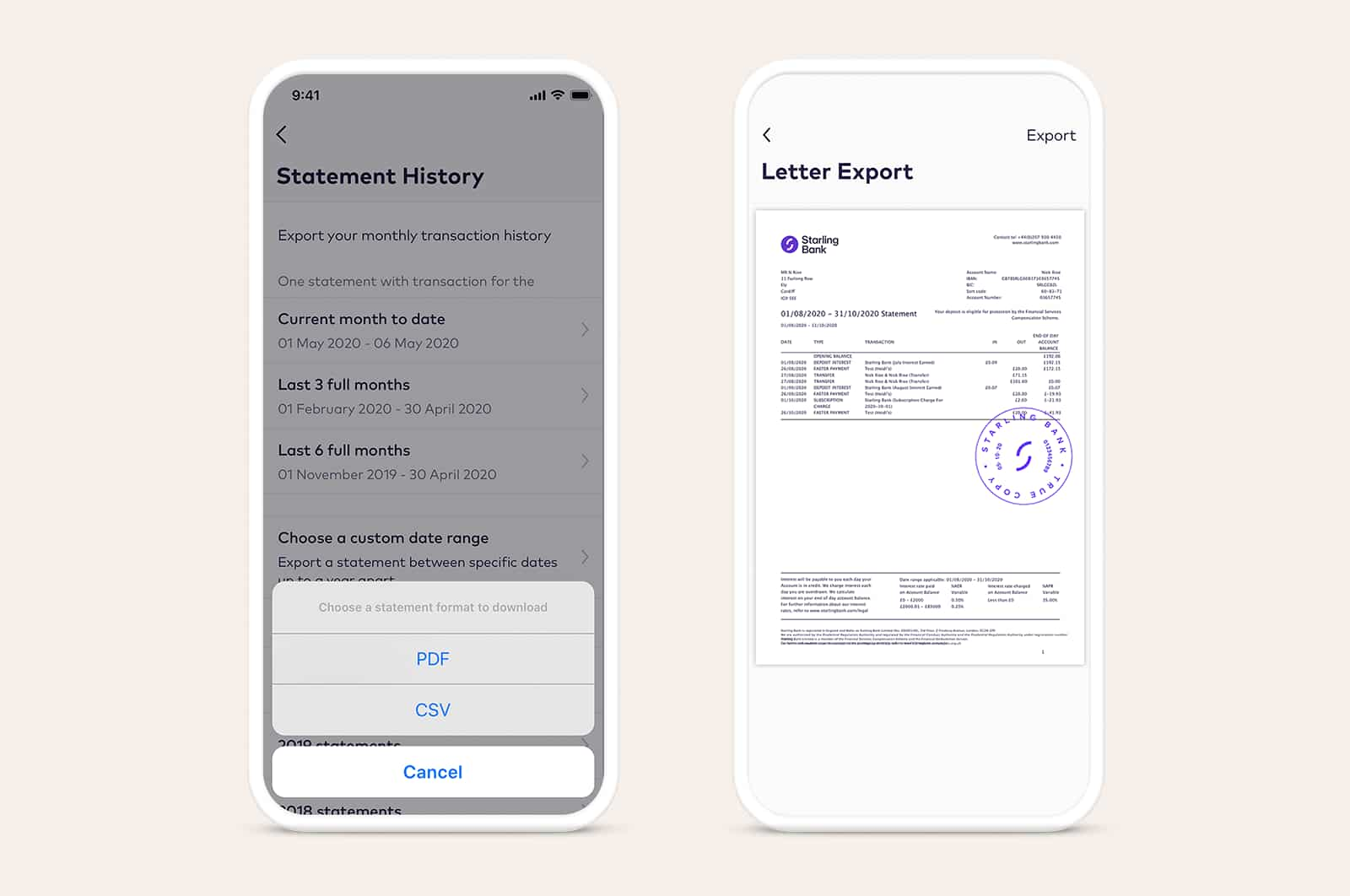

Looking at your bank statements is another way to keep track of your money, both income and outgoings. In the Starling app, or when you login to Online Banking, you can view digital bank statements by clicking the menu button, followed by ‘Statements’.

You can then view your bank statement according to a certain time period. This could be last month, or it could be between one pay day and another. You could also look at it quarterly in three month blocks.

If you’re renting somewhere new, you may need a bank statement as part of the process of becoming the tenant. For this, select the date period required, download or save it as a PDF and share it via email or another app straight to the letting agent. Remember, never share any financial data with anyone unless you know it’s safe and you’re sure you can trust them. Always think twice.

We don’t print paper statements and send them to you - saving paper is important to us, as is giving you the power to customise the date range of your statements so that they work for you.

This simple feature is highly effective for keeping you in the loop when it comes to your money. Every time money moves in or out of your Starling account, you receive a notification with the merchant name and the amount. If you’re outside of the UK, it will also include the conversion rate for the local currency.

This feature can save you time on looking up whether an invoice has been paid or alert you to an upcoming direct debit. If you haven’t got enough money to cover the upcoming payment, we’ll also let you know.

Real-time notifications can also help you stay on top of IOUs. Say you’re in Edinburgh and you go for a walk with a friend and pay for coffee and cake, you can split the bill by using Settle Up. When your friend opens the Settle Up link, they will either be directed to the Starling app, if they’re a Starling customer, or a secure page on their browser, where they can pay you back using a debit card. There’s no need to exchange bank details.

Better yet, if you’re both Starling customers, you could use Nearby Payments to split the bill while you’re on your walk. This feature is enabled by Bluetooth and pings money from one account to another quickly and easily, provided you’re in the same space (while maintaining social distancing rules, of course).

Once you’ve received the money, either by Settle Up or Nearby Payments, we’ll send a notification to confirm that the money has been received - wave goodbye to awkward texts following up on who owes what, and try these Starling features today.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025