Fighting fraud

Anyone’s identity can be stolen these days

By Starling Financial Crime Specialist

Fighting fraud

Essentially, APP fraud is where a criminal tricks someone into willingly making a bank transfer to them. APP stands for Authorised Push Payment.

UK Finance, a banking and financial services trade association representing more than 300 firms, has estimated that in 2023, almost £460 million was lost through APP fraud in the UK, principally through purchase scams. This is why it’s vital to learn what you can do to stay safe.

When it comes to APP fraud, you can never be too careful.

If someone is pressuring you to make a payment quickly, stop and think. A genuine company would never have an issue with you talking to a trusted friend or family member about a payment and taking your time.

Question unexpected contact regarding payment requests – is the request real? There’s never any harm in calling a company or individual on a contact number you find independently to check the legitimacy of a request.

Remember that phone calls and texts can be made to look like they’re from a real company – don’t take a phone number at face value.

Had an unexpected call from your bank? Call 159 to verify the call is genuine.

Remember that if someone is making you an offer that seems too good to be true, it probably is.

Always do your research before parting with your money – check independent reviews of a company and make sure they’re part of the relevant regulatory body. For example, anyone providing a financial service should be FCA registered.

Learn more about protecting yourself from APP scams over at Take Five.

Contact your bank right away to tell them what’s happened – if you made the payment from a Starling account, you can contact us through the app or by phoning the number on the back of your card.

Then report the scam (call 0300 123 2040 if you’re in England or Wales or, if you’re in Scotland, call 101 to speak to the police). You can also report scams on Action Fraud’s website.

If you’ve been scammed on or after 7 October 2024, UK banks will look at the transaction under a changed set of rules, put in place by the Payment Systems Regulator (PSR). These changes, known as the mandatory reimbursement rules, mean that more customers will be reimbursed if they are scammed out of their money through APP fraud – as long as certain conditions are met.

Mandatory reimbursement rules

What’s changing?

In a nutshell: the rules that all UK banks have to follow when it comes to reimbursing victims of APP fraud. Before 7 October 2024, there was a voluntary code that banks could sign up to, known as the Contingent Reimbursement Model (CRM), which Starling remains part of.

But from 7 October 2024, there will be a new way of looking at cases of APP fraud and new conditions for reimbursements.

How do I tell if I’m eligible for a reimbursement?

To be eligible for reimbursement, your payment must have:

taken place on or after 7 October 2024

be reported to your bank within 13 months

been made by bank transfer (through either the ‘Faster Payment’ or CHAPS schemes)

been made to a UK bank account, from a UK bank account belonging to an individual, microenterprise, or charity.

If multiple payments have gone from your account to the fraudster’s account, you can report all of them in one claim. You’ll just need to make your claim within 13 months of the date you made the last payment.

It’s also important to note that the PSR’s mandatory reimbursement rules won’t apply:

If you don’t take the steps needed to meet the Consumer Standard of Caution

If the payment you made is unlawful, for example if you’ve tried to buy something that’s illegal

If it’s a civil dispute, for example if you’ve paid a genuine business, then find that you’re unhappy with the product or service provided

If the money was sent to an account that you had control of

If your payment was made to or from a credit union account, municipal bank account, or a national savings account (i.e. one from a state-owned savings bank in the UK)

If you make a false claim.

The maximum amount a bank may refund you is £85,000.

What’s the Consumer Standard of Caution?

The Consumer Standard of Caution is something that you – the customer – need to uphold. This means:

Listening to and acting on any warnings given by your bank or law enforcement

Contacting your bank if you realise you’ve been scammed – do this straight away

Responding to requests for extra information from your bank, which will be used to support your claim if you choose to make one

Reporting any scams to the police, or allowing your bank to do this for you.

If you don’t follow the guidelines above, you may not be eligible for a reimbursement following an APP scam.

I want to make a reimbursement claim, what do I do?

If you’re a Starling customer, you can make your reimbursement claim when you tell our 24/7 customer service team that you’ve been scammed. We’ll then review your claim and work with the bank that received the money to get it back to you or see whether you’re eligible for a reimbursement.

If your claim is successful, we may apply an excess of £50 – a decision that will be made on a case-by-case basis. If we do apply the excess, we’ll deduct it from the amount we reimburse you. For example, if you were scammed out of £350, you would get £300 back if your claim is successful.

We’ll aim to reimburse you within five business days, but we could take up to 35 business days if we need more information, whether that’s from you, the bank that received your payment, or a statutory body, such as the Financial Conduct Authority (FCA).

If the outcome of your claim isn’t what you were hoping for and you want to make a complaint, you can do this by following our Complaint’s Procedure, which includes details of how to raise a complaint with the Financial Ombudsman Service (FOS).

Why is there an excess?

Under the mandatory reimbursement rules, the bank you used to make the transfer has the right to apply an excess of up to £100 for reimbursements. The bank that received your money won’t apply one. In line with this, we’ve chosen to apply a £50 excess to encourage everyone to continue to be careful when making payments from their Starling account.

The introduction of the Mandatory reimbursement rules does not mean that customers should be less cautious, especially as not all payments made to fraudsters will be eligible for reimbursement.

If you’re in an especially difficult situation, please let us know. We may still be able to reimburse you if you don’t meet all the requirements and waive the usual £50 excess. Stressful, unexpected life changes or conditions can make people much more susceptible to scams, which is why our team takes this into account when considering a claim.

I’ve not been scammed, do the mandatory reimbursement rules change anything for me?

No, everyone needs to be just as careful when making payments – this hasn’t changed. Stop, think and remember that your bank will never ask you to move your money to a ‘safe’ account: this is a scam.

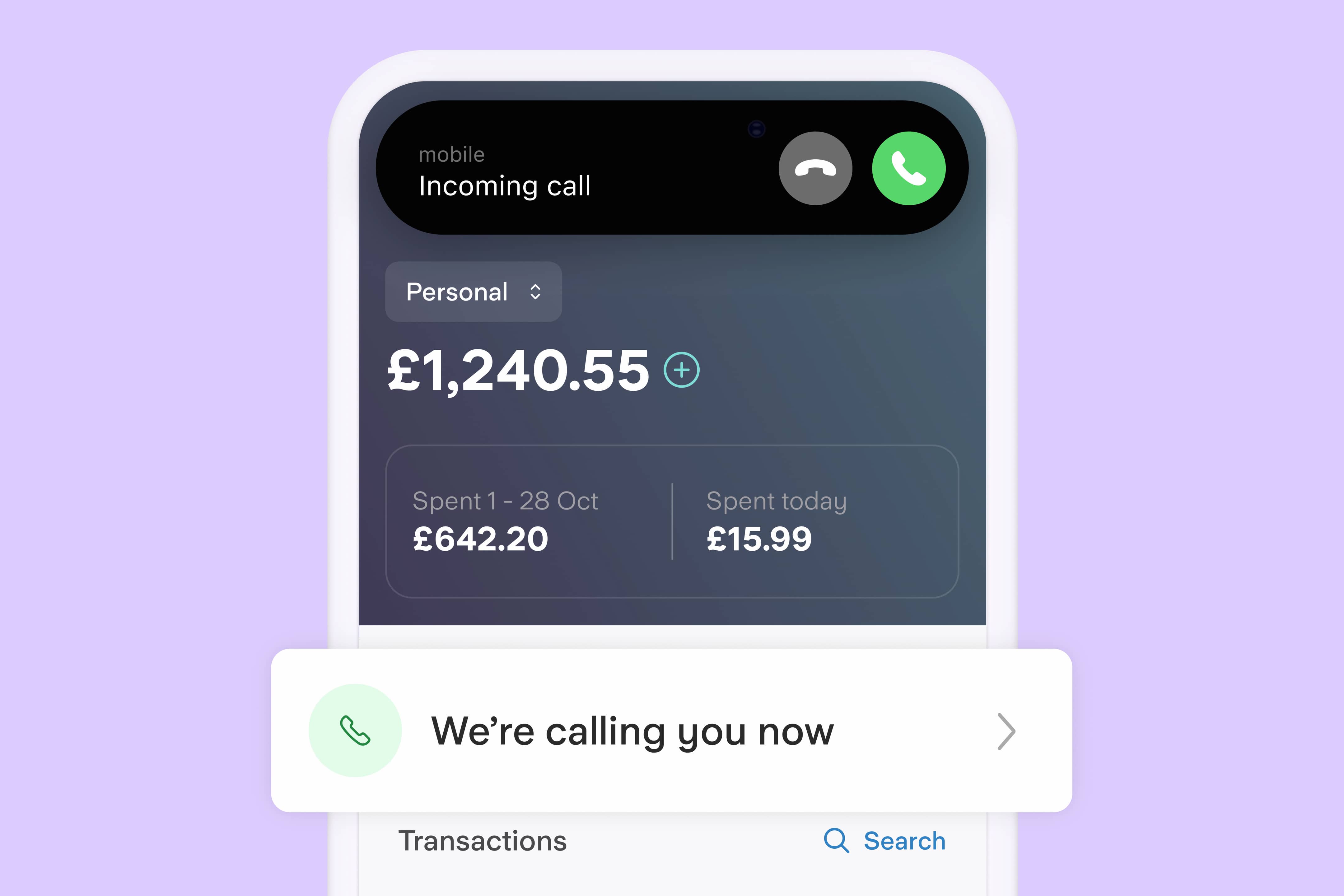

We send you pop-up warnings in the app when you make payments. These are designed to make you stop and think before making a transfer.

We’re connected to 159 – the phone number you can call to be put directly through to your bank if you think someone is trying to scam you.

We regularly share news of scam trends on our social media, on Noteworthy and by email to make sure customers are kept up to date on what to look out for.

We keep an eye on your account and will contact you through the app if we spot any payments that look like they might be part of a scam.

We flag whether or not the name you’ve entered for a new payee matches what the receiving bank has through Confirmation of Payee (CoP). This allows you to verify the name of an account before making any payments.

We’re signed up to both Take Five, which is a national scam education campaign led by UK Finance, and Stop Scams, a collaboration of banking, telecom and technology companies working together to help prevent scams.

We’re signed up to the Contingent Reimbursement Model (CRM code), a voluntary code focusing on preventing scams and supporting customers who lose money to fraudsters. It sets out the circumstances when people who have been scammed may be entitled to reimbursements (eligible transactions on or before 6 October 2024 are considered under this code).

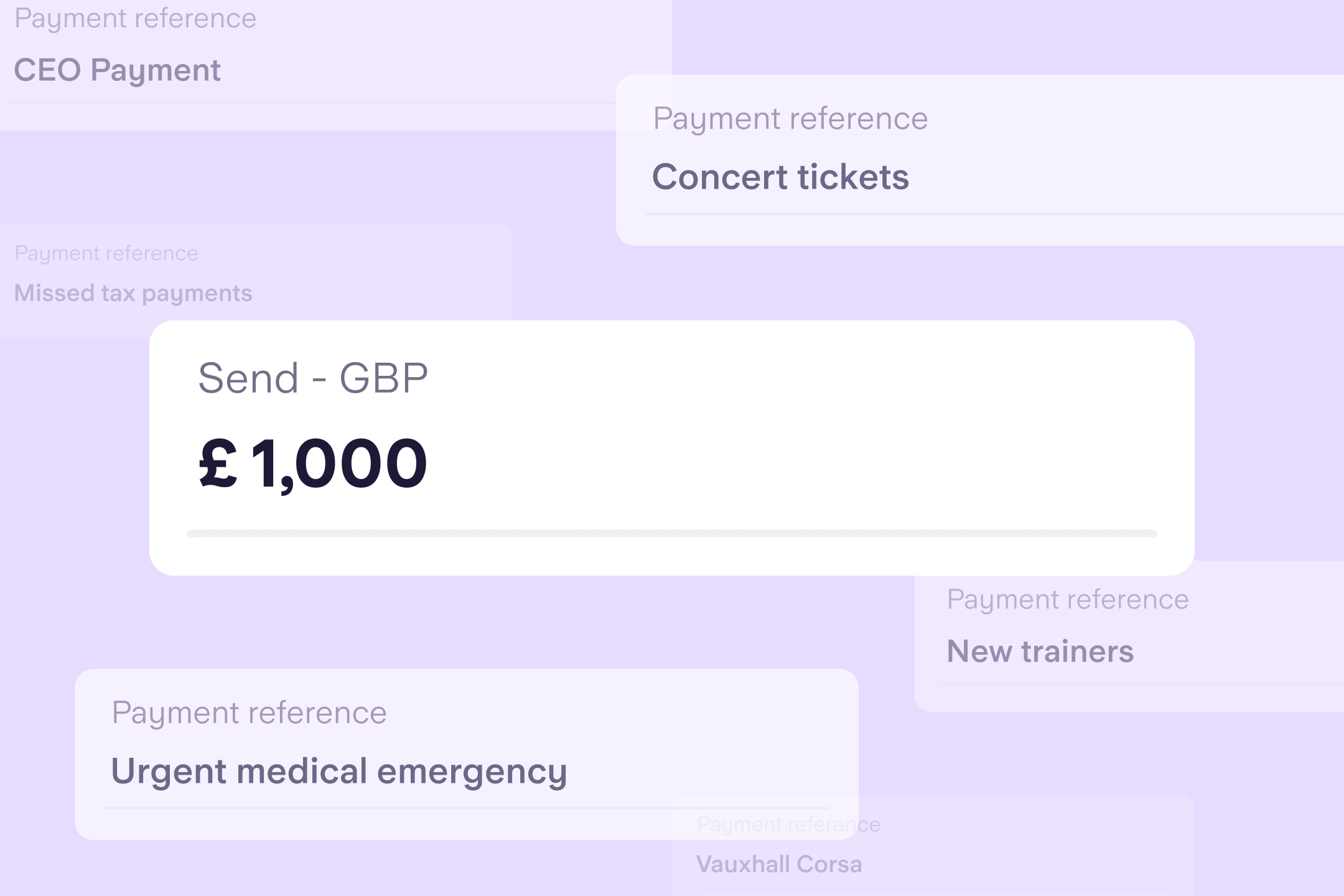

Online shopping scams

These scams are typically seen on social media and marketplace sites, where scammers ask for a bank transfer for non-existent items such as event tickets, clothing or even vehicles.

Investment scams

Fraudsters advertise fake investment opportunities, often with unrealistic returns and little risk, on social media or professional looking websites. They may even reach out to you with a phone call or in person. Scammers may impersonate real investment groups or make it appear that celebrities are endorsing the company.

Romance scams

This occurs when a victim is tricked into thinking they’re in a relationship with someone they met online and then persuaded into making payments for the benefit of their new partner. These scams often originate on dating sites or social media using fake profiles created with stolen images.

Impersonation scams

There are lots of different types of impersonation scam, but all involve criminals pretending to be an individual or a business that they are not. For example, you may get a call from your ‘bank’ encouraging you to move money into a ‘safe account’ – this is a safe account scam. HMRC and the criminal courts are also frequently impersonated, with scammers demanding an immediate payment for ‘missed tax payments’ or a ‘fine’. Family and friends can also be impersonated, with fraudsters sending texts or WhatsApp messages from new numbers asking for urgent payments.

Invoice redirection scams

This is when criminals hack into email inboxes owned by genuine firms and contact their customers, asking for payments to be made to fraudulent accounts.

Advance Fee

If a scammer asks for an upfront fee for a service they ultimately won’t provide, this is called an Advance Fee scam. They might pretend to be offering a loan, a lottery win or help to secure a job.

CEO fraud

Scammers can impersonate a senior person in a business, such as a CEO, to trick employees into executing urgent payments.

How else can you protect yourself from online scams and fraudsters?

Read more guides from our fraud team

Fighting fraud

By Starling Financial Crime Specialist

Fighting fraud

By Starling Financial Crime Specialist

Fighting fraud

By James Nesbitt

Fighting fraud

By Starling Financial Crime Specialist