Business

“Becoming a mentor helped me see my own value.”

6th March 2025

“Time is a precious resource for business owners, and everything I set out to do with Starling’s business account was to help them save time and make financial management that much easier,” says Starling’s founder Anne Boden.

Here, seven of our business customers tell us what they love about banking with Starling and how our app saves them time.

“The app is brilliant,” says florist Clare Oliver. “I get a notification when invoices have been paid and I can easily make payments on the go.” Every time money moves in or out of your Starling account, all holders of that account receive an instant push notification. Starling also sends notifications the day before a Direct Debit or standing order is due.

Nathaniel Wade adds: “Receiving notifications helps me manage our cash flow and is a helpful tool to ensure cash we’re due is coming in when it’s supposed to be.” Nathaniel runs the online marketplace Wakuda.

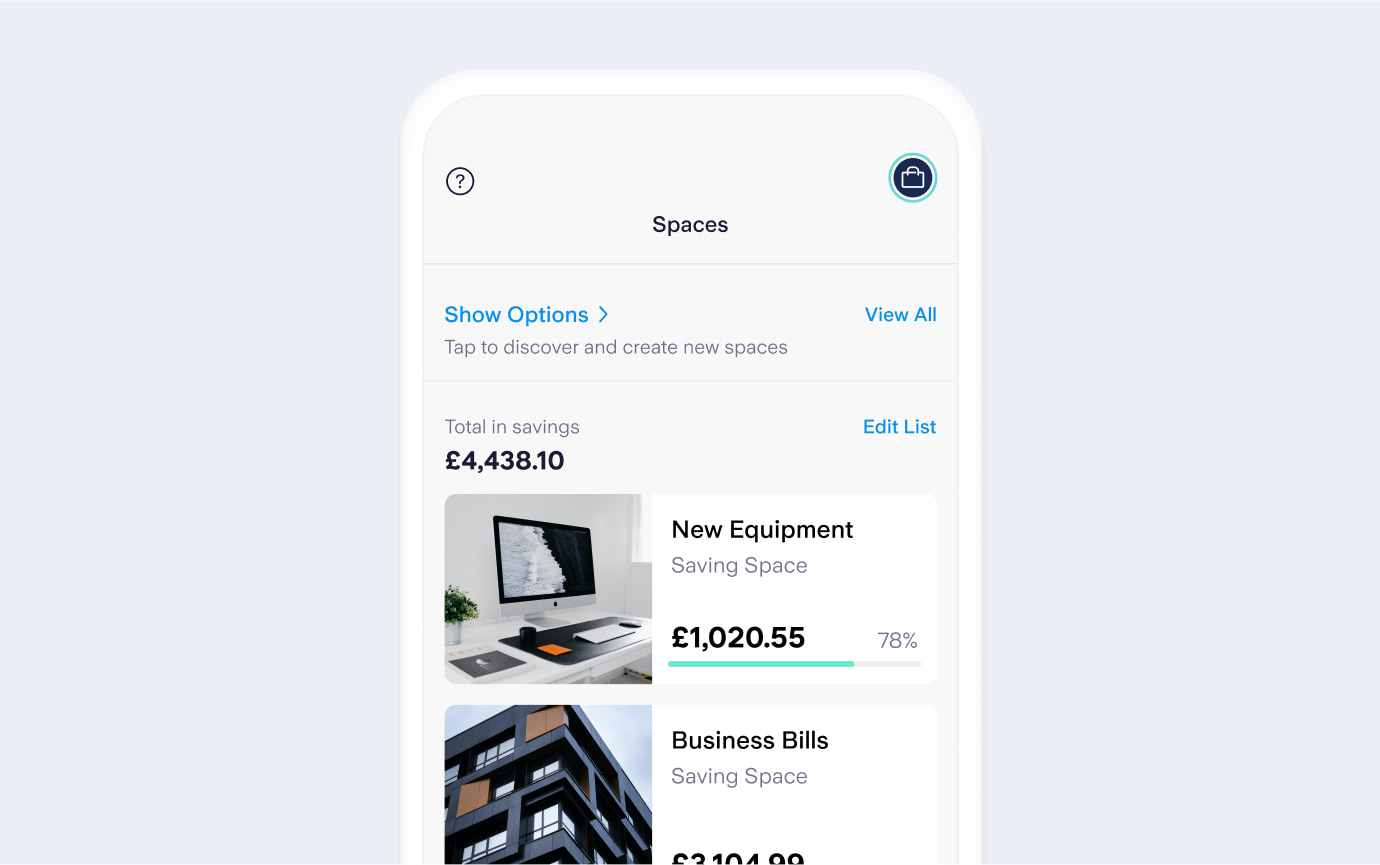

To keep their money organised, Starling business customers can set money aside from their main business account by using our Spaces feature.

“We’ve got about a dozen Spaces set up for things like rent, accounting, and staff costs,” says Amber Harrison, who runs the shop FOLDE Dorset in Shaftesbury.

For some Spaces, Amber uses the Bills Manager feature to pay Direct Debits or standing orders. “Bills Manager has been a brilliant initiative. Our rent bill gets paid from our Space, and as we save for our rent weekly, we know it’s covered.”

To manage her bookkeeping, Clare uses our Business Toolkit. “It was one of the main reasons for setting up the business account. I wanted to have really easy to use software that helps me run my business professionally and efficiently,” she says.

Toolkit enables you to estimate tax or VAT, manage receipts and create invoices. “I love the invoice tool. It not only provides me with a standardised, professional invoice system, but also matches up incoming payments when invoices have been paid.” Toolkit is free for the first month then £7 per month. You can cancel at any time.

Starling business customers can also connect to external bookkeeping software from Xero or QuickBooks through Marketplace.

“We absolutely love our Xero integration, which transfers everything over instantly,” says Farhana Haque, co-founder of scented candle brand, Handmade in Harpenden. “We also love that the integration itself is free.”

Fiona Metcalfe, co-founder of the cooking kit business, Cuisine Box, is one of many Starling business customers that uses the Live Chat function in the app to contact our 24/7 customer service team. “I’ve contacted customer service via the chat function on a couple of occasions, and have found the team to be friendly, supportive and knowledgeable,” she says.

When a fraudulent transaction attempt was made on her business card, Farhana was able to reject the online payment from the app and immediately contact Customer Service. “We were connected to a real person so quickly. They were incredibly helpful. They cancelled all our cards and sent out new ones which all arrived within two working days,” she says.

“Bulk Payments have been the single, biggest time-saving feature for our payroll function,” says Reece Couchman, founder of The SaaSy People.

“It means we can load all our employees’ payments into a single spreadsheet, upload this to Starling to verify all of the details, then with a single click, pay all our employees at once. Our payroll processing time has decreased by over 80%!” The SaaSy People company provides growing businesses with outsourced customer support.

The Bulk Payments feature is free for the first month then £7 per month. You can cancel at any time.

“When we discovered that for a small monthly fee we could have a business dollar and euro account at the touch of a button, we set both up immediately,” says Robert Bolohan, co-founder of translation agency, Lotuly.

“The amazing thing is that, if we pay an account that’s in dollars, the app automatically takes funds from the dollar account so we don’t waste money on the conversion fees and we don’t waste time manually selecting the US dollar account.”

Starling business euro accounts and business US dollar accounts are free for the first month, then the euro account costs £2 per month and the US dollar account costs £5 per month. You can cancel at any time.

There are no monthly fees for a standard Starling business account. You can apply by downloading the app.

“I would definitely recommend Starling as a one-stop shop for all your finance needs,” says Clare. “It helps you track spending and income, and saves a huge amount of time.”

Business

6th March 2025

Business

24th May 2024

Business

24th May 2024

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025