Product news

Helping economic abuse survivors with our new feature, ‘Hide references’

6th June 2023

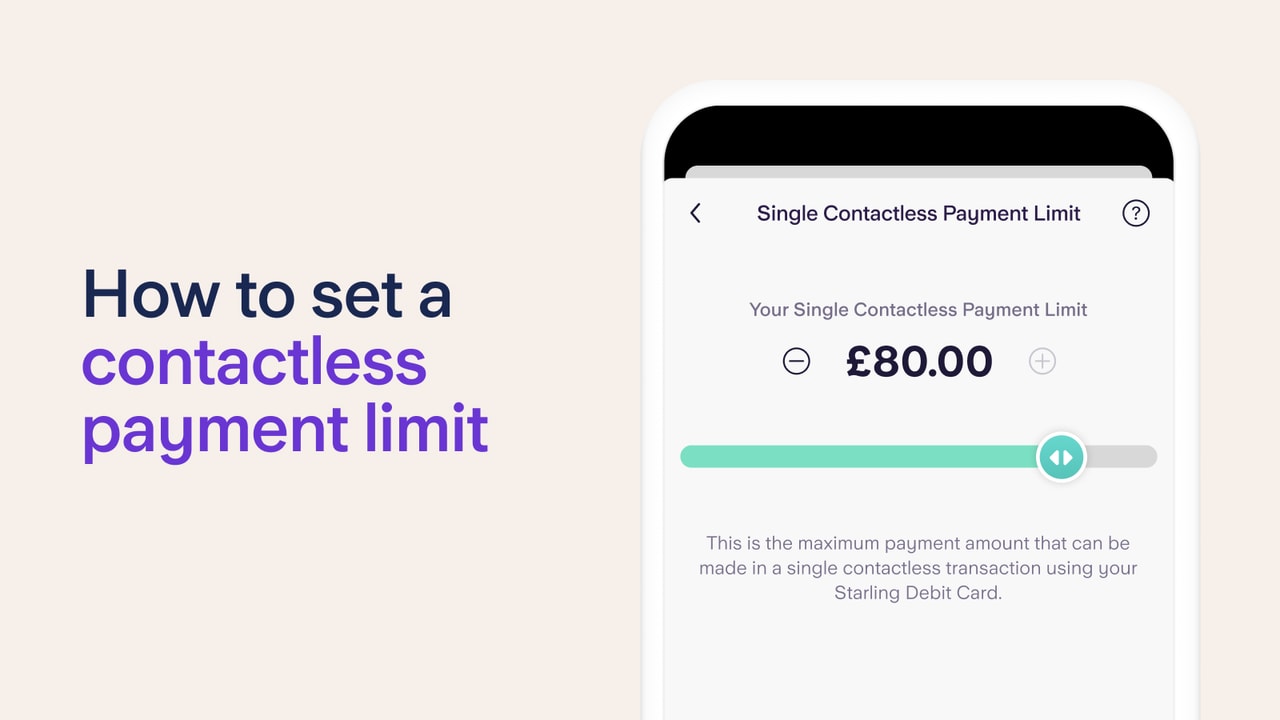

At Starling, we want our customers to be in control of their money. That’s why we’re launching a feature that enables you to set your own limit for contactless payments made on your debit card, up to £100. The new feature is available from 15th October 2021.

The maximum contactless limit will automatically rise to £100 on 15th October. From that date, Starling personal, joint and business customers will be able to choose their own contactless payment limit using our flexible in-app slider.

As our founder Anne Boden says: “The benefit of being a digital bank is the ability to listen to customers and implement wanted changes quickly. Analysing our spending data we can see that there appears to be little demand for the increased contactless limit and that many would like to retain the same contactless limit or even reduce it.”

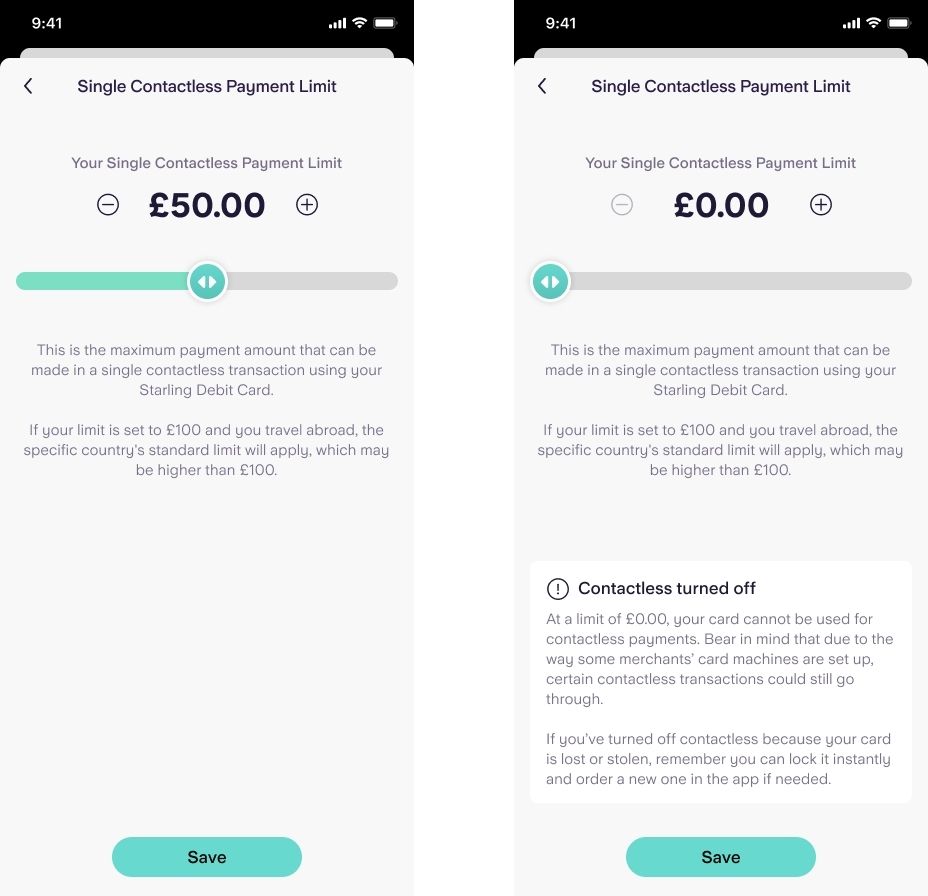

Starling customers will have full control to set a lower limit from the app. The limit can be decreased from £100 in increments of £10, right down to zero, which will turn off contactless payments completely. If you choose to switch off contactless payments, be aware that some transactions could still go through if the payment is made offline, for example when using London Underground.

It’s also worth noting that while £100 is the new contactless limit for UK banks, not all UK merchants will be ready for this change straight away, so the previous limit of £45 may still apply for some transactions.

First, check that your Starling app is up to date (from the 15th). Then go to the ‘Card’ section of the app for your Starling personal, joint or business card, depending on which card you want to adjust. You’ll find the option to change your contactless limit in ‘Card & Payment Limits’.

To adjust the contactless payment limit for a Kite card for kids or Connected card, go to the ‘Spaces’ section of the app, tap the Space connected to your Kite Card or Connected Card and click ‘Manage Space’, followed by ‘Contactless Limit’.

If you’re happy with the new contactless limit of £100, there will be no need to do anything on 15th October, when the standard limit changes.

Simply tap your card where you see the contactless symbol, for payments up to £100. You’ll need to enter your PIN for transactions above £100. Remember that some merchants may not be ready to offer the new limit immediately and could apply the previous limit of £45.

There are no changes to payments made through mobile wallets such as Apple Pay or Google Pay, which have higher payment limits than debit cards and are secured by Face ID, fingerprint ID or a passcode.

Your chosen contactless payment limit will also apply if you use your Starling card overseas. For example, if you set the limit at £30, this would mean your limit in Spain or Germany will be around €35, depending on the exact exchange rate at the time.

If you have not reduced your limit from £100 and travel abroad, the specific country’s standard limit will apply. Each country has their own limit and some are higher than £100.

Yes. When you’ve spent a total of £300 through multiple contactless payments, we’ll ask you to enter your PIN. Previously, we asked you to enter your PIN after spending £225. This is a security measure to help prevent fraud.

Product news

6th June 2023

Product news

5th June 2023

Business

3rd October 2022

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025