Fighting fraud

Anyone’s identity can be stolen these days

By Starling Financial Crime Specialist

Fighting fraud

The sad truth is that criminals are getting savvier at scamming people out of their money, with more than £570m stolen through payment fraud in the first half of 2024 alone, according to UK Finance.

Impersonation scams are a very common type of scam. They involve a criminal disguising themselves as someone legitimate so that they can trick you into sharing private information or sending money. They may pose as a friend, family member, business representative, government official or someone who works at your bank. They may even be able to mimic a real number (this is known as ‘spoofing’) or use AI voice cloning to sound like someone you actually know. Their disguise might also be backed up by a fake website or social media profile.

The most important thing to remember is that Starling will never call you and ask you to move your money into a ‘safe’ account. This is a scam.

There are many measures you can take to stay vigilant against impersonation scams.

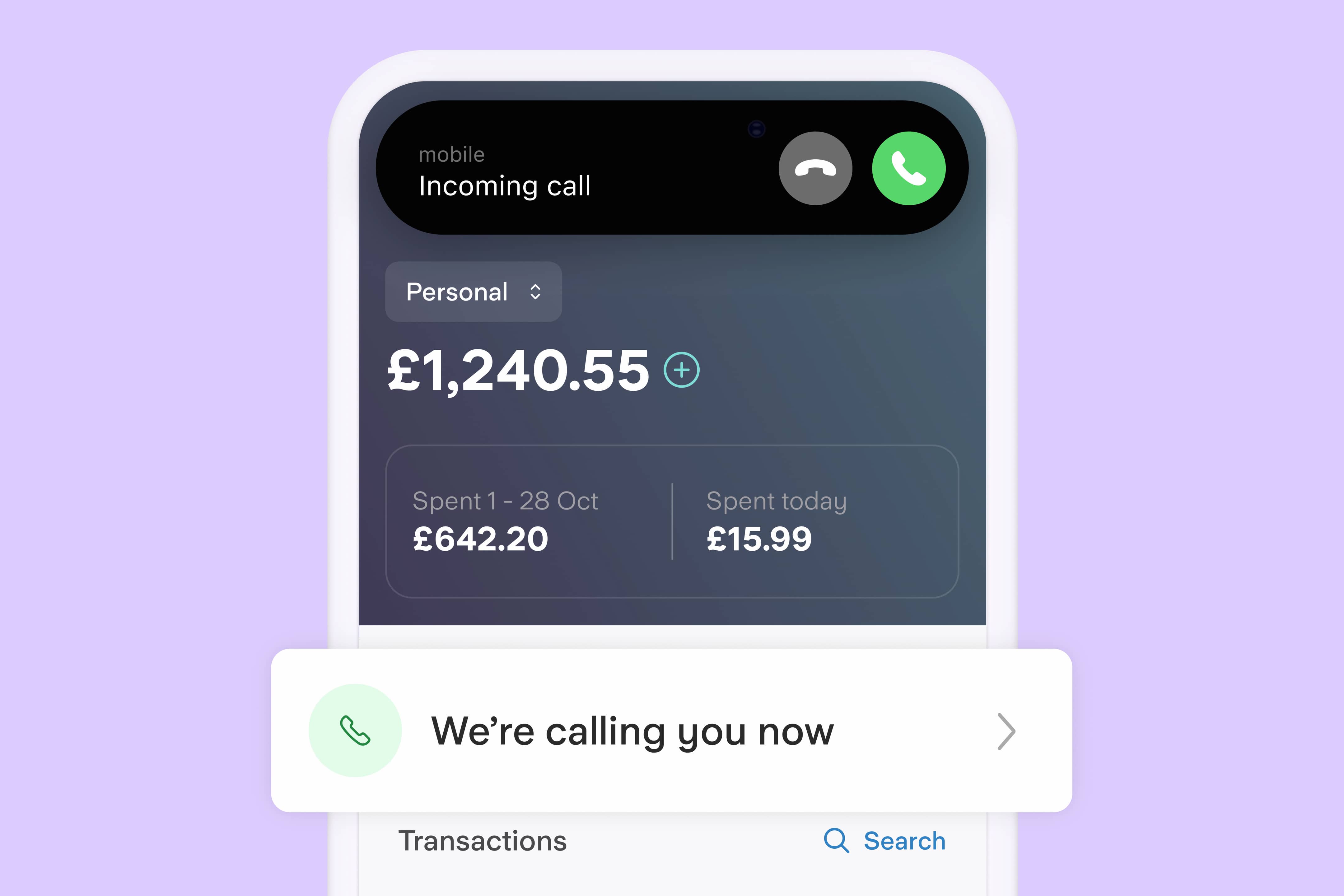

1. Check your Starling app

If someone calls you and tells you they’re from Starling, open your Starling app and check the ‘Call status’ banner. If the call is genuine, the banner will say ‘You’re on a call with Starling’ or ‘We’re calling you now’, unless you haven’t got an internet connection or haven’t updated your app. If you’re worried that it’s not us on the phone, hang up immediately and call 159 to speak to Starling’s fraud team. You should also be wary of someone saying they’re from a team that doesn’t use the banners or that there’s a technical fault which means they aren’t working.

2. Be vigilant with verifying callers

If you’re called on your landline and you want to check who’s calling you, hang up and use a mobile or different landline to call your bank, HMRC, your friend and so on. Don’t call on the same landline – fraudsters can keep the line open so that when you call back, you get straight back through to them.

3. Don’t be pressured to act quickly

A legitimate company or individual would not pressure you into making a payment immediately. They would be happy for you to check who they are and organise a test payment. You can also use Confirmation of Payee for extra security when you set up a new payee – if the name you have doesn’t match what the bank has, this is an immediate red flag.

4. Be wary on social media

Remember that social media and email accounts are easily hacked. If someone says they need money, contact the person asking for it via a different channel (preferably a phone call to a trusted number) or ask them about it in person.

5. Take note of anything odd

Look out for any spelling or formatting discrepancies on any emails, invoices or links to any websites you receive from what you believe to be genuine business. Sometimes scammers aren’t as clever as they like to think they are and we can use this to our advantage.

6. Never give access to your devices

Never allow a third party that has called you out of the blue to gain access to your computer or phone using a screen sharing application (such as Teamviewer).

Types of impersonation scams to watch out for

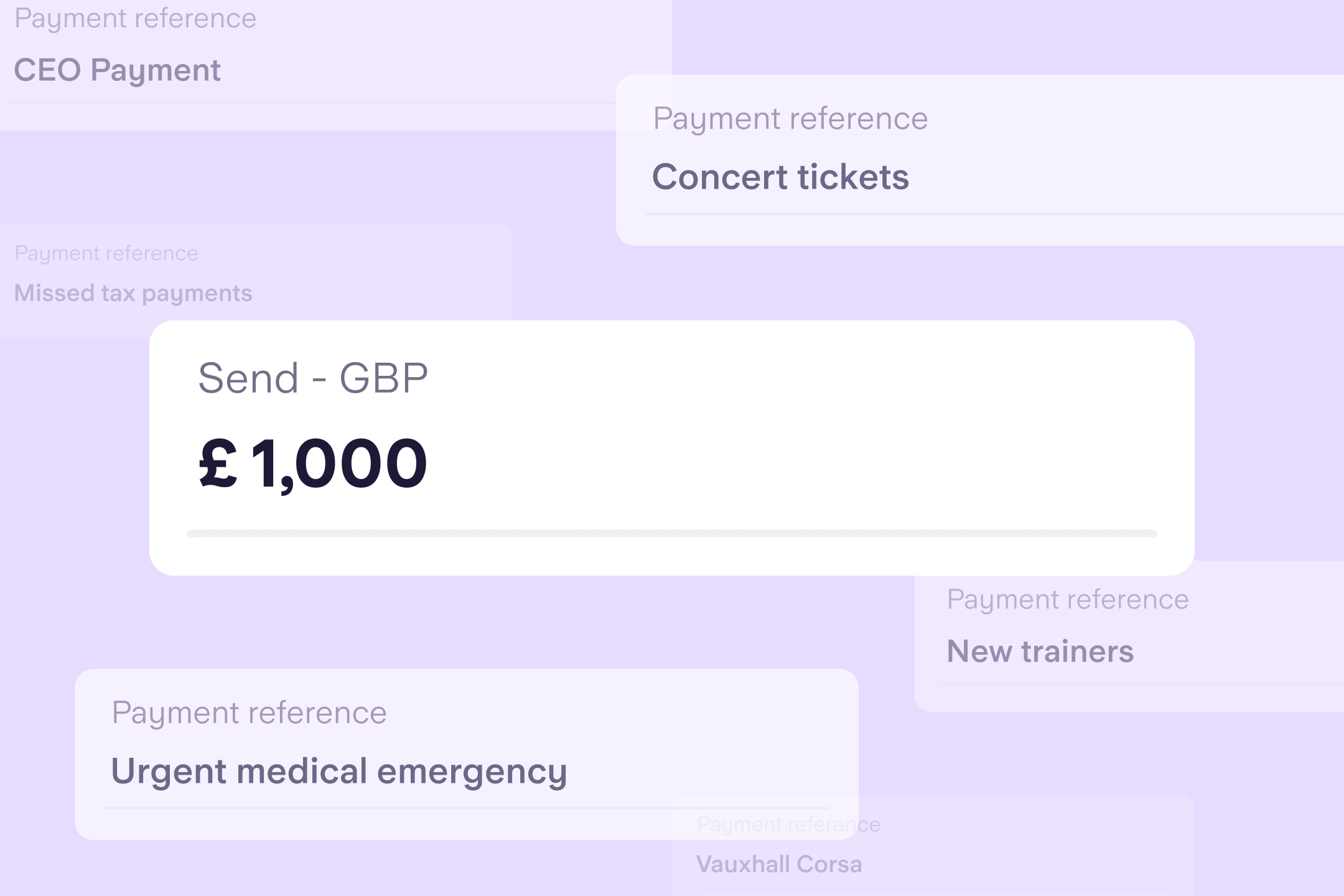

Safe Account Scams

One of the most common scams is a ‘safe account’ scam. This is where a fraudster tries to make you believe that your bank account has been compromised and that the only way to keep your money safe is to move it to a new or ‘safe’ bank account. They may also ask you to move money to ‘help them with an investigation’.

The fraudster could call you pretending to be someone from your bank, the police or even an internet provider advising that your internet connection isn’t secure. They may even be able to make the phone number look genuine, something that’s known as ‘spoofing’. This could mean that when you check the phone number online or compare it to the one on the bank of your card, the numbers match – don’t take this at face value.

Some scammers may even go as far as getting you to download a screen sharing app (such as Teamviewer or Anydesk) on to your computer or phone so that they can see everything that you see. This could enable them to steal your passwords or personal information. It could also allow them to show you pages with false information, in an attempt to make you believe your bank account or device is being hacked.

If you’re worried about the call you’ve received, hang up and call 159 to speak to your bank’s fraud team. Alternatively, call the number on the back of your card or find your bank’s contact number via their website. The web address should begin with ’https://’ and the security status should show a padlock icon on the left hand side of the website’s URL.

HMRC Scams

Other organisations that fraudsters frequently impersonate are HMRC or law enforcement organisations associated with collecting fines. For example, they might pretend to be a high court official and then tell you about an outstanding payment or fine that needs to be paid. Scammers will sometimes threaten to send the police to your address to make an arrest, or bailiffs to recover goods to satisfy the bill or fine in an attempt to intimidate you. Remember that a genuine organisation would never demand a payment for a fine you weren’t already aware of, so take time to verify that a request is real.

If you receive a call like this, hang up and call the number found on HMRC’s website or the website of the particular law enforcement organisation you were supposedly speaking with.

Invoice Redirection Scams

An invoice redirection scam is where a scammer tricks someone into paying them, rather than a business they’ve received a product or service from. The invoice you receive from the scammer will usually look very real and be something you’re expecting. These sorts of scams can happen when a fraudster hacks into an email account, or creates a new email address that looks very similar to the genuine one (for example, switching ‘o’ with ‘0’ or adding in an extra full stop). The fake invoice is usually received by email but is sometimes enabled by a fake phone call.

Always be careful about transferring money to a business or account you haven’t paid before. You can check whether an invoice is real by calling the number listed on the business’ website (make sure you find this website yourself, rather than through a link). You could also organise a test payment before settling the final bill.

Social Media Impersonation Scams

Not only can fraudsters hack into email accounts, they can also hack into social media accounts. This could allow them to send messages from a friend or family member’s account asking for money – usually for something urgent. As explored in our guide on social media scams, the scammers could even read through previous conversations to make sure that they sound convincing when writing their messages.

If you weren’t expecting to pay the person who’s sent a message, try phoning them, or ask them in person. This would also allow you to establish a ‘safe phrase’ you can use to combat scams, including scams where fraudsters use AI to impersonate someone’s voice.

Remember: Anyone can become a victim of an impersonation scam, so stay vigilant and remember that it’s okay to question who you’re speaking with.

Remember: Anyone can become a victim of an impersonation scam, so stay vigilant and remember that it’s okay to question who you’re speaking with.

For more information on scams and how to further protect yourself, visit our friends at Take Five.

How else can you protect yourself from online scams and fraudsters?

Read more guides from our fraud team

Fighting fraud

By Starling Financial Crime Specialist

Fighting fraud

By Starling Financial Crime Specialist

Fighting fraud

By James Nesbitt

Fighting fraud

By Starling Financial Crime Specialist